December Insights From Cinelytic

Second Half of 2023: Box Office Windowing and Success on Streaming

While it should come as no surprise to anyone in these early stages of the post-pandemic era, it’s been quite an eventful year at the box office. Several “surefire” blockbusters tied to historic franchises or well-known IP with high profile talent attached severely underperformed, while other titles flying slightly below anyone’s radar took theaters by storm.

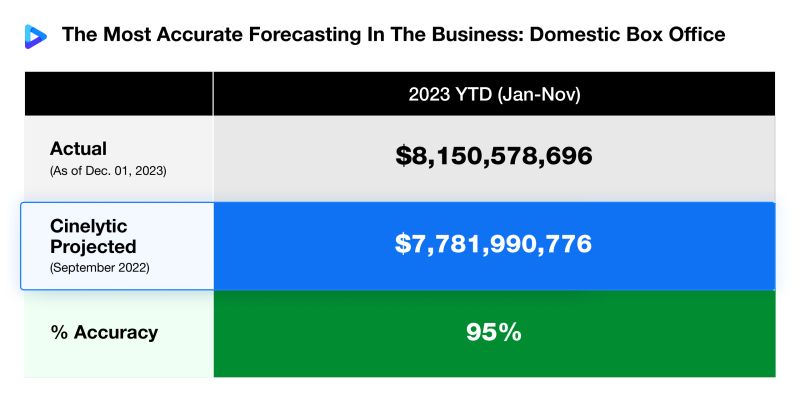

Last February, we at Cinelytic published a summary of the results from our domestic box office predictions for the full 2023 slate, which we ran in the Fall of 2022. Our efficient early forecasting model allows us to accurately estimate not only domestic and global box office performance, but also home video and TV revenues, offering a truly unique tool for the film industry.

The predictive platform estimated a total domestic gross of US$8.57b. Through the end of last month, as highlighted in the graphic below, we’ve been impressively spot on as it relates to overall domestic box office projections with 95% accuracy, a figure that is tracking to further improve as December comes to a close:

As previously mentioned, there have been some surprising films that contributed to the majority of this US$8.2b through November, along with differing degrees of follow-up success on streaming through the use of opposing theatrical windowing strategies.

Last July, we chose to evaluate and compare the streaming performance of the major theatrical releases from the first half of 2023 using our proprietary OTT demand data. This data captures 125m daily P2P transactions globally for a yearly total of 35b transactions. This month, we decided to do the same for the second half of 2023.

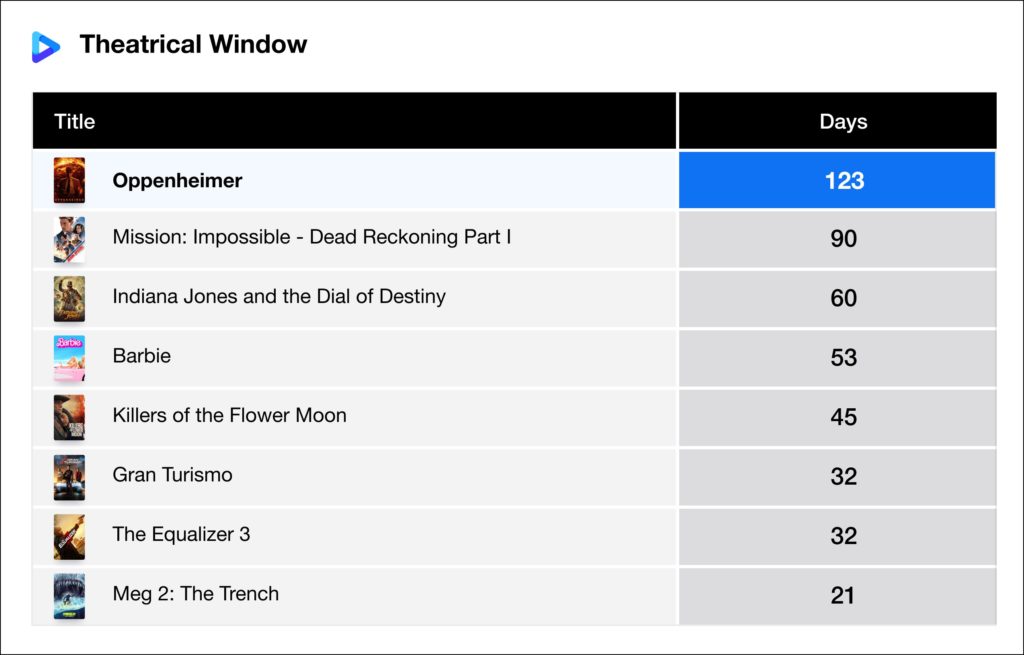

While studios have been testing numerous shortened windowing methods both during and since the pandemic, both historic and more recent figures inform us that films that perform well at the box office with longer theatrical windows usually also enjoy impressive numbers in regard to home viewing.

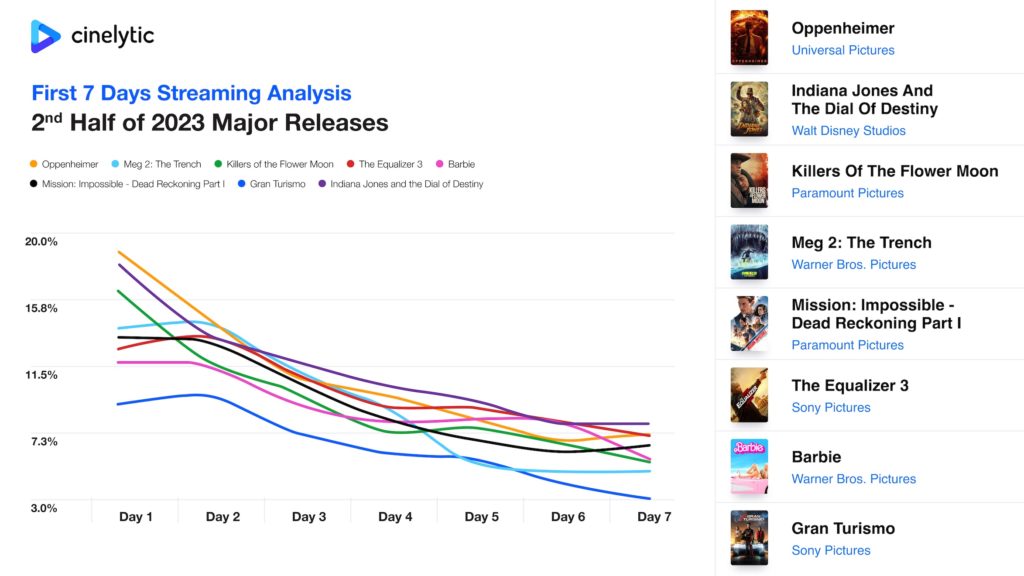

To once again test that theory and evaluate the streaming performance of some of the most high-profile theatrical releases of the last six months, we used our proprietary OTT demand data to compare the first seven days of streaming performance of eight major titles that have completed their initial runs in both theaters and home viewing:

Through the first six months of the year, six of the eight digital releases we analyzed in July represented six of the Top 10 performing box office releases. Contrarily, the second half of the year paints a slightly different picture, as only two films (BARBIE and OPPENHEIMER) from the eight analyzed represent Top 10 performing box office titles, with the remaining six being spread out across the Top 50.

The graph above allows us to view three distinct groups. The three titles with the most successful streaming debuts were INDIANA JONES AND THE DIAL OF DESTINY, OPPENHEIMER and KILLERS OF THE FLOWER MOON. These films respectively ended up averaging 11.8%, 11.5% and 10.0% of market share capture through their first week of viewing. The next batch of films includes THE EQUALIZER 3, MISSION: IMPOSSIBLE – DEAD RECKONING PART I, MEG 2: THE TRENCH and BARBIE. These titles respectively averaged 10.7%, 9.9%, 9.7% and 9.6%. It’s important to note that while THE EQUALIZER 3 did not join the Top 3 as it pertains to strongest Day 1 performance, it did perform consistently and finished strong enough to make it the third overall best performing film amongst these eight through its first week. The final title, which separated itself from the pack at the bottom, was GRAN TURISMO with an average of 7.2%.

One interesting note is the comparison of differing release strategies and subsequent streaming performance for the two most conjoined films of 2023 that were unmatched in terms of the marketing behind them: OPPENHEIMER and BARBIE.

At roughly four months, OPPENHEIMER’s theatrical window was the longest amongst this set, which was expected given the man behind the camera. When Christopher Nolan ended his 19-year relationship with Warner Bros. to partner with Universal Studios, one of his key demands of the new studio was to grant him an unusually long and exclusive theatrical release. Despite this lengthy window and the resulting historic box office success (US$954m globally), the film also performed very well in its first week of availability for home viewing.

BARBIE on the other hand, while able to enjoy even more box office success (US$1.4b globally) in a far shorter theatrical window (53 days), was not able to match the aforementioned WWII drama’s success on streaming. In between these two films when it comes to window length were the latest releases from two storied action heroes: Tom Cruise and Harrison Ford.

Cruise was reportedly very unhappy with Paramount’s original 45-day window plan for his latest film given the success of TOP GUN: MAVERICK, and even got lawyers involved in what turned out to be a successful attempt to achieve the previous franchise standard of 90 days. Meanwhile, for the latest installment in the INDIANA JONES franchise, Walt Disney Studios stayed true to their recent commitment to a 60-day window, a strategy they also utilized this year for ANT-MAN AND THE WASP: QUANTUMANIA, GUARDIANS OF THE GALAXY VOL.3 and THE LITTLE MERMAID.

Three of the other four films with theatrical windows between 20 and 45 days represent action-oriented stories tied to smaller-scale franchises or IP, while Martin Scorsese’s latest epic KILLERS OF THE FLOWER MOON is in the unique situation of being a partnered release with Apple that will eventually and exclusively make its way onto Apple TV+ after an initial period of more broad digital availability.

Which Window is Best?

The industry is still doing its best to navigate between theatrical and digital releases in order to find the most efficient strategy when it comes to timing. The reality is that those decisions will need to be made on a title-by-title basis. That being said, as it pertains to these eight films released in the second half of this year, the four titles that showcased the best average market share capture through their first week of availability had an average theatrical window of 65 days, while the bottom four had an average theatrical window of 49 days. As such, the mantra likely still holds that windowing does matter and films with material separation (minimum 45 days) tend to see improved performance in the home viewing window.