JULY INSIGHTS FROM CINELYTIC – Mid-Year Box Office Blues and Streaming Silver Linings

While it came as little surprise, domestic box office (DBO) in the first half of 2024 underperformed in comparison to the same period in 2023, signaling a 19% drop in revenue. Several major and costly titles, such as ARGYLLE, THE FALL GUY and FURIOSA: A MAD MAX SAGA fell vastly short of expectations despite their appealing genres or IP, large scales, and marketable talent.

Despite this, some of these same titles have found considerable success and second lives once available for home viewing, which is a trend that we will dive into later in these Insights.

Meanwhile, other films like DUNE: PART TWO and INSIDE OUT 2 have achieved significant success in theaters. As we move into the second half of the year, each upcoming month features multiple high-profile releases that will undoubtedly keep studios on their toes.

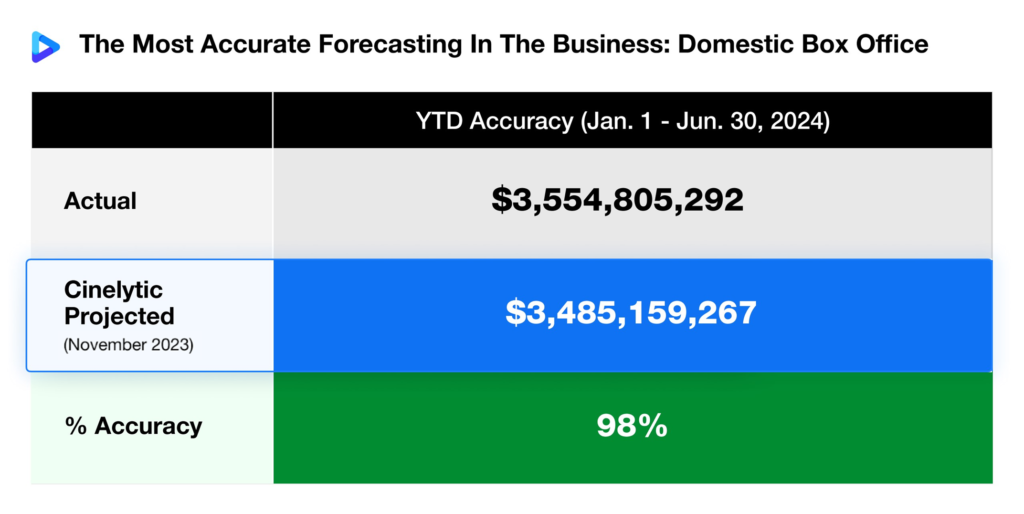

Fortunately, there are tools available to help studios make safer decisions when greenlighting projects. Using our predictive platform, Cinelytic ran projections in November 2023 for the entire 2024 slate, estimating a total domestic gross of US$8.15 billion.

This efficient early forecasting model also allows us to accurately estimate not only domestic and global box office performance, but also home video and TV revenues, offering a truly unique tool for the film industry. As highlighted in the graphic below, our projections for the first six months of this year have been impressively spot on, achieving 98% accuracy:

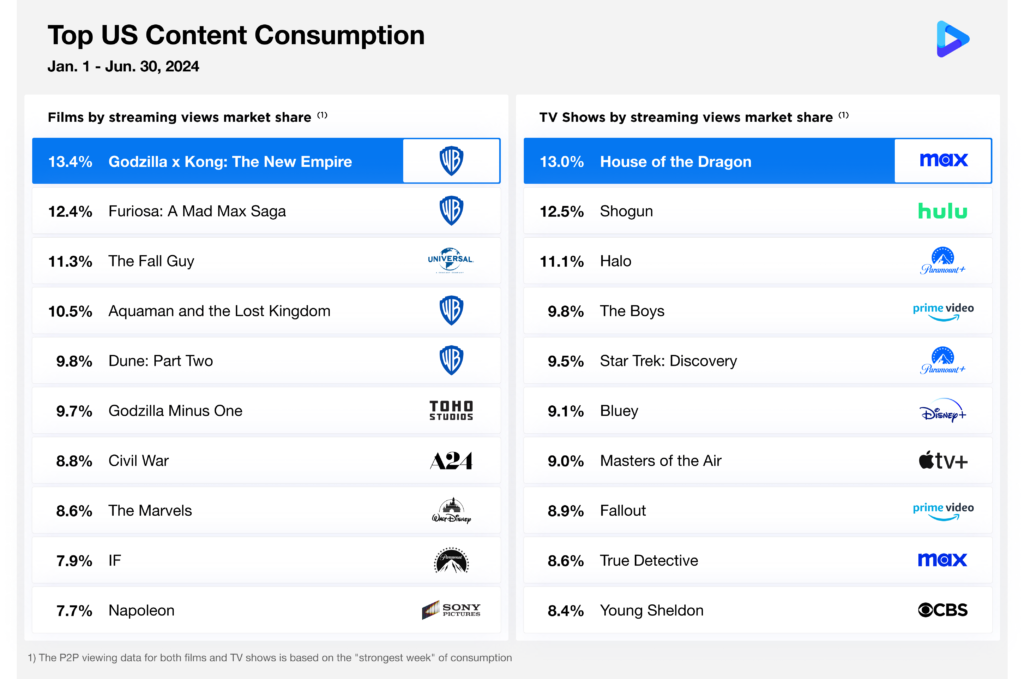

There have been some surprising films that contributed to this US$3.6b, along with differing degrees of follow-up success on streaming. In the graphic below, we chose to evaluate and compare the streaming performance of both films and TV series in 2024 using our proprietary OTT demand data.

This data captures 125m digital content consumption transactions per day across the world to agglomerate to an annual tally of 35bn illustration consumer IP/content preferences on a global basis. For this exercise, we ranked the Top 10 most viewed movie and TV releases between January and June of this year, analyzing the “strongest week” of consumption for each:

The graphic above shows that well-known IPs, franchises, and sequels accounted for six of the Top 10 films, with Warner Bros. Pictures being the most represented distributor.

The remaining four films consist of original concepts spanning various genres, including historical drama, fantasy, thriller, and the aforementioned action-comedy THE FALL GUY, which Universal quickly moved to streaming after a brief and underwhelming 19-day theatrical run.

An interesting note is that THE FALL GUY and FURIOSA: A MAD MAX SAGA are two of the Top 3 performing films and represent major projects with notable stars that while undoubtedly misfired during their theatrical runs, have clearly found a strong audience and additional revenue on digital platforms. On the TV side, Amazon Prime Video, Max, and Paramount+ were the only networks with multiple series in the Top 10.

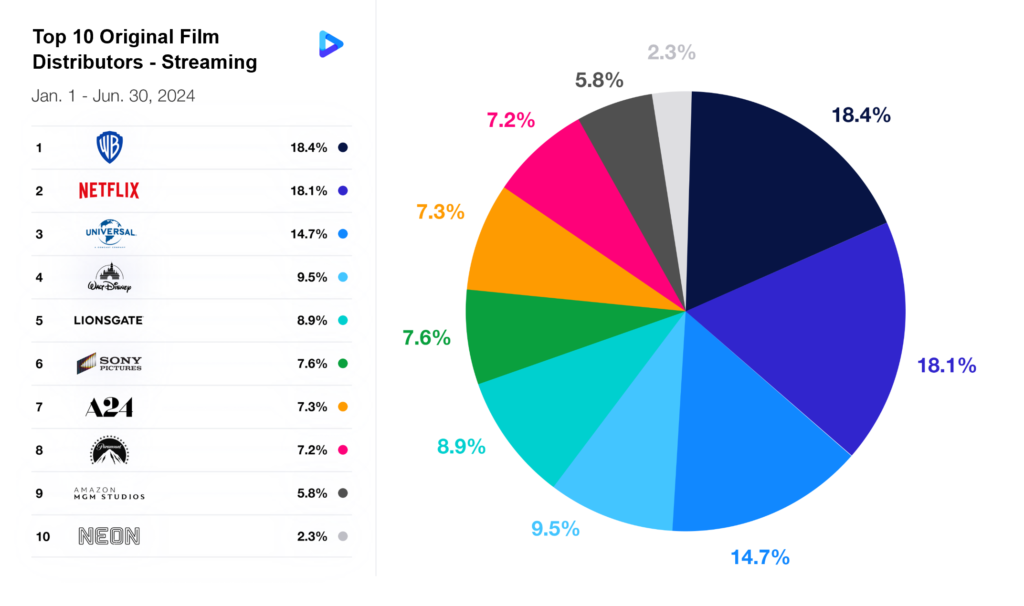

To provide a more comprehensive view of the success of film distributors in 2024 regarding digital viewership, the graphic below highlights the Top 10 companies based on data related to the Top 100 OTT film releases in the United States:

Last year, Universal Pictures led the digital release market, capturing 21.0% of the market share among the top 10 film distributors. In 2024, Warner Bros. Pictures has taken the lead, securing a slightly less but still impressive 18.4%. The major studio narrowly edged out Netflix, which ranked second despite having the most titles (11) among the top 100 most-watched OTT movies. Furthermore, while GODZILLA MINUS ONE was originally distributed by Toho, its U.S. digital debut was on Netflix and thus counted towards the streaming platform’s total viewership in this analysis.

Notably absent from the Top 10 is Apple Studios. Despite partnering with major players like Paramount, Sony, and Unviersal for theatrical distribution on significant late 23’ and early 24’ releases (KILLERS OF THE FLOWER MOON, NAPOLEON, ARGYLLE), Apple itself did not serve as the initial digital home for any of these titles, and otherwise did not produce any straight to streaming projects that made it into the list of the Top 100 performing films.

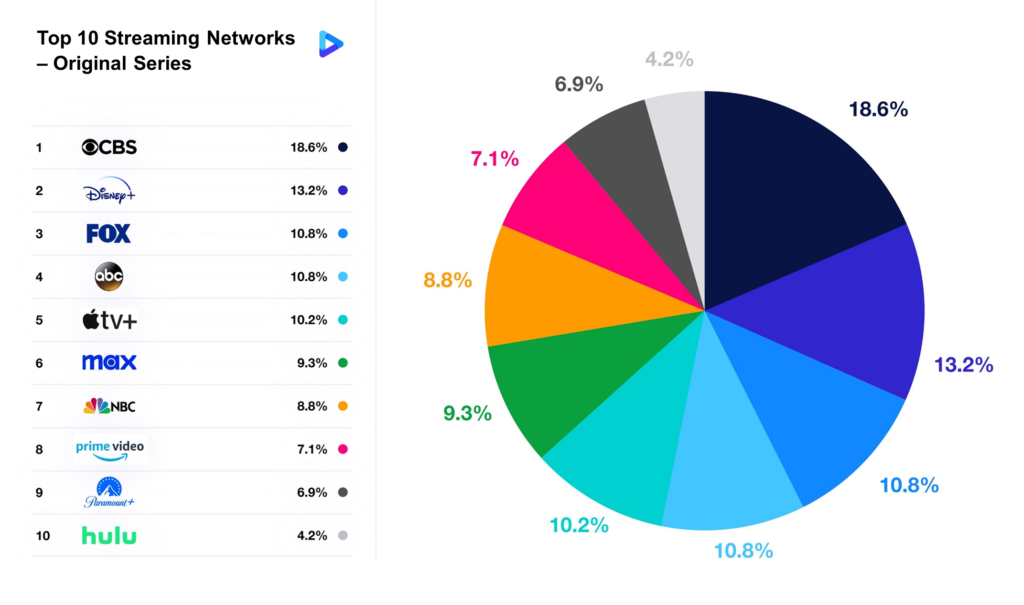

The additional graphic below provides similar insight into the top content produced by TV networks in the first half of 2024, once again focusing on the strongest week of performance:

Focusing on the strongest individual networks, CBS achieved the most digital success largely due to flagship series like YOUNG SHELDON, TRACKER, FBI and S.W.A.T. However, when considering parent companies and all available series within the analyzed time frame, Paramount Global (which controls both CBS and Paramount+) ranked as the second-best group in the world of TV streaming.

The media conglomerate was bested by The Walt Disney Company, which also captured the most TV viewing market share in 2023. Through five of its subsidiary networks (Disney+, ABC, Hulu, FX, and Lifetime), Disney secured 28.1% of the total viewing market share.

The interesting omission from the Top 10 on the TV side is Netflix. The streaming giant’s top-performing series so far in 2024 is 3 BODY PROBLEM, which came in at #15. However, new seasons from several major series such as THE UMBRELLA ACADEMY, OUTER BANKS, VIKINGS: VALHALLA and EMILY IN PARIS are set to release in the coming months and likely boost their overall TV viewership.

2024 – Part 2

While theatrical performance is undeniably important, a narrow focus on box-office returns as the primary metric of a movie’s success overlooks the significant revenue that can be generated through streaming. As streaming continues to grow in popularity, it provides a substantial and sustained source of income that can outpace initial theatrical earnings.

A failure or unwillingness to acknowledge this risks neglecting the long-term profitability and audience engagement that streaming offers. As discussed above, several films that are quickly deemed to be “disasters” have long and healthy lives on digital platforms. Balancing attention between box office success and streaming revenue is crucial for a more comprehensive understanding of a film’s true financial performance.

As the entertainment industry navigates the fluctuations of 2024, the second half of the year promises to be a thrilling ride. With a mix of both anticipated blockbusters and exceedingly expensive projects on the film side, and new seasons of long-awaited shows on the horizon, studios and streaming platforms alike must stay agile and data driven.

Buckle up for an exciting continuation of the year, where every release has the potential to redefine success in the box office and digital realms.