May Insights by Cinelytic: Animation Spotlight – Netflix vs. Disney, NBCU, WB – Which Film Comes Out on Top?

With THE MITCHELLS VS. THE MACHINES releasing on April 30th on Netflix much has been made about how well the film is performing for the streamer and whether the price paid makes sense for both parties. No one outside of the respective companies really knows what that means, how it compares to other titles and ultimately how does it impact the bottom line to the distributor, financier, and producer. Cinelytic is here to help provide transparency to the issue by using our proprietary AI powered film analysis platform along with our OTT consumer demand data to give you insight.

Green-Light Pre-Pandemic vs. Today

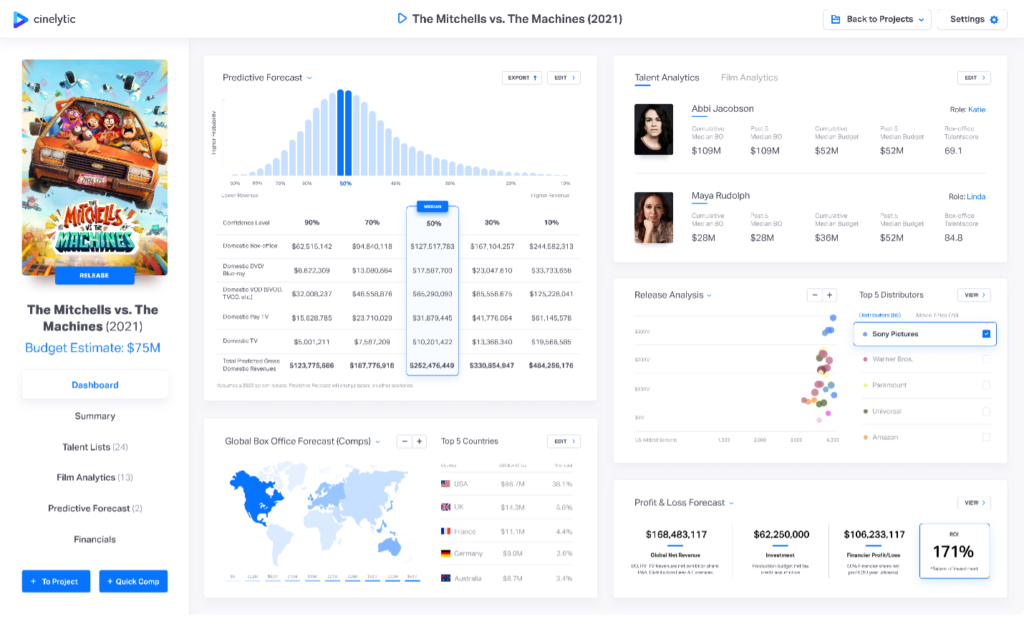

The best way to understand the relative value is to make sense of the underlying economics of the title in a pre vs. pandemic environment comparing both to ultimate deal value. The film was purchased by Netflix for “more than $100m.” Looking at THE MITCHELLS VS. THE MACHINES with an assumed budget of US$75m, we ran the title through our predictive module considering the 19 key attributes to run the AI output including budget, genre, rating, talent, IP value, etc. and projected a pre-pandemic domestic box office tally in the median scenario of US$127.5m. Coupled with all other media revenues, the platform projected domestic gross revenues of US$252.5m.

Considering the costs associated with distributing the title on worldwide basis yielded Gross Net Revenue of US$168.5m before considering the budget of $75m. With a Production Tax Credit of 20%, the film in the end would net US106.2m to the Studio (before any equity or profit participation). When compared against a price tag of “more than $100m” the math seems spot on regarding the price tag paid. But was there value left on the table for Sony?

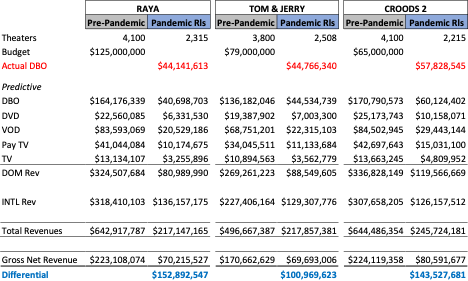

To make sense of deal value one has to look at similar animated titles released theatrically during the pandemic and compare the actual results against pre-pandemic green lights. Using the Cinelytic platform we compared the green light to actuals forecasts for each of RAYA AND THE LAST DRAGON, TOM & JERRY and THE CROODS: A NEW AGE.

Using the same methodology as for THE MITCHELLS VS. THE MACHINES, the platform predicted a pre-pandemic vs. pandemic release Gross Net Revenue Differential of between US$100m-US$150m for the three films. This is prior to taking into consideration the budget. The table below outlines the results output by the Cinelytic platform.

From this animation all-media revenue comparison, we now understand that the difference between a pre-pandemic theatrical release and a pandemic release with limited access to theaters and moviegoers is US$100m to the bottom line. Had THE MITCHELLS VS. THE MACHINES released theatrically during the pandemic, it would have performed to the same level as its peers, generating approximately US$70m of Gross Net Revenue, US$100m less than a pre-pandemic model and unable to pay back its US$75m production cost and generate upside profit. Thus, from a comparison perspective alone, Sony made a great decision in selling the film to a strong streaming company.

OTT Consumer Demand:

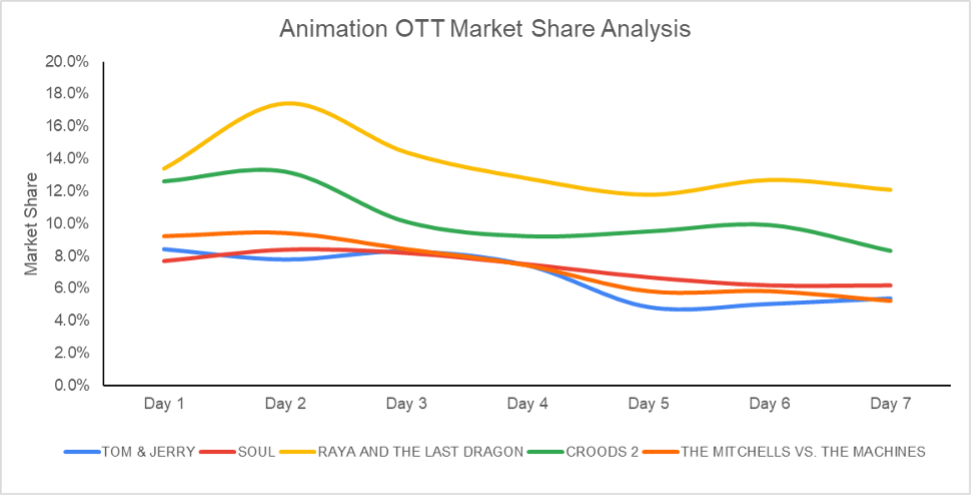

Next, we need to look at this animation comparison group in terms of OTT consumer demand to see whether the various release strategies (theatrical vs. straight to OTT) made a difference.

In terms of the analysis, we took our proprietary OTT Demand Data which captures 125m daily P2P transactions for a yearly total of 35b transactions. The best metric for the demand data is the representative market share a title holds against all titles in release. By this measure, Cinelytic is able to compare films like for like without the issue of seasonality.

Outlined below is the Market Share by day detail for the 1st seven days of release for each of the five comparison titles.

What clearly stands out is that RAYA AND THE LAST DRAGON truly captured its place in the market upon OTT release. It had strong competition from COMING 2 AMERICA throughout its run. CROODS: A NEW AGE also performed well but was relatively without competition when it released in November. SOUL released at the same time as WONDER WOMAN 1984, the strongest OTT of 2020 along with its impressive box office run. TOM & JERRY had the market to itself and failed to really pop and capture market share in its 1st seven days of release.

THE MITCHELLS VS. THE MACHINES and WITHOUT REMORSE released on OTT on the same day while MORTAL KOMBAT premiered D/D a week earlier. Both titles early in their releases captured market share and limited THE MITCHELLS reach.

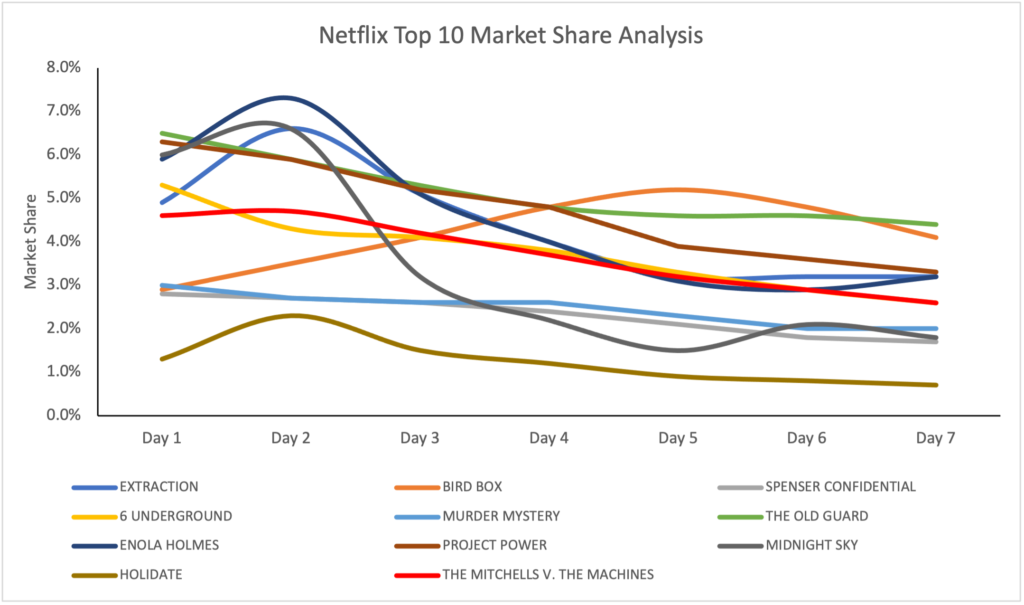

When one then looks to see how THE MITCHELLS plays out in terms of market share against the top original film titles to release on Netflix, one can see that THE MITCHELLS is holding its own amongst this celebrated group. It sits right in the middle of where the top ten played out over the course of their 1st seven days and actually feels to be capturing as much market share by day as 6 UNDERGROUND (US$150m budget) captured during its 1st seven days, ultimately tying for 4th place with 83m views to date. All to say that the film is achieving great attention on the platform and should be considered a win for Netflix.

In The End It’s All About The Subs:

Now having looked at what the impact is to a film’s P&L and what one needs to do for an effective OTT release, what then does this all mean to subscribers.

For Disney+ who now sits at 100m subscribers (March 2021) vs. 33.5m just a year ago, the releases of HAMILTON, MULAN, SOUL and RAYA seem to have greatly impacted subscriber growth. In terms of absolute numbers, December 2020 (SOUL) seems to have gained 8.1m subscribers for the month while September 2020 (MULAN) seems to have increased by 6.6m. April 2020 was a strong month for Disney+ growth but much is attributed to 8m new subscribers from India.

HBO Max and HBO domestic subscribers ended March 2021 with 44.2m vs. 41.5m at the end of 2020. This represents an almost 3m subscriber bump due to the 30-day windows for WONDER WOMAN 1984, THE LITTLE THINGS, JUDAS AND THE BLACK MESSIAH, TOM & JERRY, MORTAL KOMBAT and GODZILLA V. KONG (check out our April Insights for that analysis). This only takes domestic subscribers into account and does not include the international subscriber bumps.

Netflix today sits at around 208 subscribers worldwide. The impact of any one Film or TV show is difficult to quantify. What we do know is that 7 of the top 10 English language Films on the platform hail from 2020 (two from 2019 and a title from 2018). Understanding that a big push for the year, 40m additions, came during COVID, the reality is that something has to keep consumers on the service. Subscriber growth may have slowed for Q1 2021, but the streamer has a significant strategy for animated family fare going forward. THE MITCHELLS playing as well as 6 UNDERGROUND in terms of market share, only helps the company succeed in that venture.

Conclusion:

Overall, Disney+’s RAYA comes out on top, CROODS 2 comes in second followed by a close race for third between SOUL, MITCHELLS and TOM & JERRY in terms of digital audience attention. We can also establish that MITCHELLLS was among the strongest releases for NETFLIX over the last two years. The sale of THE MITCHELLS VS. THE MACHINES can be seen as a win-win for both Sony who developed the title and then had a distribution decision to make and Netflix with 208m avid viewers always ready for good new content. The Studio was able to avoid a US$100m loss to the film if it opened theatrically during the pandemic and Netflix was able to get a quality project that fits with its upcoming push into animation.