June Insights From Cinelytic – 2023 Summer Blockbuster Deep Dive

This time last year, Cinelytic Insights dove into the first true “Summer Blockbuster” season since 2019. We ran projections on the four most high-profile live-action films (DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS, TOP GUN: MAVERICK, JURASSIC WORLD DOMINION and THOR: LOVE AND THUNDER) being released between May and June, and discussed how the studios behind them were poised to capitalize on a return to theatrical viewing.

Those films ended up showcasing performance that vastly exceeded expectations, respectively earning US$955.8m, US$1.5b, US$1.0b, and US$760.9m in global box office (GBO) revenue. In terms of domestic box office (DBO) revenue alone, 2022 raked in US$7.347b, representing a 64.4% increase from the year prior.

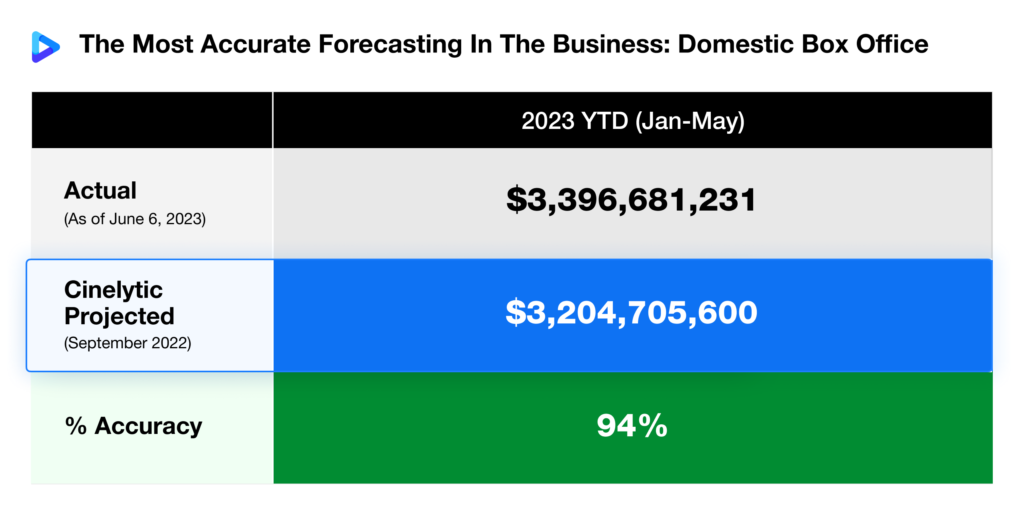

Forecasting Accuracy

As for this year, Cinelytic ran projections back in September of 2022 for the full 2023 slate, estimating a total domestic gross of US$8.65b. This efficient early prediction model also allows us to forecast home video and TV revenues, offering a truly unique tool for the film industry. So far in 2023, as shown in the graphic below, we’ve been impressively spot on with our overall domestic box office projections, currently tracking with just above 94% accuracy:

To give you some perspective on how 2023 will achieve this projected 17.4% increase in DBO from 2022, we need to digest and evaluate the upcoming Summer, which is poised to contribute a material portion to the year-end tally.

We decided to highlight a few key titles from the 2023 CY projection that we ran in September of last year, picking the five most high-profile blockbuster titles from each major studio set to be released between June and August of 2023.

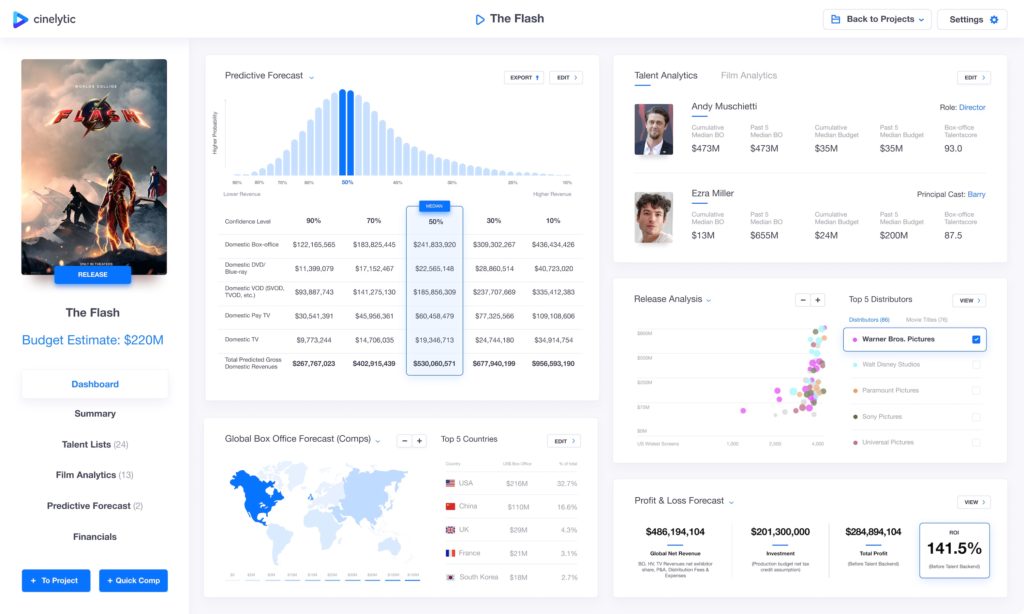

The Flash – All Media Revenue Forecast

We forecasted these titles on our platform, spotlighting Warner Bros. Pictures’ upcoming addition to the DC Extended Universe (DCEU), THE FLASH, to showcase what the summer of 2023 may have in store. Utilizing the reported budget of US$220m, global P&A costs totaling an additional US$200m, and 19 key attributes to run the AI output including budget, genre, rating, talent, IP value, etc., the platform projects DBO of US$241.8m and IBO of US$280.0m in the base case median scenario.

In addition, the Cinelytic platform is capable of predicting Home Video and TV revenue ultimately based on real data:

Based on the anticipated global net revenues (including BO, HE, TV net of distribution fees and expenses), the film is projected to result in a strong return for the studio, with a projected ROI of 141.5% before the talent back-end, which can be substantial. The studio investment of US$201.3m, along with the distribution pattern and story elements all coalesce in a very strong ROI for this film.

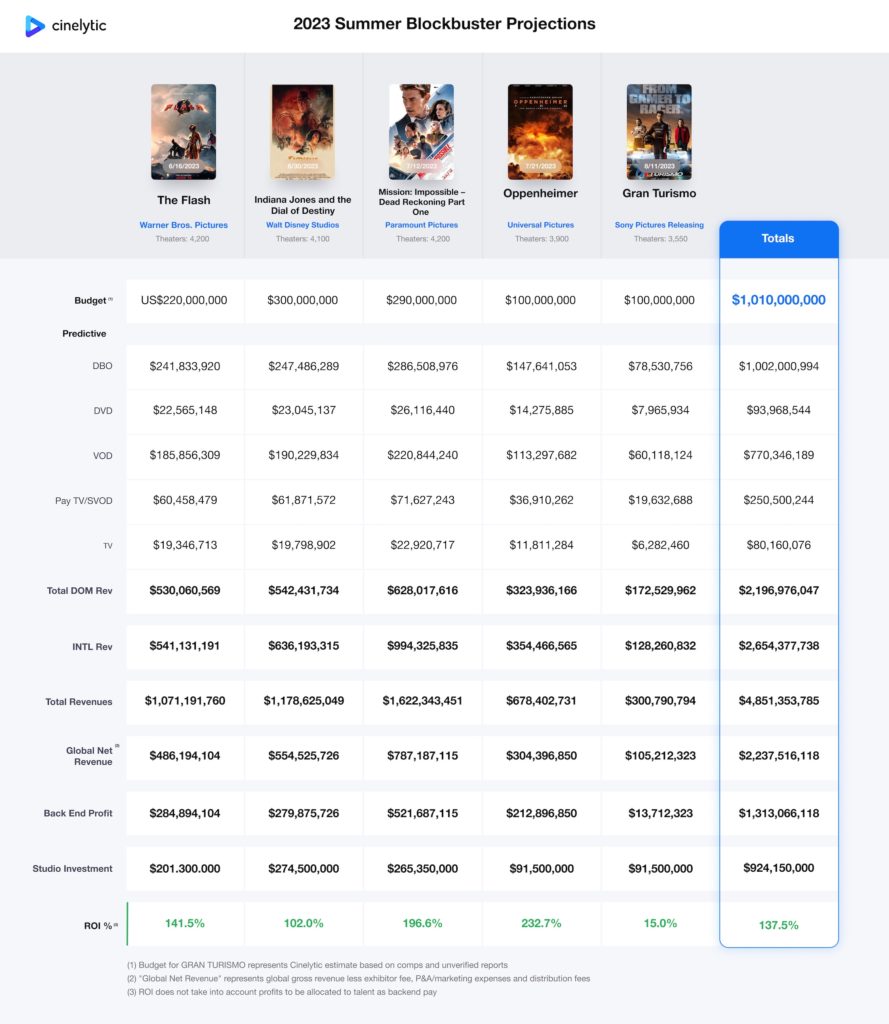

Summer Blockbuster Deep Dive

To understand whether the ROI, investment, and domestic/global net revenues are in sync for a film of this caliber, it is helpful to compare the same data points for other Summer titles releasing in the coming months. For this analysis, we used the Cinelytic platform to also run projections for INDIANA JONES AND THE DIAL OF DESTINY, MISSION IMPOSSIBLE – DEAD RECKONING PART ONE, OPPENHEIMER and GRAN TURISMO. The table below outlines the results output by the Cinelytic platform:

As shown above, three of these additional titles are projected to result in impressive returns, and all five titles showcase an average ROI of 137.5%. While still displaying a positive return for Sony Pictures, the outlier in this group is undoubtedly GRAN TURISMO, which has a projected ROI of 15.0% before the talent back-end. With its likely high budget, it may be tough to attract the large audiences needed for a notable profit without a household name in a lead role and with a director who, while talented, only has one true box office hit to his name that was released in 2009 (DISTRICT 9).

Walt Disney Studios’ fifth installment in the INDIANA JONES franchise has the highest reported budget amongst the five analyzed films at US$300m and is projected the result in the second lowest ROI amongst the set at 102.0%. It’s a title that will need to overcome its lukewarm initial reactions and enjoy a lengthy and fruitful theatrical run to justify its inflated budget and assumed P&A costs.

TOP GUN: MAVERICK, which was undoubtedly the most talked about movie of 2022, released just prior to last year’s summer slate and became the 12th highest-grossing film in history. Tom Cruise’s next project will be the seventh installment in the MISSION: IMPOSSIBLE film series. With all the TOP GUN momentum behind him and the added statistic that his last two MISSION: IMPOSSIBLE entries averaged US$737.2m in global box office revenue, the Cinelytic platform has Paramount Pictures’ biggest release of 2023 earning them an impressive ROI of 196.6%.

The final film we analyzed is Christopher Nolan’s latest historical drama OPPENHEIMER. Nolan’s last release in the midst of the COVID pandemic, TENET, unfortunately, broke an impressive career-long box office streak that has made him the 7th highest-grossing director in history. Considering the film’s $100m reported budget and estimated marketing costs, many in the industry believe it needs to earn at least US$400m to make a profit. While it boasts a three-hour runtime and R-rating, the star-studded cast, IMAX filming appeal and Nolan’s successful history in the genre have the project yielding an ROI of 232.7% on the Cinelytic platform.

All to say…

While the industry still hasn’t and may not again reach pre-COVID levels of box office revenue, the recovery of the 2022 theatrical business, and in particular the success of that Summer’s release slate, was enough to breathe some confidence into the lungs of studio execs. Five of the Top 10 grossing titles at the 2022 worldwide box office were released in the Summer months, and with additional success stories like BLACK PANTHER: WAKANDA FOREVER and AVATAR: THE WAY OF WATER to close out the year, it’s no wonder that the major studios almost immediately began marketing the 2023 summer slate at the turn of the new year. Whether or not the industry underperforms, matches or exceeds the revenue earned from last Summer is a question the industry will have an answer for by the Fall.