Has Theatrical Finally Leveled Out? Year-End Trends and a Preview of 2026

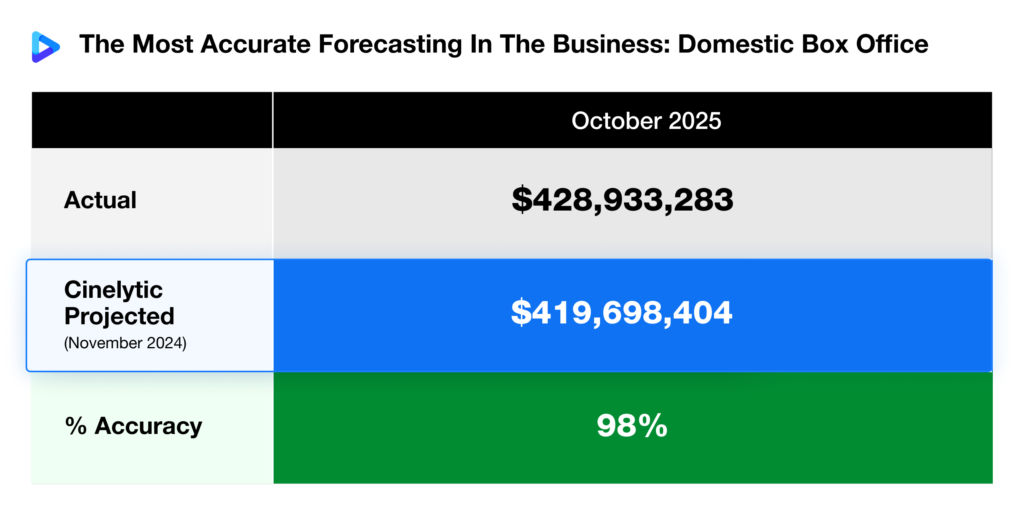

All year long we have been benchmarking the predictions we published at the end of 2024 for the 2025 film slate. With a historically low October domestic box office (DBO) now closed and totals finalized, it is worth noting that Cinelytic’s forecasts for the month landed at a 98% accuracy rate, almost exactly one year after they were published. The chart below highlights just how closely actual performance aligned with our original projections:

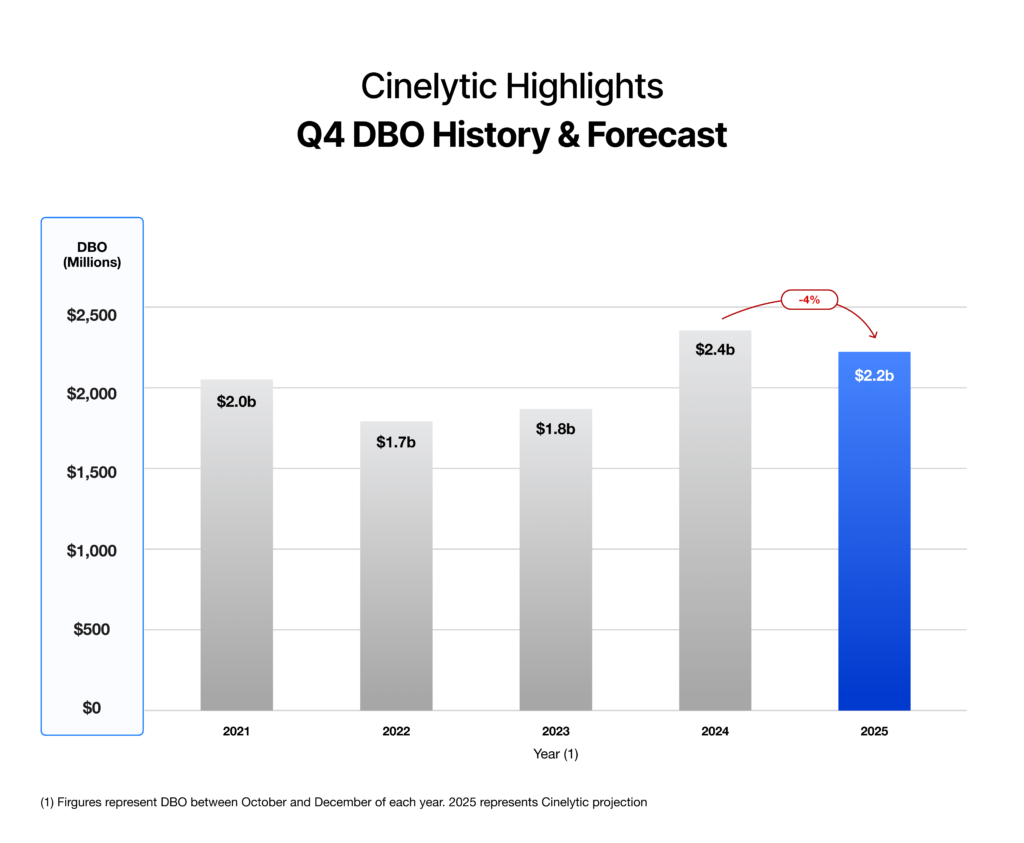

As we move into the final quarter of the year, many will recall the Q4 DBO outlook we shared in our September Insights. At that time, we projected roughly US$2.4b in total Q4 revenue, a modest 3% improvement over the same period in 2024.

Since then, several highly anticipated releases have shifted into 2026. Major projects, including THE BRIDE! and MORTAL KOMBAT II from Warner Bros. Pictures, were among the moves forcing a recalibration of calendar expectations. As a result, we have updated our Q4 2025 forecast to just over US$2.2b, instead representing a 4% year-over-year decline:

While this drop is notable, it remains relatively small when compared with the sharp 26% surge in Q4 2024. If anything, the contrast underscores a broader trend. Rather than preparing for big spikes or sudden drops, the industry appears to be settling into a more predictable cadence after several years of volatility. The domestic market may finally be shaping into a post-COVID equilibrium, with fewer extremes and steadier theatrical behavior from both distributors and audiences.

This revised projection also of course affects our total domestic haul for 2025. We originally pegged the year at US$9.35b in box office revenue, a sizable 9.1% increase over a soft 2024. With the slate adjustments, our updated estimate now sits at US$9.18b. The new number still reflects growth, though at a more measured pace of 7.1%.

What About Next Year?

Even with these revisions, 2025 remains positioned to deliver the strongest theatrical performance of the post-COVID era, though not quite to the degree many across the industry had hoped for during earlier planning cycles. The bigger picture may simply be a settling period, where the market rebuilds gradually rather than surging all at once.

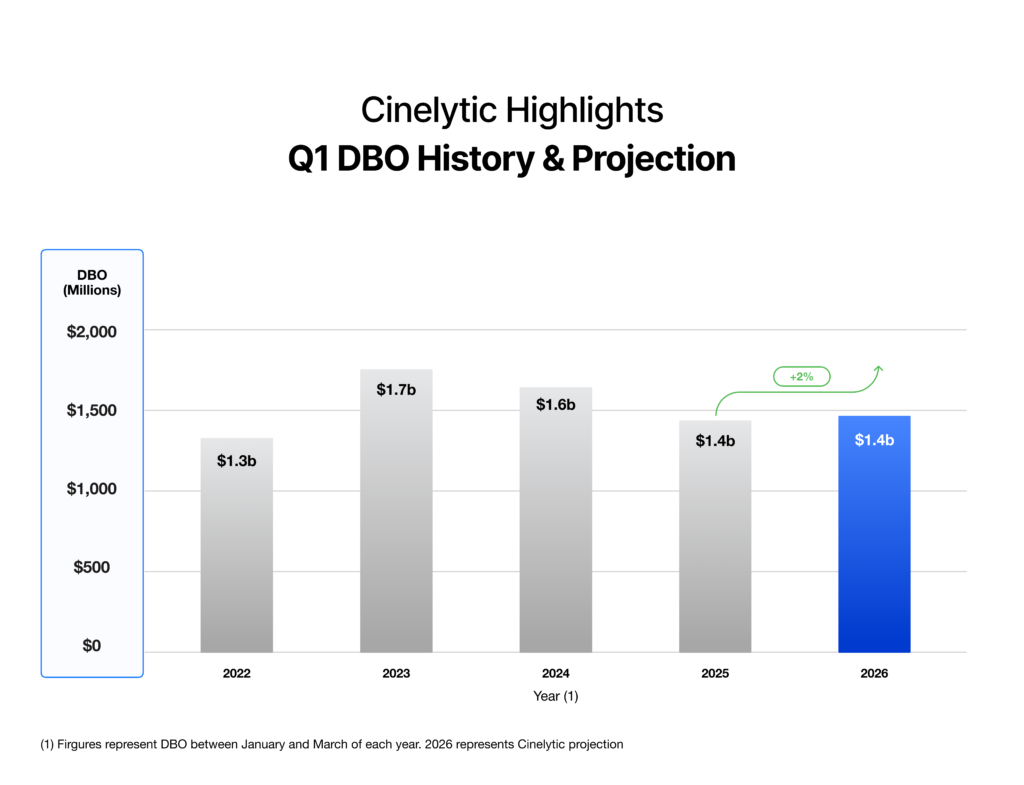

Looking ahead, we ran the Q1 2026 slate through Cinelytic’s predictive forecasting platform, which utilizes AI and 19 key attributes to generate highly accurate models of domestic and global box office projections, along with home entertainment and television revenues.

As shown in the graphic below, our full Q1 forecast for 2026 reflects only a subtle change from the prior year, projecting a 2% increase in DBO totals to just over US$1.4b:

What’s Driving Q1?

The early months of 2026 also mirror the general scenario observed in Q1 2025, not only due to the lack of major franchise tentpoles, but because both quarters benefited from residual box office carryover tied to massive prior releases.

In 2025, that meant continued revenue from titles such as WICKED, MOANA 2 and MUFASA: THE LION KING, all of which helped bolster performance beyond the films actually debuting during the quarter. Similarly, Q1 2026 will see additional earnings from late-year blockbusters including WICKED: FOR GOOD, ZOOTOPIA 2 and AVATAR: FIRE AND ASH, providing a comparable boost to early-year totals.

When looking strictly at films that opened during their respective windows, the contrast becomes even clearer. The first quarter of 2024 delivered heavyweights such as DUNE: PART TWO, GHOSTBUSTERS: FROZEN EMPIRE, KUNG FU PANDA 4 and GODZILLA X KONG: THE NEW EMPIRE. A year earlier, audiences were offered franchise staples like ANT-MAN AND THE WASP: QUANTUMANIA, CREED III and JOHN WICK: CHAPTER 4.

The performance narrative for Q1 2025 offers a more useful comparison point. That quarter consisted largely of lower-profile films performing either on target or below expectations, leaving the quarter without a clear breakout success. Examples included DEN OF THEIVES: PANTERA, WOLF MAN, FLIGHT RISK, CAPTAIN AMERICA: BRAVE NEW WORLD, MICKEY 17 and SNOW WHITE.

In the same vein, the first quarter of 2026 features no mega-IP like we saw between 2023 and 2024. While films like 28 YEARS LATER: THE BONE TEMPLE and SCREAM 7 are franchise titles that will appeal to loyal fans, they do not carry the same momentum as the aforementioned films.

Some of the other major releases that may define the quarter include Amazon MGM’s MERCY and PROJECT HAIL MARY, WUTHERING HEIGHTS from Warner Bros., and Pixar’s HOPPERS.

As we look toward Q1 2026, there is cautious optimism that a few less hyped titles could punch above their weights. Projects like GREENLAND: MIGRATION, SHELTER and THE DOG STARS may bring welcome sleeper success if early word of mouth and marketing traction align.

Is This Indeed the New Norm?

With 2025 now tracking to close very near our updated projection and in the US$9.1b range, and with both 2023 and 2024 exhibiting totals within a similarly narrow bracket, it is reasonable to consider that this figure may represent the new stable zone for the domestic theatrical market.

This level reflects roughly a 22% reduction from the averages seen in 2018 and 2019, underscoring the long-term impact of shifting theatrical habits, evolving tastes, streaming competition, and evolving production strategies.

Whether the next few years deliver surprise over-performance or simply reinforce this new threshold, one thing is clear: accurate forecasting and strategic greenlighting will be more important than ever. Tools such as Cinelytic’s AI-powered Predictive Forecasting platform will increasingly guide studios, financiers, distributors and production companies as they assess investment windows, compare ROI benchmarks and build smarter slates in an era of measured growth rather than explosive spikes.Stay tuned for our full DBO Forecast for 2026, which we will be publishing very soon. The data is already telling quite a story.