Indie Late Summer Releases – Some Winners and Some Losers

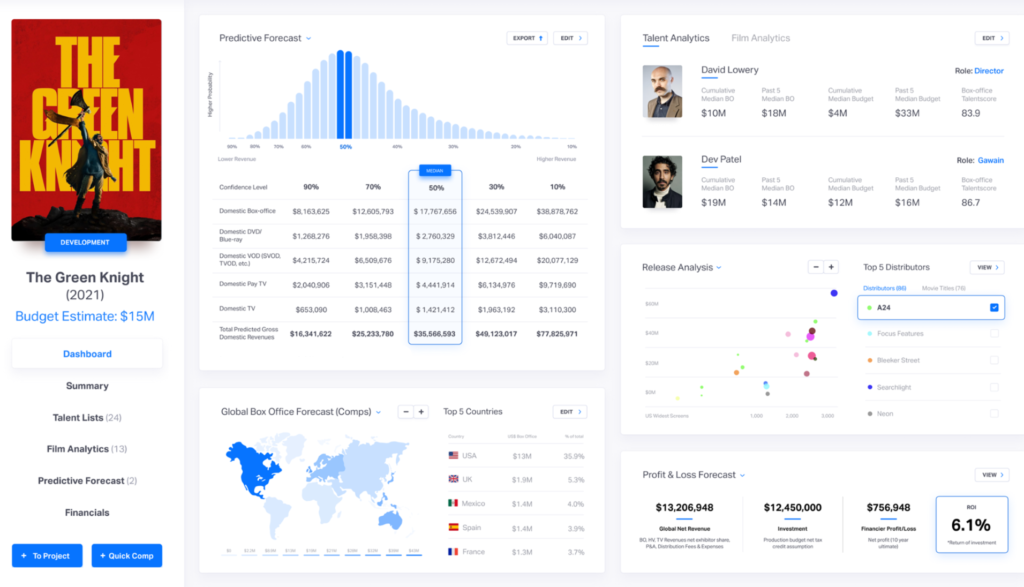

With Summer wrapping up, this month we decided to take a look at Indie fare to see how the Fall season is sizing up for film audiences in theater and at home. We took a deep dive into the releases of STILLWATER, CODA, JOE BELL, and THE GREEN KNIGHT using both our Cinelytic intelligence platform to forecast a traditional release model and our proprietary P2P data to understand consumer demand at home.

Are There Winners?

From this group of films, both THE GREEN KNIGHT and STILLWATER have performed in both theaters and at home under the current circumstances. They both released on July 30th and split the audience earning $14m of DBO for STILLWATER and $17m for the THE GREEN KNIGHT. JOE BELL generated $1m of DBO while CODA released directly on AppleTV+.

Using the platform, we reviewed the four titles focusing on both pre-COVID and pandemic release strategies. For THE GREEN KNIGHT we found that from a domestic box office perspective, the DBO cume of $17m was in line with our COVID forecast (see below) but $10m lower than what the film would have generated in a non-pandemic environment. Pre-pandemic the system projected approximately $27m of DBO. This nearly 40% reduction in DBO is in-line with what we see with other films pre-pandemic vs. today. Focusing on the current environment one sees that the film will break even from an investor point of view so long as the P&A spent is limited and the title performs to the similar level internationally as it generated domestically. International performance will be challenging in the current release environment.

Running the same analysis for STILLWATER as we did for THE GREEN KNIGHT yields similar results albeit with the film showing a loss due to the higher budget and weaker performance relative to its pre-pandemic forecast ($14m vs $30m). The film will need to perform well in Home Video and internationally to break-even.

Box Office Only Tells Part of the Story

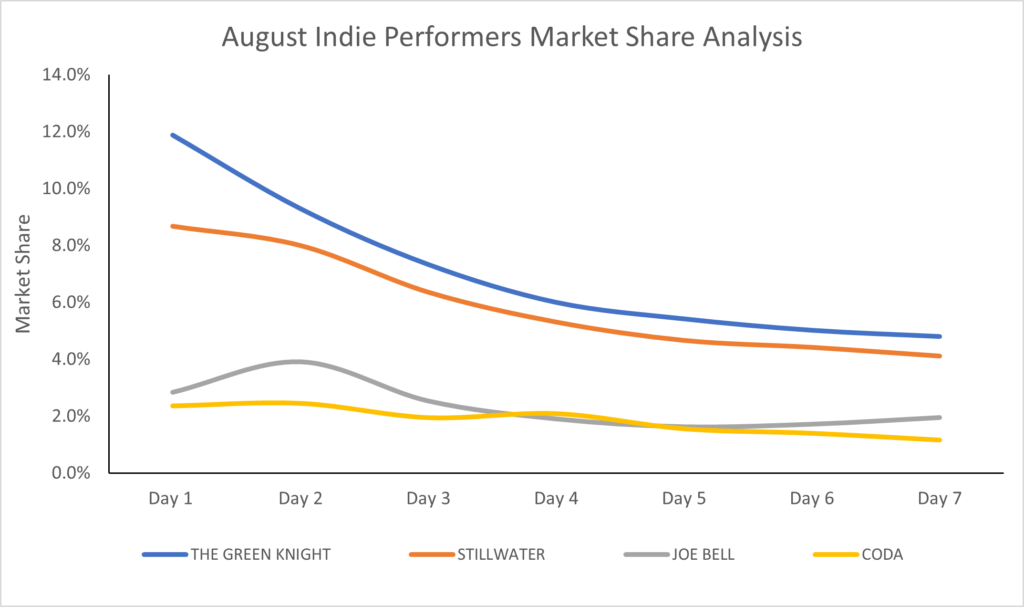

Layering in our digital OTT consumption analysis amplifies the points we made above. We took our proprietary OTT Demand Data which captures 125m daily P2P transactions for a yearly total of 35b transactions. The best metric for the demand data is the representative market share a title holds against all titles in release. By this measure, Cinelytic is able to compare films like for like without the issue of seasonality.

In this case, we took the first 7 days of P2P consumption for each of STILLWATER, THE GREEN KNIGHT, CODA and JOE BELL.

Both THE GREEN KNIGHT and STILLWATER released on OTT on the same day and had similar performance over their first week of release. THE GREEN KNIGHT like in its box office performance had slightly better domestic OTT consumption starting Day 1 with 12% and finishing the week at approximately 5%. STILLWATER debuted at approximately 9% and gradually dropped over the week to finish at 4%. This should translate into strong HV revenues for both titles, especially THE GREEN KNIGHT. The question is whether the premium VOD window captures enough consumptions as the initial price tag can cause digital consumption to be below potential.

JOE BELL and CODA were not able to capture audience share in their first week of the digital release. Both sat just under 3% for their first day with JOE BELL holding during the week and finishing with a slight bump to 2% at the end of the week. CODA failed to capture audience share sitting at 2% for most of its first week before dropping to around 1% on Day 7.

What Does This All Mean in the End?

What we are slowly understanding over the pandemic after several months of analysis is that windows matter. As we move through the pandemic, we find that every three months a new distribution window emerges. What we are starting to see though is that there is a pattern where theatrical releases followed by an OTT window makes sense for the right product. In September, we see that Indie fare if well executed at the right budget will have a life in both theaters and OTT. We see that consumers will find the content and watch it in the media they desire. Other product can have a harder time gaining traction whether released in theaters or at home. Which parallels the old adage that the more things change, the more they stay the same.

Join us next month as we dissect the OTT release of SHANG-CHI AND THE LEGEND OF THE TEN RINGS along with the theatrical releases of NO TIME TO DIE and VENOM and the hybrid release of DUNE.