September Insights From Cinelytic – A Look Ahead to Q4

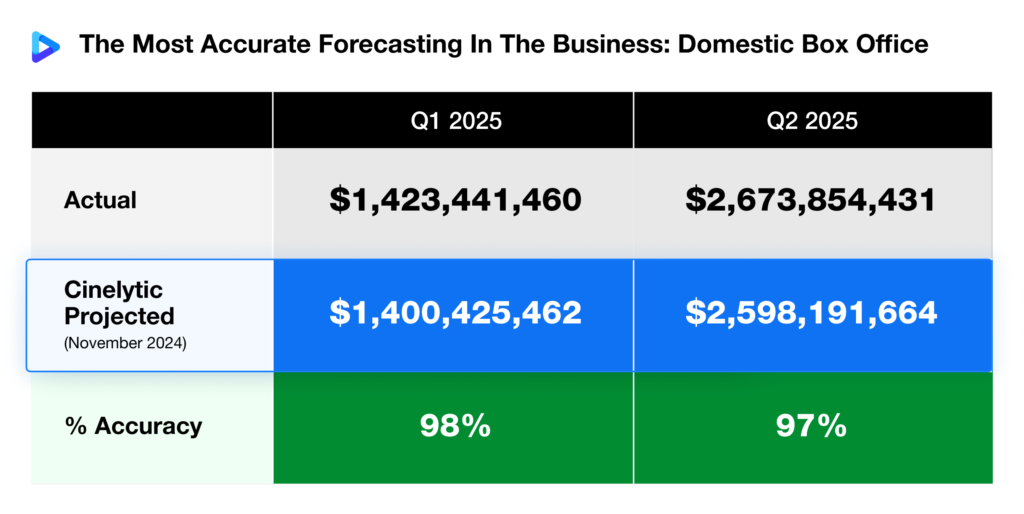

Over the course of this year, we’ve been tracking and revisiting the projections we made at the end of 2024 for the 2025 film slate. Now that the summer box office season has wrapped and the final stretch of releases lies ahead over the next three months, we’d like to share an update on our latest accuracy metrics.

As we await the end of Q3, the graphic below highlights how our Domestic Box Office (DBO) projections have remained remarkably accurate through the first two quarters of the year:

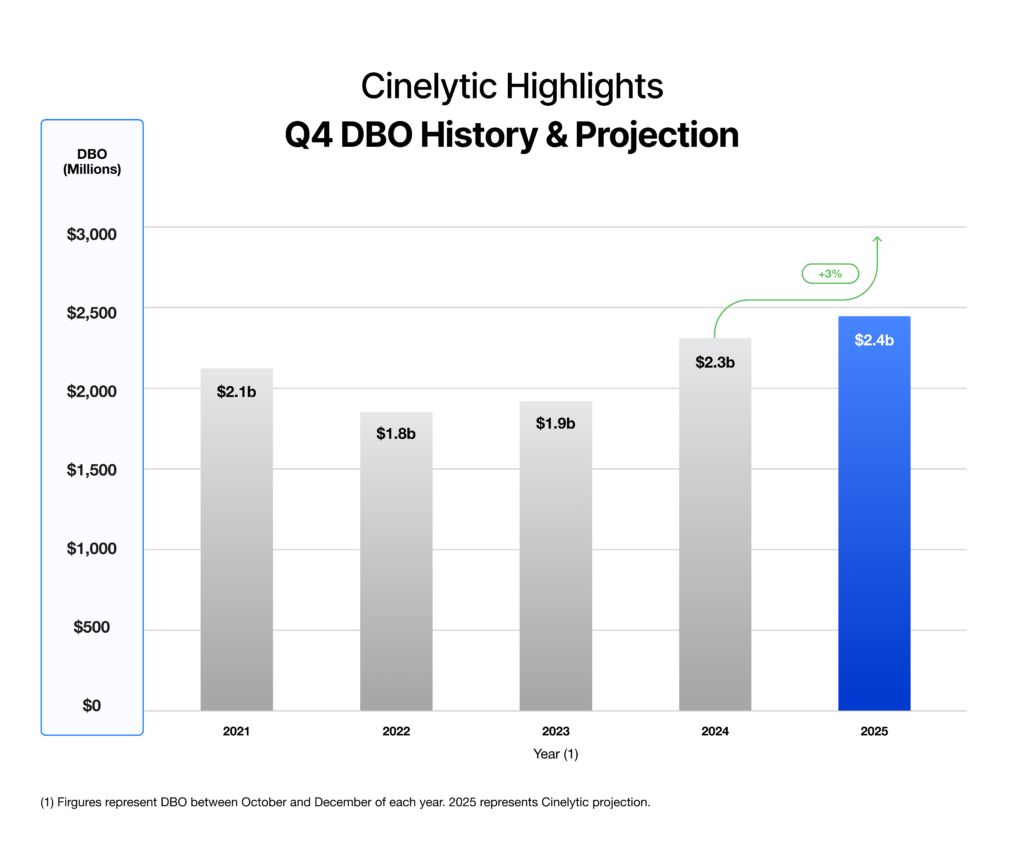

As we head into the final quarter of the year, Cinelytic’s predictive platform anticipates a modest box office lift compared to last year—one that would narrowly surpass 2024’s mark as the most lucrative Q4 since 2019, pre-COVID.

As illustrated in the graphic below, our projections call for a 3% increase in Q4 DBO over 2024, driven largely by a strong year-end showing from Walt Disney Studios. Later in these Insights, we highlight four key titles, each poised to leverage established intellectual property (IP) and the holiday season to extend the ongoing trend of franchise-driven success:

This projected 3% increase may appear modest, especially when compared with the prior year’s 26% surge in Q4 earnings. This contrast further reinforces the notion that the industry is beginning to stabilize into a “new norm” for DBO performance in the post-COVID era—at least for the near future.

Looking at historical context, when comparing the average Q4 performance from the two years prior to the pandemic (2018–2019) with the last two years (2024–2025, inclusive of our projections), revenues are down 19%. This decline closely aligns with the 23% drop in full-year DBO averages across those same periods.

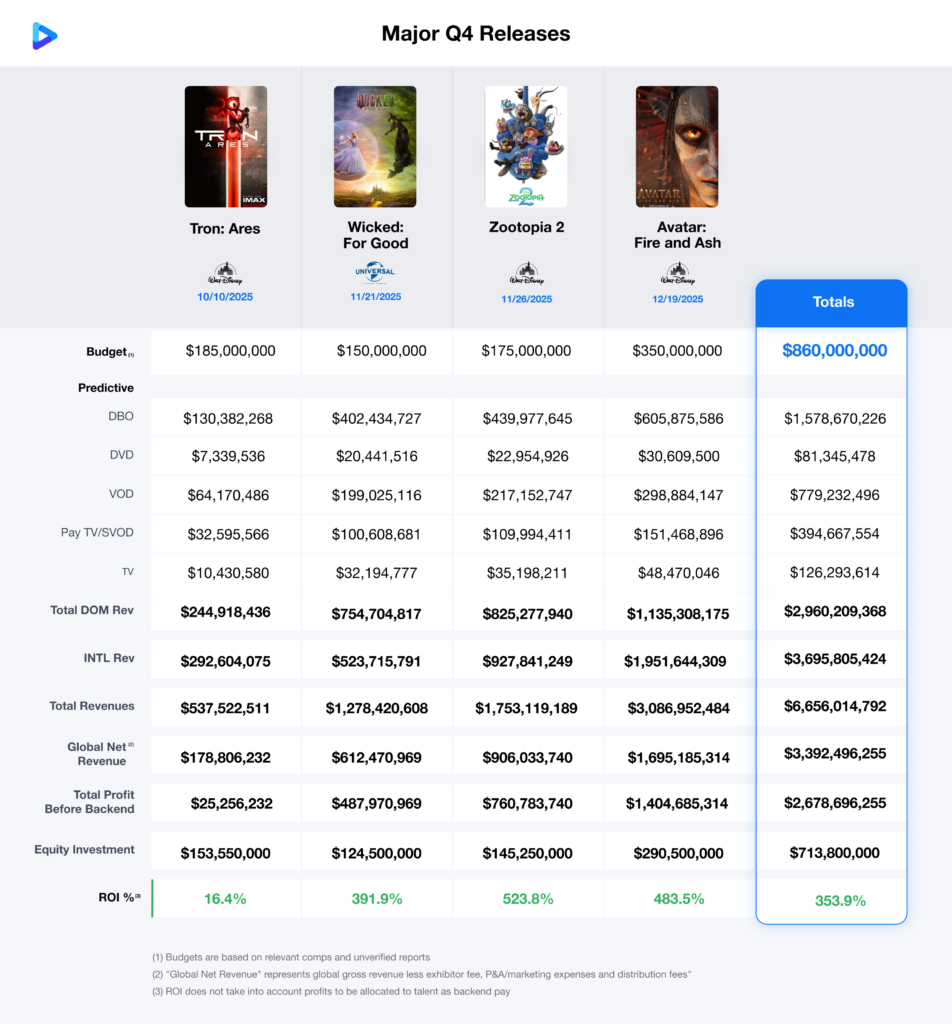

Last year’s Q4 was anchored by four major family-friendly releases—WICKED, MOANA 2, SONIC THE HEDGEHOG 3, and MUFASA: THE LION KING—all based on well-known IP. This year’s slate shifts slightly, with an equal balance of family-oriented titles with large-scale sci-fi action, each one a sequel: TRON: ARES, WICKED: FOR GOOD, ZOOTOPIA 2, and AVATAR: FIRE AND ASH.

These conclusions stem from running the 2025 Q4 slate through Cinelytic’s predictive forecasting platform, which leverages AI and 19 key attributes to model box office performance and ROI. For a closer look at the individual projections, the graphic below highlights these four upcoming releases and offers insight into why they are well-positioned to drive a strong Q4 finish:

TRON: ARES is projected to deliver an ROI of 16% before talent backend payouts, the lowest among the titles we analyzed. The film’s estimated budget is high, and despite its nostalgic appeal, large-scale visuals, and ambitious world-building, the franchise lacks strong recognition with modern audiences—the last film released 15 years ago to only modest critical and financial results. Lead star Jared Leto also has not been consistently tied to box office hits, potentially resulting in further limitations to the film’s draw.

WICKED: FOR GOOD ranked third in our projections but still carries a highly promising and lucrative ROI outlook at 392%. The film is almost certain to be a major success, even if it doesn’t quite match the cultural phenomenon of its predecessor.

Its prospects are supported by the enduring popularity of the original, the short gap between releases, Thanksgiving weekend boost, and the franchise’s broad family-friendly appeal coupled with the kind of in-theater spectacle that continues to drive strong turnout.

In the top spot is another title poised to take advantage of Thanksgiving. ZOOTOPIA 2 is expected to enjoy robust success and an ROI of 524% despite the nine-year gap since the original film’s release. The first installment remains one of Disney Animation’s most acclaimed and highest-grossing titles, with characters and themes that continue to resonate across demographics.

The sequel benefits from built-in family appeal, an active merchandising and streaming presence, and broad four-quadrant reach that positions it as a holiday season favorite. Adding to its potential, 2025 has yet to produce a breakout hit in a fully animated title, further boosting the appeal of a proven IP for family-oriented audiences.

And finally, we come to what is far and away the most prominent holiday release. AVATAR: FIRE AND ASH represents the third installment in James Cameron’s record-breaking franchise, one that already claims two of the top three highest-grossing films in history.

Even if this entry falls short of matching its predecessors, it is still positioned to be this year’s top-earning release at the box office with a projected ROI of 484%, and another likely addition to the upper tier of the all-time rankings for James Cameron. With its established global fan base, reputation for groundbreaking visuals and immersive world-building, and the proven draw of the AVATAR brand as a theatrical event, the film is expected to dominate the box office in late 2025 and early 2026.

All to Say… Taken together, these projections reinforce both the stability and the challenges of today’s theatrical market. While overall growth remains modest compared to pre-pandemic highs, franchise-driven releases anchored in well-known IP are still capable of providing reliable returns and draw audiences back to theaters. As the year closes, the four titles we analyzed here are set to define the quarter, with Disney once again leading the charge and Cinelytic’s platform demonstrating the value of data-driven forecasting in navigating an evolving box office landscape.