August Insights From Cinelytic: Increasing TV Content Budgets: Justified…or Inflated?

In last year’s August Insights, we focused on the rapid increase in episodic TV show budgets by the major streaming platforms in an attempt to compete for subscribers. We decided to provide some data to help our readers better understand whether or not this sizable increase in content spending has been justified and chose to evaluate and compare the streaming performance of the most expensive shows that aired since the onset of the pandemic.

At the time of that article, HBO’s HOUSE OF THE DRAGON, Amazon’s THE RINGS OF POWER and Disney’s STAR WARS: ANDOR were about to be released and represented three of the most expensive shows of the year. Analyzing the data for all the other major 2022 shows with per episode budgets of at least US$10m that had already released, we were able to get a feel as to how each streamer’s spending habits were translating to success amongst viewers.

Our 2023 Update

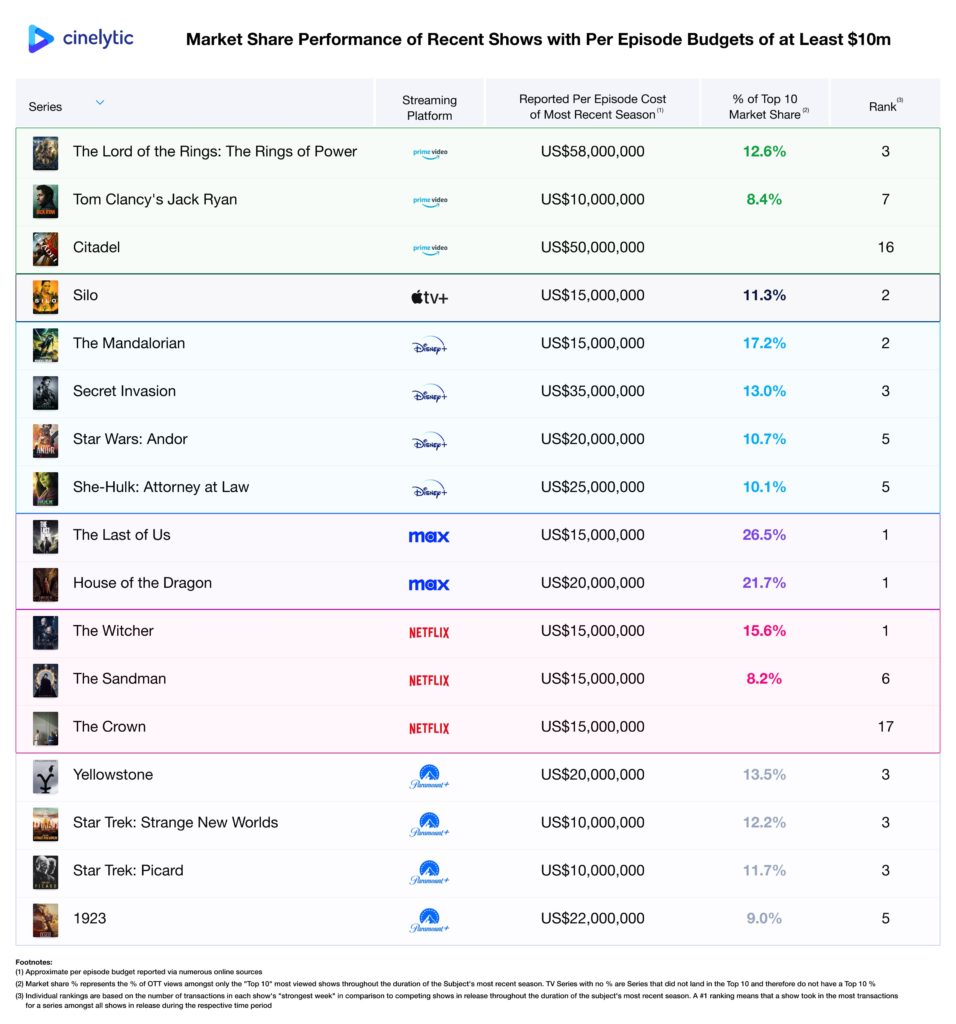

One year later, we decided to once again pull the same type of data for not only the three aforementioned flagship series, but also other high budget series releasing new or debut seasons since August of 2022. For this exercise, we again ranked each show against the Top 10 series in release throughout the duration of each subject’s most recent season by their “strongest week” of consumption across global P2P. The results in the table below provide some interesting conclusions about what has and hasn’t changed over the past 12 months:

As shown in the above graphic, Disney+ and Paramount+ led the pack with four original series, each with reported per episode budgets of at least US$10m. Netflix and Amazon Prime Video came in second with three shows each, HBO’s newly rebranded Max produced two shows, and Apple TV+ had one. The biggest changes since last year’s data come courtesy of Disney+ and Paramount+.

Last year, Disney+ had eight series all within the STAR WARS and MARVEL universes, many of which were on air simultaneously, with per episode budgets ranging between US$15m and US$25m. As we’ve seen via some recent comments by Bob Iger, it looks as if Disney is back tracking on this onslaught of content in order to avoid what he referred to as a “dilution of the audience’s focus”. While the budgets of their current STAR WARS and MARVEL shows have not decreased, the number of shows on air has been seemingly cut in half, despite the fact that seven of their eight high budget shows from 2022 ranked as the most watched shows on air during their respective seasons.

Paramount+ didn’t even make into our analysis last year, but that all changed as a result of a major push into the STAR TREK universe and budget increases for both existing and new series created by writer Taylor Sheridan (YELLOWSTONE, 1923, MAYOR OF KINGSTOWN, TULSA KING), who apparently now commands US$500m in annual content spending for his shows alone.

Content-Spend Effectiveness by Streamer: HBOmax on top

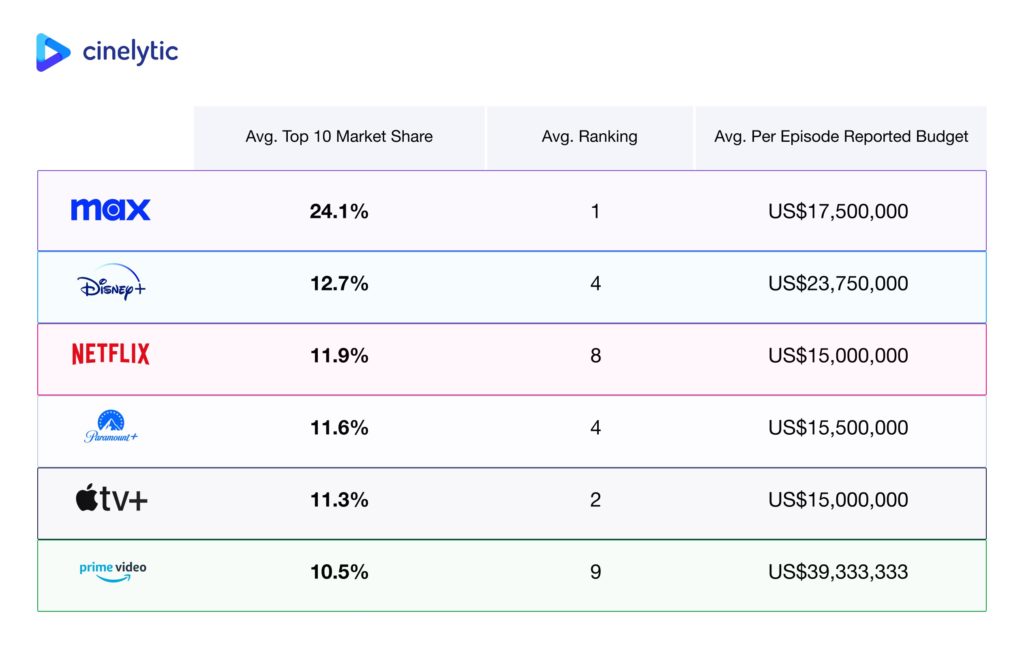

While HBO, Netflix and Apple TV+ saw less drastic changes in their content catalogues, Amazon Prime Video completely separated themselves from the competition in regard to spending. The graphic below provides a brief summary of how each streamer has been performing as it relates to the shows we analyzed:

HBO was the top performer when it comes to how effectively they spent each dollar. As they are usually the most selective of the streamers, they focused their highest budgets on just two series, both of which ranked as the most viewed show during their latest seasons based on “Strongest Week” of consumption. HBO also averaged the highest average market share capture amongst the Top 10 most viewed shows during each respective season.

Paramount+ seemed to be the next most effective streamer, as they achieved a similar average ranking and market share capture as Disney+ while spending an average of over US$8m less per episode. Given that the data set only considers one series from Apple TV+, it would be fair to say that Netflix was the third best performer based on lower spending and a solid average market share, despite having the second lowest average ranking amongst the analyzed shows.

Last year, Amazon Prime Video had two “high budget” shows on air, both of which had per episode budgets of US$10m (THE BOYS, THE WHEEL OF TIME). At the time of last year’s article, THE RINGS OF POWER was about to premier and become the most expensive show in history with an average per episode budget of US$58m. About eight months after that historic release, Amazon decided to add another record breaker to their slate with CITADEL, which immediately cemented itself as the second most expensive show in history. Unfortunately for them, CITADEL wasn’t able crack the Top 10 throughout its recent season, settling as the sixteenth most watched show in relation to “Strongest Week”. Amazon not only achieved the lowest average market share and ranking, but also had the highest per episode budget for their expensive shows amongst all streamers, besting the next biggest spender (Disney+) by nearly US$16m.

What Does This Mean for Streamers?

While the theatrical industry continues to recover and has no doubt boasted some impressive releases in 2023, traditional studios are focusing on profits in the world of streaming that will require further budget cuts. Streaming has a long road ahead of it before it becomes as reliable as linear TV once was, and losses will continue while the platforms attempt to increase subscribers. For example, NBCUniversal, whose streaming service didn’t even make it into our analysis due to their avoidance of higher per episode budgets and the absence of a true hit series, expects losses for Peacock to reach US$3b in 2023.

In addition to decreasing the amount of expensive content they churn out, Disney is also reportedly considering going back to licensing out its content, while Paramount has begun removing titles from its newly partnered Showtime streaming platform in an apparent attempt to downsize and instead use the Showtime cable network as a marketing device for Paramount+.

The driving point behind the analysis is that content is truly still king. The analysis above shows that with the right spending on the right content, hits can be produced, and audience share can be captured. Thus, not only is IP important, but also the cost and execution of said content is critical. Going forward, profligate spending alone will not dictate success, and content curation along with the management of costs will help attract and retain audiences.