July Insights from Cinelytic: The Unbiased Story of 2025’s Top Streaming Titles (So Far)

While it came as little surprise to us at Cinelytic based on projections made at the end of last year, domestic box office (DBO) performance in the first half of 2025 exceeded that of the same period in 2024, marking a 15% increase in theatrical revenue.

As has become increasingly common in today’s market, several major and high-budget releases including CAPTAIN AMERICA: BRAVE NEW WORLD, THUNDERBOLTS*, SNOW WHITE, and MISSION IMPOSSIBLE – THE FINAL RECKONING underperformed despite strong genre appeal, recognizable IP, large scale production, and star-powered casts.

Interestingly, some of these titles have gone on to find renewed success in the home entertainment market, a trend we’ll explore further in this edition of Insights.

Conversely, titles such as A MINECRAFT MOVIE, LILO AND STITCH, SINNERS, and FINAL DESTINATION BLOODLINES have delivered strong results at the box office. As we look ahead to the second half of the year, a steady stream of high-profile releases promises to keep studios alert and competitive.

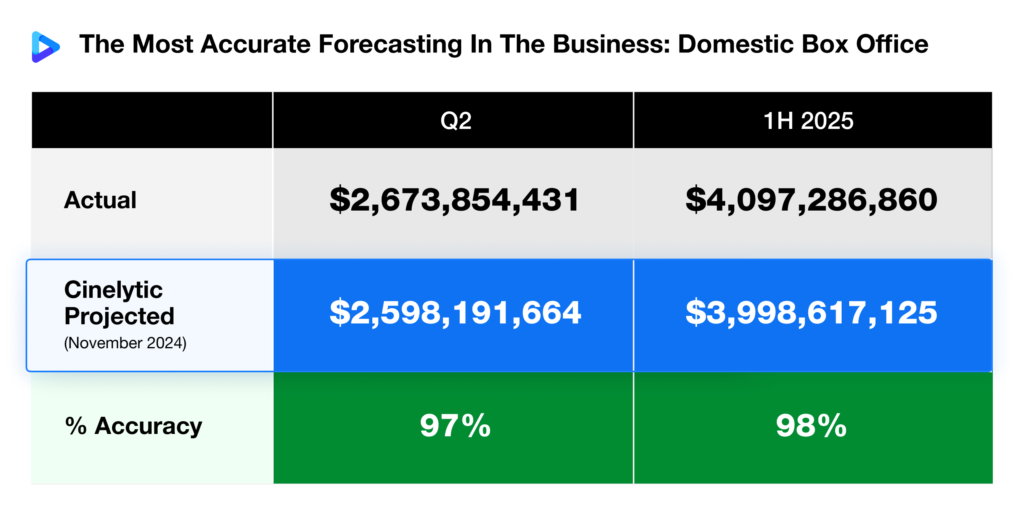

Fortunately, studios now have access to tools that can mitigate risk during green lighting. Using our predictive analytics platform, Cinelytic projected the entire 2025 film slate back in November 2024, estimating a total domestic gross of US$9.35b.

This early forecasting model enables accurate predictions not just for domestic and global box office, but also for home entertainment and television revenues, offering the industry a powerful and multifaceted decision-making tool. As the graphic below illustrates, our projections for the first half of the year have proven remarkably accurate:

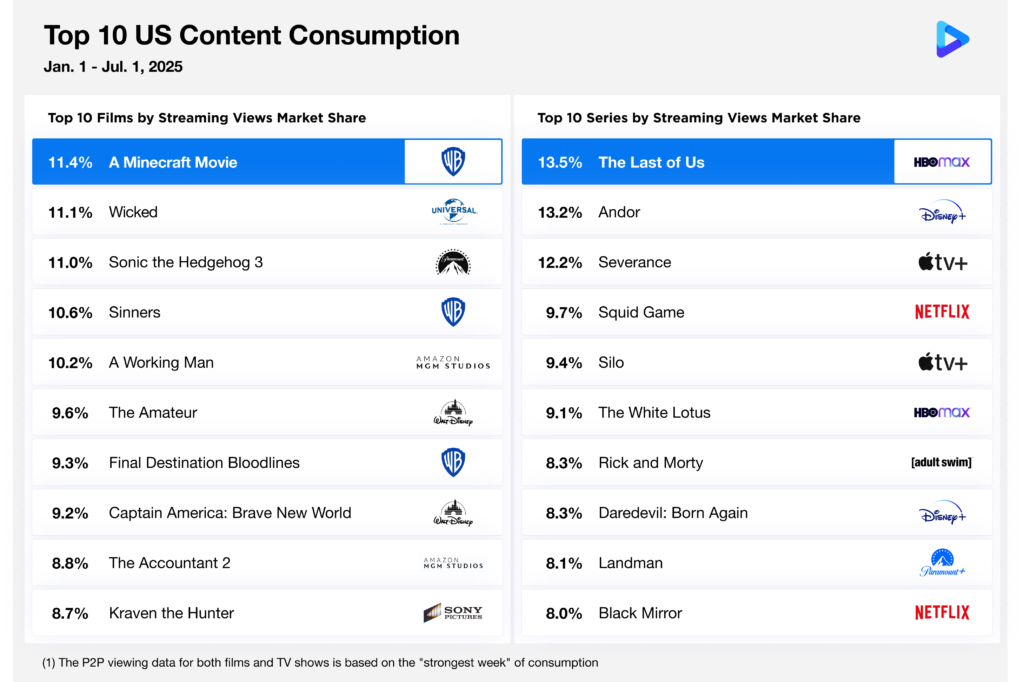

There have been some surprising films that contributed to this US$4.0b, along with varying degrees of follow up success on streaming. In the graphic below, we evaluated and compared the streaming performance of both films and TV series in 2025 using our proprietary OTT demand data.

This data captures 125m digital content consumption transactions per day across the world, aggregating to an annual total of 35b, illustrating consumer IP and content preferences on a global scale. For this exercise, we ranked the Top 10 most viewed movies and TV series through the end of June of this year.

Importantly, our methodology removes platform bias by not relying solely on subscriber count or self-reported metrics like total minutes viewed, which can disproportionately benefit longer-form content or platforms with larger user bases.

Instead, we normalize consumption behavior across all major streaming platforms, isolating the actual consumer demand for a title during its peak performance week. This approach provides a more accurate, apples-to-apples measurement of true popularity, regardless of platform size or exclusivity, and better reflects a title’s cultural and commercial resonance with audiences:

The graphic above shows a healthy mix of original ideas and well known IPs or franchises among the Top 10 films, with six major distributors sharing the load. On the TV side, science fiction emerged as the dominant genre among the Top 10 most viewed series.

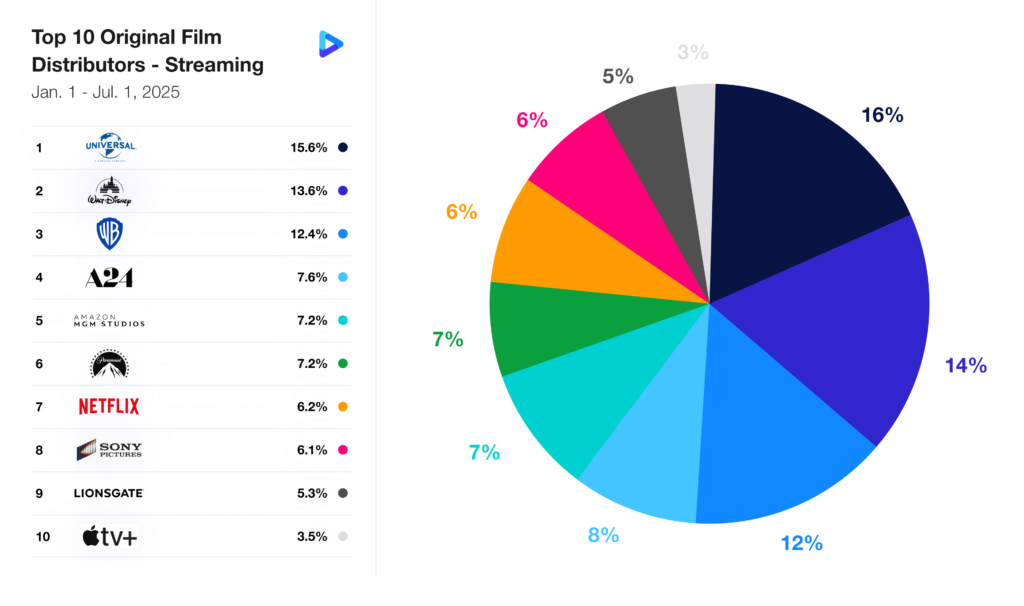

To provide a more comprehensive view of film distributor success in 2025 with respect to digital viewership, the graphic below highlights the Top 10 companies based on data from the Top 100 OTT film releases in the United States:

Last year, Warner Bros Pictures led the digital release market. So far this year, they have fallen to the third spot, while Universal Pictures, despite boasting only one title in the Top 10 (WICKED), has taken the lead with an impressive 15.6% market share capture across 12 titles. The major studio edged out Walt Disney Studios, which ranked second with 11 titles and 13.6%.

A new name among the Top 10 is Apple TV+, replacing Neon from last year. While their latest release F1 is without question their biggest theatrical gamble to date, it was three of their straight to streaming releases, THE GORGE, FOUNTAIN OF YOUTH, and ECHO VALLEY, that earned them a spot.

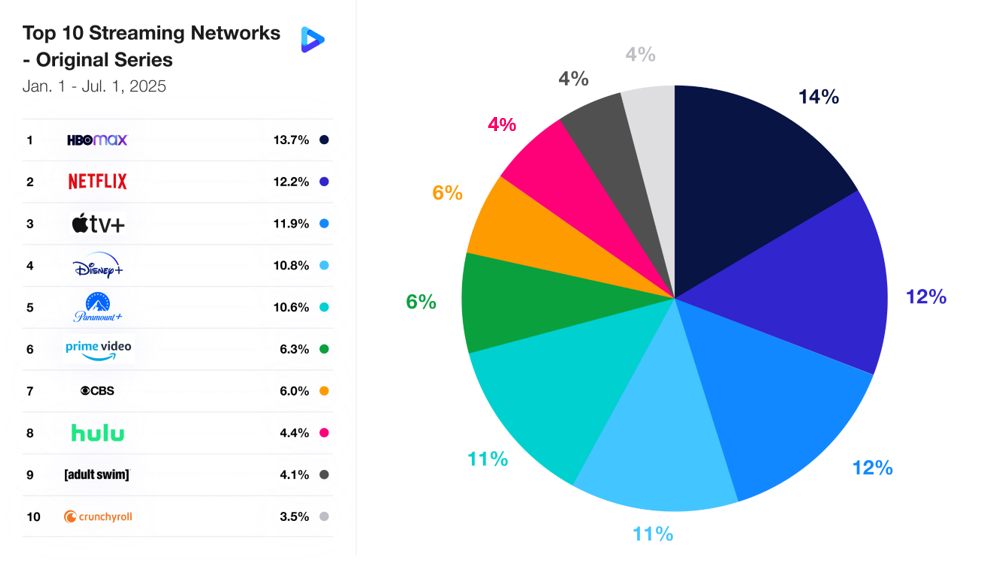

The additional graphic below provides similar insight into the top content produced by TV networks in the first half of 2025, once again focusing on the strongest week of performance:

Looking at the strongest individual networks, HBO Max led digital success largely thanks to popular series such as THE LAST OF US, THE WHITE LOTUS, and THE PITT, among nine others. Notable changes from last year include newcomers like Crunchyroll and Adult Swim, as well as Netflix, which was a surprise omission from last year’s Top 10 but has shown significant improvement in performance during the first six months of this year. Meanwhile, CBS slipped from the top of the leaderboard to seventh place.

Even when considering parent companies and all series available within the analyzed time frame, HBO Max remains a key player, since Warner Bros. Discovery ranked as the top overall group in the TV streaming space. The entertainment conglomerate is supported by multiple additional networks like Adult Swim, TBS, and TNT, each of which contributed with their own top performing series.

2025 – Part 2

Although theatrical box office results remain a vital measure of success, relying solely on these figures overlooks the growing impact of streaming revenues. So far 2025, streaming has once again solidified itself as a powerful and ongoing revenue stream that often surpasses a film’s initial theatrical performance. Ignoring this shift risks missing out on the long-term financial gains and deeper audience engagement that digital platforms provide. As highlighted earlier, films that might initially be labeled as failures often find renewed life and profitability through streaming services. A balanced evaluation that accounts for both box office and streaming income is essential to fully grasp a movie’s true financial footprint.

As the entertainment industry progresses through 2025, the remainder of the year is shaping up to be an exhilarating journey. With a slate featuring both highly anticipated blockbusters and costly productions, alongside new seasons of popular series arriving on streaming platforms, studios and digital distributors must remain adaptable and data savvy. Prepare for a dynamic second half where every release carries the potential to reshape what success looks like across theatrical and streaming landscapes.