April Insights From Cinelytic – Streaming vs Box Office: What’s Happening Beneath the Surface?

Last month we highlighted some of the dynamic ways our clients can utilize Cinelytic’s new Streaming Consumption Score. This groundbreaking tool allows users to forecast and monitor digital content consumption on a per-title basis across global platforms and countries.

To offer some more insights regarding this tool, we decided to focus this month’s article on how the relationships between streaming views, box office performance and budget have shifted across several film genres, along with an analysis into the growing industry claim of “Superhero Fatigue”.

Are People Tired of Superheroes?

In recent years, the film industry has grappled with a growing sense of weariness surrounding the Superhero genre. After a surge in these types of movies and franchises that dominated the box office and home viewing platforms for years, audiences and critics alike have begun to express exhaustion with the formulaic tropes, repetitive narratives and overuse of CGI that often accompany these films. The volume of Superhero content has led to concerns about oversaturation and a lack of originality, prompting discussions about the need for innovation and diversification.

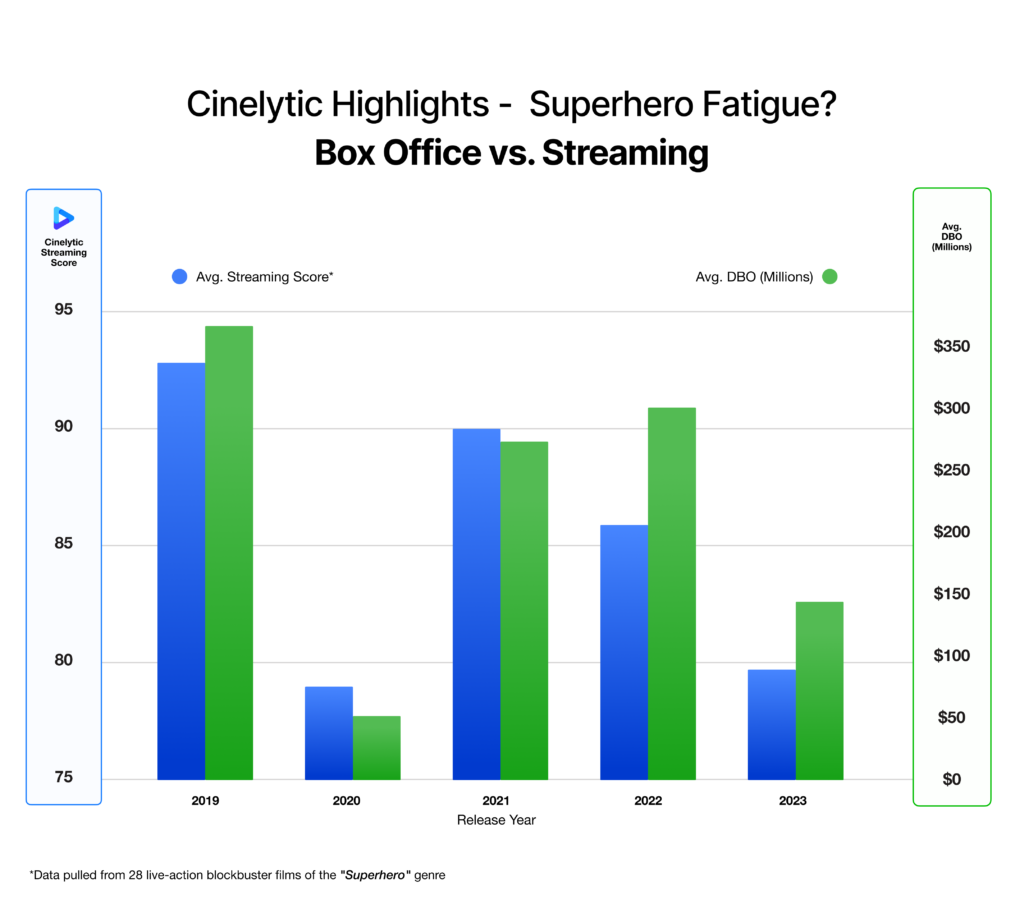

In order to test the validity of this theory, we analyzed the 28 live-action and high-profile Superhero films that released both theatrically and on streaming between 2019 and 2023:

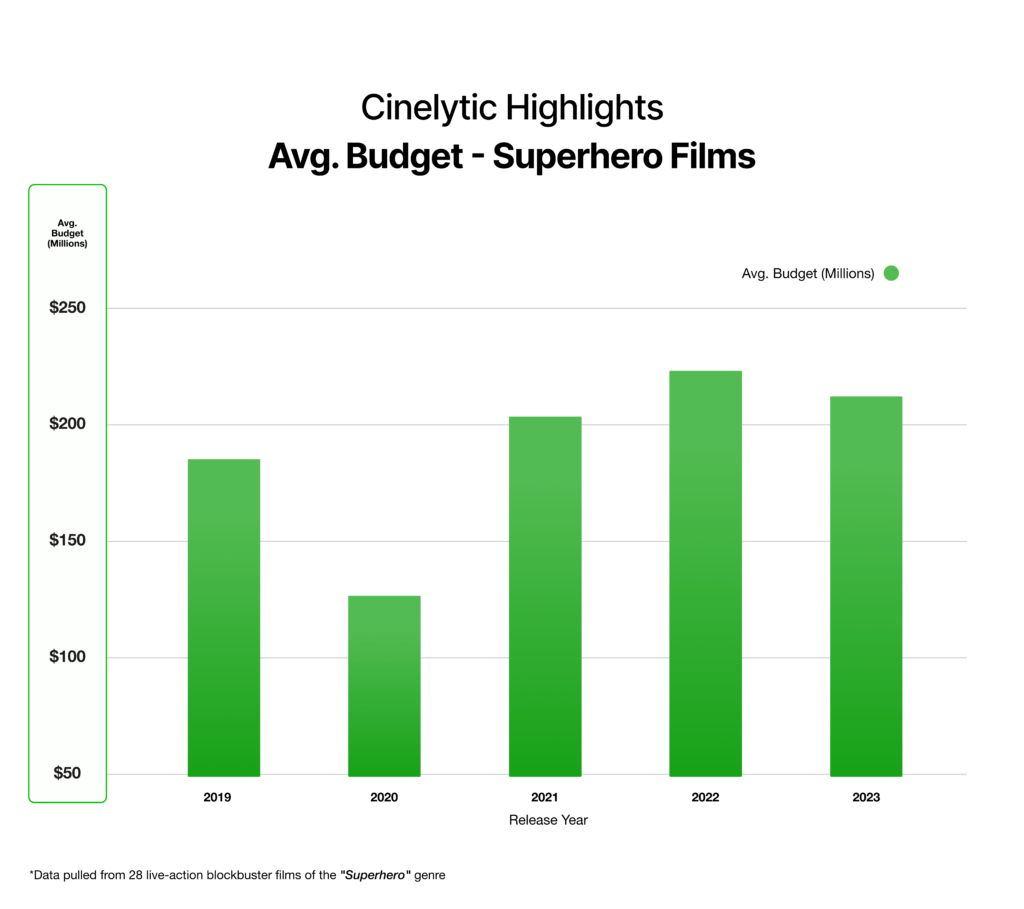

As the graphic above illustrates, both the average streaming score and domestic box office (DBO) for these titles have exhibited a consistent downtrend, outside of an understandable rebound following the 2020 COVID closures. In fact, between 2019 and 2023, the average streaming score and DBO respectively dropped 14% and 61%. Furthermore, it’s important to note that while interest in these films may have dropped, the same can’t be said regarding studio expenditures to get them made. This is evidenced by the chart below, which displays an increase in average budgets by around 15% since 2019 to US$212m:

This overall downtrend provides some support for the argument stating that audiences may be growing tired of comic book sourced narratives and increasingly desire other types of storytelling. This raises the important question: What type of content can make up for the revenues lost from Superhero releases?

To answer this question, we took a deeper dive into both the box office and streaming performance of Original Action, large Non-Franchise and Drama titles over the last five years.

Original Action:

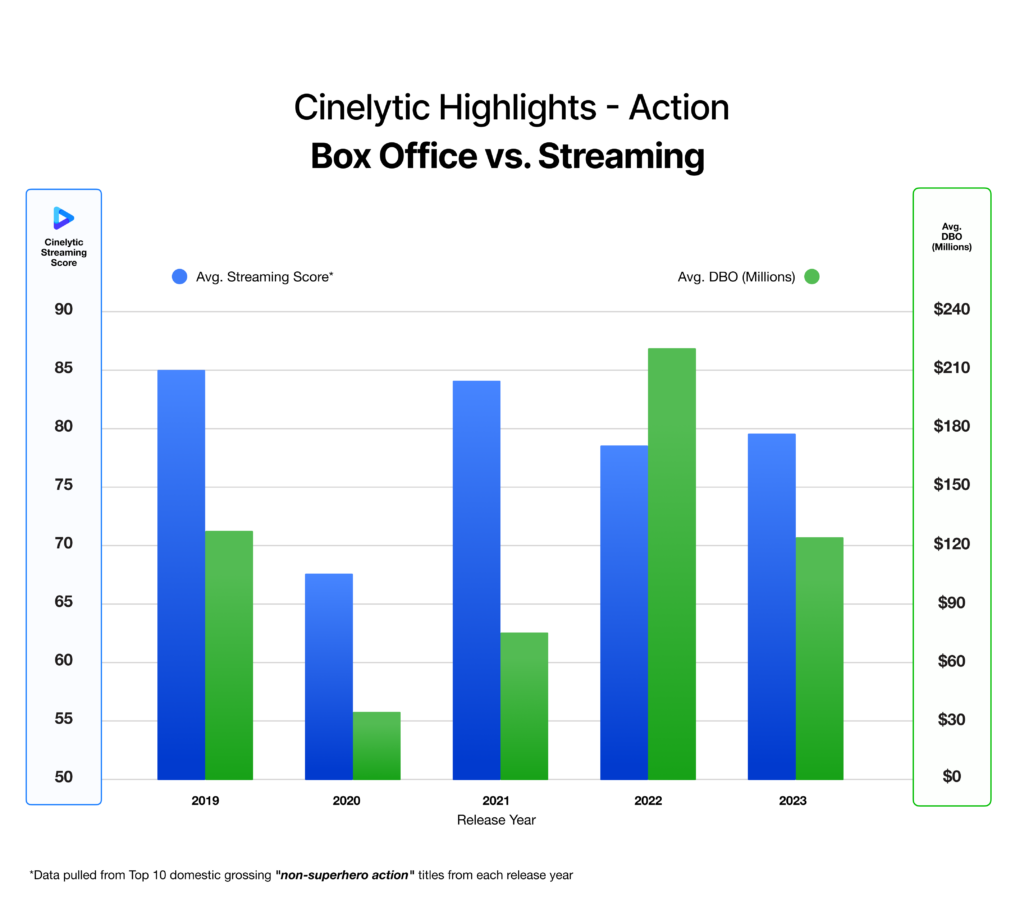

The 50 non-Superhero Action titles that we pulled data for showcased slightly more inconsistent trends in both streaming score and DBO. Some of the most high-profile examples of these movies include titles representing the Star Wars, Fast & Furious, John Wick, Bad Boys, James Bond, Top Gun, Avatar, Indiana Jones and Mission: Impossible franchises.

While both fluctuated, the average streaming score and DBO since 2019 can be considered flat as both decreased by only 6% and 2% respectively, indicating stable demand in comparison to Superhero films released in the same time period. However, the budgets of these films since 2019 have considerably increased by 28% to US$195m.

Large Non-Franchise:

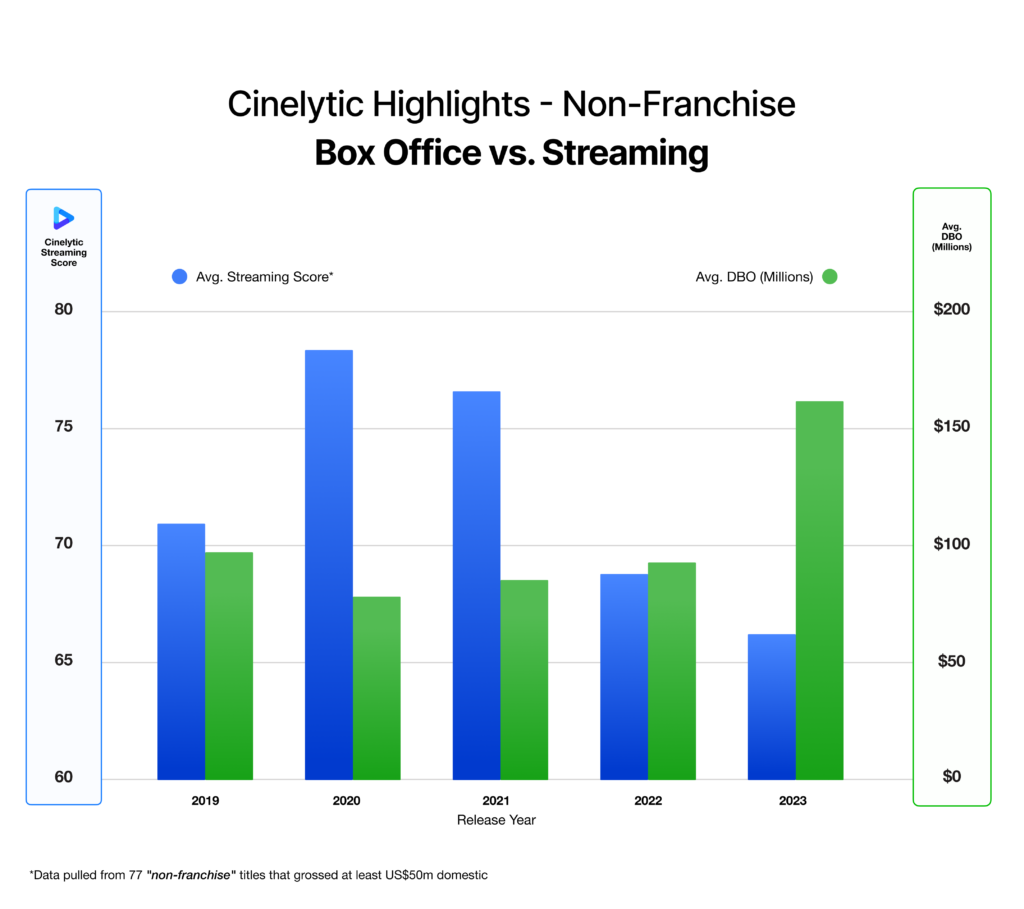

We used our platform to look at all the non-Superhero titles that generated at least US$50m in DBO and were not part of any established film franchises. This allows us to gauge how audiences reacted to content across numerous genres and a wide range of consumer segments. In this case, the 77 analyzed films presented opposing trends for streaming and box office performance.

Despite considerable boosts during the lockdowns in 2020 and 2021 when audiences had huge appetites for Non-Franchise films on digital platforms, the average streaming score performed similarly to Action across all five years and can also be considered flat with a small decrease of 6%.

The data points out that the strong demand for that content type shifted to the theatrical setting and resulted in a 65% increase in average DBO during the same five-year span. That should come as good news for the studios involved in these projects since the average budgets for these same movies increased by 73% since 2019. In particular, 2023 was distinctly impressive at the box office, in large part due to historically successful theatrical runs for films like BARBIE, THE SUPER MARIO BROS. MOVIE and OPPENHEIMER.

Drama:

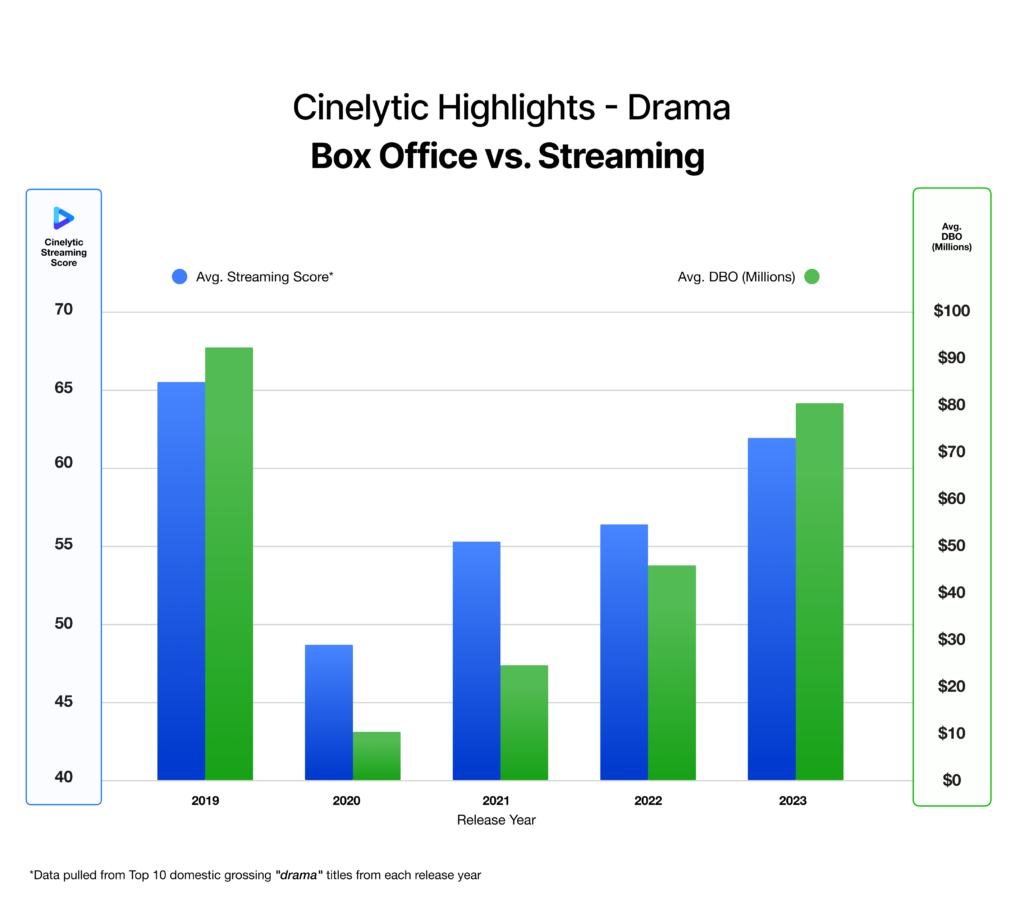

Despite interest in Superhero titles consistently decreasing, the opposite can be said for the least expensive genre in this study: Drama.

Popular releases prior to the pandemic like ONCE UPON A TIME…IN HOLLYWOOD, FORD V FERRARI, THE UPSIDE and LITTLE WOMEN helped make 2019 the strongest year we analyzed for Drama. The data points out that Drama was not in the audiences favor during the pandemic, which resulted in a sharp drop in 2020 and 2021 on a per film average.

Since then, the genre has been marked by steady improvement as audiences have been looking for more than just escapism and instead crave interesting storylines. The average streaming score and DBO respectively and impressively increased by 27% and a whopping 682% between 2020 and 2023, which indicates strong upcoming demand in 2024. It remains to be seen if this year’s upcoming slate will be able to support that demand.

Changing Appetites

It should come as little surprise that most of this data shows box office and streaming performance decreasing since 2019 for the films we incorporated in these analyses, as the slate of films released in that year was extremely strong. As it relates to Superhero movies, they seem to have taken the biggest hit with no signs of steady improvement. Meanwhile, content that was unrelated to comic book universes fared noticeably better. Our data clearly indicates that there is a very healthy demand for larger Non-Franchise films across theatrical and streaming consumption. Furthermore, the resurgence in a demand for drama content is clearly moving in the same direction.

The good news is that all this may signal that consumers are hungry for quality content. Perhaps the elevated storytelling in the episodic TV realm has raised audience expectations for films as well. To accommodate this, the industry will need to find and shine a light on creative voices who can produce content sourced from original ideas that can potentially lead to future franchises or prioritize the re-imagining of popular IP. This year’s domestic box office success of a variety of films like DUNE: PART TWO, GODZILLA X KONG: THE NEW EMPIRE and even A24’s dystopian thriller CIVIL WAR seem to all be varying examples of these types of efforts.