STRIP AWAY THE NOISE: A DATA-DRIVEN LOOK AT NETFLIX AND WBD

If you’ve opened any news or social media recently, you’ve likely seen all the headlines that have dominated the industry conversation. The story is everywhere, and rather than rehash what’s already been exhaustively covered, we’ll keep our commentary light here.

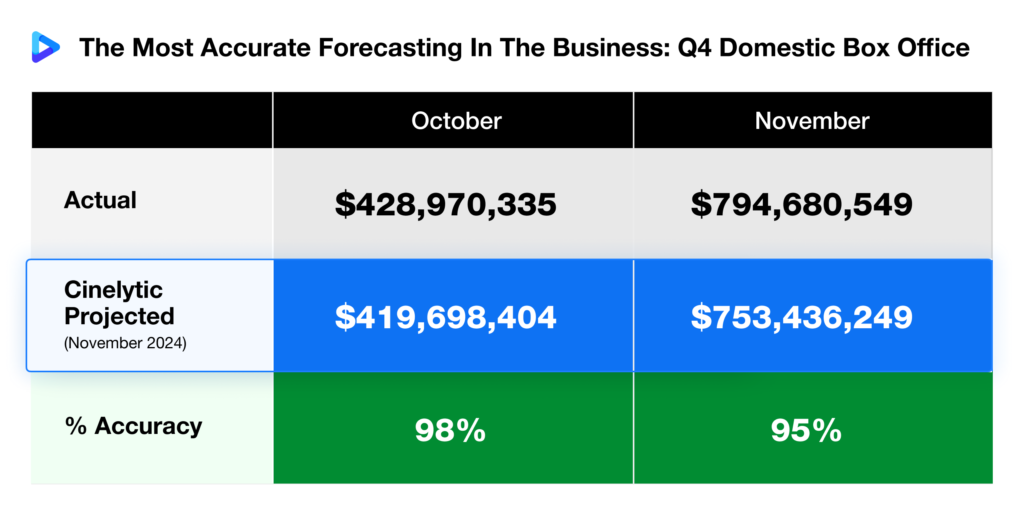

But before circling back to the broader Netflix vs. Warner Brothers Discovery (WBD) discussion, a quick update on something closer to home. As we enter the final stretch of the year, we wanted to share a brief update on our domestic forecasting accuracy so far in Q4, achieved through The Cinelytic Group’s predictive analytics platform, which projected the entire 2025 theatrical slate back in November 2024.

This early-stage forecasting model enables accurate predictions not only for domestic and global box office, but also for home entertainment and television revenues, offering studios, distributors, and financiers a powerful, multi-layered decision-making tool well ahead of release.

As the graphic below illustrates, our projections for the first two months of the quarter have been extremely strong, averaging 96% accuracy:

Rather than repeating the details of a historic potential acquisition, we thought it would be more interesting (and more fun) to look at how Netflix and WBD have actually performed thus far this year in the streaming ecosystem.

In the graphics below, we evaluated and compared the streaming performance of both original films and television series from each company using our proprietary OTT demand data.

This dataset captures approximately 125 million digital content consumption transactions per day worldwide, aggregating to roughly 35 billion annually, offering a clear window into global audience behavior and IP preference.

Importantly, our methodology removes platform bias. We do not rely on subscriber counts or self-reported metrics such as total minutes viewed, which tend to disproportionately favor longer-form content or platforms with larger installed user bases. Instead, we normalize consumption behavior across all major streaming platforms, isolating actual consumer demand during each title’s peak performance week.

This approach enables a true apples-to-apples comparison, regardless of platform size, exclusivity, or release strategy, and better reflects a title’s cultural and commercial resonance.

Let’s start with television

As shown above, Netflix’s standout television performers included the first part of the final season of STRANGER THINGS, WEDNESDAY, and breakout critical darling ADOLESCENCE. Counting titles not shown, Netflix logged 13 series that ranked within the Top 100 for the year thus far.

WBD, by comparison, placed 16 total titles, benefiting from a multi-channel distribution footprint that extends beyond HBOMax to include Adult Swim, TNT and TBS. Their key highlights included THE LAST OF US, RICK AND MORTY, and THE WHITE LOTUS.

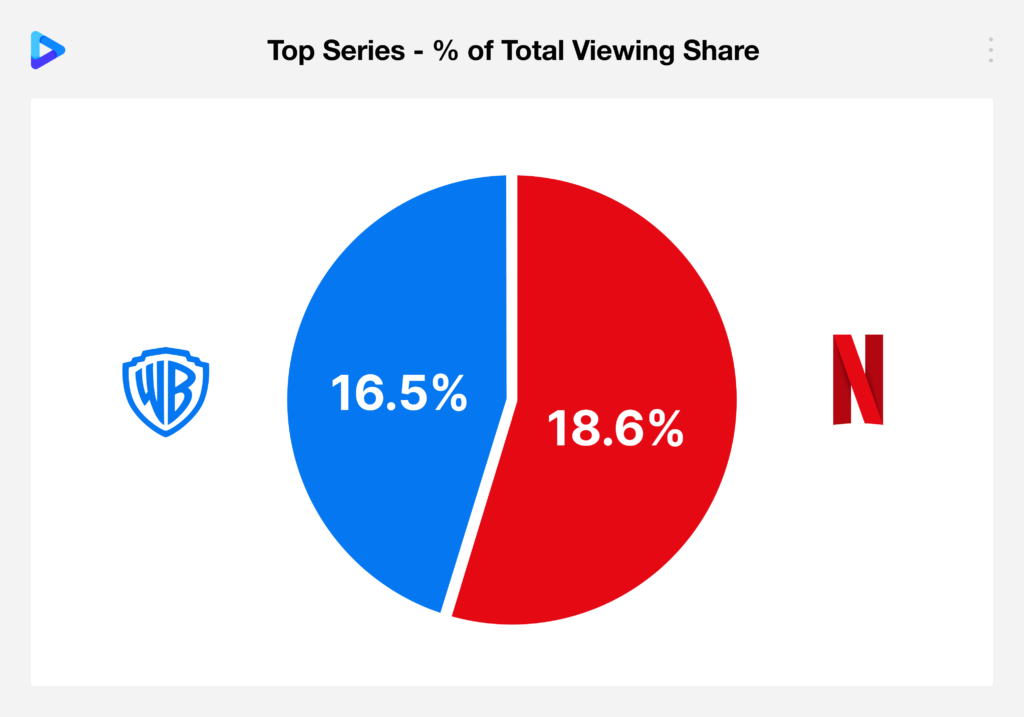

The summary graphic below illustrates the cumulative impact of each company across episodic television on digital platforms. While WBD’s diversified channels drive volume, Netflix holds a noticeable overall lead, one that is likely to widen further with upcoming debuts before year-end, including the next season of EMILY IN PARIS and Part II of the STRANGER THINGS finale:

Netflix’s 18.6% makes it the top performing digital distributor of TV series, while WBD ranks third and just behind Apple TV+.

Films: A Much Tighter Race

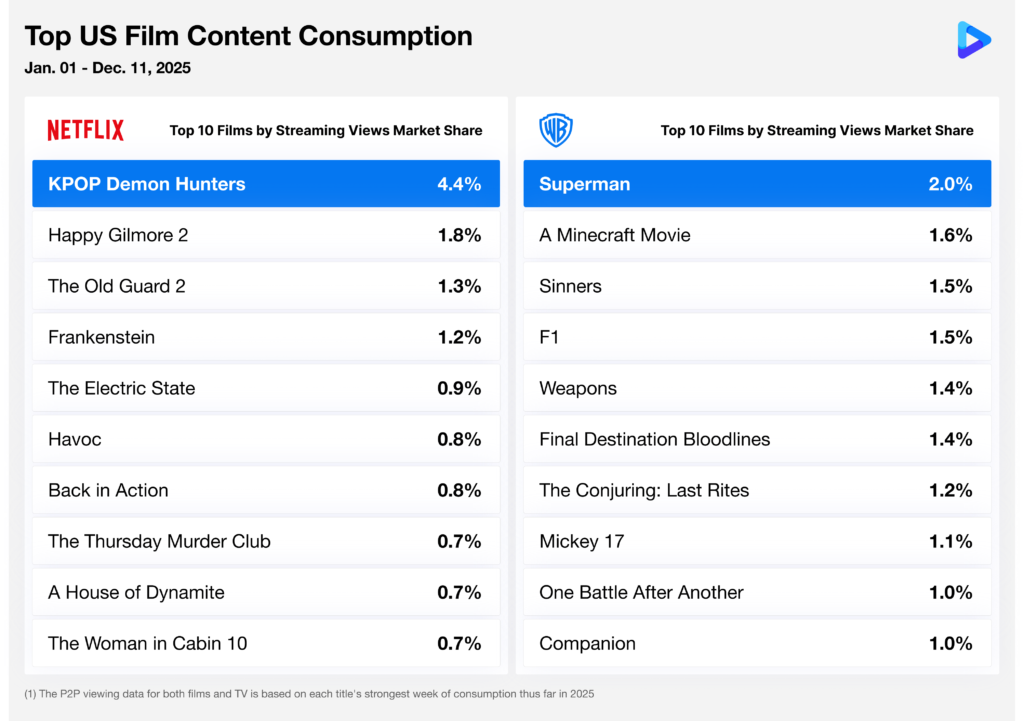

Turning to films, Netflix and WBD each placed exactly 10 among the Top 100 most-watched titles of the year thus far.

Netflix achieved what is widely recognized as the most streamed digital film of the year across all platforms, KPOP DEMON HUNTERS, alongside strong performers such as HAPPY GILMORE 2 and FRANKENSTEIN.

WBD, meanwhile, found significant streaming success despite substantial theatrical runs for all of the titles shown. Highlights included SUPERMAN, SINNERS, ONE BATTLE AFTER ANOTHER and F1, demonstrating continued audience appetite for premium theatrical IP once it transitions to digital platforms. F1’s performance is particularly notable given that this impact was generated prior to the film’s Apple TV+ debut just last week; viewing on Apple TV+ this late in the year is unlikely to surpass the scale of its original digital release as a WBD title, underscoring the strength of its initial streaming run:

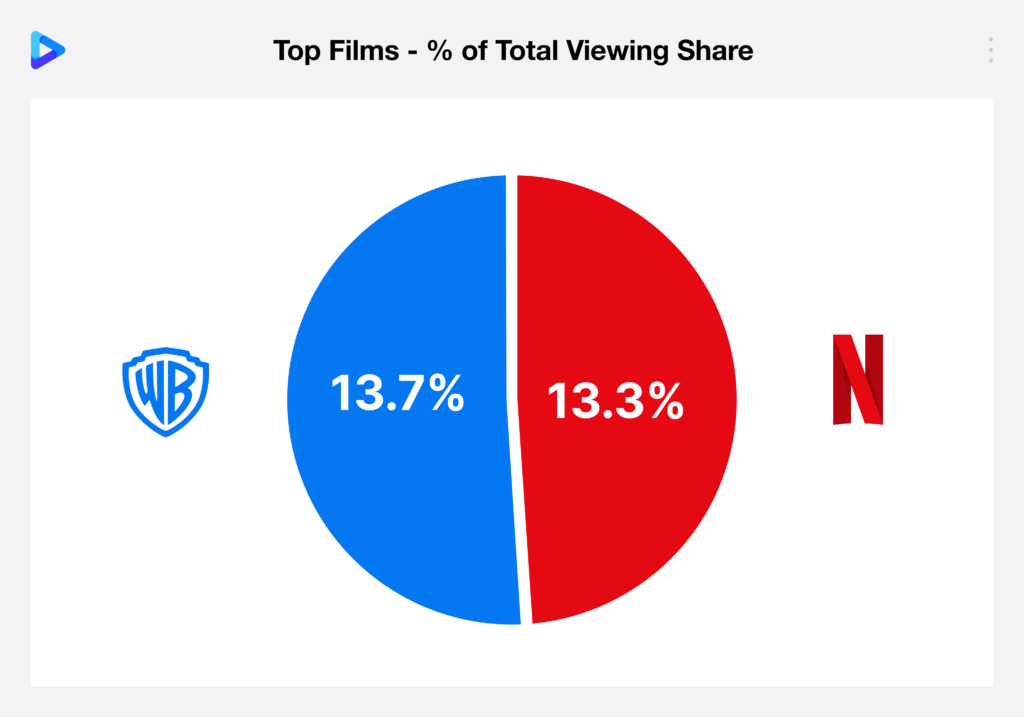

The summary graphic below suggests that WBD currently holds the edge in film performance. However, context matters. WBD has no remaining major film titles scheduled for digital release before the end of December. Netflix, by contrast, continues to benefit from occasional breakout films—event-level titles that can meaningfully outperform on an individual basis, as seen earlier this year with K-POP DEMON HUNTERS. That said, Netflix’s film performance has been less consistent across genres, while WBD’s broader slate strength and IP diversity have driven more reliable aggregate results, allowing WBD to maintain its current position in the rankings.

Looking ahead, Netflix is positioned to regain momentum before year-end with the recent release of the third entry in the highly popular KNIVES OUT franchise, which is already projecting strongly and is expected to push Netflix ahead in the final weeks of December:

As it stands, this puts WBD in third place behind Walt Disney Studios in second and Universal Pictures in the top spot, with Netflix close behind in fourth and ahead of Paramount and Sony.

All to Say…

Taken together, this snapshot underscores why the broader industry conversation around a potential Netflix and WBD combination has captured so much attention. On paper, the aggregation of their respective film and television portfolios would represent an unprecedented concentration of premium IP and audience reach, one that would almost certainly eclipse competitors in total market share across both episodic and feature content on digital platforms. At the same time, the data reinforces a more nuanced reality. While it is no surprise that Netflix is likely to outperform WBD overall on streaming this year, a normalized view of performance reveals that the gap—particularly in film—is narrower than prevailing narratives often suggest. When assessed against the full competitive landscape rather than in isolation, Netflix and WBD display distinct strengths, release strategies, and consistency profiles that shape their real-world impact. Evaluating these dynamics through a standardized lens provides clearer insight into where each company truly stands today, how they compare to peers, and why disciplined, data-driven analysis remains essential as the industry continues to evolve.