November Insights From Cinelytic – Box Office Trends and Streaming Success

The post-pandemic era continues to reshape the industry, making 2024 another unpredictable and captivating year at the box office. While several “surefire” blockbusters—backed by iconic franchises, high-profile IPs, and star-studded casts—fell short of expectations, others achieved historic milestones, and a few under-the-radar releases surprised with unexpected theatrical success.

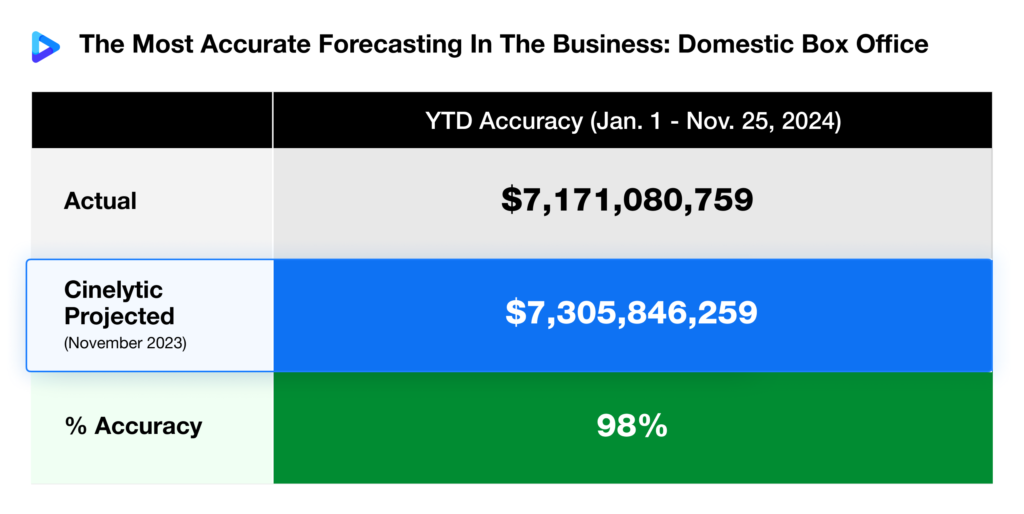

Earlier this year, Cinelytic shared a breakdown of our domestic box office predictions for the 2024 slate, which were generated using our forecasting model in late 2023. Our advanced early prediction tools enable us to accurately project domestic and global box office performance, along with home video and TV revenues, offering a comprehensive resource for the film industry.

For 2024, our model projected a total domestic gross of US$8.2b. As shown in the graphic below, we’ve achieved an impressive 98% accuracy rate on these projections thus far, a figure poised to improve further with one weekend remaining in November:

As previously noted, a variety of films have played a significant role in the US$7.2b earned at domestic theaters up to this point, with varying levels of subsequent success on streaming platforms after differing theatrical windowing strategies. To delve deeper, we analyzed and compared the streaming performance of some recent major releases using our proprietary streaming demand data. This dataset tracks 125m daily P2P transactions worldwide, amounting to an impressive 35b transactions annually.

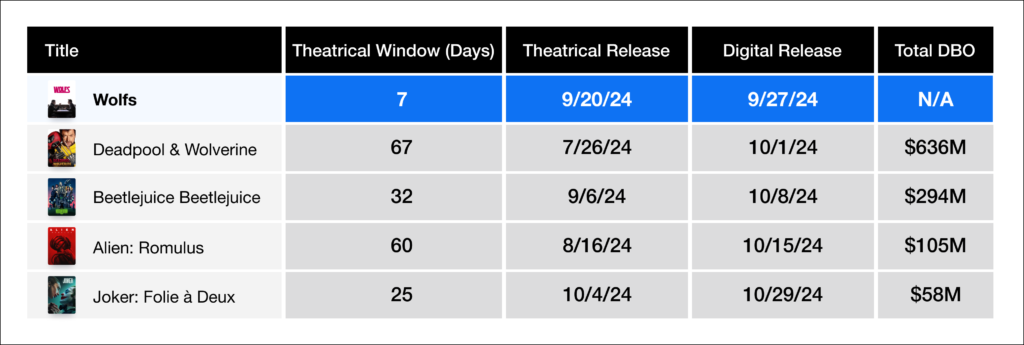

Studios have experimented with various shortened windowing strategies both during and after the pandemic, yet historical and recent data consistently show that films with strong box office performance and longer theatrical windows often achieve impressive results in-home viewing as well.

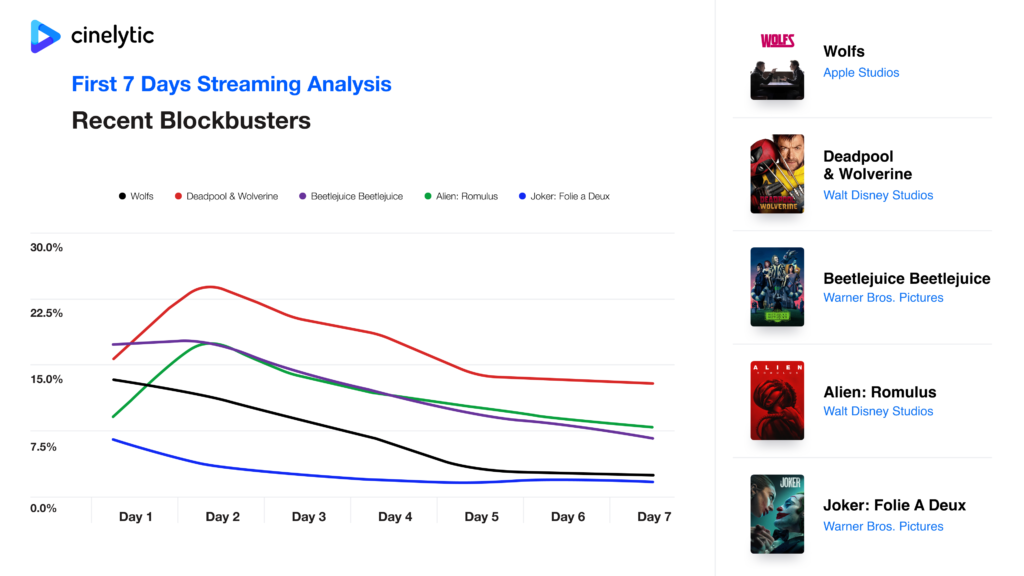

To put this theory to the test once more, we used our proprietary streaming demand data to analyze the first seven days of streaming performance of five major titles that recently concluded their theatrical runs and now live on digital platforms: DEADPOOL & WOLVERINE, ALIEN: ROMULUS, BEETLEJUICE BEETLEJUICE, WOLFS and JOKER: FOLIE A DEUX.

Among the titles we analyzed, DEADPOOL & WOLVERINE and BEETLEJUICE BEETLEJUICE ranked among the Top 5 highest-grossing box office releases of the year before transitioning to streaming. Meanwhile, ALIEN: ROMULUS currently holds the #18 spot, JOKER: FOLIE A DEUX sits at #32, and WOLFS bypassed traditional box office revenue entirely after Apple Studios shifted gears and opted for a limited one-week theatrical release.

DEADPOOL & WOLVERINE and ALIEN: ROMULUS followed nearly identical trajectories during their first week, experiencing notable Day 2 surges followed by a slow and consistent decline. Both titles secured the #1 spot as the most-viewed films throughout their respective opening streaming runs. The latest MCU entry achieved an impressive average market share of 16.7% and a peak of 23.1%, while the newest installment in the ALIEN franchise maintained a strong 11.5% average.

Tim Burton’s sequel to his 1988 classic also experienced a Day 2 bump, though it was far less pronounced. As a result, it followed a steadier overall trajectory, holding the #1 spot for all but one of its first seven days and finishing similarly in performance to ALIEN: ROMULUS with an average market share of 12.3%.

Now, let’s turn to the less successful digital performances. While WOLFS has been promoted by its tech giant distributor as the most-viewed film in Apple TV+ history, it ranked fourth in opening-week performance among the analyzed titles and gradually reached an average market share of 7.4%.

Finally, JOKER: FOLIE A DEUX, the sequel to Todd Phillips’ 2019 megahit, struggled both commercially and critically, leading to a quick transition from theaters to home viewing. Despite debuting as the #1 most-watched film on Day 1, it saw minimal recovery following a Day 2 decline and ended with the lowest average market share of the group, at just 3.6%.

Which Window is Best?

With the exception of WOLFS, all of these titles are linked to established IPs, and all but JOKER: FOLIE A DEUX—despite its comic book origins—utilize significant action or comedy elements. The three films with the longest exclusive theatrical windows, spanning roughly 30 to 70 days, delivered the strongest performance both in theaters and on home platforms. In contrast, titles with shorter or virtually nonexistent theatrical releases appear to have struggled to generate revenue in either delivery method.

In some cases, pulling a film early from theaters due to weak box office figures, like with this year’s THE FALL GUY, has led to strong digital performance and some financial recoupment. However, this strategy did not seem to work as effectively for the aforementioned DC Comics adaptation, ultimately leading to weaker performance on home platforms despite its early exit from theaters.

The industry continues to grapple with finding the most effective strategy for balancing theatrical and digital releases in terms of timing. Ultimately, these decisions will need to be made on a case-by-case basis for each title. However, the data discussed above suggests that a principle we have previously mentioned still holds: windowing matters, and films with significant separation (at least 30 days) tend to perform better during the home viewing phase