April Insights – The Sweet Spot: Mid-Length Theatrical Windows Continue to Redefine Box Office and Streaming Success

Historically, the 90-day theatrical window was crucial for a film’s box office success, maximizing revenue and creating urgency for audiences to see films in theaters. However, the rise of streaming platforms and the impact of the COVID-19 pandemic have led to a significant reduction in this window. Despite these changes and the ongoing challenges facing the theatrical market, it remains a vital component of a film’s overall performance.

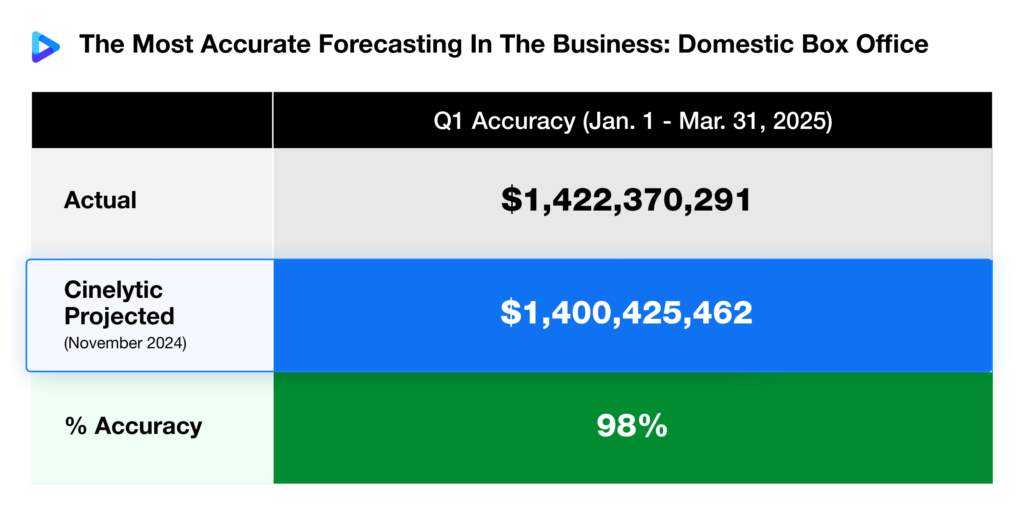

In fact, we’ve continued to meet the moment with precision—our projections made in Q4 of last year were 98% accurate through Q1, as highlighted in the compelling graphic below:

As consumer preferences shift toward instant access to content at home, studios are exploring various release strategies, balancing theatrical exclusivity with early streaming availability to boost both box office and streaming performance. We’ve analyzed windowing before, but how about an update?

For this analysis, we gathered data on box office and digital viewership for all major films released between Q4 2024 and Q1 2025 that had both theatrical and streaming runs.

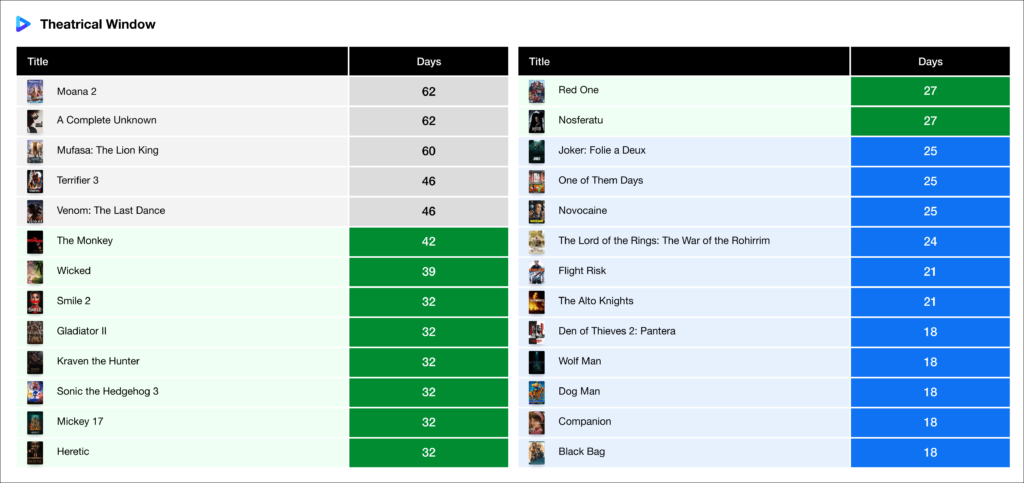

The analysis dealt with 26 releases, categorized by their exclusive theatrical windows and placed into the following groupings: 25 days or less, 26 to 45 days, and over 45 days. A summary of all the films analyzed is shown below:

Clearly, studios are increasingly hesitant to keep their films in theaters for more than 45 days. The longest window—62 days—was shared by MOANA 2 and A COMPLETE UNKNOWN, two distinctly different films aimed at very different audiences. Each had its own rationale for the extended theatrical run: one as a major holiday franchise release catering to families, the other leveraging ongoing Oscar buzz.

Examples of titles in the shorter 26 to 45-day window include WICKED, GLADIATOR II, MICKEY 17, and NOSFERATU, while titles in the 2-3 week window include BLACK BAG, COMPANION, DEN OF THIEVES 2: PANTERA, and FLIGHT RISK.

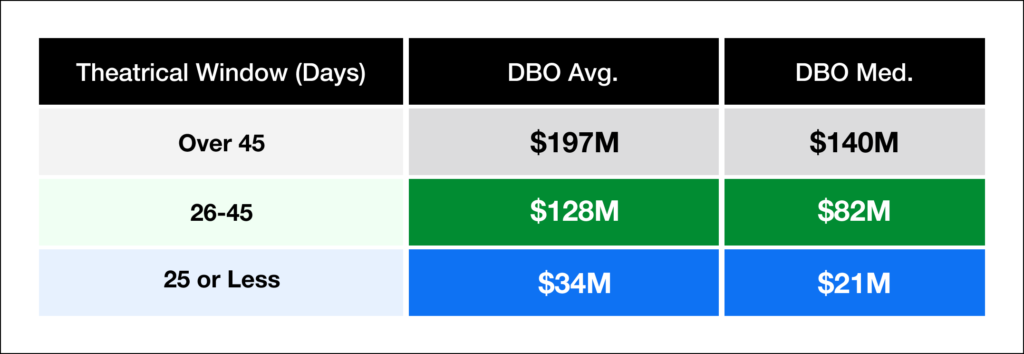

The table below summarizes the domestic box office (DBO) performance of each group:

It seems obvious that the five films with the longest theatrical windows, most of which were blockbuster releases tied to established franchises, naturally tended to generate higher box office earnings. However, it’s worth noting that two of these films, VENOM: THE LAST DANCE and TERRIFIER 3, had theatrical windows of 46 days, meaning they could also justifiably be categorized in the 26–45 day range.

So why were so few films given windows longer than 45 days?

By shortening the window, studios can take advantage of the initial buzz and word of mouth that drive audiences to stream the film sooner, leveraging that momentum for success at home. This approach allows studios to preserve the excitement from the theatrical release and quickly shift that energy to streaming platforms, where the film can continue to grow its audience and generate additional revenue.

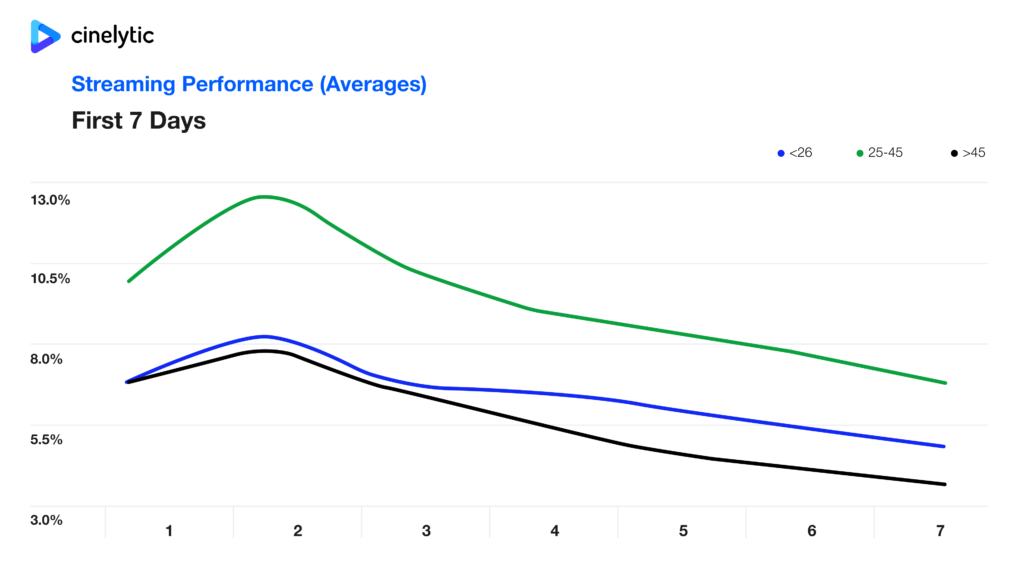

Now, let’s look at how these differing strategies impacted streaming performance. Using our proprietary streaming demand data, which tracks 125 million daily P2P transactions globally, we analyzed the first seven days of streaming performance for the same 26 titles:

As shown in the graphic above, films with theatrical windows between 26 and 45 days captured a significantly higher average percentage of the viewing market share among the Top 100 films each day, compared to those in the other two categories.

Interestingly, this middle-ground approach not only struck a balance in maximizing box office potential but also yielded the highest average streaming viewership during initial release. Films in this category benefitted from a sweet spot: long enough in theaters to build anticipation and cultural presence, but not so long that they lost momentum before reaching audiences at home.

This mid-length window seems to effectively support both marketing and revenue objectives. In contrast, films with shorter theatrical runs—less than 25 days—consistently underperformed across both box office and streaming platforms, albeit still outperformed the longest window grouping when it comes to the first week of streaming availability. This suggests that, in some cases, rushing to digital may hinder a film’s ability to build momentum or even register with audiences in the first place.

Of course, there are exceptions. In the case of JOKER: FOLIE À DEUX, the theatrical rollout was so sluggish that, given the film’s sizable production and marketing budgets, the studio opted to cut its losses after three weeks and pivot to streaming while public conversation around the title was still active.

As the market continues to evolve, a clear trend is emerging: theatrical windows of 26 to 45 days strike the most effective balance between box office performance and streaming success. Shorter runs risk leaving money on the table at both the box office and on streaming platforms, while longer ones may only suit major tentpole franchises and have minimal impact for home viewers. Ultimately, the most successful strategies are proving to be flexible, data-driven, and tailored to each film’s unique identity—bridging the gap between traditional theatrical impact and the immediacy of home streaming.