May Insights From Cinelytic

2023 Cannes Film Festival Special

The 76th annual Cannes Film Festival is well underway and continuing through this upcoming weekend, and several events have already begun making headlines. Whether it’s the rapturous reception for Martin Scorsese’s latest and long-awaited epic KILLERS OF THE FLOWER MOON, the “comeback” of Johnny Depp, or the career tribute to Harrison Ford, this year seems to be the subject of substantial media coverage.

As such, we at Cinelytic decided to take a deep dive into a series of titles that sold during last year’s 75th festival to see how their presence/participation and release strategies translated into OTT viewership. Based on the type of releases, there were essentially three different trends of performance.

Furthermore, we forecasted the potential performance of a couple of the hottest “for sale” titles on the market at this year’s ceremonies that are already garnering significant attention.

Which of last year’s sales found a home on streaming?

Since streaming (VOD/SVOD) became one of the main revenue streams for festival titles over the last few years, we wanted to analyze consumption to see how audiences engaged with films that received the most attention during Cannes 2022. To do so, we used our proprietary OTT viewership proxy system that aggregates upwards of 100m transactions per day from P2P sites around the globe.

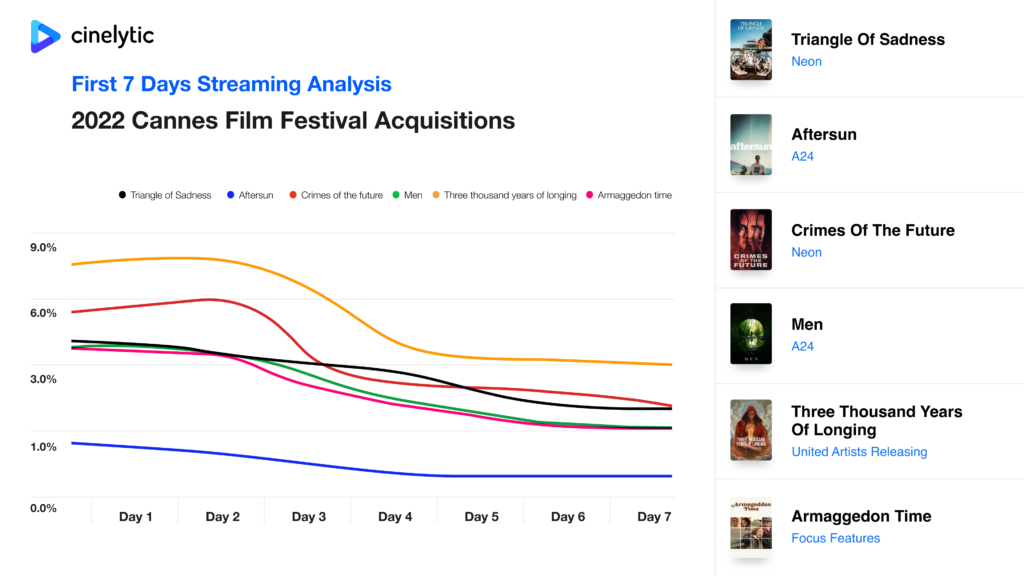

The data cumes up to 35b transactions per year. In this case, we took six of the most high-profile sales from last year and pulled their first seven days of release on OTT to showcase a directly comparable metric:

While none of these releases seemed to turn a profit at the box office, it’s clear in reviewing the data that at least a couple were able to perform respectably in regard to the home viewing audience for independent films. Amongst these options, George Miller’s THREE THOUSAND YEARS OF LONGING and David Cronenberg’s CRIMES OF THE FUTURE had the best openings on OTT and followed a similar path that included a comparable Day 3 drop off, respectively averaging 5.2% and 3.6% of the viewing market share throughout their first week of release.

These top two features benefited from more marketable cast members (Viggo Mortensen, Kristen Stewart, Idris Elba) and the mystique of their directors. George Miller seemingly directs a movie every five to six years, and THREE THOUSAND YEARS OF LONGING was his first project since 2015’s lucrative MAD MAX: FURY ROAD, which is now regarded as one of the best action films ever made. David Cronenberg is another man who is no stranger to a layoff, as CRIMES OF THE FUTURE was his first production in eight years. All to say, it’s no mystery that these two titles performed the best amongst this set due to the buildup and anticipation that accompanies any effort by either of these filmmakers.

The next three titles that performed comparably to each other were TRIANGLE OF SADNESS, MEN and ARMAGEDDON TIME, all of which showcased more static movement and respectively averaged 2.9%, 2.4% and 2.2% of the viewing market share. Director Ruben Östlund was quite the hot commodity at the 75th Cannes Film Festival, being that his previous release THE SQUARE from 2017 won the highest prize possible at Cannes: the coveted “Palm d’Or”. His follow-up starring Woody Harrleson was well received in 2022, as he became just the ninth filmmaker in history to win the Palm d’Or twice. That being said, most of the marketing behind this title was geared toward Europe (namely Sweden and Germany), which may explain why it didn’t make waves with the US streaming audience.

Both MEN and ARMAGEDDON TIME were also helmed by acclaimed directors: Alex Garland and James Gray. Gray’s semi-autobiographical period piece can be viewed as an underperformer given that it was also nominated for the Palm d’Or and included the presence of names like Anne Hathaway, Anthony Hopkins and Jessica Chastain. Meanwhile, Garland’s twisted folk horror effort did not benefit from any major stars and proved to be a tough sell to audiences due to what were perceived as disturbing and confusing elements.

The final movie we looked at in this OTT analysis was the coming-of-age drama AFTERSUN. While this project’s lead Paul Mescal did receive a “Best Actor” nomination at the 95th Academy Awards, this news wasn’t announced until a month after the film’s digital release. Without the boost of a nomination announcement and absence of major talent, it’s no surprise that this grounded and emotional directorial debut only managed to average 0.5% of the viewing market share.

Now on to Cannes 2023.

Netflix makes a move, while Ron Howard is still on the market

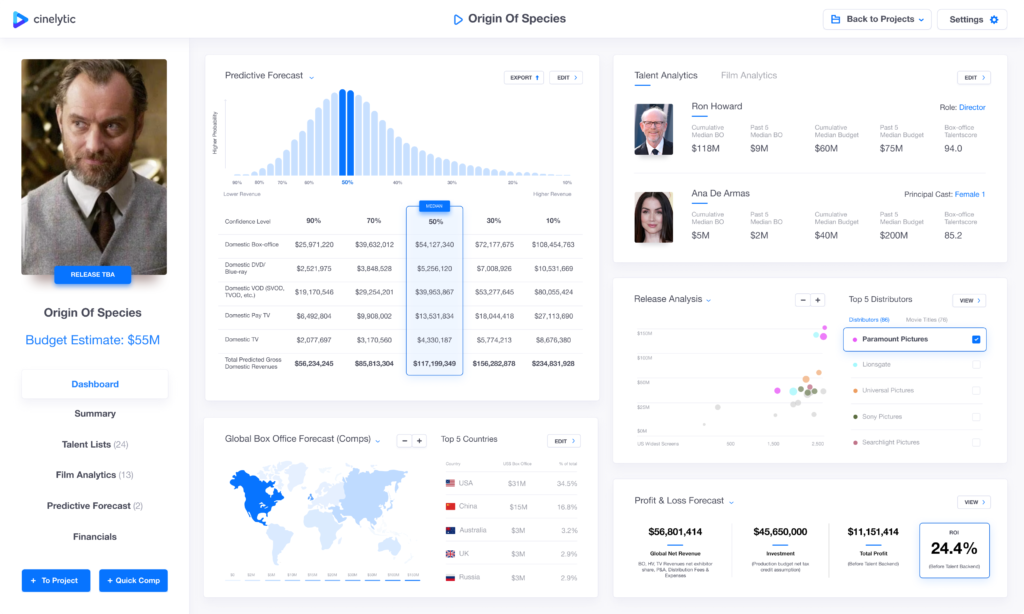

Ron Howard has enjoyed a very lucrative and productive career that has usually leaned more toward bigger budgets and all-star casts. That being said, his last couple of projects (HILLBILLY ELEGY, THIRTEEN LIVES) have been less geared toward the blockbuster crowd and had budgets closer to US$50m, and it seems as if his upcoming release ORIGIN OF SPECIES will continue that trend. We ran this title through our predictive tool, which takes into consideration 19 material input attributes to determine a full-performance waterfall, P&L and ROI.

We estimated a budget of US$55m for this survival thriller starring Ana de Armas, Jude Law, Alicia Vikander and Daniel Bruhl, an additional US$53m in total P&A costs and proposed a theatrical release strategy of 3,100 screens with de Armas in the lead. The Cinelytic platform predicts a DBO of over US$54m and domestic gross revenues (BO, HV, TV) that total over US$117m. While it may be one of Howard’s smaller-scale films on his resume, the high-profile talent and mass-appealing genre are projected to net a positive ROI:

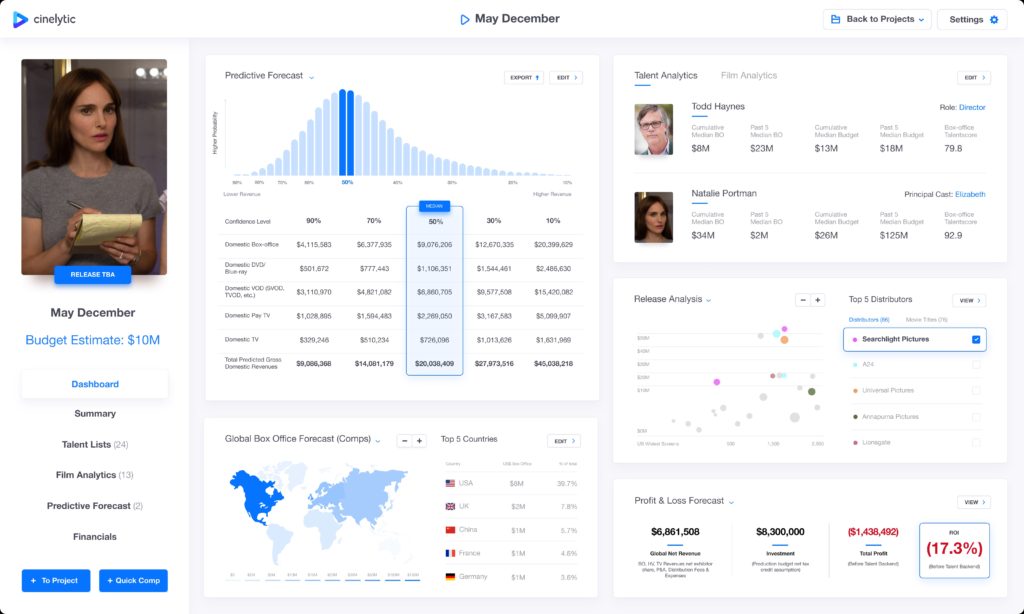

Most of the current sales buzz at Cannes revolves around Netflix’s recent US$11m acquisition (North American rights) of the Todd Haynes helmed romantic drama MAY DECEMBER starring Natalie Portman and Julianne Moore. While, as a Netflix acquisition, this title will likely not be given much theatrical distribution (if any).

We ran two forecasts for the title – a domestic sales price forecast for a classic theatrical window distributor and a worldwide ROI forecast.

Estimating a budget of US$10m, domestic P&A costs of US$7.5m, and a US theatrical release of 1,100 screens – with Portman in the lead, the Cinelytic platform predicts a DBO of over US$9m and domestic net revenues of BO, HV, TV 10 year ultimates (minus all distribution fees and expenses) of US$4.98m in the base case. Netflix paid more than double that amount.

As noted in the visualization below, the mix of release strategy and revenues by media and associated costs would net a negative ROI for this project worldwide, and thus selling the domestic rights to a streamer like Netflix for US$11m makes sense as the producers can recoup their budget while the streaming giant is simultaneously able to market a prestige title on its platform.

Conclusion

We’ll all have to wait and see who wins the bidding war for Howard’s latest thriller, and whether or not that acquisition will involve a theatrical release strategy. As mentioned before, none of the six sales we analyzed from last year’s film festival found success at the box office, and only two of them were able to flaunt respectable openings on digital platforms. As such, it seems as if more and more of the types of films marketed at Cannes may be heading in the direction of “straight to streaming” distributors like Netflix, with a need to focus marketing efforts more on home audiences in order to boost OTT views.