August Insights From Cinelytic

Big Spending, Big Returns? TV Budgets vs Streaming Success Over the Past Year

In August of last year, we took a deep dive into escalating TV content budgets and questioned if they were a sound investment or merely inflated expenditures. This conversation has now taken on new urgency by a pair of recent and relevant headlines. Paramount Global just announced that it will shut down its more traditional cable arm Paramount Television Studios in its efforts to eliminate US$500m in costs by year end, and last month Apple disclosed their plan for a significant decrease in content spending due to insufficient views and stagnant subscriber growth. The tech giant’s streaming service attracted just 0.2% of TV viewing in the US, which accounts for less viewing in one month than Netflix does in one day.

In addition to challenges with its streaming service, Apple has also faced financial setbacks with its theatrically released films. High-profile and expensive releases such as KILLERS OF THE FLOWER MOON, NAPOLEON, ARGYLLE and FLY ME TO THE MOON had reported budgets that averaged US$178.8m, but all drastically underperformed at the box office with an average global haul to date of US$128.8m.

Moreover, F1, the Brad Pitt-led sports drama and Apple’s biggest theatrical bet for 2025, has encountered significant production issues that have caused the budget to balloon to a reported US$300m. The company is now re-evaluating its strategy, likely aiming to focus on more cost-effective content creation and a more selective approach when greenlighting.

While Apple and Paramount may have the latest news about overspending tied to them, it’s important to also examine how other platforms’ spending and streaming success have evolved over the past year. As such, we at Cinelytic updated our analysis of the most expensive TV shows.

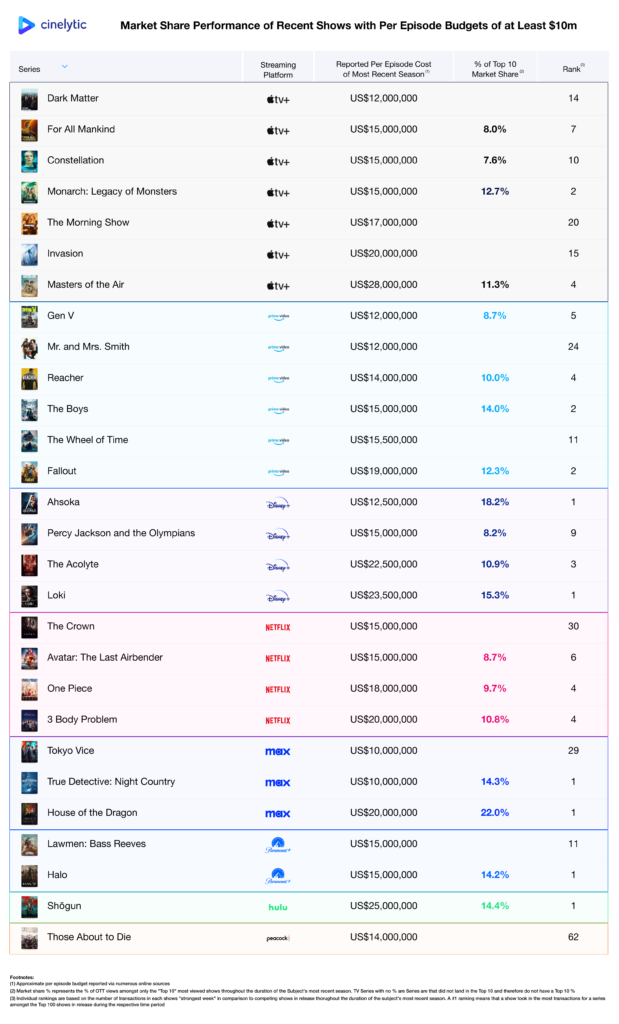

We reviewed shows in the last twelve months with reported budgets of at least US$10m per episode and ranked each against the Top 10 series in release throughout the duration of the subject’s most recent season. Focusing on each show’s “strongest week” of our proprietary streaming views, we produced the results detailed in the table below, revealing key insights into the changes and trends over the last 12 months:

In what should come as little surprise, the graphic above illustrates that the two major tech players with the deepest pockets topped the list, with Amazon Prime Video and Apple TV+ featuring six and seven original series respectively that had recent seasons with per episode budgets of at least US$10m.

In our 2023 analysis, Amazon Prime Video had only three series on the list. However, this wasn’t due to being stingy about budgets, as two of these were among the most expensive shows ever produced: THE RINGS OF POWER (US$58m per episode) and CITADEL (US$50m per episode). This time around, it appears they have diversified their spending a bit, providing subscribers with twice as many high-budget series. Most of these series managed to secure spots in the Top 5 most viewed shows during their peak weeks.

The most notable change from last year, which could offer some obvious explanation for their planned spending cuts, came from Apple. They increased their budget significantly, going from one show costing US$10m per episode between August 2022 and August 2023 to seven in the following 12 months. However, only four of these made it into the Top 10 during their peak viewing weeks.

Disney+, Netflix, and Max maintained more consistent spending habits in terms of the number of series and average expenditure. Meanwhile, newcomers Hulu and Peacock joined the ranks with varying degrees of viewing success, as the former’s hit historical drama SHOGUN became the second most watched series in the first half of 2024.

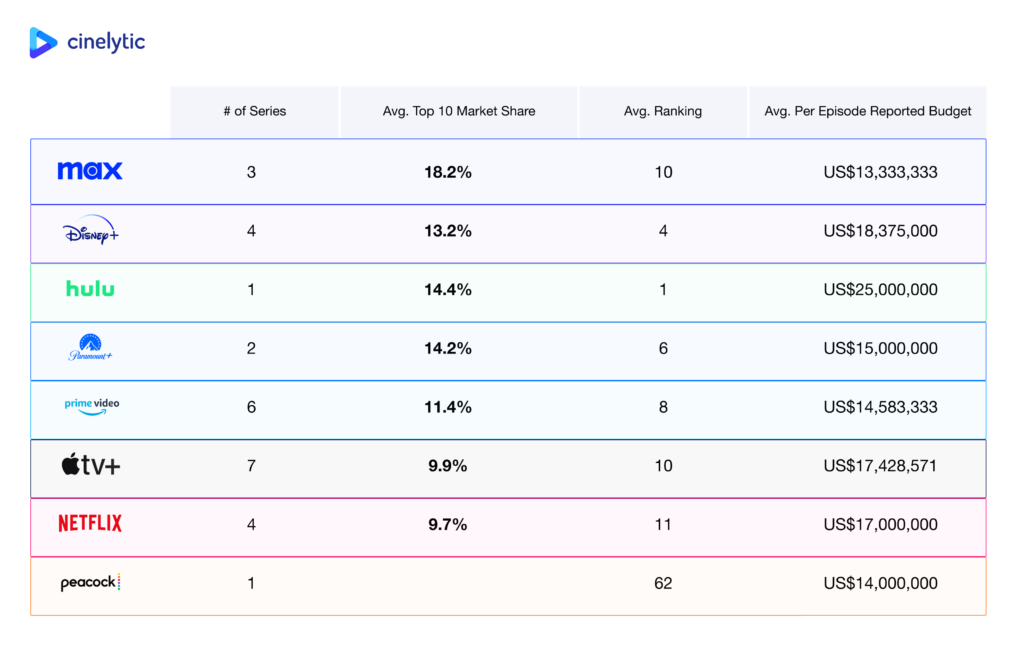

Content-Spend Effectiveness by Streamer

While flagship series like Max’s HOUSE OF THE DRAGON or Amazon Prime Video’s THE BOYS keep viewers engaged throughout each season, others like Apple’s THE MORNING SHOW have never been able to reach that level of success, with that show’s most recent season ranking of 20 being the highest in its history (Season 1 ranked at 54 and Season 2 at 27). Sustained engagement requires more than just a big budget; it demands compelling storytelling and consistent quality.

Performance has also varied widely. Disney+, Max and now seemingly Amazon Prime Video (in comparison to their performance in the previous year) have seen solid results from their big-budget productions, often due to established franchises and broad appeal. In contrast, platforms like Apple TV+ face challenges in achieving worthwhile viewership, particularly without a vast library of content or significant franchise properties.

The data indicates that strategic spending is essential. Platforms must be discerning in their investments, focusing on projects that not only attract but also retain subscribers. Investing in high-quality writing, innovative storytelling, and strong character development is crucial, regardless of budget size.

Future Trends

Episodic spending within this group indicates that among the most expensive shows, a budget of US$15m per episode is optimal if the Top 10 market share capture of a series falls between 10-12%. Spending above this level doesn’t necessarily lead to higher viewing scores unless the series is tied to immensely successful and proven IP, as is the case with HOUSE OF THE DRAGON. Looking at the figures above, along with similar insights from past years, it appears that Max has perfected the formula, consistently delivering content that is less costly than rivals and performs better in terms of viewership. Disney+ also leverages its strong IP related to STAR WARS and MARVEL and maintains an average budget under US$15m per episode, representing a significant decrease to the previous year when their most expensive series had average per episode budgets closer to US$24m.

As previously mentioned, Amazon has spread its portfolio to find its footing while Hulu found great success with SHOGUN, despite coming with a reported US$25m per episode price tag. Unlike the previous year, Paramount Global’s streaming arm Paramount+ did not have any products tied to the STAR TREK or YELLOWSTONE universes, which in the past have averaged Top 10 market share captures of 12% and average per episode budgets of US$10m and US$20m, respectively. Despite having a #1 ranked release in HALO just a few months ago, the streamer and its partners announced its cancellation in July after two seasons and their intention to shop the series to other outlets.

Conclusion: The Necessity of Balance

The budget cuts from groups like Paramount Global and Apple underscore the necessity of balance in content spending. While rising budgets can lead to success, it is more often creative execution paired with strategic planning based on the right insights that more often lead to strong results. As the streaming landscape continues to evolve, platforms will need to adapt their strategies to achieve sustainable growth and profitability. Additionally, advancements in AI and data analytics will play a significant role in identifying worthwhile projects for investment.

Here at Cinelytic, we will continue to monitor these trends and provide the tools and insights that can help navigate these challenges effectively in the coming months.