April Insights From Cinelytic

An update on post COVID box office windowing

Shortly before this year’s 95th Academy Awards, Steven Spielberg pulled Tom Cruise aside to tell him that he “saved Hollywood’s ass and might have saved theatrical distribution”. He was of course referring to the fact that TOP GUN: MAVERICK exceeded all expectations to become the second movie to gross over US$1b at the worldwide box office following the COVID-19 pandemic. With a US$1.49b worldwide gross, the film now ranks as the 12th highest-grossing movie in history (unadjusted for inflation). While SPIDER-MAN: NO WAY HOME also managed to pass the billion-dollar threshold just five months earlier, the industry was still skeptical that audiences were ready to return to theaters in large numbers for any movies that were not related to comic book IP.

However, since the success of Tom Cruise’s nostalgia play, a handful of other titles have also exceeded expectations to differing degrees with differing theatrical windowing strategies. The Marvel Cinematic Universe’s follow-up to 2018’s groundbreaking BLACK PANTHER, James Cameron’s sequel to the highest-grossing film in history, and the latest installments in the SHREK and ROCKY franchises all released within nine months after TOP GUN: MAVERICK, which utilized a traditional 88-day theatrical window.

The four aforementioned titles that followed respectively were released with 82-day, 102-day, 16-day and 29-day exclusive theatrical windows, grossing US$453.8m, US$683.0m, US$185.5m and US$155.2m in domestic box office revenue.

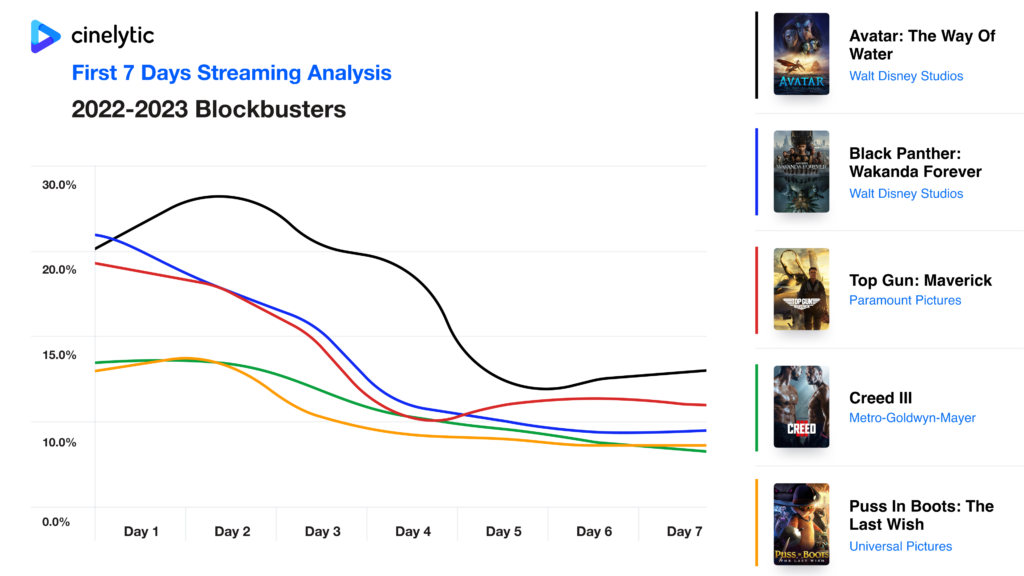

Historically speaking, films that perform well at the box office after longer theatrical windows usually also enjoy impressive numbers in regard to home viewing. To evaluate and compare the streaming performance of these five box office success stories, we used our proprietary OTT demand data. This data captures 125m daily P2P transactions globally for a yearly total of 35b transactions. For this exercise, we utilized this data to compare the first seven days of streaming performance for all five titles:

The graph above allows us to view three distinct groups. James Cameron’s long-awaited sequel to AVATAR was finally made available on digital platforms late last month after cementing itself as the third highest grossing film in history with a global theatrical intake of US$2.3b. It should come as no surprise that this title is in a league of its own in-home viewing as a mass appealing blockbuster in the truest sense of the word, despite being justifiably marketed as a film that was a “must see” in theaters for the duration of its elongated 102-day window. This movie averaged an impressive 17.9% of the viewing market share throughout its first week (peaking at 27.0%), with a notable Day 2 bump and comparable Day 5 slump.

In the next grouping, we see TOP GUN: MAVERICK and BLACK PANTHER: WAKANDA FOREVER, both of which utilized windows closer to 90 days. While both titles suffered a slightly earlier Day 4 drop off in comparison to AVATAR, both performed very similar to each other overall. TOP GUN: MAVERICK managed to recover to a steady and slightly higher level, narrowly besting its comic book companion with a 13.8% average market share capture.

Finally, we have CREED III and PUSS IN BOOTS: THE LAST WISH. Due to less extensive target demographics than the three aforementioned films, one would not expect these two titles to perform as well at either the box office or on digital platforms, especially with theatrical windows less than 30 days. None the less, both franchise installments still managed double digit market share averages during their first seven days, with CREED III following a steadier path to 10.7% and PUSS IN BOOTS: THE LAST WISH achieving 10.1% and a noticeable Day 3 drop.

What does this all mean?

The overall message one can draw from these metrics is related to different methods of windowing and maximizing both box office and home video revenue. Throughout the COVID-19 pandemic, titles shifted from “straight to streaming” to the “day and date” simultaneous release model in order to adjust to sporadic cinema closures. Later, as movie theaters began to re-open at a faster and more consistent pace, but COVID protocols were still in effect, the 45-day exclusive theatrical window seemed to become the best option.

However, as the film industry slowly attempts to return to a state of “normalcy” and we collect more data like the information detailed above, it seems as though massive blockbusters such as AVATAR: THE WAY OF WATER, BLACK PANTHER: WAKANDA FOREVER and TOP GUN: MAVERICK can once again utilize and find success with the more traditional pre-COVID 90-day exclusive theatrical window, only to follow that by dominating the home viewing market share once made available on digital platforms. Titles that have less globally recognized IP and less potential for prolonged box office dominance (CREED III, PUSS IN BOOTS: THE LAST WISH) seem better suited for shorter exclusive theatrical windows well below 45 days so that they can maximize their respective marketing budgets and quickly capture the attention of the home viewing market.

Will this continue?

It will be interesting to see how the next run of high-profile theatrical releases fare at both the box office and on streaming. Some recent releases like ANT-MAN AND THE WASP: QUANTUMANIA and SHAZAM! FURY OF THE GODS underperformed theatrically, while JOHN WICK: CHAPTER 4 is already the best-performing film of that franchise in terms of global ticket sales and is still on its exclusive theatrical run. The latest Marvel entry was just recently released on digital after a 60-day theatrical window, while the sequel to SHAZAM! implemented a much shorter 21-day window. Interestingly enough, the lackluster box office performance of both these comic book films has been followed by successful initial digital runs. Next month alone brings us three additional potential heavy hitters in GUARDIANS OF THE GALAXY VOL.3, FAST X and THE LITTLE MERMAID, and we’ll have to wait and see if they will supplement any theatrical success with impressive digital viewership like the titles we analyzed above.