FEBRUARY INSIGHTS FROM CINELYTIC

2023 Domestic Box Office Forecast Deep Dive

As highlighted in last month’s Insights, 2022 represented a welcome boost in Domestic Box Office (DBO) revenue in comparison to the pandemic era of theater closures and limited releases in the two years prior. Last year earned US$7.37b in domestic ticket sales, equating to a massive 64% increase from COVID stricken 2021. While it’s possible we may never again reach the pre-pandemic US$11.63b DBO average achieved between 2018 and 2019, it’s safe to say things are trending in the right direction.

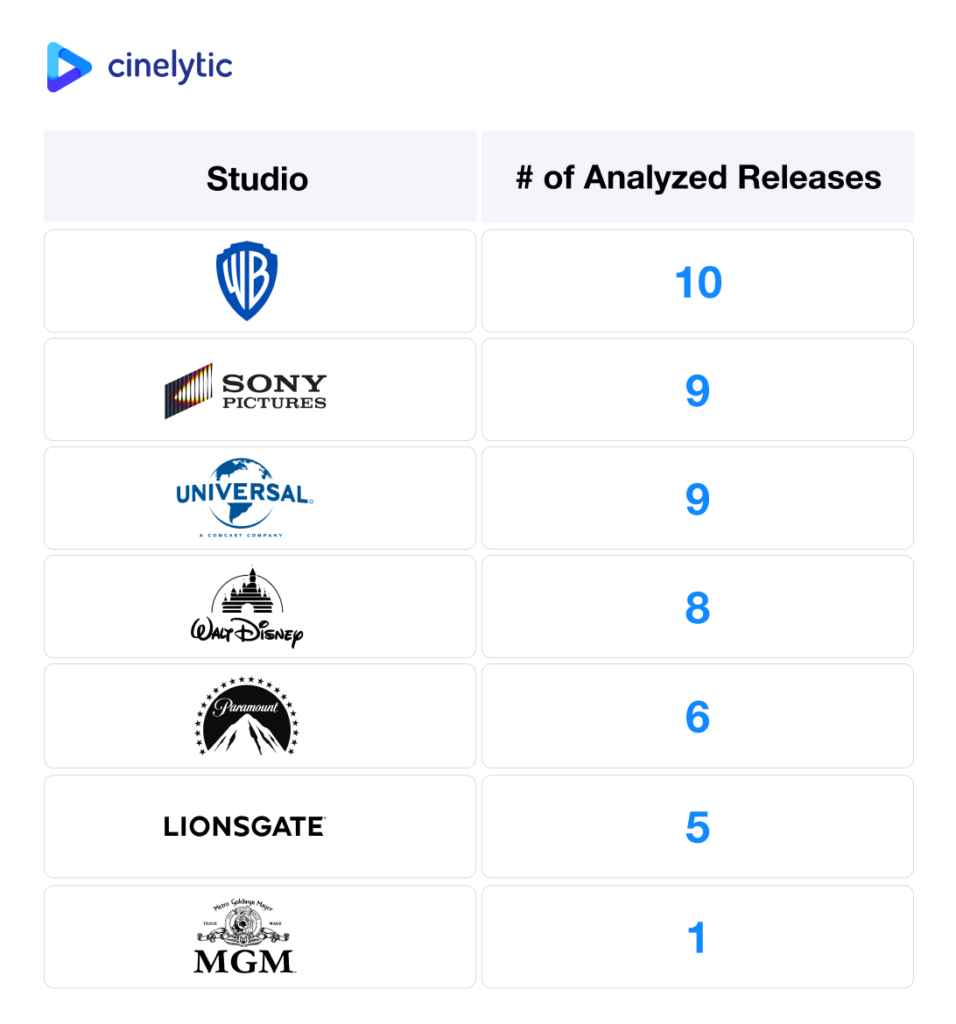

In December of last year, we at Cinelytic decided to get a head start on analyzing what 2023 has in store for the domestic theatrical industry, running projections on all the major releases announced for the upcoming year to produce a bottom forecast of the annual and monthly domestic box office. Cinelytic focused on 48 titles planned for wide release, with a breakdown of the number of releases from each studio as follows:

2023 Annual and Monthly Forecasts

In total, Cinelytic’s forecasts US$8.57b in 2023 DBO, which represents a 16% increase from 2022. This figure was further broken down into monthly forecasts.

As a testament to our accuracy, let’s take a look at the actual performance of the January 2023 DBO in comparison to our projections. The total domestic revenue from January is US$584.5m. Cinelytic’s December 2022 estimate for the same figure was US$533.0m, coming within 9% of the actual figure.

Bottom Up 2023 Per Title Forecasts:

The Cinelytic platform utilized 19 key project attributes to run predictive analyses for these titles based on our proprietary algorithms and machine learning. It is important to note that the system allows for a COVID adjustment to the predictive output results. We also took into account late 2022 major releases that are still generating theatrical revenue early in 2023. In this case, this meant including a calculated portion of the projected early 2023 DBO revenue from BLACK PANTHER: WAKANDA FOREVER, PUSS IN BOOTS: THE LAST WISH, AVATAR: THE WAY OF WATER, and BABYLON into our early 2023 income forecasts. A summary of the Top 10 highest-earning films in regard to projected DBO is highlighted in the graphic below:

What Does Each Forecast Look Like?

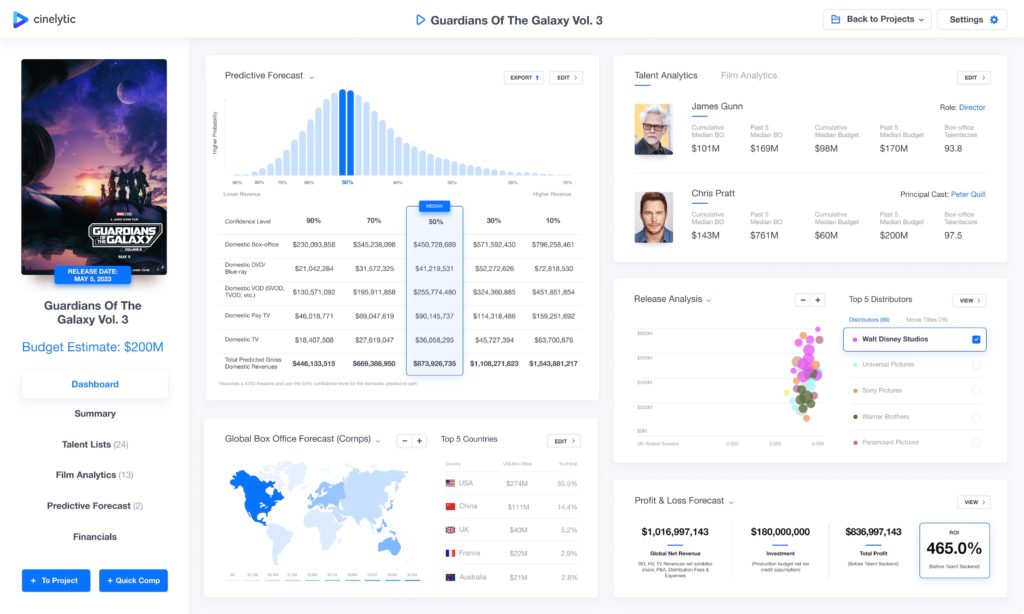

Highlighting Walt Disney Studios’ second addition of the year to the Marvel Cinematic Universe, GUARDIANS OF THE GALAXY VOL.3, we can provide an in-depth example of just one of these projections. Utilizing an estimated budget of US$200m, global P&A costs totaling an additional US$220m, and attributes to run the AI output including budget, genre, rating, talent, IP value, etc., the platform projects DBO of US$451m in the base case median scenario. In addition, the Cinelytic platform is capable of predicting Home Video and TV revenue ultimately based on real data:

Based on the anticipated global net revenues (including domestic/ international box office, home entertainment, TV net of distribution fees and expenses), the film is projected to result in a substantial return (10-year ultimate) for the studio, with a projected ROI of 465.0% before the talent back-end, which can be substantial.

Methodology

While the 48 films we analyzed in detail may represent the bulk of the DBO set to be earned in 2023, there are of course far more movies planned for release. In order to expand this analysis and conclude upon the full domestic forecast, we analyzed actual performance in 2018, 2019 and 2022 (ignoring the pandemic period) and looked to see how the Top 48 titles performed against the total yearly DBO for each of these years. In 2018, 2019, and 2022, the Top 48 performing titles respectively accounted for 71%, 74%, and 89% of the total DBO, which equated to an average of 78%. Utilizing this average, Cinelytic’s DBO projection for 2023 calculates to the aforementioned US$8.57b.

There’s More Where That Came From

As previously mentioned, Cinelytic has in-depth projections for not only the top major studio releases for the upcoming year but also titles being made available theatrically by several mini-major/independent distributors. Please feel free to reach out here if you’d like more detailed information on what our projections say for each major title awaiting release throughout the next 11 months.