2025 EFM Insights Special

The European Film Market (EFM) 2024 proved once again to be a critical barometer for the global independent film industry, with key titles sparking early bidding wars and a slate of new projects setting the tone for the year ahead. Berlin’s marquee market drew a dynamic mix of prestige dramas, high-concept thrillers, and auteur-driven passion projects, all vying for the attention of distributors, streamers, and sales agents looking to secure the next breakout hit.

From surprise buzz generators to calculated acquisitions, EFM underscored the evolving strategies shaping the industry, particularly in an era of shifting audience behavior and evolving revenue models.

Looking ahead, 2025 is already generating significant anticipation, as major players recalibrate their pipelines and new financing models gain traction. Industry confidence appears to be growing, with increased interest in sophisticated genre films and prestige-driven mid-budget projects that balance critical appeal with commercial viability.

While questions remain about the post-strike recovery and long-term theatrical trends, early indicators suggest that demand for high-quality, internationally viable content remains strong.

Now on to EFM 2025

At Cinelytic, we leveraged our AI-driven forecasting tools to take a closer look at three of the most talked-about titles vying for sales at this year’s market: EDDINGTON, THE RAGE, and WIFE & DOG. Each film brings a unique market proposition—whether through star power, genre appeal, or festival pedigree—and our ROI modeling provides valuable insights into their potential performance across key metrics. These insights are particularly crucial for financiers, producers, and equity providers looking to make informed decisions in a competitive acquisition landscape.

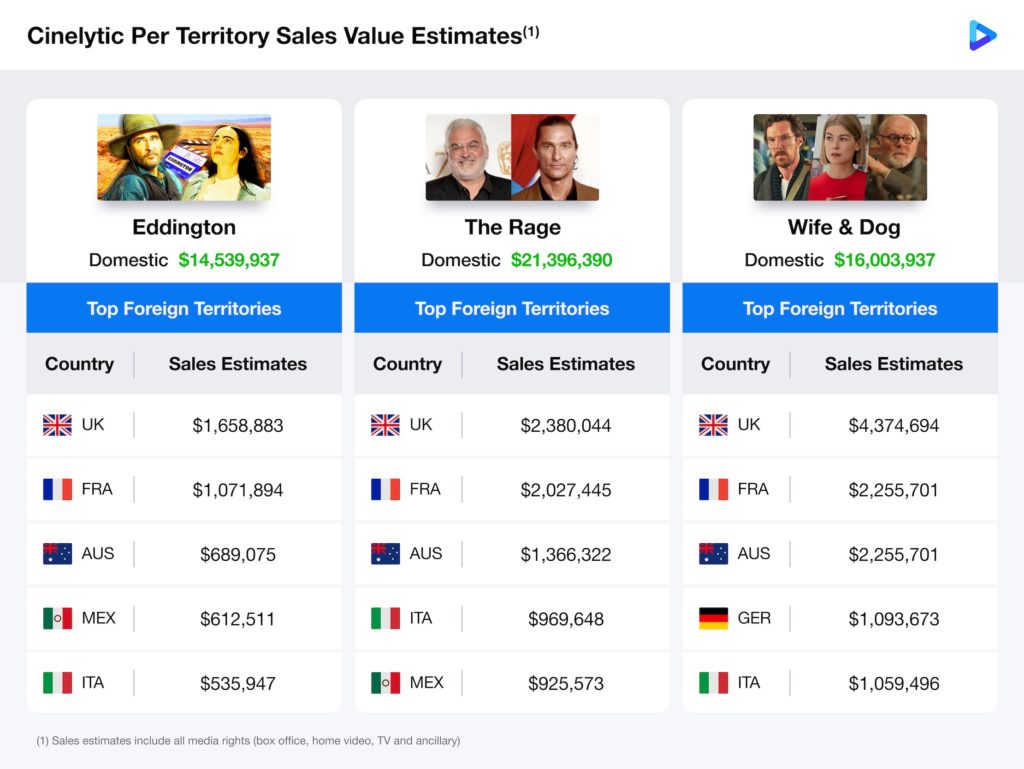

In addition, our sales estimates tool offers a distinct advantage, allowing buyers and sellers at EFM to evaluate each title’s per-territory value across all media rights, from theatrical to streaming, home entertainment, and ancillary revenue. As the graphic below demonstrates, having real-time, data-driven benchmarks in a market setting enables stakeholders to determine the right price for each territory’s rights. In an environment where strategic dealmaking is paramount, predictive analytics is no longer just an advantage—it’s a necessity.

EDDINGTON is brought to us from horror veteran Ari Aster, marking his second dark comedy collaboration with Joaquin Phoenix after 2023’s BEAU IS AFRAID. A contemporary Western following a small-town New Mexico sheriff with big ambitions, the film will blend Aster’s signature psychological tension with offbeat humor. With an ensemble cast including Emma Stone, Pedro Pascal, and Austin Butler, Aster’s latest is already generating buzz, with A24 handling sales as expected. Given Aster’s cult following and A24’s strong track record, buyers are eager to see how this genre-blurring project plays out.

THE RAGE marks the first of two upcoming collaborations between director Paul Greengrass and star Matthew McConaughey, coupled with Apple TV+’s THE LOST BUS. Known for his kinetic style, Greengrass brings his signature intensity to this gritty period drama, which is a historical epic set during England’s 1381 Peasants’ Revolt. FilmNation Entertainment is handling sales, and with McConaughey leading a prestige-driven, commercially viable thriller, this title is shaping up as one of EFM’s hottest acquisition titles.

WIFE & DOG sees writer/director Guy Ritchie back in his signature world of quick-witted criminals and aristocratic betrayals. Starring Benedict Cumberbatch, Rosamund Pike, and Anthony Hopkins, the reportedly fact-based film will likely deliver Ritchie’s signature mix of humor and deception. Black Bear is handling sales, and with Ritchie’s brand of stylish, elevated crime storytelling remaining a major draw, the film could spark competitive bidding across multiple territories.

Revenue Forecasting: Spotlight – EDDINGTON

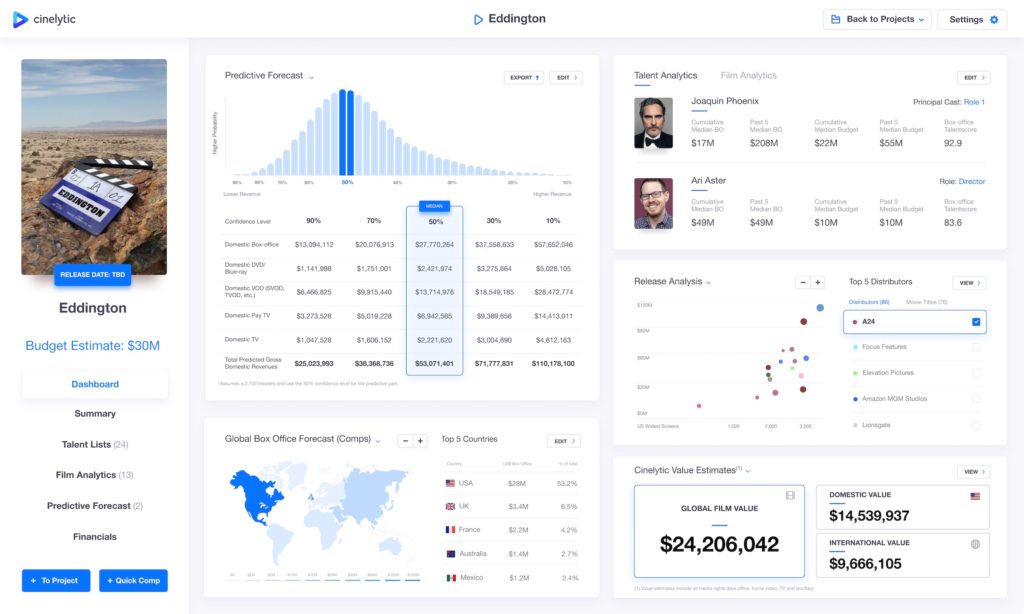

In order to provide sample of our detailed projections, we chose to highlight EDDINGTON and run it through our predictive tool to showcase what may lie ahead for these types of releases in terms of revenue. This tool takes into consideration 19 material input attributes to determine a full-performance waterfall, P&L and ROI.

We estimated a budget of US$30.0m, an additional US$32.0m in total P&A costs and proposed a theatrical release strategy of 2,700 screens with Phoenix in the lead. The Cinelytic platform predicts a DBO of roughly US$27.8m, domestic gross revenues (BO, HV, TV) that total US$53.1m, and international gross revenues totaling US$41.1m:

Based on the anticipated domestic and international net revenues (10 year ultimate including BO, HE, TV net of distribution fees and expenses), we estimate this film’s global value to be US$24.2m.

All to Say…

In an increasingly complex and competitive market, having the right data at the right time is key to making informed acquisition and financing decisions. As recent major film markets and festivals have demonstrated, the appetite for high-quality, commercially viable films remains strong, but strategic dealmaking requires more than just intuition—it demands real-time, data-driven insights. Cinelytic’s AI-powered forecasting and sales estimation tools provide a crucial advantage, helping stakeholders navigate market volatility with confidence. Whether assessing a film’s ROI potential, determining optimal sales pricing, or identifying the most promising acquisition targets, our platform delivers the intelligence needed to maximize value. As the industry looks ahead to 2025 and beyond, those equipped with predictive analytics won’t just be reacting to trends—they’ll be shaping them.