June Insights From Cinelytic – Here Comes the Heat: Summer Movie Season Has Begun

As the 2025 summer box office season kicks into high gear, we’re taking a closer look at performance trends so far and what lies ahead. From AI-powered forecasting to genre-level breakouts, our insights continue to offer a data-driven edge for decision makers navigating a rapidly evolving theatrical landscape.

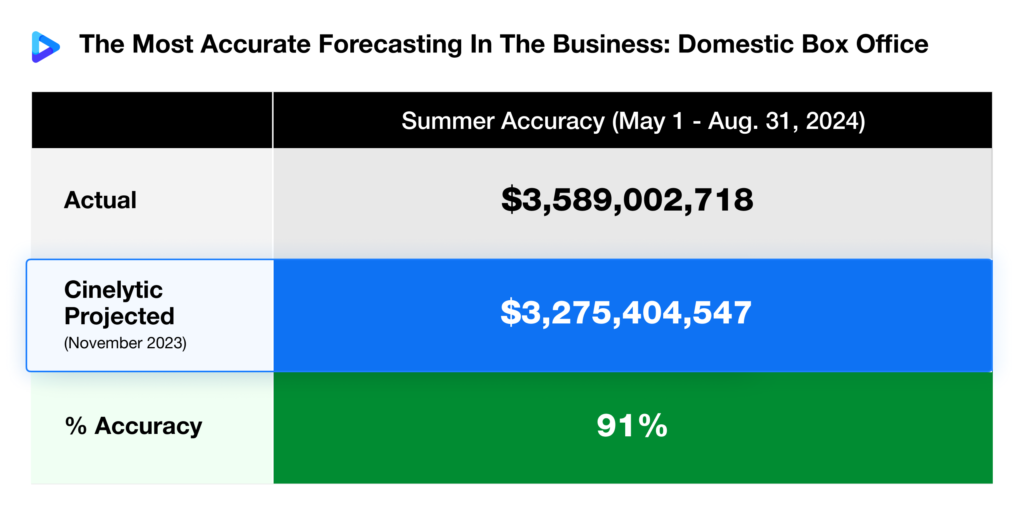

As the graphic below demonstrates, Cinelytic’s predictive platform projected last year’s summer domestic box office (DBO) within 91% accuracy, reaffirming Cinelytic’s position as the most reliable forecasting tool in the business and our model’s strength across multiple release windows and genres:

For studios, financiers, and distributors, this level of forecasting accuracy offers real financial and strategic advantages. The ability to identify outliers, calibrate expectations, and make data-informed marketing and release decisions remains one of our core value propositions—and our track record continues to speak for itself.

A Strong Start to Summer 2025

As the summer movie season progresses, the box office is experiencing a significant resurgence, marked by record-breaking openings and robust audience engagement. May 2025 alone saw DBO revenues reach just under US$970m, a notable 76% increase compared to May 2024, signaling a strong rebound for theaters nationwide.

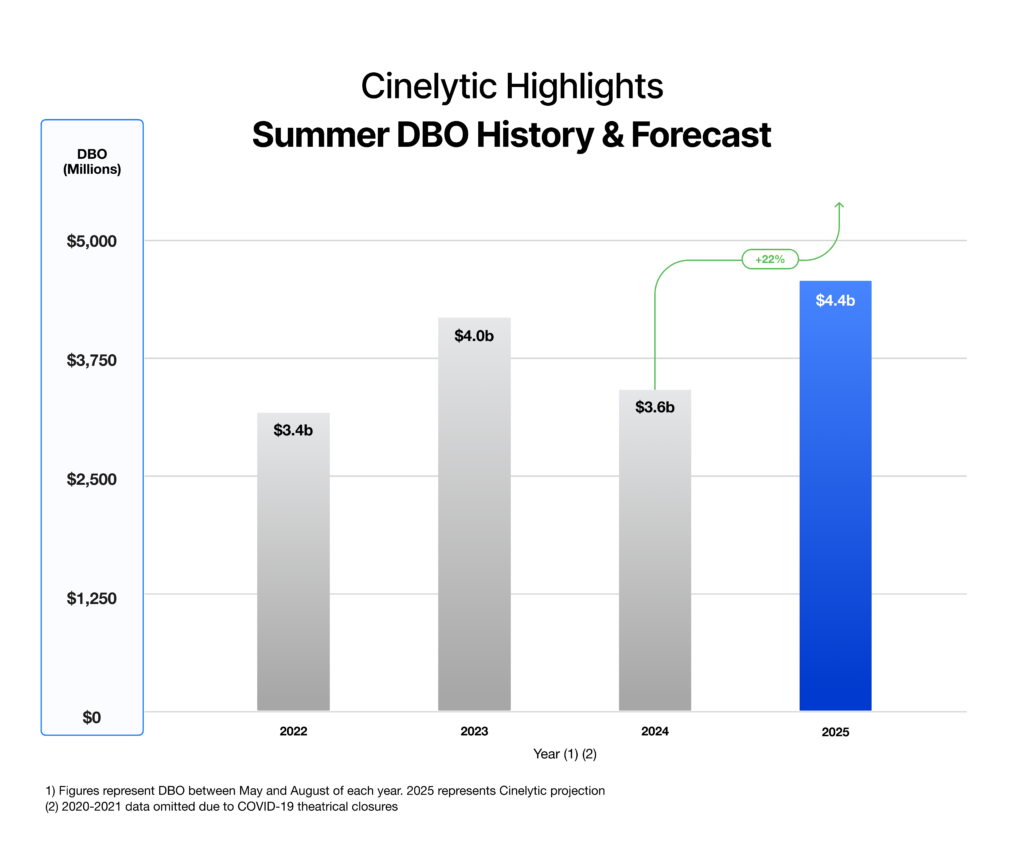

Looking ahead, the graphic below shows that Cinelytic projects the total DBO for the full 2025 summer season (May through August) to reach approximately US$4.4b, marking a 22% increase from 2024.

If this projection holds, it would mark the strongest summer performance of the post-COVID era—surpassing every summer since 2020—and aligning closely with pre-pandemic benchmarks. Both 2018 and 2019 closed their summer seasons at roughly the same level, signaling a return to form for theatrical exhibition in terms of revenue scale and audience turnout.

So far, Disney’s live-action remake of LILO & STITCH has emerged as a standout, grossing a whopping US$339m domestically to date despite being released less than three weeks ago. The film set a new Memorial Day weekend record with a US$183m domestic opening, surpassing previous benchmarks and demonstrating the enduring appeal of reimagined classics.

Paramount’s MISSION: IMPOSSIBLE – THE FINAL RECKONING, featuring Tom Cruise’s supposed final performance as Ethan Hunt, has also made a significant impact. The film achieved a franchise-best domestic opening of US$79m over the four-day Memorial Day weekend.

In the realm of horror, FINAL DESTINATION: BLOODLINES has revitalized its franchise, delivering a series-best US$52m opening domestic weekend and accumulating a total of US$124m to date.

Recent Major Streaming Releases

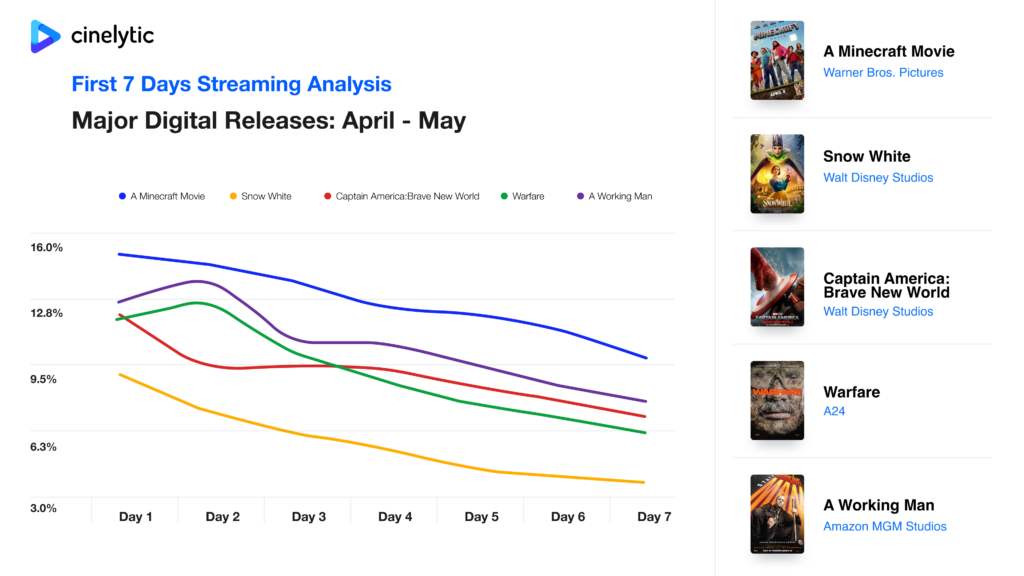

To complement our theatrical insights, we turn to streaming, where several high-profile titles competed head-to-head in recent months. The chart below, powered by Cinelytic’s proprietary streaming demand dataset—which tracks over 125 million daily peer-to-peer (P2P) transactions globally—offers a direct comparison of digital market share capture during each title’s first seven days post-release:

Warner Bros.’ A MINECRAFT MOVIE emerged as the dominant force, consistently holding the top market share position each day and maintaining an average of just under 13% across the week. The film’s success is largely attributed to the enduring popularity of the IP and a robust, community-driven social media campaign.

In stark contrast, Disney’s SNOW WHITE struggled to gain traction, averaging less than half of MINECRAFT’s share. Despite launching on the same day, SNOW WHITE has long suffered from negative press and weak critical reception, and while it maintained the #2 position, it did so at a distant second.

In another “same day” matchup, CAPTAIN AMERICA: BRAVE NEW WORLD and Amazon MGM’s A WORKING MAN both posted strong results. The latter—Jason Statham’s latest action vehicle—captured a higher average market share of 10.4%, leading the digital charts for its entire first week. The Marvel Cinematic Universe’s entry held steady at 9.0%, showing signs of franchise fatigue but still enough draw to maintain a firm #2 ranking throughout.

A surprise came in the form of WARFARE, A24’s gritty war drama. With minimal marketing and a niche genre, it nonetheless managed to essentially match CAPTAIN AMERICA’S average market share (9.1%)—a significant achievement for a smaller, R-rated title with limited promotional spend. Notably, WARFARE even took the #1 spot during its release week, highlighting the growing potential for prestige, adult-skewing films to cut through the noise on streaming platforms.

Forecasting Highlight – SUPERMAN

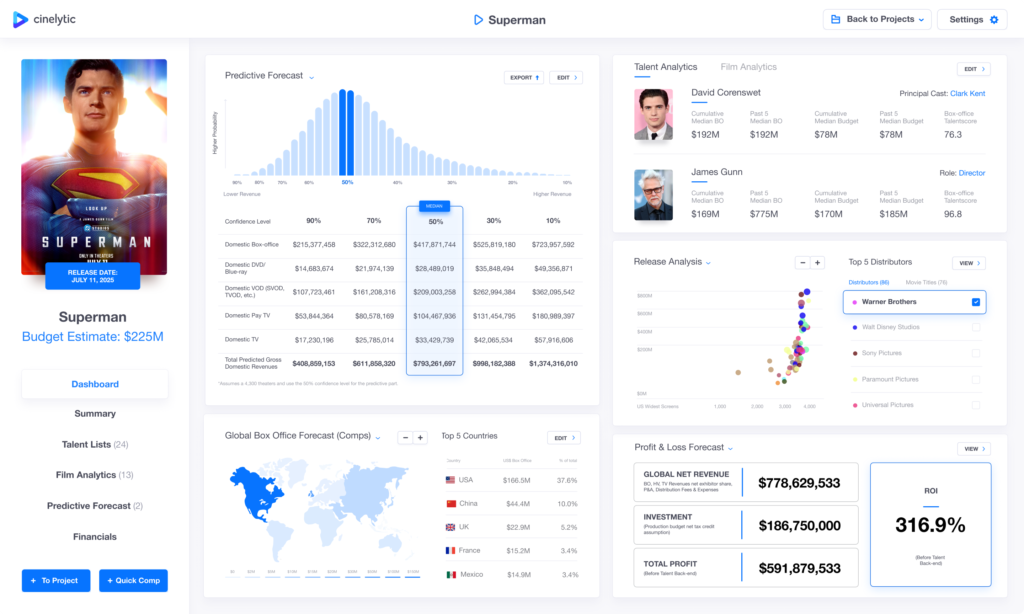

The Cinelytic platform leverages 19 critical project attributes, applying proprietary algorithms and machine learning to deliver advanced predictive analytics on major film titles. A compelling example of Cinelytic’s predictive power is the upcoming SUPERMAN film—an ambitious move for both Warner Bros. and Marvel alum James Gunn, now leading the charge at DC Films. Positioned as the cornerstone of a brand-new cinematic universe, SUPERMAN aims to reintroduce a range of iconic comic book characters in bold, reimagined forms.

Using a reported production budget of US$225.0m and estimated global P&A costs of US$240.0m, Cinelytic incorporates key project attributes—including budget, genre, rating, talent, and IP strength—into its AI-driven forecasting model. The result: a massive projected DBO gross of US$417.9m in the base case median scenario. And that’s just the start—Cinelytic goes beyond theatrical, offering predictive insights into Home Video and TV revenue, all grounded in real-world data for a truly comprehensive performance outlook:

Based on the anticipated global net revenues totaling US$778.6m (including domestic/international box office, home entertainment, TV net of distribution fees and expenses), the film is projected to result in a significant return (10-year ultimate), with a projected ROI of 316.9% before talent back-end payouts.

All to Say

As the summer heats up, both on screen and at the box office, Cinelytic continues to deliver the clarity and foresight needed in an unpredictable entertainment landscape. Whether it’s forecasting the next breakout theatrical hit, analyzing head-to-head streaming competition, or modeling long-term profitability for tentpole releases like SUPERMAN, our platform equips industry stakeholders with actionable intelligence grounded in real-time data and predictive precision.

With summer 2025 already outperforming expectations and setting new benchmarks across platforms, Cinelytic remains the trusted partner for navigating today’s dynamic content economy—one insight at a time.