July Insights: First Half of 2023: Box Office Windowing and Success on Streaming

Through the first half of the year, 2023 has been “predictably unpredictable” at the domestic box office (DBO) as the theatrical industry continues its journey to find consistent footing in its recovery from the COVID-19 pandemic. Numerous expensive titles underperformed despite having established audiences and known IP, while others found unexpected and record-breaking success.

Whether it’s FAST X becoming the first film in the franchise unable to surpass US$150m in DBO since the third entry in 2006, or THE SUPER MARIO BROS. MOVIE achieving the biggest worldwide opening weekend for an animated film and then becoming the highest-grossing title based on a video game, audiences are definitely keeping studios guessing.

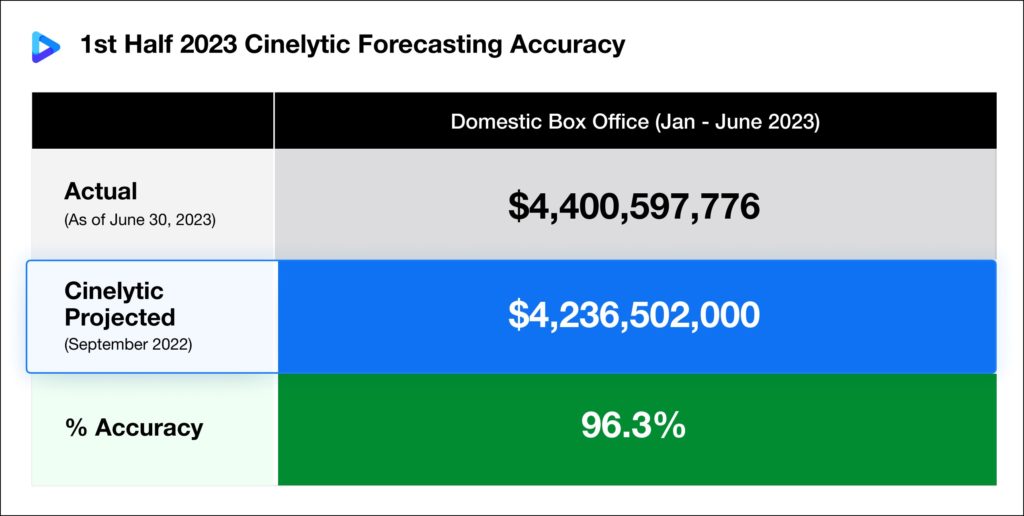

Fortunately, there are tools out there that can help put studios in a safer position when it comes to greenlighting major projects. Using our predictive platform, Cinelytic ran projections back in September of 2022 for the full 2023 slate, estimating a total domestic gross of US$8.66b. This efficient early forecasting model also allows us to accurately estimate home video and TV revenues, offering a truly unique tool for the film industry. As of June 30, 2023, highlighted in the graphic below, we’ve been impressively spot on with our overall domestic box office projections, currently tracking with just above 96% accuracy, improving upon the 94% we achieved through May:

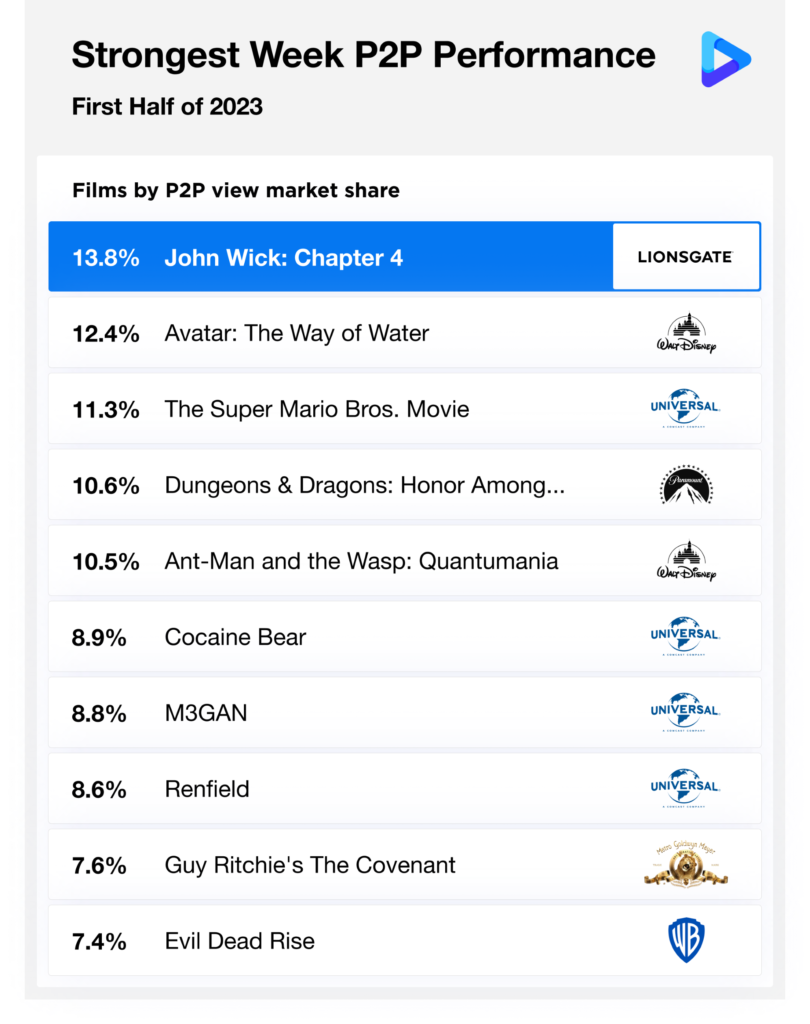

As previously mentioned, there have been some surprising films that contributed to the majority of this YTD US$4.4b, along with differing degrees of follow-up success on streaming through the use of opposing theatrical windowing strategies. In the graphic below, we chose to evaluate and compare the streaming performance of 2023 releases using our proprietary OTT demand data. This data captures 125m daily P2P transactions globally for a yearly total of 35b transactions. For this exercise, we ranked the Top 10 performing titles by their “strongest week” of consumption across global P2P:

Amongst the Top 10 in this table, Universal Pictures has found the most success on streaming, capturing nearly 38% of the viewing market share via four separate titles. Furthermore, and perhaps to the surprise of many, the fourth installment in the JOHN WICK franchise was able to outperform James Cameron’s historic follow-up to AVATAR.

There are two possible explanations for this. The first may be that there are few movies left in the current landscape that are justifiably marketed with a “demand” for in theater viewing, and AVATAR: THE WAY OF WATER is perhaps the best example of this. As a result, most people who saw this film understandably made the decision to see it in a movie theater, as evidence by its US$2.3b global box office haul.

Second, JOHN WICK: CHAPTER 4 has received near universal praise by both audiences and critics, with numerous publications labeling it as one of the best action movies ever made. Nevertheless, a quick look into who is missing from this Top 10 list provides some useful insight into the current state of theatrical windowing.

A Deeper Dive

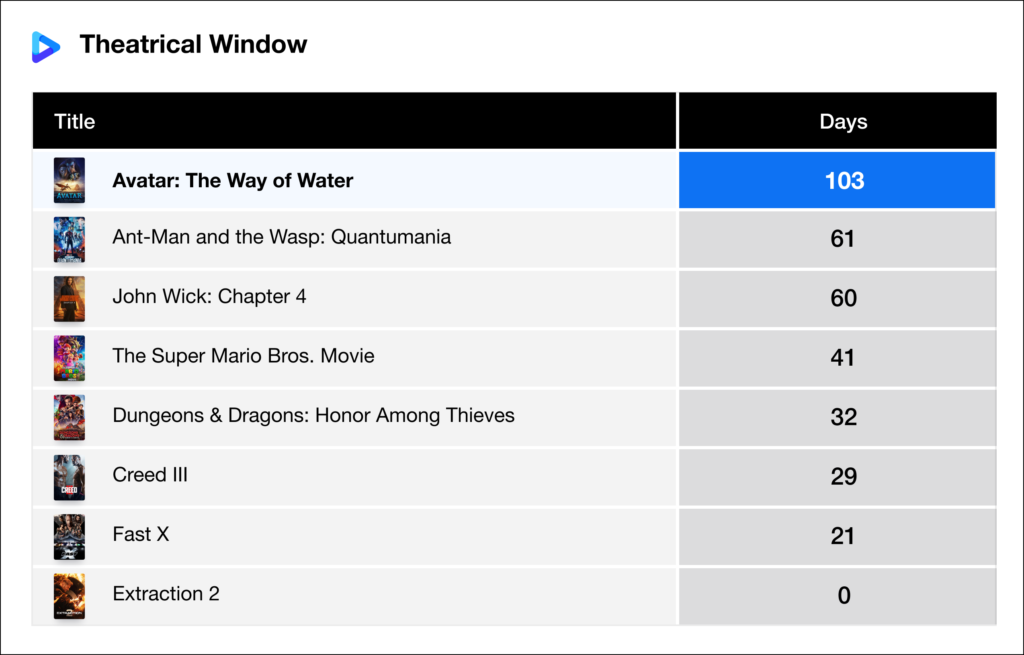

Historically speaking, films that perform well at the box office with longer theatrical windows usually also enjoy impressive numbers in regard to home viewing. While studios have been testing numerous shortened windowing methods both during and since the pandemic, our data shows that history is once again beginning to repeat itself.

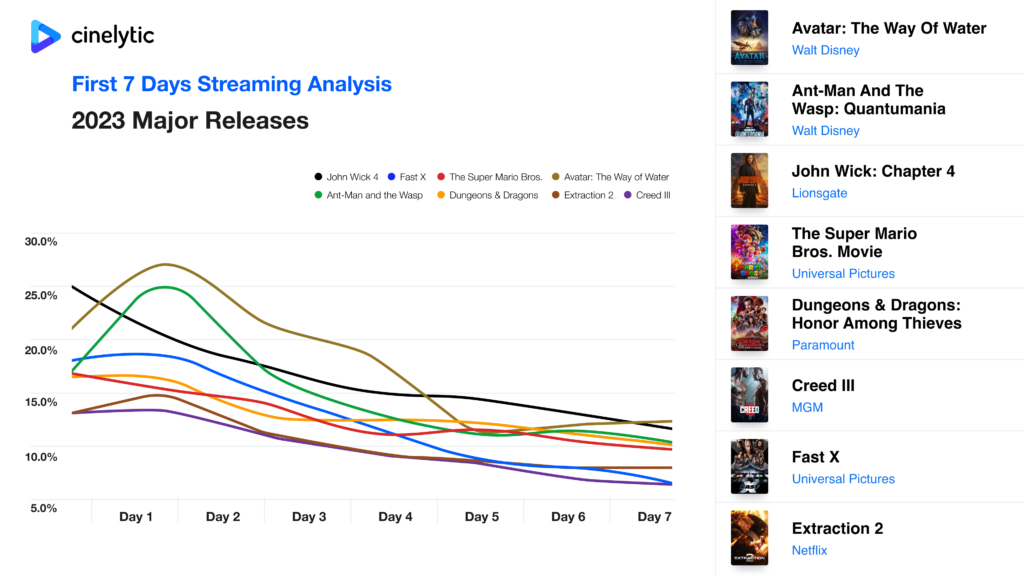

To evaluate and compare the streaming performance of some of the most high-profile and expensive box office releases, we once again used our proprietary OTT demand data, comparing the first seven days of streaming performance of eight major titles that have completed their initial runs in both theaters and home viewing:

Six of the eight titles in the above graph represent six of the Top 10 performing box office releases of 2023. The seventh title (DUNGEONS & DRAGONS: HONOR AMONG THIEVES) is ranked at #17 in DBO, while Netflix’s latest installment in the EXTRACTION series was of course a straight to streaming release.

First Half of 2023: Box Office Windowing and Success on Streaming

This graph allows us to view four distinct groups. In keeping with the data in the aforementioned “Strongest Week” table, JOHN WICK: CHAPTER 4 had the most impressive debut on digital platforms, capturing over 25% of the overall viewing market share before decreasing at a steady pace and achieving an impressive first week average of 17.1% (second best in this comp set). While FAST X’S debut was noticeably lower at 18.2%, it did achieve a slight Day 2 pop before following a similar consistent crawl to an average of 12.9%.

The two titles that achieved the largest Day 2 bumps were AVATAR: THE WAY OF WATER and ANT-MAN AND THE WASP: QUANTUMANIA. Over its first week, AVATAR was the best performing film amongst this set, achieving an average of 17.9%, while the Marvel Studios release came in third place at 15.2%.

The next two films that seemed to move in unison with one another were THE SUPER MARIO BROS. MOVIE and DUNGEONS & DRAGONS: HONOR AMONG THIEVES. The role-playing game adaptation slightly outperformed everyone’s favorite Italian plumber, achieving a very consistent 13.5% average against Mario’s 13.2%. Despite conceivably not matching its success in theaters, THE SUPER MARIO BROS. MOVIE’s streaming figures are none the less exciting given that it is the only film amongst these eight with zero live action elements.

It’s interesting to note that Netflix’s most highly anticipated release and the overall most watched straight to streaming release through June of this year across all platforms came in second to last place in regard to “First Seven Days” performance. EXTRACTION 2, despite not sharing any views with theatrical partners or exhibitors, was only able to average 10.9% in market share capture. Joining it at the bottom with a slightly lower average of 10.3% was Metro-Goldwyn-Mayer’s CREED III.

What does this all mean?

The overall message one can draw from these metrics is related to different methods of windowing and maximizing both box office and home video revenue. As shown in the graphic above, the three titles that separated themselves in regard to streaming success all had exclusive theatrical windows of at least 60 days, while the remaining five releases ranged from zero to 41 days. The mantra still holds that windowing does matter and films with material separation (minimum 45 days) tend to see improved performance in the home viewing window, boding well for the consumer who is willing to return to the theater while still enjoying good cinema at home.