January Insights From Cinelytic

From Bust to Bounce Back: Our Bottom-Up 2026 Domestic Box Office Forecast

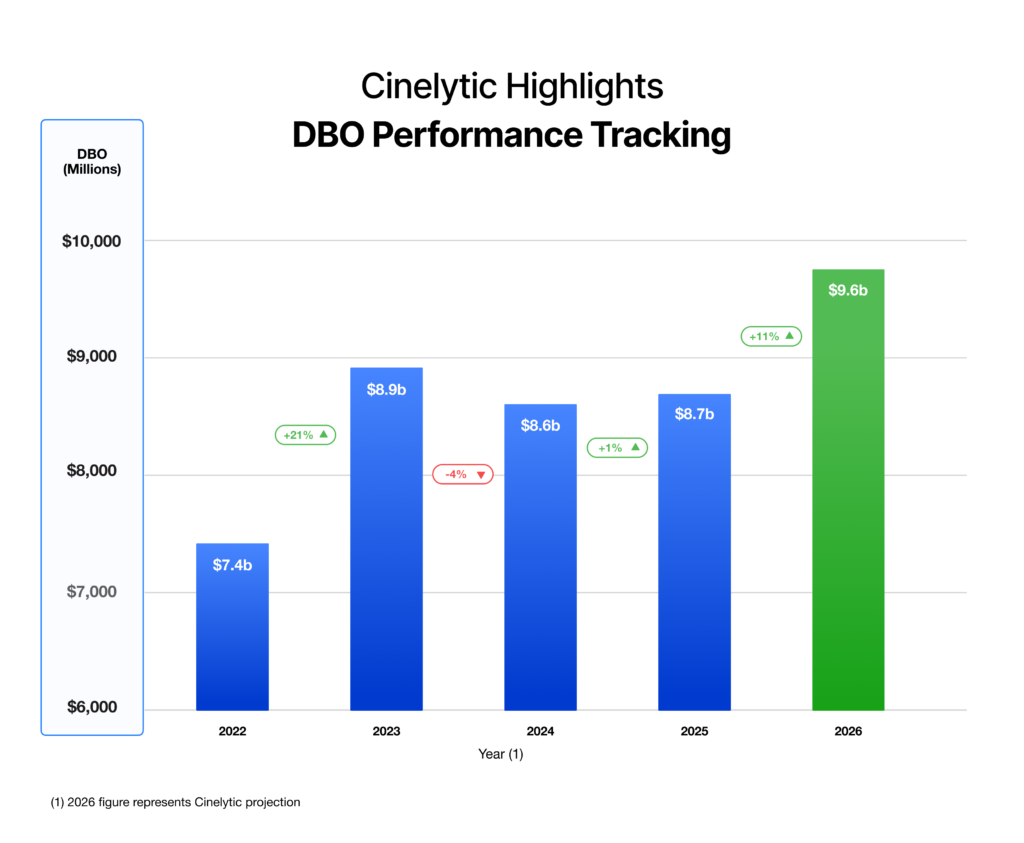

After a year that ultimately did not perform the way most of the industry expected, 2025 closed with little to no meaningful improvement over the year prior. Domestic box office (DBO) totals once again landed at roughly US$8.6b, marking the second consecutive year at that level and underscoring how stubborn the recovery has been despite a fuller release slate and improved theatrical conditions.

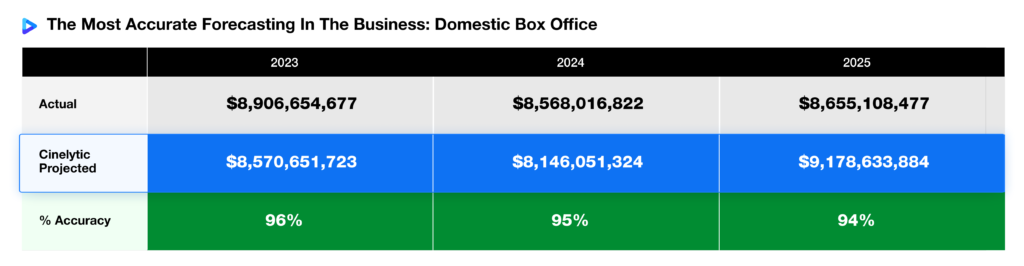

That said, the team at Cinelytic once again stood firmly behind the projections we published at the close of 2024, finishing the year with an overall forecast accuracy of approximately 94%. As the graphic below highlights, this continues a successful trend, with our DBO forecasts consistently landing between 94% and 96% accuracy for three consecutive years, a level of precision we take real pride in as we now turn our focus to the 2026 outlook:

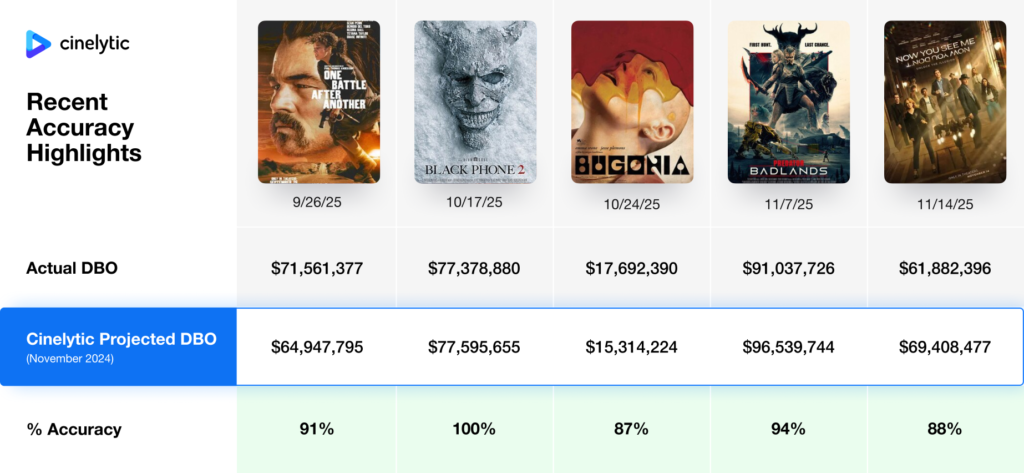

For a sneak peek at how these projections played out on a title-by-title basis, the visualization that follows highlights several recent releases from the final months of 2025, showcasing select accuracy wins as those films completed their theatrical runs:

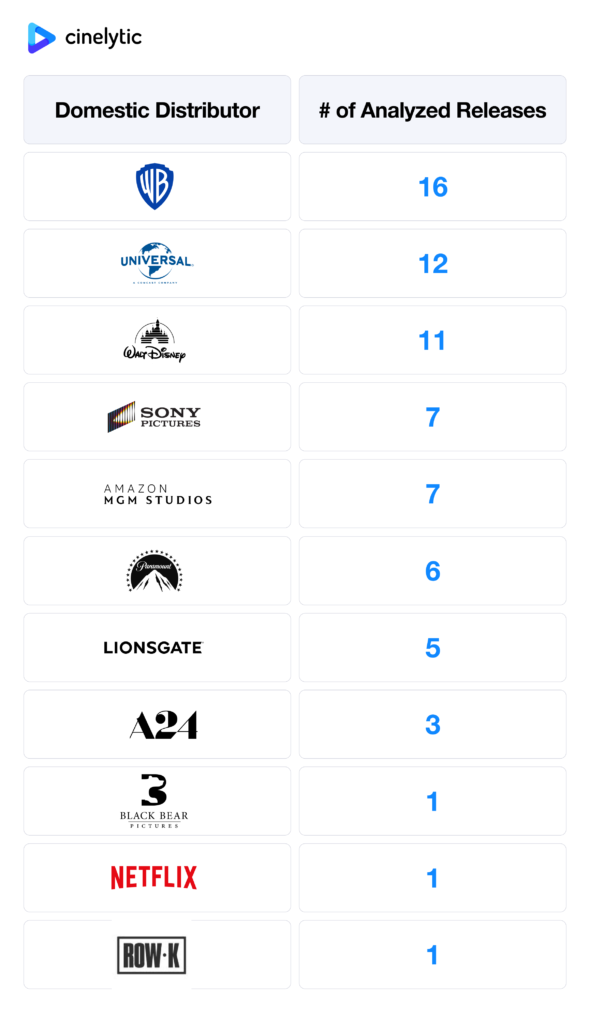

To kick-off the new year, we’ve once again leveraged our powerful bottom-up approach to deliver an early, in-depth look at what’s ahead for the domestic theatrical market. Last November, our team meticulously analyzed the full slate of 2026 major releases, running advanced projections to forecast both annual and monthly DBO performance. This comprehensive analysis covered 70 major titles set for wide release, with a breakdown of releases by distributor as follows:

2026 Forecasts

After 2025 delivered just a 1% increase over the prior year, 2026 is shaping up to represent a far more meaningful step forward. While we do not yet see the market reclaiming the US$10.0b threshold, the trajectory is undeniably improving as we head into what will likely be the strongest DBO year of the post-2020 era.

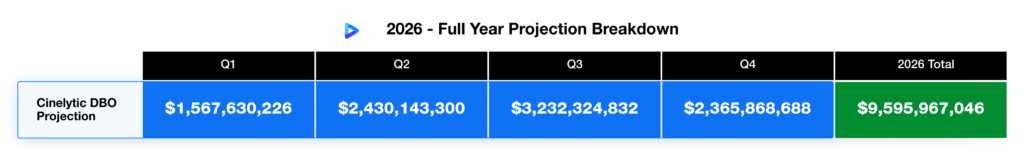

At Cinelytic, our latest data-driven forecast calls for approximately US$9.6b in 2026 DBO revenue, representing an 11% year-over-year increase from last year’s stagnant results. Our detailed monthly and quarterly projections show momentum building across the year, with Q3 and Q4 projected to deliver the strongest performances for those periods in the post-COVID state of industry. Below, you’ll find the quarterly breakdown alongside a snapshot of recent annual box office performance compared with our 2026 forecast:

How Do We Do This?

The Cinelytic platform harnesses the power of 19 key project attributes, using our proprietary algorithms and machine learning to perform advanced predictive analyses on major titles. As part of our standard approach, we’ve also incorporated late 2025 major releases that are expected to continue driving box office revenue into the first quarter of this year.

This includes factoring in a projected share of early 2026 DBO revenue from high-profile year-end titles such as ZOOTOPIA 2, AVATAR: FIRE AND ASH and MARTY SUPREME, among others.

What’s Fueling the 2026 Recovery?

The projected 11% lift in 2026 is driven by two primary factors. First, several major titles were pulled from the 2025 release calendar at late notice and repositioned into 2026, including high-profile examples such as MORTAL KOMBAT II and THE BRIDE! from Warner Bros. Pictures.

More importantly, however, 2026 marks a meaningful return of large-scale, historically proven IP and franchise filmmaking. This includes a notable resurgence from Marvel, which has not delivered a true breakout hit since DEADPOOL & WOLVERINE in 2024, but returns this year with SPIDER-MAN: BRAND NEW DAY and AVENGERS: DOOMSDAY, both backed by the full force of Disney’s global marketing engine and franchises that rank among the highest-grossing of all time.

The slate is further bolstered by a deep bench of recognizable, high-upside titles such as THE SUPER MARIO GALAXY MOVIE, SCREAM 7, SUPERGIRL, THE DEVIL WEARS PRADA 2, THE MANDALORIAN AND GROGU, TOY STORY 5, MINIONS 3, a live-action MOANA, JUMANJI 3, and DUNE: PART THREE.

Complementing these franchises is a strong lineup of large-scale, non-franchise films generating strong early momentum from elite filmmakers, including PROJECT HAIL MARY from Phil Lord and Chris Miller, DISCLOSURE DAY from Steven Spielberg, and THE ODYSSEY from Christopher Nolan, just to name a few.

Taken together, this mix of delayed tentpoles, franchise-heavy releases, and premium original filmmaking underpins our confidence in a materially stronger DBO performance in 2026.

All to Say…

As the industry moves deeper into a data-driven era, the divergence between intuition-led forecasting and analytically grounded decision-making has never been clearer. In an environment defined by shifting audience behavior, evolving release strategies, and heightened financial scrutiny, tools that can deliver consistent, transparent, and repeatable insights are no longer optional.

At The Cinelytic Group, our ability to model performance from the ground up, validate forecasts with proven accuracy, and adapt in real time to market changes is what allows our partners to plan with confidence. As 2026 shapes up to be a pivotal year for theatrical recovery, rigorous analytics will remain essential to separating signal from noise and turning opportunity into measurable results.