2024 Sundance Insights Special

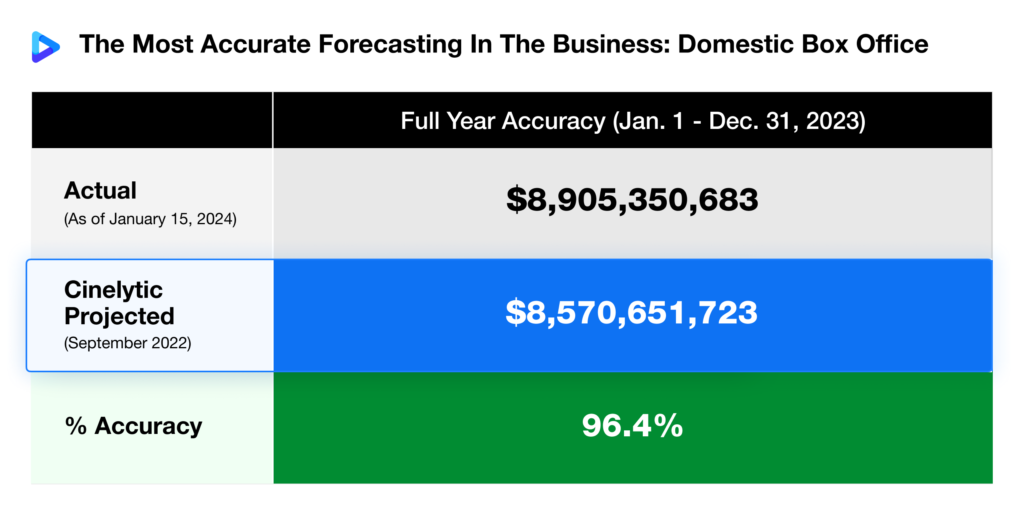

2023 was another bounce back year for the theatrical industry, representing a 21% increase in domestic box office revenue (DBO) from 2022 and a 99% increase from 2021. The US$8.9b tally came as welcome news to both studios and exhibitors, and as shown in the graphic below, it’s a figure that we at Cinelytic got pretty close to when we forecasted 2023’s entire domestic slate back in the Fall of 2022:

As for 2024, the Sundance Film Festival signifies the first major film market of the year for numerous upcoming theatrical releases, and with its commencement this week, we decided to take a deep dive into the streaming performance of some competition titles from Sundance 2023 to see how their festival presence/participation and release strategies translated.

In addition, we forecasted the box office performance of several titles premiering in Park City this week, including FREAKY TALES, the first film from directors Anna Boden and Ryan Fleck since their megahit CAPTAIN MARVEL in 2019.

Theatrical releases and subsequent OTT performance

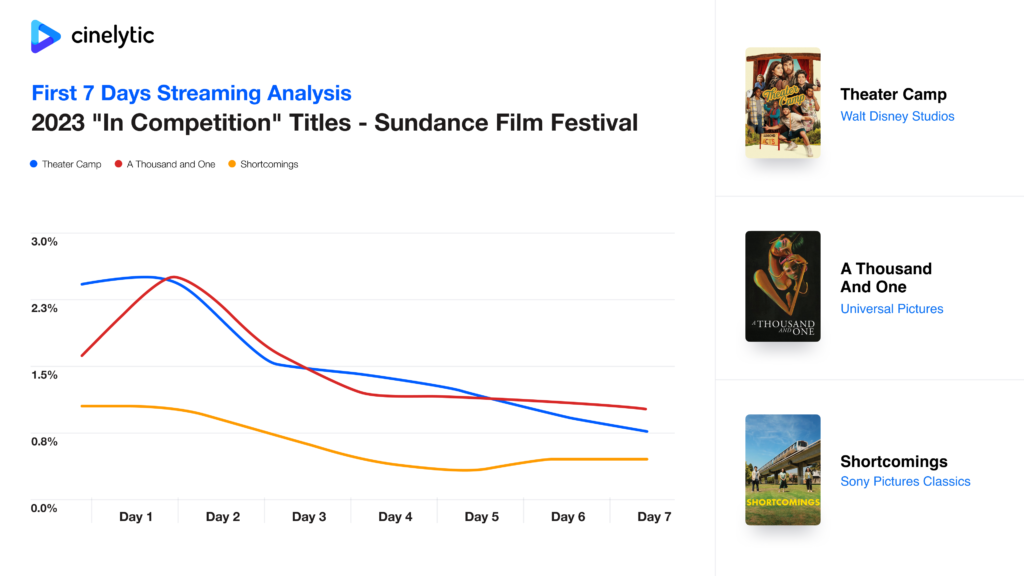

Since streaming (VOD/SVOD) has become one of the main revenue streams for Sundance titles over the last few years, we analyzed consumption to see how audiences engaged with some 2023 festival titles. To do so, we used our proprietary OTT viewership proxy system that tracks 125m digital content consumption transactions per day across the world to agglomerate to an annual tally of 35bn illustration consumer IP/content preferences on a global basis. We took three of the titles with the most buzz that were in competition in 2023 and pulled their 1st seven days of release on OTT to showcase a directly comparable metric:

In reviewing the data, we see that THEATER CAMP and A THOUSAND AND ONE had stronger OTT debuts in comparison to SHORTCOMINGS and both managed to average virtually the same overall and modest market share capture (1.5 – 1.6%) across their first week of availability. However, their paths differed slightly as THEATER CAMP demonstrated a stronger Day 1 followed by a noticeable drop-off, while A THOUSAND AND ONE conversely saw its peak on Day 2 and then experienced a similar drop-off. SHORTCOMINGS managed a significantly lower first week average of just 0.6% and a more consistent trend line.

A THOUSAND AND ONE won the Grand Jury Prize at the festival, was acquired by Focus Features and was named one of the Top 10 independent films of 2023 by the National Board of Review. This all led to a theatrical release on 926 screens that resulted in US$3.5m in worldwide box office revenue. Joining it in praise was THEATER CAMP, which received two standing ovations from the audience at its premiere and shortly after had its distribution rights acquired by Searchlight Pictures for US$8m million. Despite a less expansive theatrical release on 555 screens, it actually managed to pull in a higher box office total (US$4.6m). While it may not have received the same level of attention as the other two titles in this comp set, SHORTCOMINGS was acquired by Sony Pictures Classics and granted a comparable 404 screens for theatrical viewing, albeit it was only able to earn just under US$700,000.

Now on to Sundance 2024.

Boden and Fleck – Back to basics

After starting off with a series of highly regarded indie comedies and dramas between 2006 and 2015, filmmaking duo Anna Boden and Ryan Fleck were asked to join the Marvel Cinematic Universe, resulting in one of the highest grossing films of all time in 2019’s CAPTAIN MARVEL. No strangers to the Sundance Film Festival, the pair are now returning to their grounded dramatic roots with the premiere of their highly anticipated period anthology film FREAKY TALES.

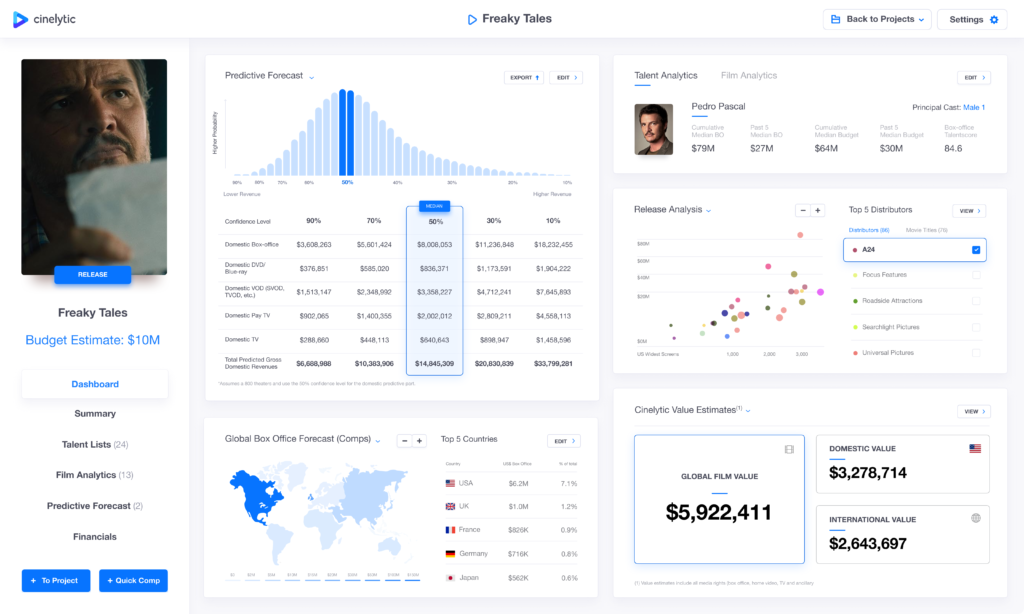

We ran this title through our predictive tool, which takes into consideration 19 material input attributes to determine a full-performance waterfall, P&L and ROI. Estimating a budget of US$10m, we also took into account a proposed theatrical release strategy of 800 screens with Pedro Pascal in the lead. The Cinelytic platform predicts a DBO of just over US$8.0m and domestic gross revenues (BO, HV, TV) that total approximately US$14.8m. The mix of release strategy and revenues by media and associated costs would net a negative ROI for this project.

While our signature ROI forecasting is more useful for financiers, producers and all those providing equity for a project, our sales estimates tool allows both buyers and sellers at festivals like Sundance to view the per territory value estimations of a title inclusive of all media rights (box office, home video, TV and ancillary). This tool may be more interesting to those in a market setting who are attempting to calculate the correct figure each territory’s rights should be bought or sold for. As shown in the graphic below, we estimate domestic and international values for this project at US$3.3m and US$2.6m respectively, yielding a global valuation of US$5.9m:

In looking at a film like FREAKY TALES along with the competition titles we analyzed from last year’s festival, we expect that a potential domestic theatrical release would help propel its after life on OTT, thereby helping its bottom line and further pushing its domestic and global values.

We additionally ran analyses for other upcoming market highlight titles including PRESENCE, THE AMERICAN SOCIETY OF MAGICAL NEGROES, A DIFFERENT MAN, WINNER, MY OLD ASS, ROB PEACE, SASQUATCH SUNSET and others both premiering and in competition.

Conclusion

Buyers, sellers, and enthusiasts are eagerly anticipating the second in-person Sundance Film Festival in the post-COVID era. With numerous premieres and competitive entries spanning ten days, the evolving festival and market dynamics will require thoughtful decisions on whether a theatrical release is justified. If not, alternative strategies must be explored to generate the essential awareness for a successful debut on OTT platforms.