October Insights From Cinelytic – From Summer to Fall: Box Office Hits, Misses & Streaming Trajectories

As this month comes to a close, the film industry is poised to witness what’s tracking to finish as the worst October at the domestic box office (DBO) since 1997 (discounting the 2020 COVID shutdown). That year’s October total came in just above US$381m, while the broader 1997 slate was defined by major blockbusters like MEN IN BLACK and THE LOST WORLD: JURASSIC PARK, with TITANIC on deck to redefine box office history by year’s end.

As the graphic below demonstrates, Cinelytic’s predictive platform continues to show remarkable accuracy in forecasting market outcomes, including this very slowdown, which our models projected back in Q4 2024 as a similarly and historically soft month for theatrical performance:

It wouldn’t be fair to single out October alone, as 2025 has been filled with a wide spectrum of theatrical outcomes. From ambitious tentpoles that missed the mark to steady performers that met expectations and a handful of overachievers that defied the odds, the year so far has delivered no shortage of lessons about audience behavior and release strategy.

Underperformers, On Target and Overperformers

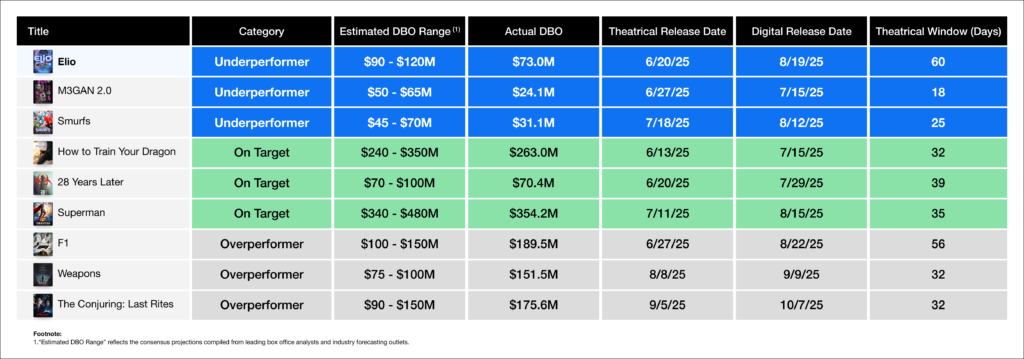

To explore this dynamic further, Cinelytic identified nine high-profile titles released theatrically since June, distributed evenly across three categories based on their actual box office results versus pre-release industry consensus:

Among the underperformers, ELIO struggled to connect with families amid heavy competition and a crowded animated slate, M3GAN 2.0 leaned too heavily on the viral appeal of its predecessor and displayed overconfidence with a borderline genre shift, and the SMURFS reboot failed to overcome brand fatigue despite a family-friendly window.

The on-target performers each fell within expected forecast ranges, driven by strong brand recognition, loyal fanbases, and well-timed marketing pushes.

Meanwhile, the overperformers outpaced expectations thanks to a mix of star power, smart positioning, and franchise momentum that carried them through late summer and into early fall.

It’s worth noting that WEAPONS and THE CONJURING: LAST RITES, both spooky, horror-driven releases, would almost certainly have helped October avoid its “historically bad” label had Warner Bros. held them just a bit longer.

The studio’s reasoning, however, was clear: late-summer windows offered less competition, more premium-screen availability, and the ability to build sustained buzz leading into Halloween rather than competing directly with crowded late-October schedules.

In the end, those strategic early releases performed exceptionally well but also left a noticeable void in what has otherwise been the weakest October in nearly three decades.

Correlation to Streaming

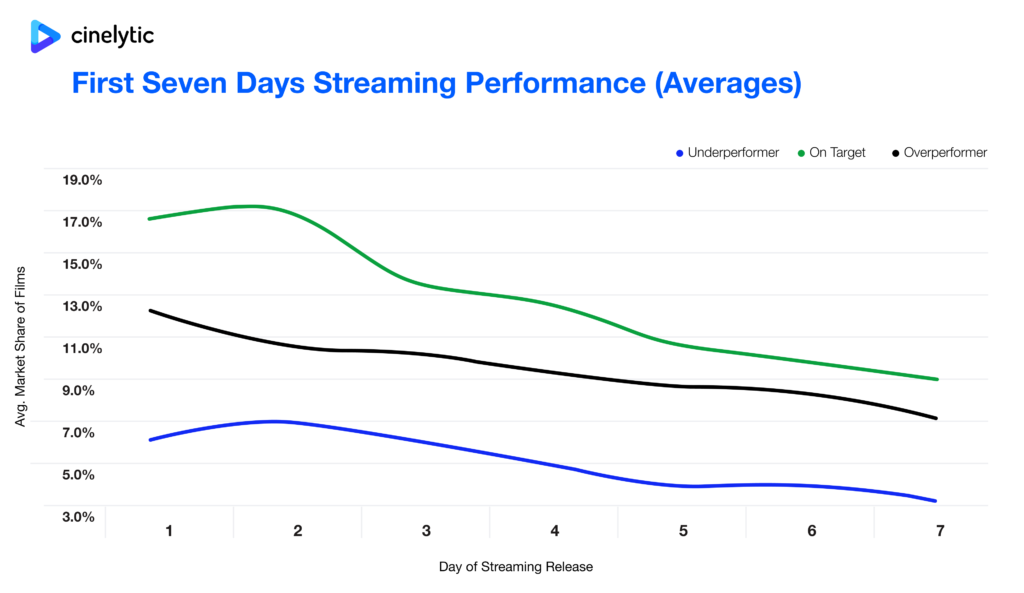

To understand the bigger picture, we turn to streaming. The chart below is powered by Cinelytic’s proprietary Streaming Demand Dataset, which tracks over 125 million daily peer-to-peer (P2P) transactions worldwide. This graphic illustrates digital market share capture during the first seven days of post-release for these nine same titles:

The results reveal an interesting correlation between box office performance and early digital traction. Films that performed on target in theaters achieved the highest first-week streaming capture, averaging 12.8% of total digital market share.

Those that overperformed theatrically still translated well to streaming, though at a lower average of 9.5%, suggesting that much of their audience demand had already been met during their theatrical run.

Meanwhile, underperformers mirrored their box office struggles in the digital space, averaging just 4.9% in their first week.

What are the Key Takeaways?

While this pattern reinforces the idea that films aligning most closely with audience expectations tend to thrive across both windows, the most valuable insight comes from the fact that the theatrical outperformers did not outperform on streaming.

Today’s consumers are highly informed about what films are worth seeing in theaters, at home, or skipping altogether. Going to the cinema is expensive and requires extra effort compared to the comfort and convenience of home viewing. However, audiences still flock to theaters for truly cinematic experiences. These are films that demand a big screen, benefit from the shared energy of a live audience, or deliver that premium theatrical feel. These titles tend to outperform at the box office but often see softer results on streaming, as most interested viewers have already watched them in theaters.

The next tier consists of strong films that offer a positive theatrical experience but aren’t considered “must-see in theaters.” While they draw respectable attendance, many viewers choose to wait for their streaming release, driving strong digital performance as a result. These are films audiences want to see but don’t feel compelled to spend extra money or effort on a theatrical trip.

Finally, there are films that fail to engage audiences either in theaters or at home. These typically suffer from weak execution or concepts that don’t resonate. In an entertainment landscape that is currently crowded with sports, gaming, and social media, consumers are selective with their time, and these titles simply don’t break through.

All to Say…

Ultimately, insights like these underscore why Cinelytic’s platform and suite of tools have become an essential tool for today’s entertainment decision-makers. By unifying real-time box office tracking, audience sentiment, and global streaming demand into a single data-driven ecosystem, Cinelytic empowers studios, streamers, and financiers to move beyond guesswork.

We provide them with the ability to identify optimal release windows, calibrate marketing spending and accurately forecast revenue potential across every platform. In a marketplace where timing, positioning, and audience connection determine success, Cinelytic gives the industry a measurable advantage by turning data into foresight, and foresight into smarter results.