June Insights By Cinelytic – How will Summer 2024 Box Office Fare?

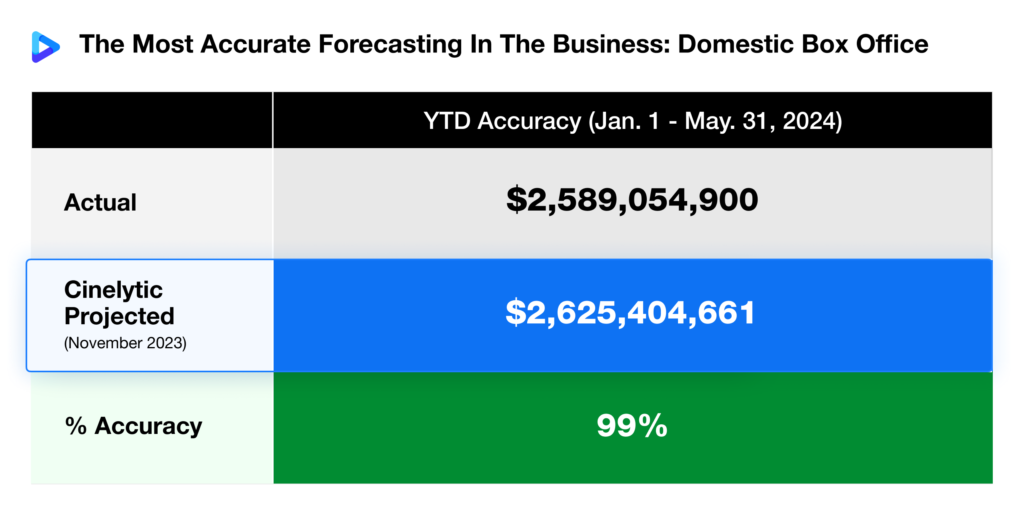

Throughout this year, we at Cinelytic monitor the projections we released at the end of 2023 for the entire 2024 slate. Initially, we estimated a total domestic box office (DBO) gross of US$8.17b. As illustrated in the graphic below, we have maintained some remarkable accuracy in our DBO projections so far, currently tracking at approximately 99% through May:

Despite this accuracy and continued confidence in our assessments, the ever-changing landscape of the film industry often warrants small adjustments. As such, we modified our predictions on a few key titles still awaiting wide release over 2024’s remaining seven months, resulting in an updated and slightly more conservative DBO projection of US$8.15b for 2024.

Another Lucrative Summer?

Last summer, blockbusters like BARBIE and OPPENHEIMER collectively boosted the domestic box office by nearly a billion dollars. However, this year, studios are banking mostly on a variety of mid-range sequels and prequels, as well as family-oriented animated films, to fill the void left by the “Barbenheimer” phenomenon. Adding to the challenges are production delays stemming from the prolonged Writers Guild and SAG-AFTRA strikes, which continue to affect studios. As a result, the season which typically runs from the first Friday in May through Labor Day and traditionally attracts the largest movie theater audiences is off to a shaky start, potentially impacting the overall box office totals for 2024.

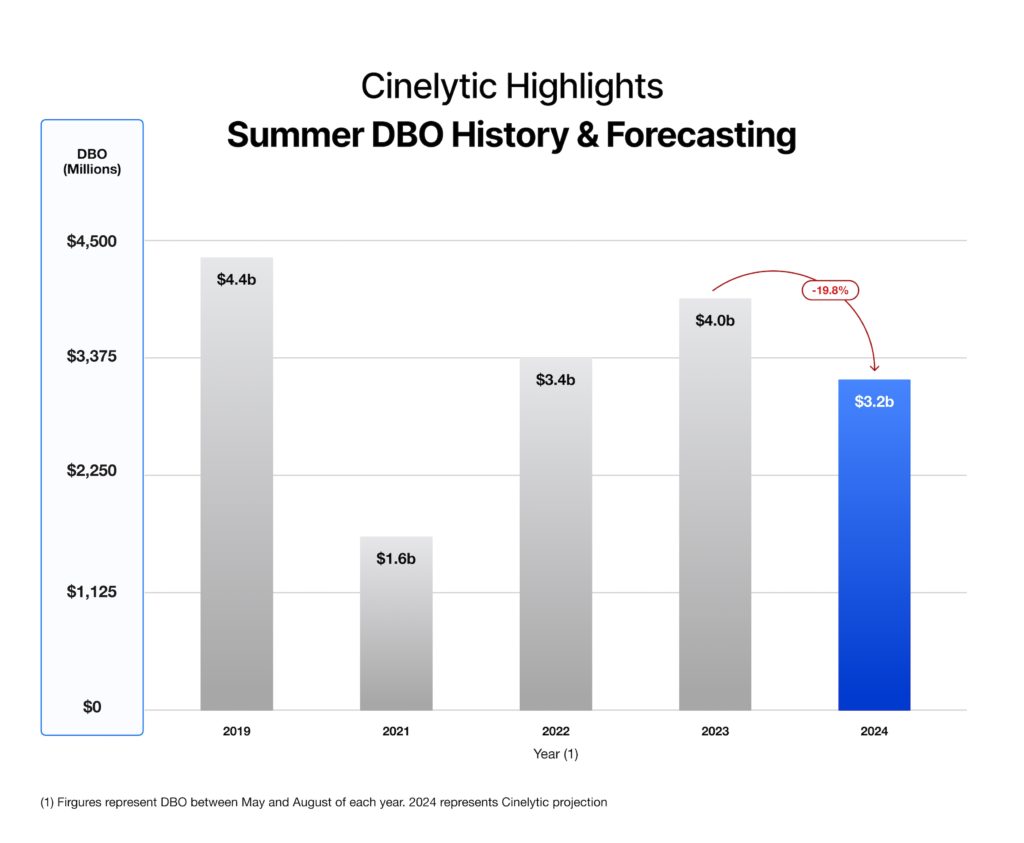

Of the US$8.15b we expect films in 2024 to earn domestically, we estimate US$3.17b to be collected between the summer months of May and August. To see how this stacks up against past years (excluding 2020), take a look at the graphic below:

If our accuracy persists through the end of the year, that means 2024 will go down as the worst summer blockbuster season in the post-COVID era and the first step backward in the recovery since 2020. This represents a 19.8% drop.

It is our current belief that Covid structurally changed the consumer’s elasticity to spend on ever-inflating theatrical ticket prices as there is an increasing amount of competition from gaming, social media, sports and other forms of entertainment available 24/7 in our pocket.

With many consumers having upgraded their home entertainment equipment during Covid, streaming became a key metric to have to understand the overall economic success of a film across all windows.

Theatrical and Streaming

Despite some recent and high-profile May releases like KINGDOM OF THE PLANET OF THE APES and THE GARFIELD MOVIE enjoying some success at the box office, most of this season’s press has revolved around underperforming titles like THE FALL GUY and FURIOSA: A MAD MAX SAGA. While George Miller’s latest entry in the “Mad Max” universe is still exclusively viewed in theaters, David Leitch’s action comedy starring Ryan Gosling and Emily Blunt made a swift move to digital platforms just 19 days after its initial release.

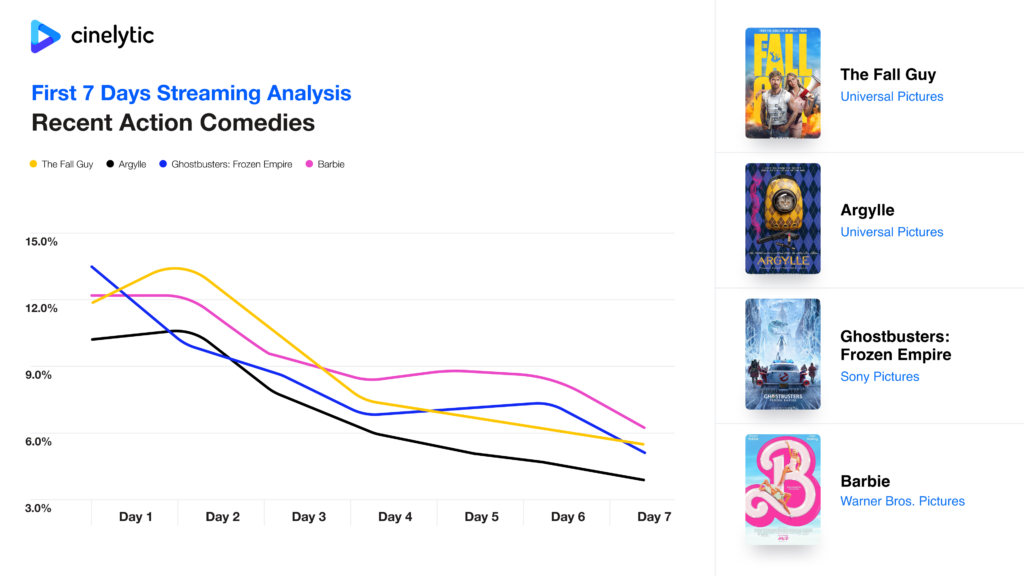

Propped up as a summer hit riding the coat tails of Gosling’s peak BARBIE stardom, Universal Pictures quickly decided to make the film available for home viewing in a likely attempt to recoup losses. To analyze how successful THE FALL GUY has been on streaming since this shift, we used our proprietary OTT demand data to compare its first seven days of streaming performance to three other recent comedy titles that contain action elements:

In reviewing the above data, it becomes clear that THE FALL GUY has done well on digital platforms thus far, showcasing the sharpest bump into its second day and the second-best overall performance amongst this comp set through its first week of viewing. The film averaged 9.0% market share capture amongst all competing digital films in comparison to BARBIE’s 9.6% and ranked as the most viewed streaming film for each of its first three days of availability (BARBIE remained on top through its first six days). ARGYLLE and GHOSTBUSTERS: FROZEN EMPIRE rounded out the group, with the former averaging 7.1% and the latter 8.5%.

Although THE FALL GUY had a disappointing theatrical run, its clearly had a strong initial showing on VOD. Furthermore, the film’s box office revenue decreased by only 39% between its second and final weekends, indicating positive word of mouth and strong audience retention. Our data has long indicated that in the post pandemic world, a 45-day exclusive window is the most optimal strategy for wide blockbuster releases in order to maximize both theatrical and digital success.

In this constantly changing environment studios need to adapt to viewer habits and the financial realities to optimize monetize across all windows.

Key Summer Releases?

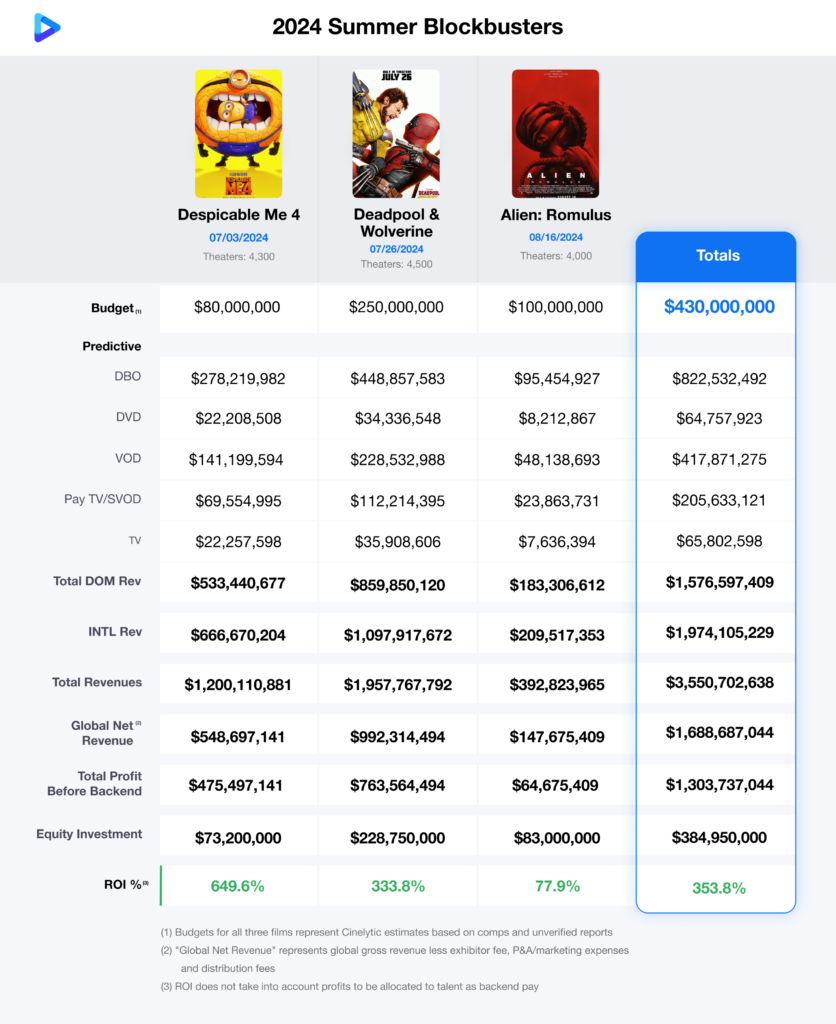

Being in the midst of some major June releases like Sony’s BAD BOYS: RIDE OR DIE and Disney’s INSIDE OUT 2, we at Cinelytic decided to utilize our forecasting tool and take a deep dive into how the biggest remaining films coming out between July and August may perform financially in the hopes of finding some light at the end of the tunnel for this summer season. For this exercise, we analyzed DESPICABLE ME 4, DEADPOOL & WOLVERINE and ALIEN: ROMULUS:

DESPICABLE ME 4 represents the sixth film in the expanded DESPICABLE ME / MINIONS universe. As one of the most successful animated franchises in history, its previous five films have averaged DBO revenue of US$318m against an average budget of just US$80m. While our box office projections for the latest installment fall below the franchise average, we still expect a substantial return (10-year ultimate) for Universal Pictures and Illumination, with a staggering ROI projection of 649.6% before talent back-end payouts.

Walt Disney Studios is eagerly anticipating DEADPOOL & WOLVERINE after months of “superhero fatigue” headlines and underwhelming performances from recent Marvel Cinematic Universe releases. The film’s first trailer, released in February, became the most viewed trailer of all time in a 24-hour period. Last month, Fandango announced that ticket pre-sales for the film were the best of 2024, the franchise’s best, and the highest for an R-rated film on their platform. Similarly, AMC Theatres revealed that 200,000 first-day tickets were sold, setting a new record for any R-rated film at their locations. The Hollywood Reporter estimated first-day ticket sales to be between US$8m and US$9m, predicting the film would debut with over US$100m, a milestone no 2024 release has yet reached.

Given all this hype, it should come as no surprise that our projected ROI for the film stands at 333.8%, which is particularly exciting for a movie that will more than likely command a budget of well over US$200m.

The lowest projected ROI amongst these three titles, while still strong at 77.9%, comes courtesy of horror veteran Fede Álvarez’s first foray into the iconic ALIEN franchise.

All to say… After a considerably strong showing in 2023, the film industry has faced significant challenges in 2024, with general audience disinterest and many releases underperforming at the box office. Despite the gloomy start, the upcoming summer blockbuster season offers a glimmer of hope for a rebound. Anxiously awaited releases like the titles analyzed above are generating substantial buzz and impressive pre-sale numbers. This optimistic outlook suggests that these films could rejuvenate the box office, setting the stage for a much-needed improvement in performance as the industry heads into the fall and winter seasons.