January Insights From Cinelytic

The top streamed films and TV shows of 2023 – which studios and networks featured the most successful film and TV content?

After a nice boost from WONKA in the final two weeks of 2023, the domestic box office (DBO) for last year currently sits at US$8.91b as of today, a figure that is estimated to grow to slightly above US$9.0b once all final tickets have been tallied. That total will mark the best DBO performance since 2019’s US$11.4b. While crossing the US$11.0b DBO threshold was an industry standard between 2015 and 2019, surpassing US$9.0b should come as a relief to studios and exhibitors after a prior 3-year pandemic era average of US$4.7b.

That being said, people were still enjoying plenty of content from the comfort of their own homes. Total domestic subscription revenues are estimated to reach US$36b in 2023, which is nearly four times the box office and a strong indication of consumer behavior.

While Netflix is dominating the distribution within the streaming industry based on the number of subscribers and minutes watched, our proprietary digital consumption data highlights the demand for original content without platform bias.

We track 125m digital content consumption transactions per day across the world to agglomerate to an annual tally of 35bn illustration consumer IP/content preferences on a global basis.

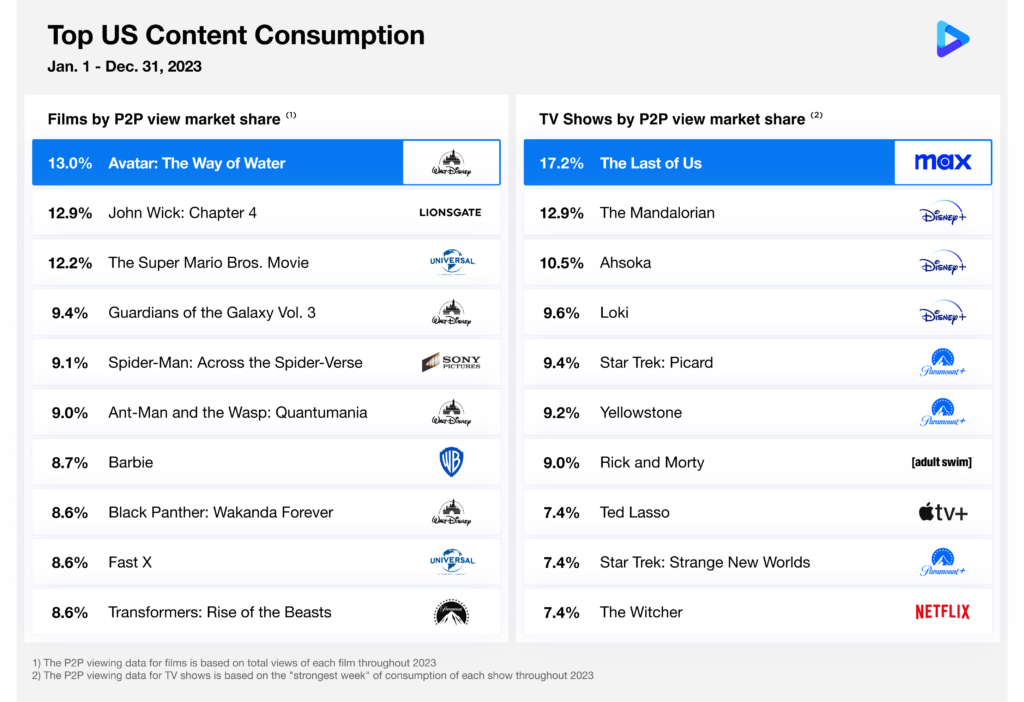

As we begin our journey into 2024, we have decided to once again look into the strongest titles to see how 2023 releases performed. For this exercise, we ranked the Top 10 performing movie and TV releases, analyzing total views for films and the “strongest week” of consumption for TV shows throughout last year:

As the above graphic illustrates, known IP, franchises and sequels made up most of the film titles amongst the Top 10, with Warner Bros. Pictures’ megahit BARBIE, which was also the best-performing film at the box office, being the only exception. Noticeably absent from the Top 10 is Universal Pictures’ historic success and original story OPPENHEIMER, which impressively came in at #12 in total views despite a far later digital release just 40 days prior to the end of the year. On the TV side, Disney Plus and Paramount Plus accounted for six of the 10 shows with the strongest weeks of performance in 2023, while Max’s long-awaited video game adaptation THE LAST OF US was able to nab the top spot.

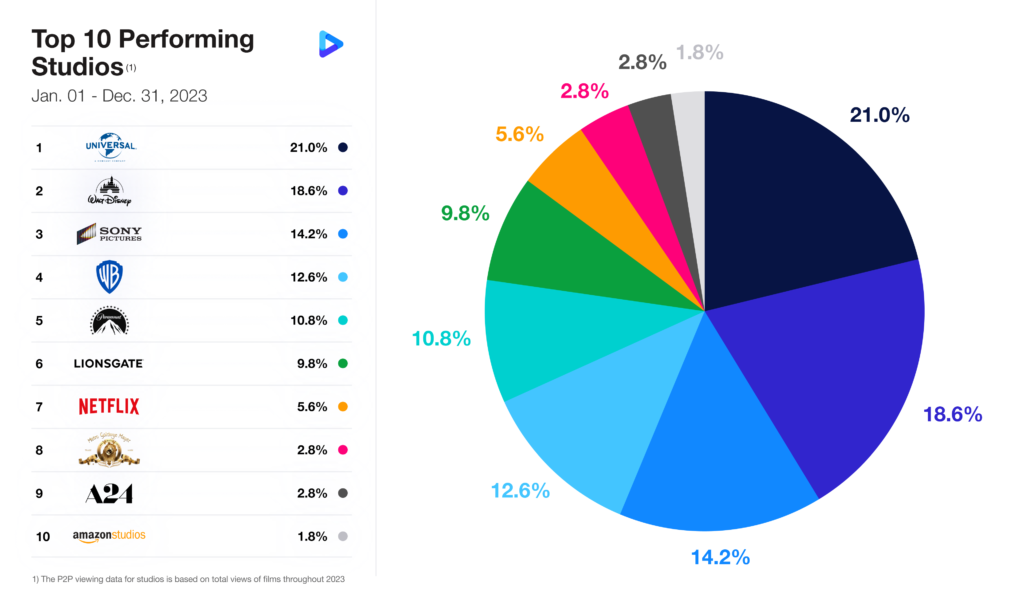

In order to take a more expansive look into the success of film distributors in 2023 in regard to digital performance, the below graphic highlights the Top 10 performing companies based on data related to the Top 100 OTT film releases in the United States:

In a manner very similar to the same data pulled from 2022, Universal Pictures edged out Walt Disney Studios to be the top studio for digital releases via a balanced mix of original ideas (OPPENHEIMER, M3GAN, COCAINE BEAR) and known IP (THE SUPER MARIO BROS. MOVIE, FAST X, PUSS IN BOOTS: THE LAST WISH). All films generated 21% market share for Universal amongst the Top 10 performing studios. Narrowly missing the Top 10 with a market share capture of just 1.4% was Apple Studios.

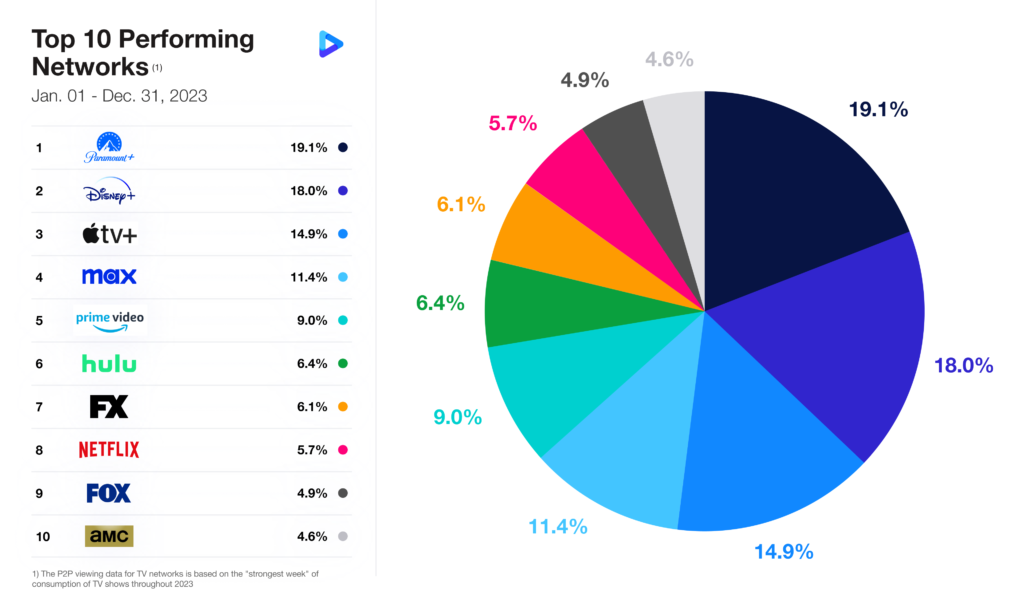

The additional graphic below provides similar insight into the top-performing original content by TV networks in 2023, once again focusing on the strongest week of performance of shows as opposed to total views:

As previously alluded to in our August Insights, Paramount+ enjoyed substantial digital success and made quite the statement last year after a quiet 2022. This was in large part the result of a major push into the STAR TREK universe and increases in both budgets and popularity for existing and new series created by writer Taylor Sheridan (YELLOWSTONE, 1923, MAYOR OF KINGSTOWN, TULSA KING, SPECIAL OPS: LIONESS, LAWMEN: BASS REEVES), who reportedly now commands US$500m in annual content spending for his shows alone. Despite their impressive year, technically speaking Paramount did not capture the most market share, as media giant Disney is represented by three separate networks that made it into the Top 10 (Disney+, Hulu, FX) and collectively totaled roughly 31%.

Moving into 2024…

Based on our analysis, three companies found themselves in the Top 5 when it comes to original digital content performance for both film and TV: Disney, Paramount and Warner Bros. Discovery. Despite NBCUniversal’s success in home viewing of their films, neither NBC nor its streaming partner Peacock were able to crack the Top 10 in TV, collectively coming in at #11 amongst the networks with five original programs making it into the Top 100 shows with the strongest weeks.

Netflix is dominating distribution in the streaming market based on number of subscribers and hours watched on the platform, but its original content does not yet reach the popularity of studio films and traditional TV shows. Using its superior distribution position, Netflix won back licensing deals with studios, further strengthening its lead in digital content distribution.

With what has been widely described as a “less than stellar” 2024 movie slate coming to theaters over the next 12 months, domestic box office performance is potentially going to take a step backward while streaming consumption could further grow to new heights.

It will be interesting to see if and how the Top 10 lists for both movies and TV shift as viewers consume upcoming content. Will Apple continue its partnerships with other major studios for higher-profile films to boost digital viewership and move up the list? Will NBCUniversal find more success in the TV world? These are questions that only time will answer.