February Insights by Cinelytic: Decoding Apple’s $25M “Coda” Sundance Acquisition

Cinelytic provides critical insights into the economics of a traditional theatrical vs. direct to OTT release by using our OTT demand data and our AI-driven content intelligence platform. We used our platform to shed some light on CODA’s value to different sides of the market and what that says about the current state of the independent film industry.

The Classic Film Distribution Analysis:

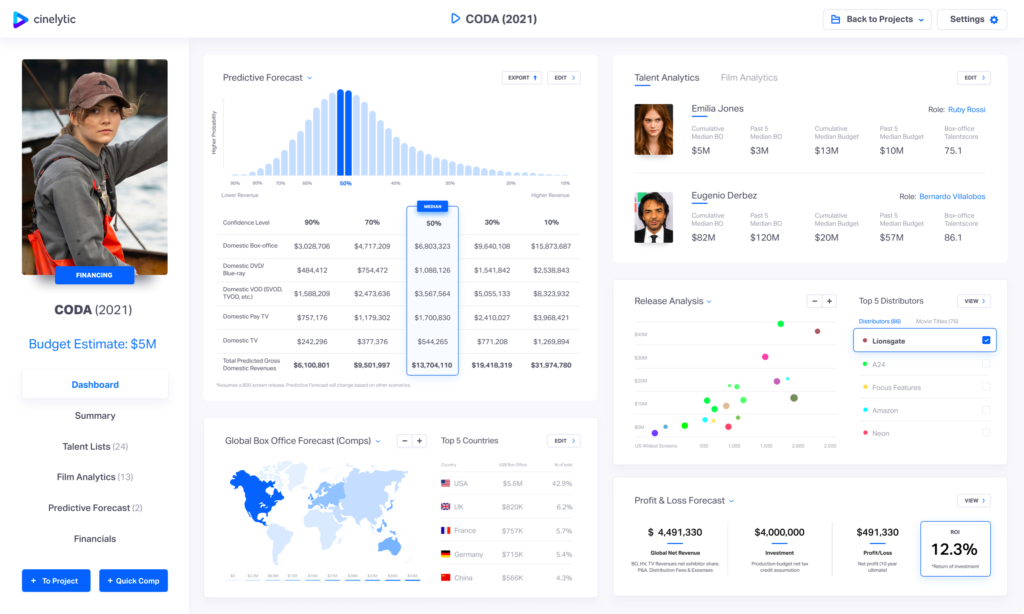

We ran Sundance hit CODA on our data-driven platform as a classic theatrical release in a post-Covid environment. By taking into account key project variables and a $4m investment the system predicted a ROI of 12.8% in the median revenue forecast – the outcome with the highest probability. See our forecast summary below:

If audiences catch on, these figures can increase as shown in our probability weighted forecast scenarios. Overall, Cinelytic’s median forecast is 85%+ accurate. The forecast analysis clearly illustrates that the value of CODA to a traditional distributor without streaming platform support is between US$3-5m globally.

Therefore, it was a surprise to many that AppleTV+ paid US$25m, the highest fee ever for a Sundance title. Looking at this disconnect we took a deeper dive to see if one can make a case for the price paid.

Worldwide Revenues

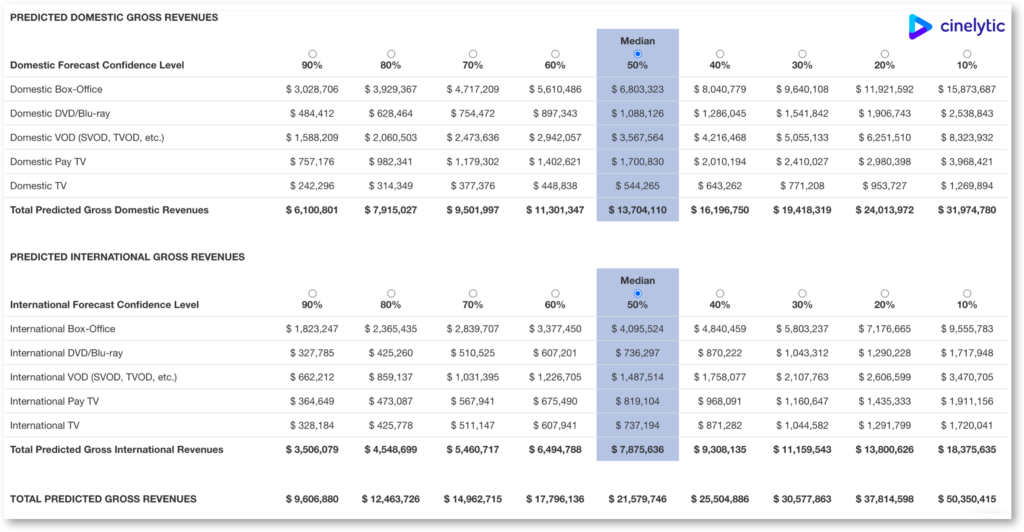

First we ran Cinelytic’s predictive revenue module to assess global gross revenues which exclude exhibition and distribution expenses in. Based on the 19 input assumptions, the platform predicts that CODA could generate worldwide revenues of US$21.6m in the median base case (the most likely outcome).

The worldwide revenue forecast indicates that the US$25m purchase price is close to the base case and right on target at the 40% confidence level. As AppleTV+ self distributes globally, the worldwide revenue forecast at the 40% confidence interval is a true indication of total value to a streaming platform.

Creative Fit:

From a creative standpoint, the film clearly fits into Tim Cook’s creative vision for AppleTV+, uplifting messaging with a distinct programming sensibility to compete with the likes of Disney+. The film’s charm, creative fit and online/critical response set off a bidding war among several potential acquirers before AppleTV+, with its deep pockets, emerged victorious over the weekend.

Streaming Model

Traditional revenue forecasts and creative fit only partly explain CODA attracted a US$25m price tag. To fully appreciate the business case for CODA, one needs to analyze the streaming model for comparable films. By doing so one can understand the true value of such a title to a streaming platform. PALM SPRINGS sold to HULU last year at Sundance for US$22.5m (including bonus). We ran the title in January of 2020 and found that on a 1,000 theater release, the film would generate US$28m of overall revenue.

Comparing the two titles, the CODA price tag feels aggressive. But this does paint the full picture.

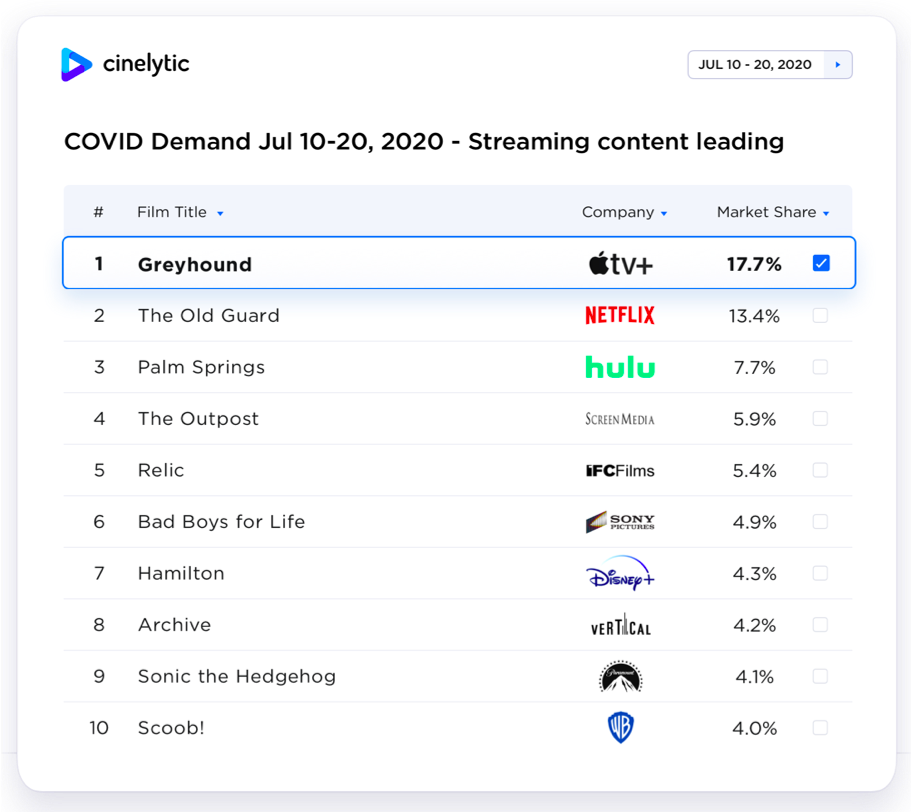

When looking at our OTT demand data, one notices that Hulu struck gold with PALM SPRINGS as it became Hulu’s most watched original movie of 2020. Releasing in July, it launched a strong #3 behind GREYHOUND (AppleTV+) and THE OLD GUARD (Netflix) and continued to play well through the summer. Both titles had budgets that towered in comparison.

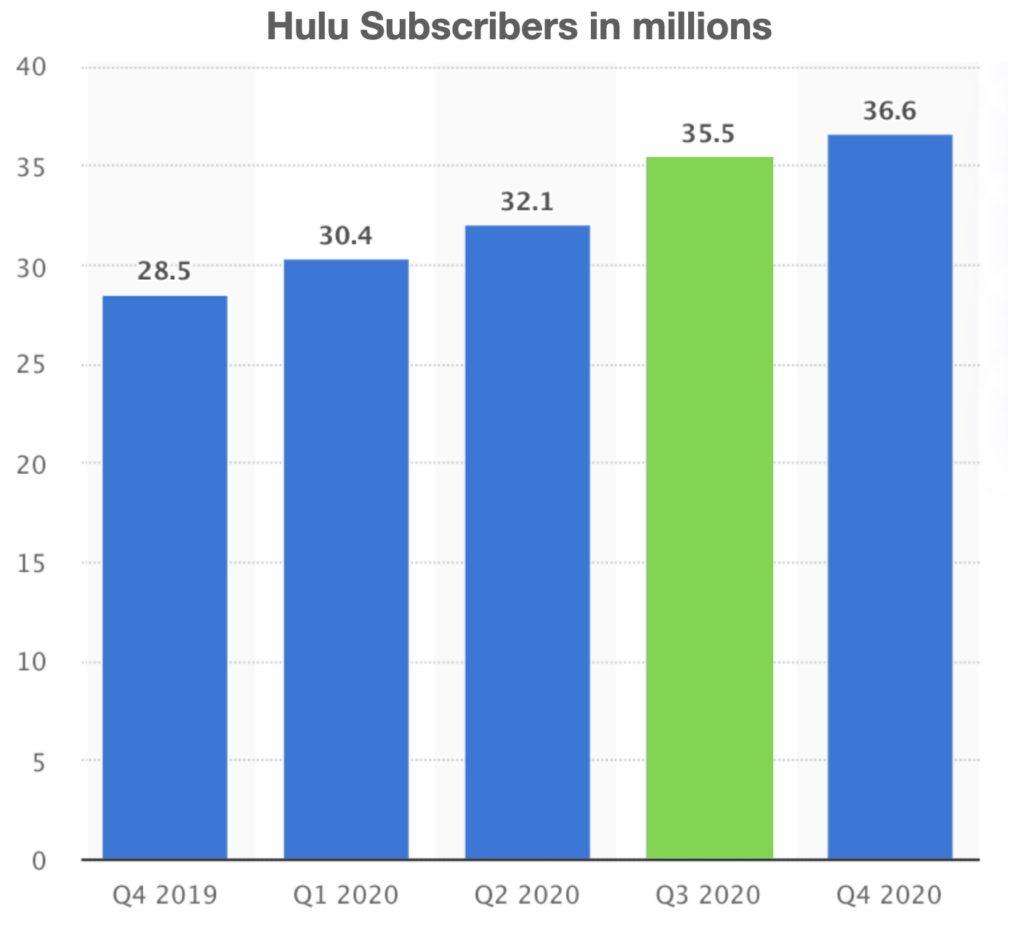

In Q3 2020, the quarter during which PALMS SPRINGS was released, Hulu Subscriber numbers increased by 3.4 million or 11% to 35.5 million – its strongest quarterly subscriber growth of the year. If one assumes a US$10 value per new subscriber the monetary benefit is US$34m. It seems as though AppleTV+ is taking a page out of the Hulu playbook and possibly also motivated by the strong results generated by their GREYHOUND acquisition (Sony title that we analyzed last year: GREYHOUND ANALYSIS). All to say, our data shows single picture acquisitions can drive a great deal of value for streaming platforms with the acquisition costs ascribed to customer acquisition / marketing expenses.

Conclusion:

Putting the various pieces together provides a more complete picture and understanding as to why streaming platforms are motivated to spend large sums on specific content in order to drive brand value and subscribers. In addition, this analysis highlights how widely this model differs to a traditional theatrical release that often limits film distributors in offers today. Other Sundance titles that did not attract streaming platform interest sold for much less than CODA and more in line with the analysis outlined at the beginning of this article.

As top dollar streaming platform sales are few and far between, it is crucial to base a film’s financing structure on a realistic business models and release strategy. The traditional release potential should still be the base case as outlined above but one needs to include OTT demand data to better understand if and when a streaming platform could be motivated to pay a high premium for a film that fits their profile and content strategy.

With our OTT demand data and AI-driven intelligence platform, Cinelytic is here to support this type of critical thinking and out of the box decision making.

Get in touch today to learn how Cinelytic can future proof your decisions.