2025 Sundance Insights Special – Running the Numbers

As we gear up for Sundance 2025, it’s impossible not to reflect on the broader state of the film industry. While each year since the COVID-19 pandemic had marked steady improvement in domestic box office (DBO) totals, 2024 bucked the trend, registering the first decline since 2020. The most updated figures peg the year’s total at just under US$8.6b—a 3.8% drop from 2023’s US$8.9b.

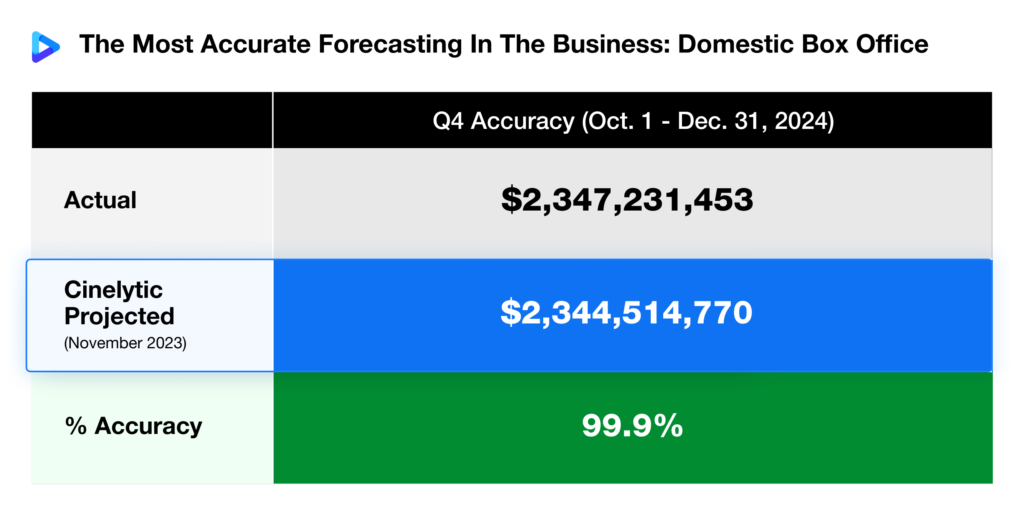

This downturn wasn’t wholly unexpected. At Cinelytic, our proprietary predictive analytics foresaw this outcome. Our forecasts for the total 2024 slate, made in late 2023, proved over 95% accurate for the second year running. Particularly impressive was our near perfect Q4 accuracy, exceeding 99%, which underscores the precision and reliability of our data-driven insights. While the dip in box office revenues isn’t the best news, it reaffirms the importance of leveraging predictive tools to navigate an evolving industry.

Turning our attention to Sundance 2025, the festival continues to be a launchpad for some of the most exciting voices in cinema. To understand the evolving impact of Sundance on distribution strategies, we revisited the streaming performance of several titles from the 2024 edition.

Over the last few years, streaming has solidified itself as a primary revenue stream for Sundance titles, particularly as platforms increasingly seek prestige content to bolster their catalogs.

For this analysis, we utilized our proprietary OTT viewership proxy system, which aggregates 125 million digital content consumption transactions daily across the globe.

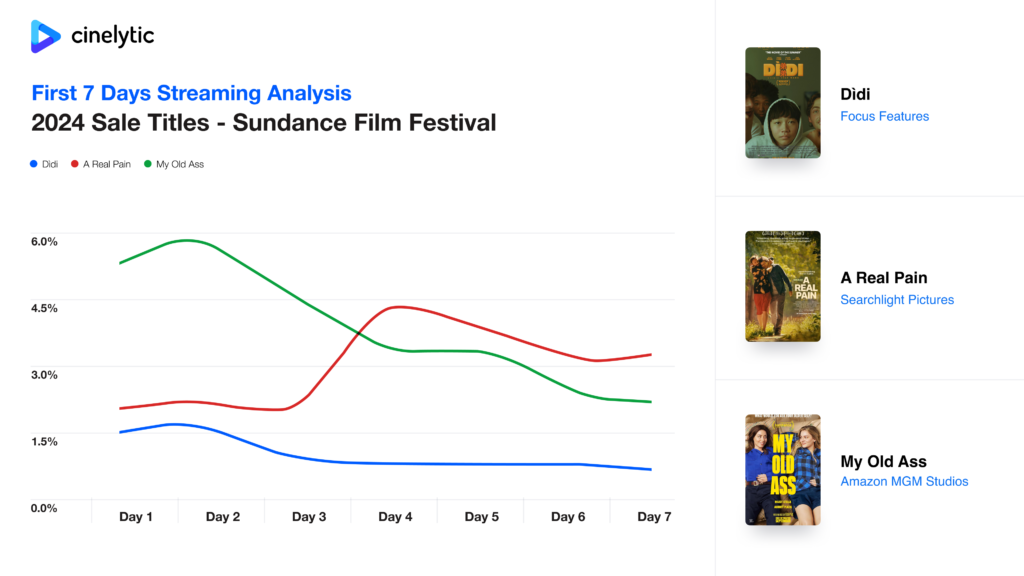

This system provides an unparalleled view into consumer IP/content preferences, amassing an annual tally of over 35b data points. Using this dataset, we selected three buzzy titles that sold to distributors at Sundance 2024 and examined their first seven days of OTT release: DÌDI, A REAL PAIN and MY OLD ASS.

These films each made quite the splash at Sundance and performed distinctly during their digital runs, reflecting varied market reception and viewing dynamics.

DÌDI, acquired by Focus Features for an undisclosed amount, reached its peak performance on Day 2, ranking 16th overall in daily market share. However, its momentum quickly faded, averaging just 0.8% of the total market through its first week. This rapid decline may point to limited marketing push, niche appeal, or the lack of significant star power driving sustained interest.

In contrast, A REAL PAIN, which sold to Searchlight for US$10M, performed noticeably better. The film saw a strong surge on Day 4, pushing its peak ranking to #4, and maintained an average market share of 2.9% for the week. Likely contributing factors include the film’s relatable subject matter and notable lead cast, which helped generate buzz and broader audience engagement.

Finally, MY OLD ASS, acquired by Amazon MGM Studios for US$15M, outperformed both competitors, achieving the top ranking on Day 2 and averaging the highest weekly market share at 3.7%. This strong performance can likely be credited to its digital premiere on Amazon Prime Video, which offered superior marketing, extensive exposure, and instant accessibility for subscribers.

The film’s early success underscores the significant advantages of platform-driven releases in maximizing audience reach—even for a grounded comedy with limited star power, competing in its first week against blockbuster digital offerings like DEADPOOL & WOLVERINE, ALIEN: ROMULUS and BEETLEJUICE BEETLEJUICE.

Now on to Sundance 2025

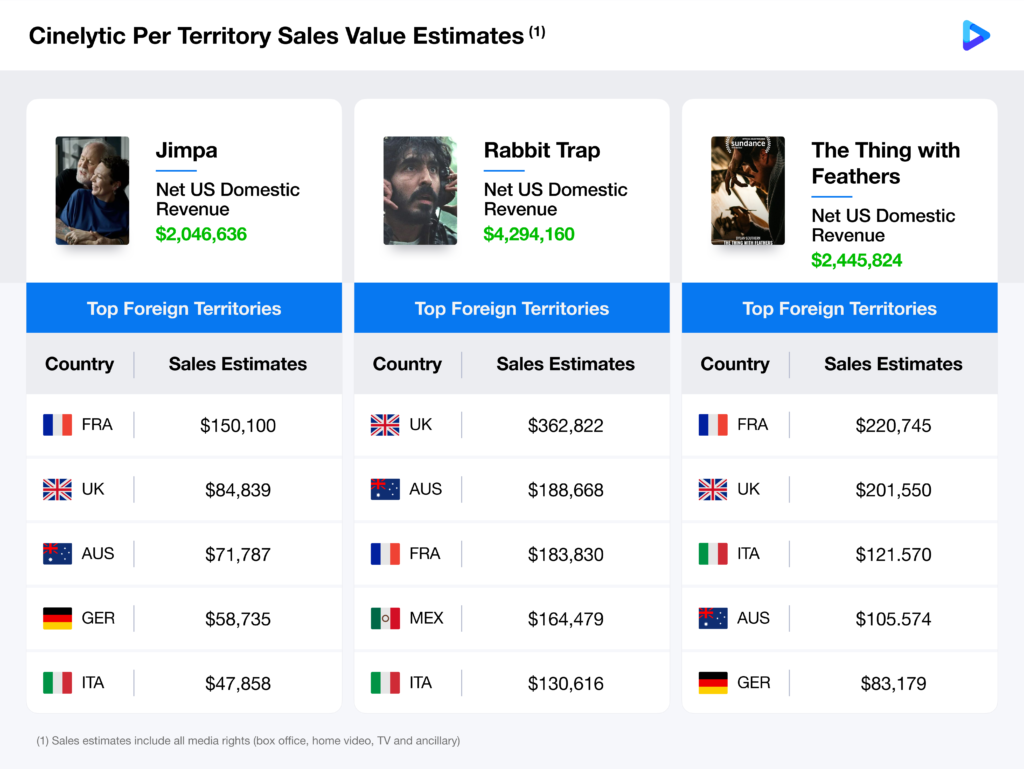

With this year’s festival set to kick off this week, Cinelytic is using our forecasting tool to take a closer look at a few buzzworthy premiering titles vying for attention and domestic distribution at this year’s event: JIMPA, RABBIT TRAP and THE THING WITH FEATHERS. Our ROI forecasting, detailed further in these Insights, is particularly valuable for financiers, producers, and equity providers.

In addition, our sales estimates tool offers a distinct advantage, allowing buyers and sellers at Sundance to evaluate each title’s per-territory value across all media rights (box office, home video, TV, and ancillary). As the graphic below demonstrates, this tool is especially valuable in a market setting, helping stakeholders determine the right price for each territory’s rights.

JIMPA, written and directed by Sophie Hyde, is a collaboration between Australia, the Netherlands, and Finland. Hyde’s previous film, the dramedy GOOD LUCK TO YOU, LEO GRANDE, premiered at the 2022 Sundance Film Festival to widespread acclaim. It was subsequently acquired by Searchlight Pictures and marketed as a Hulu original film. Her latest effort is a family drama featuring John Lithgow and Olivia Colman.

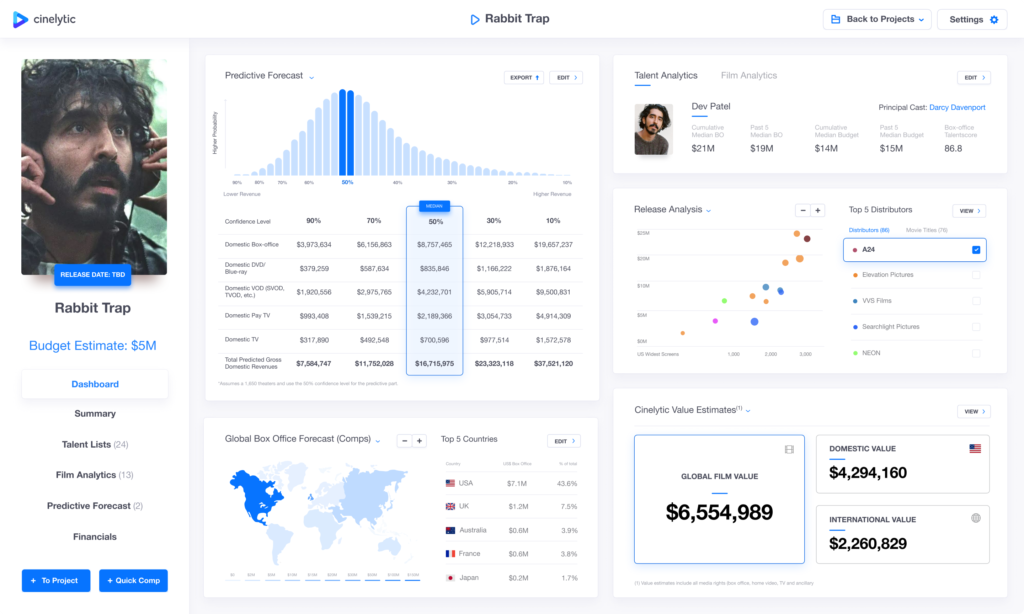

RABBIT TRAP, a psychological horror film from the United Kingdom, marks the feature-length debut of writer/director Bryn Chainey. Starring Dev Patel, the story follows a husband experiencing mysterious events on an isolated Welsh island in the 1970s. This film likely has the most promising box office potential among the lineup, thanks to the genre’s popularity and Patel’s star power, particularly in the UK.

The final notable project, THE THING WITH FEATHERS, is a family-centered drama adapted from Max Porter’s book Grief Is the Thing with Feathers. The story revolves around a father and his sons navigating life after the sudden loss of their wife and mother. Starring Benedict Cumberbatch, the film is poised to elevate an otherwise challenging genre in terms of revenue generation with added appeal and star power.

Revenue Forecasting: Spotlight – RABBIT TRAP

In order to provide sample of our detailed projections, we chose to highlight RABBIT TRAP and run it through our predictive tool to showcase what may lie ahead for these types of releases in terms of revenue. This tool takes into consideration 19 material input attributes to determine a full-performance waterfall, P&L and ROI.

We estimated a budget of US$5.0m, an additional US$7.5m in total P&A costs and proposed a theatrical release strategy of 1,650 screens with Patel in the lead. The Cinelytic platform predicts a DBO of roughly US$8.8m, domestic gross revenues (BO, HV, TV) that total US$16.7m, and international gross revenues totaling US$9.0m:

Based on the anticipated domestic and international net revenues (including BO, HE, TV net of distribution fees and expenses), we estimate this film’s global value to be US$6.6m.

All to Say…

Cinelytic’s platform gives buyers a significant advantage at film markets and festivals like Sundance, where data-driven insights into pricing and release strategies are critical. With tools such as per-territory sales estimates and ROI forecasting, stakeholders can assess a film’s value across multiple distribution channels with precision.

This detailed analysis empowers buyers to make well-informed investment decisions by aligning acquisition costs with realistic revenue projections. For projects like those featured in these Insights, our platform evaluates potential based on factors such as genre appeal, talent packaging, and marketing budgets, enabling the development of optimized release strategies.

Whether a film is best suited for a theatrical release or a direct-to-streaming model, Cinelytic provides buyers with the analytics needed to negotiate confidently and strategically, ensuring maximum profitability in today’s dynamic media landscape.