December Insights From Cinelytic

Q4 Performance and Initial 2025 Outlook

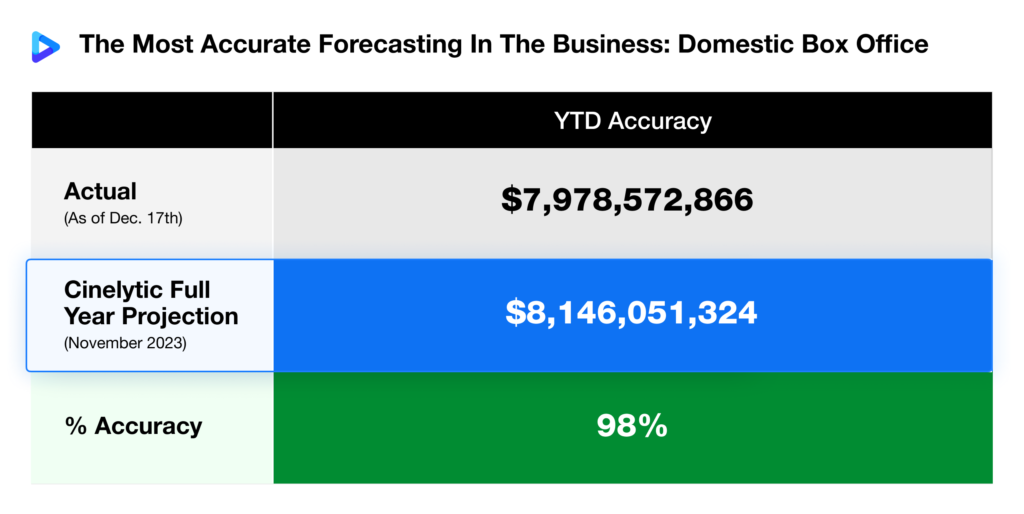

As we near the end of 2024, it’s time to once again revisit the domestic box office (DBO) projections we made at the close of 2023 for this year’s film slate. With just a few weeks left before the final box office tallies come in and major titles like SONIC THE HEDGEHOG 3, MUFASA: THE LION KING and NOSFERATU awaiting their theatrical debuts during the holiday season, we’re proud to report a 98% accuracy rate in our projections so far.

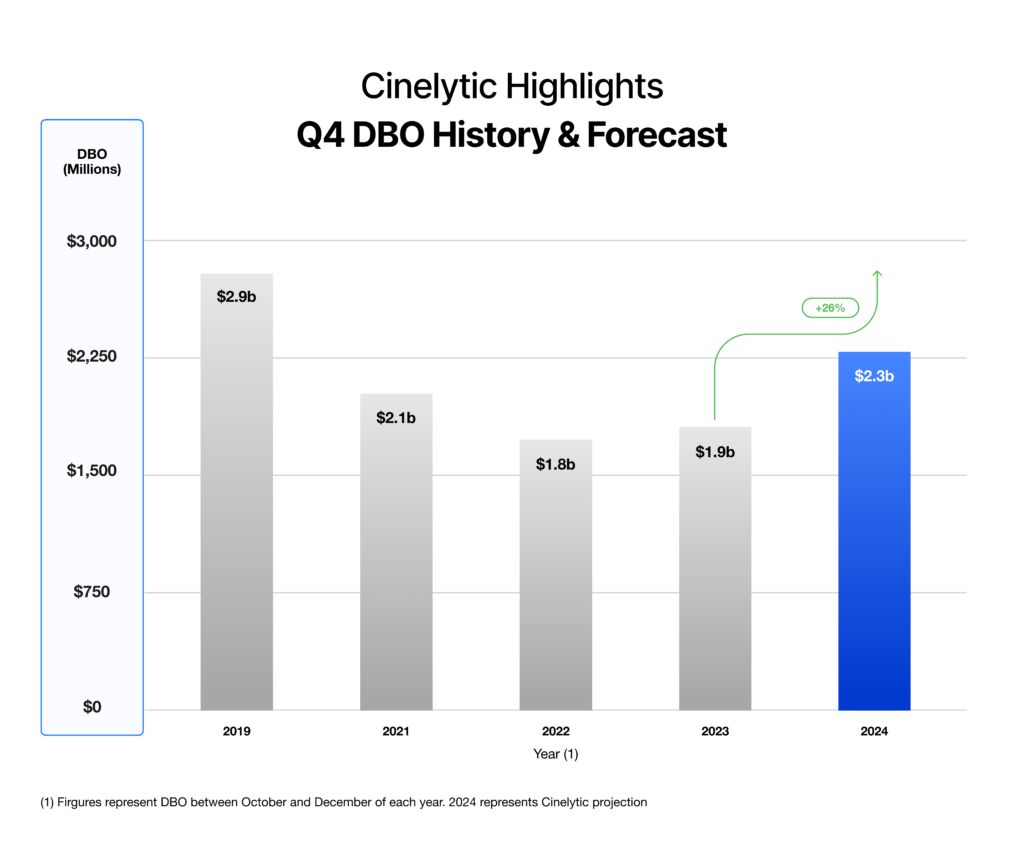

Our October Insights predicted that Q4 of this year would be the most profitable final quarter since 2019, with an estimated US$2.3b in DBO revenue—a 26% increase from 2023. So far, we are on track, with the quarter already generating over US$1.8b. This growth has been largely fueled by family-friendly offerings such as WICKED and MOANA 2, which have captivated audiences nationwide and grossed US$359m and US$338m respectively as of this week.

Our projections emphasized the dominance of family-friendly titles in Q4, and the data speaks for itself. While films like WICKED and MOANA 2 have soared, more adult-oriented releases have faced challenges at the DBO. Expensive titles such as JOKER: FOLIE A DEUX, RED ONE and GLADIATOR II have underperformed relative to budgets and expectations. This trend underscores a broader shift in consumer preferences during the holiday season, where films offering multi-generational appeal continue to dominate.

What About Next Year?

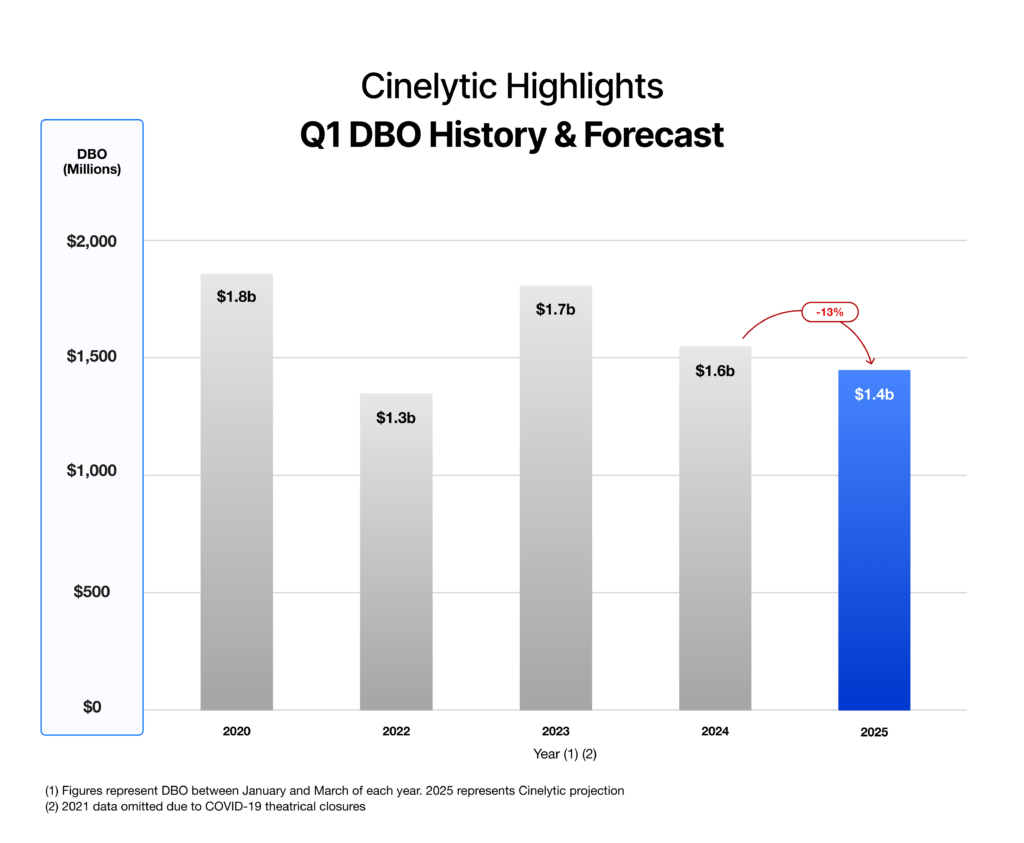

While 2024 looks like it will close on a high note, the first quarter of 2025 presents a more uncertain picture. This conclusion comes as a result of running the January through March slate using Cinelytic’s predictive forecasting platform, which leverages AI and utilizes 19 key attributes to project performance and ROI. This advanced early prediction tools enable us to accurately project domestic and global box office performance, along with home video and TV revenues, offering a comprehensive resource for the film industry.

Our projections indicate a significant 13% decrease in Q1 DBO revenue compared to 2024, with an estimated total of just over US$1.4b. This figure would mark the second lowest Q1 revenue among the five years we analyzed.

What’s behind this anticipated decline? The lineup for early 2025 lacks the high-budget, franchise-driven tentpoles that have buoyed previous years. In 2024, Q1 featured blockbusters such as DUNE: PART TWO, GHOSTBUSTERS: FROZEN EMPIRE, KUNG FU PANDA 4 and GODZILLA X KONG: THE NEW EMPIRE. Similarly in 2023, the first quarter gave audiences options like ANT-MAN AND THE WASP: QUANTUMANIA, MAGIC MIKE’S LAST DANCE, CREED III, JOHN WICK: CHAPTER 4 and SCREAM 6.

By contrast, 2025 offers only two: CAPTAIN AMERICA: BRAVE NEW WORLD and SNOW WHITE. Even these films face challenges. The former shifts a supporting character into the lead in place of fan-favorite Chris Evans’s “Steve Rogers”, which may dampen enthusiasm among Marvel’s devoted fan base. Meanwhile, the latter has long been plagued by production controversies and negative press, raising questions about its potential reception.

The Potential for Surprise Hits

While the Q1 2025 slate may appear lackluster at first glance, history has shown that surprises can emerge. This year’s MEAN GIRLS, THE BEEKEEPER and BOB MARLEY: ONE LOVE exceeded expectations, proving that strong word-of-mouth and niche appeal can drive unexpected success to kickstart the year.

A few of the potential overperformers this time around include Blumhouse’s next “monster universe” reimagining WOLF MAN, another Jason Statham action vehicle in LEVON’S TRADE, Oz Perkins’ THE MONKEY (a follow-up to his horror hit LONGLEGS), and SINNERS, Ryan Coogler’s period vampire thriller starring Michael B. Jordan. These films, while not tentpoles, have the ingredients to capture audience interest and defy initial projections.

Despite a potentially slow start, 2025 is shaping up to be one of the most promising years for the DBO since 2019. The months following March are packed with a mix of established intellectual properties and exciting original projects helmed by notable talent. As outlets have already suggested, the year could deliver performance that reaches the highest level since the pre-pandemic era.

At Cinelytic, we’ll be closely monitoring these developments and will release our full-year projections soon. For now, we remain optimistic about the industry’s resilience and capacity for innovation as we head into another exciting year of cinema.