2026 Sundance Insights Special

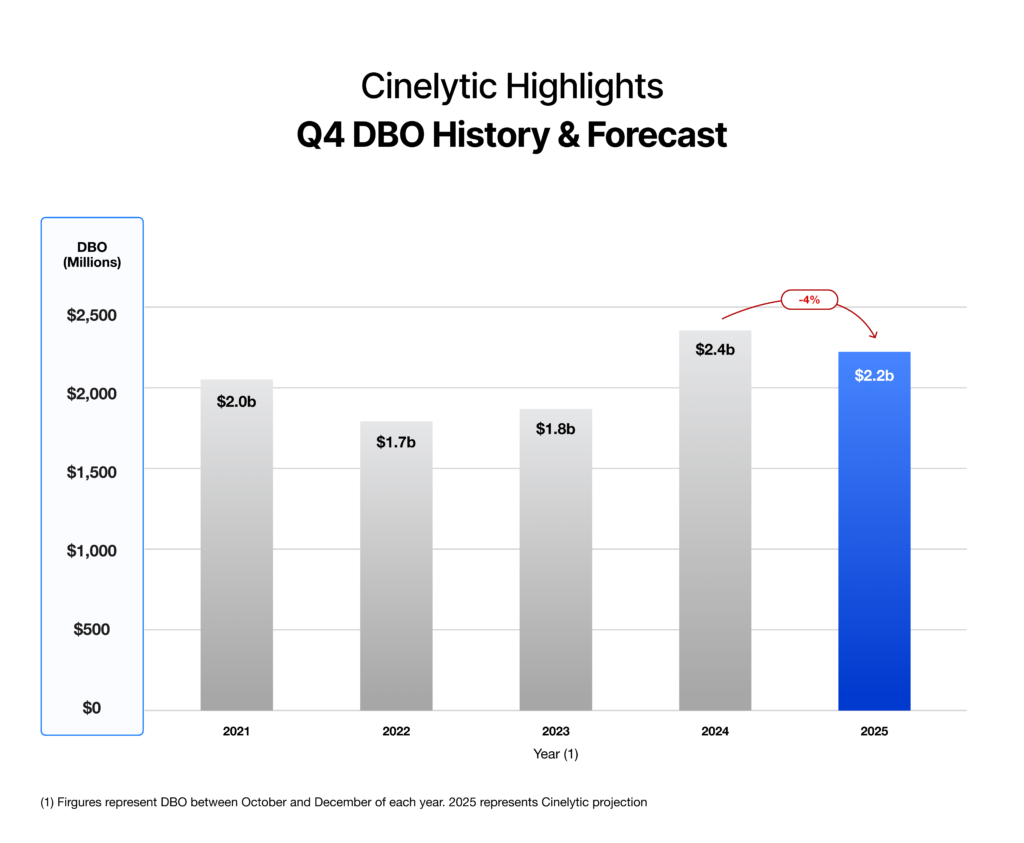

With the 42nd annual Sundance Film Festival just around the corner, we at The Cinelytic Group are again putting our forecasting tools to work, this time spotlighting several upcoming releases attracting attention on the festival circuit as “hot sales titles” seeking distribution at this year’s ceremonies: THE INVITE, THE GALLERIST, THE WEIGHT and THE SHITHEADS.

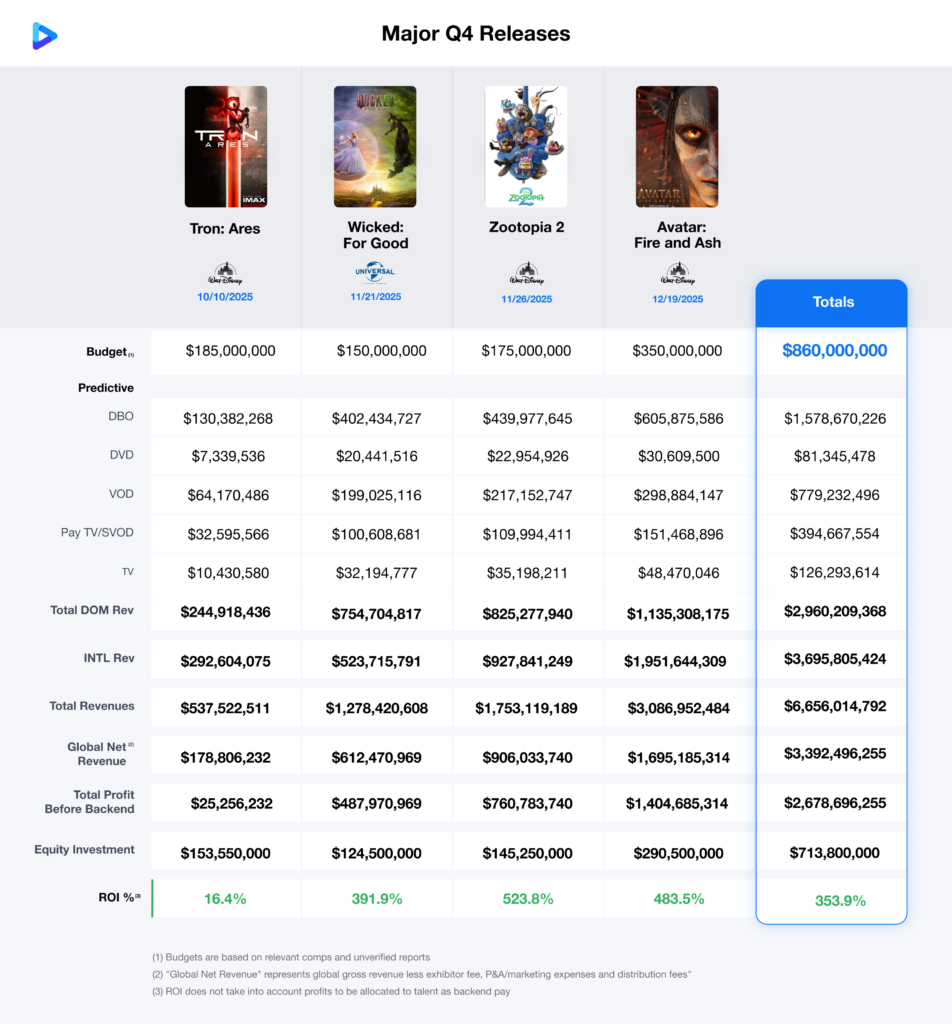

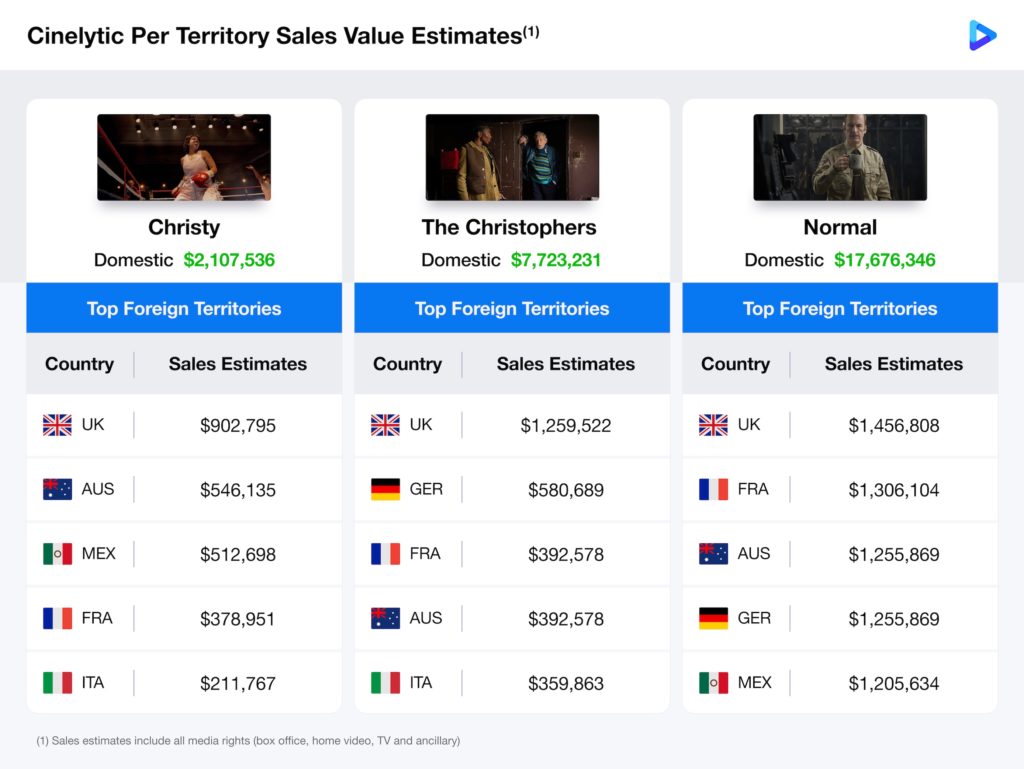

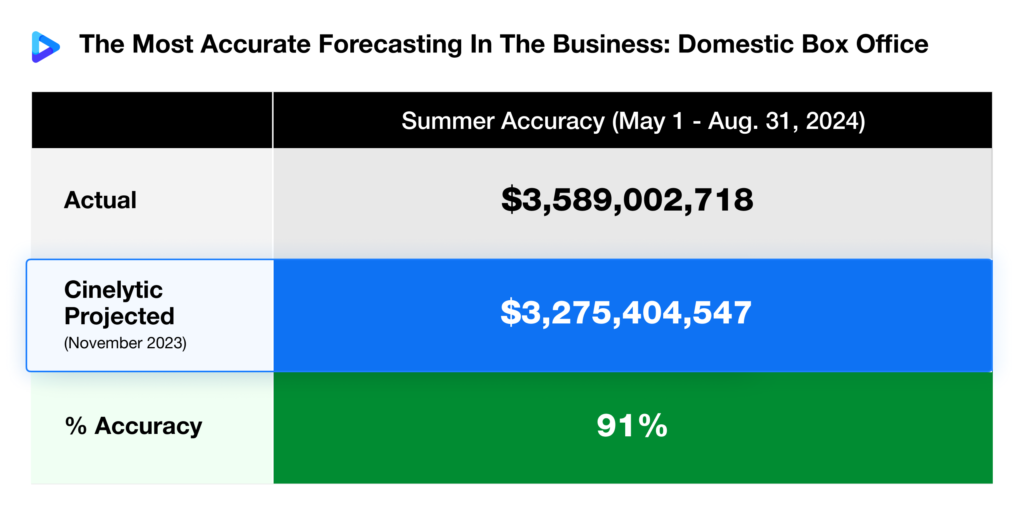

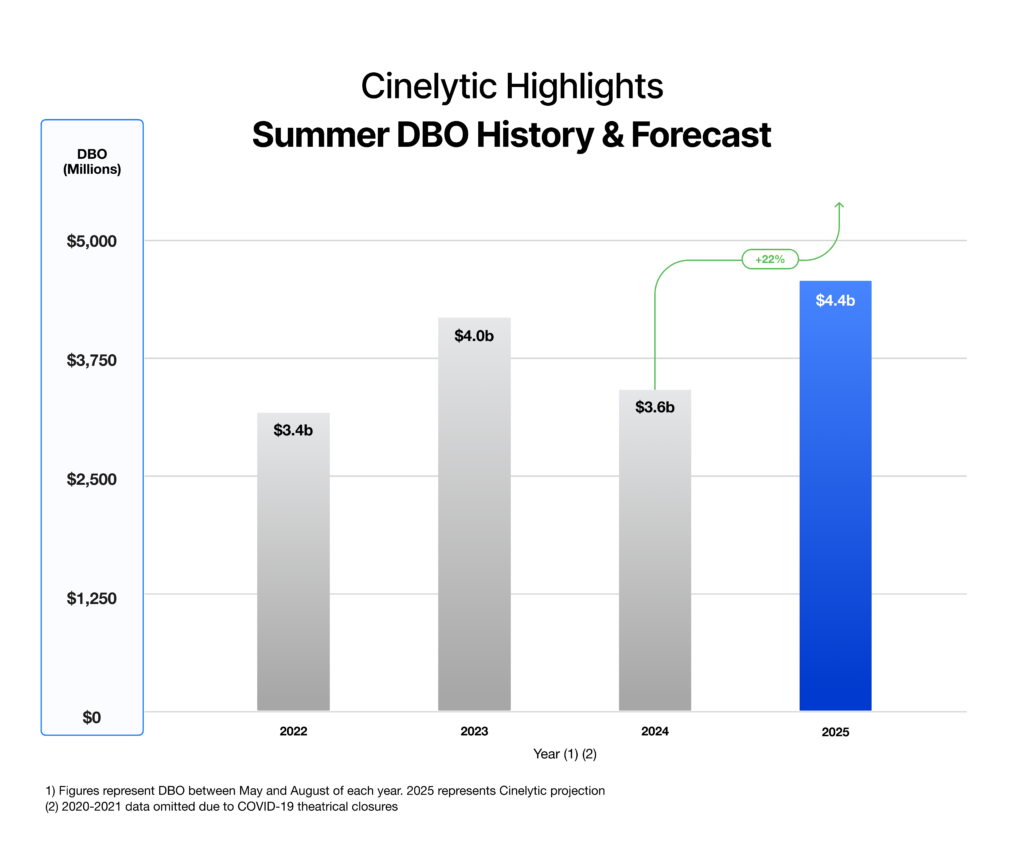

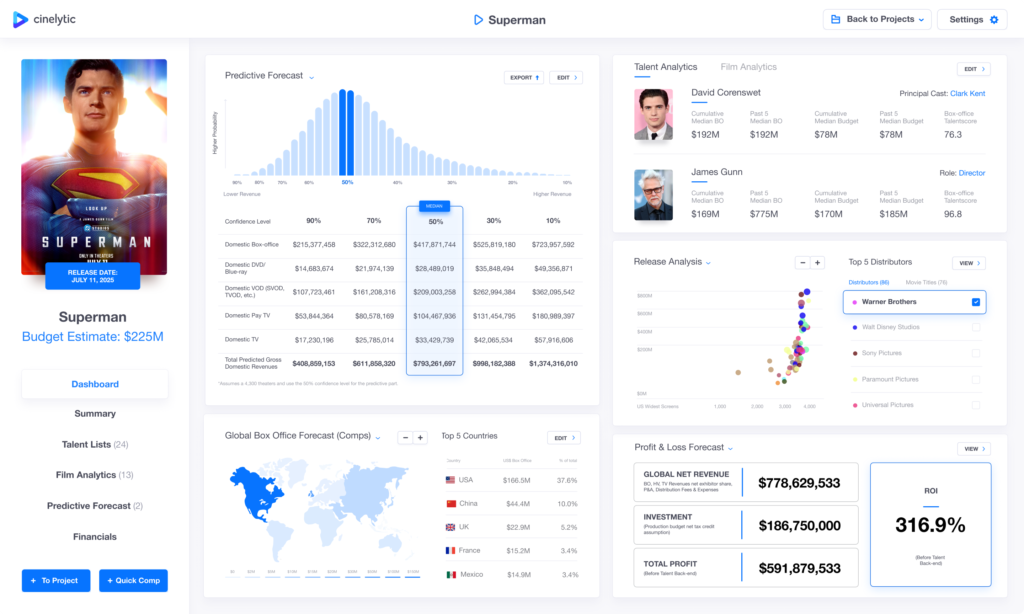

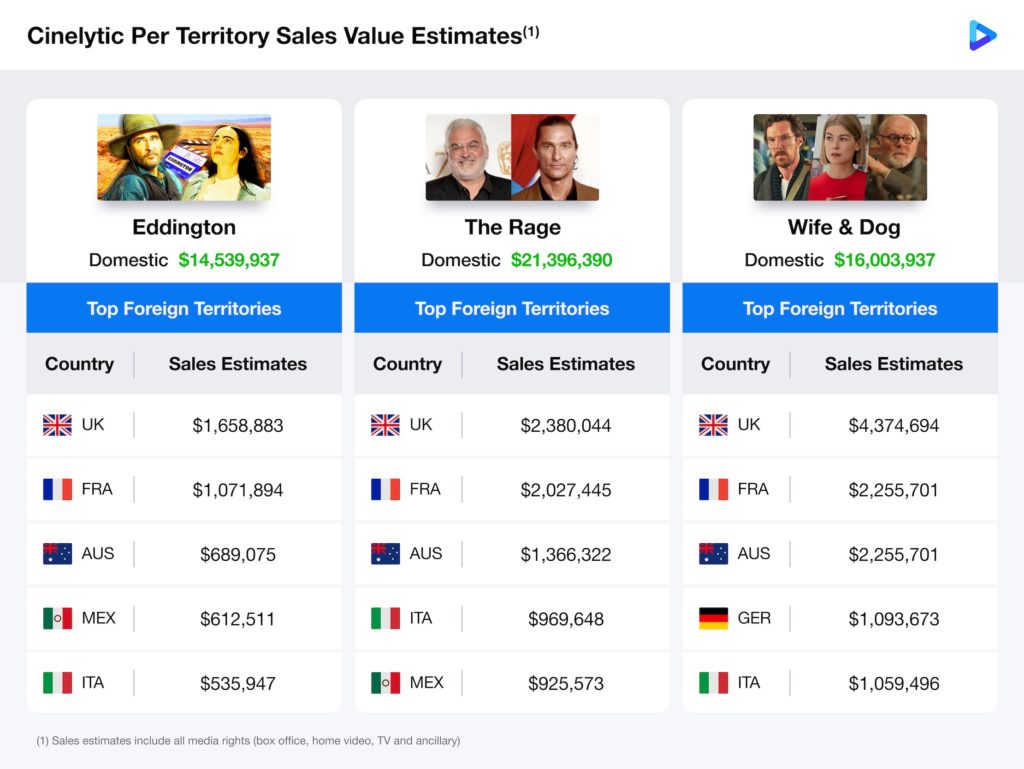

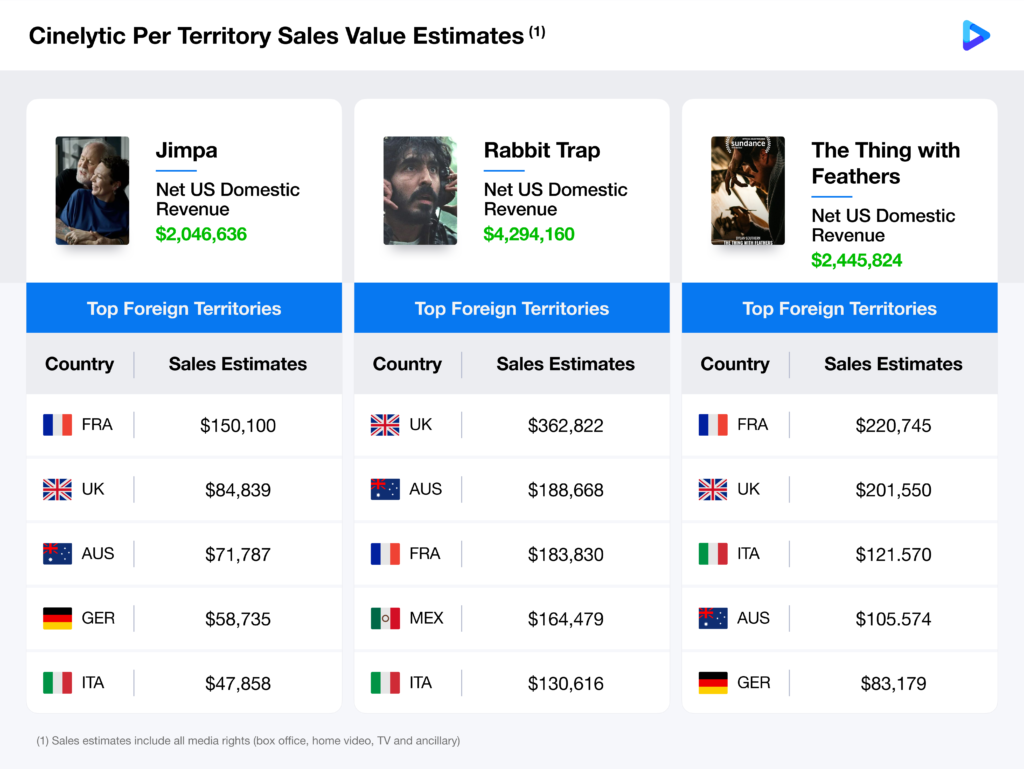

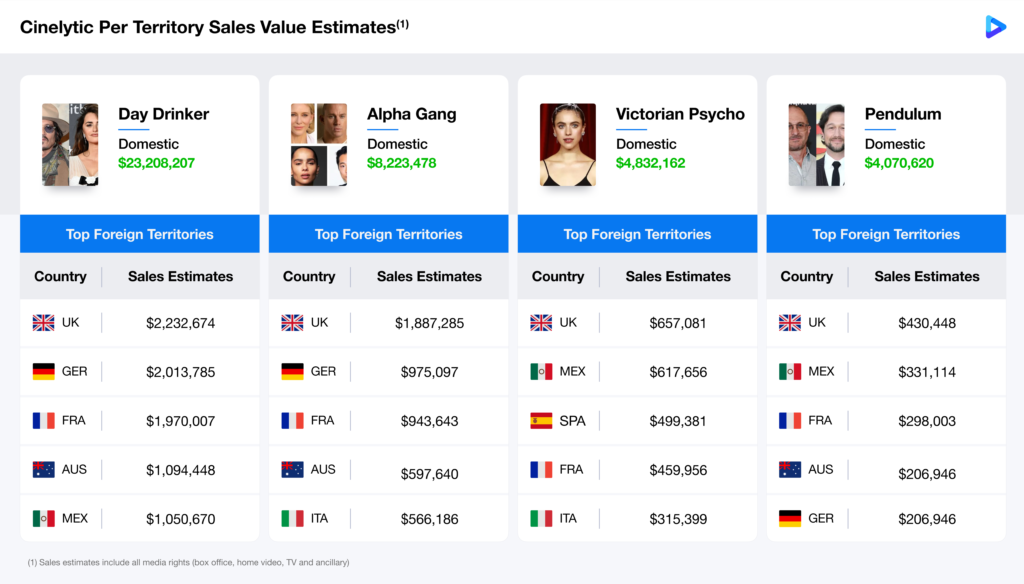

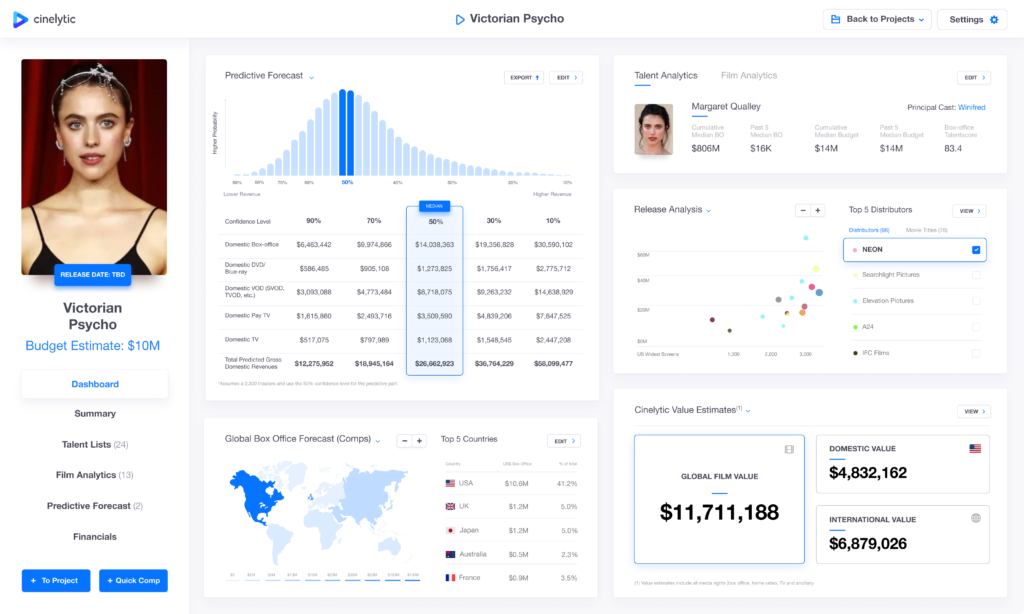

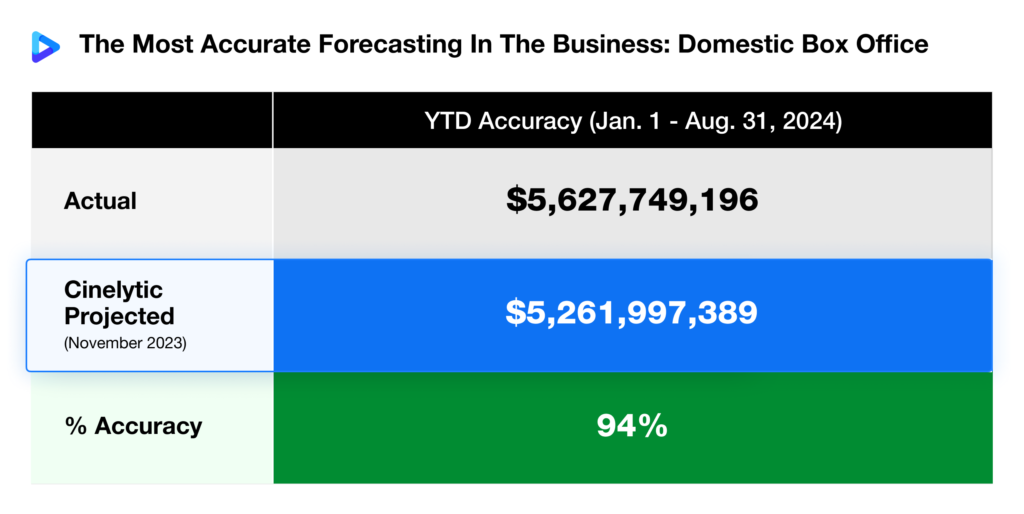

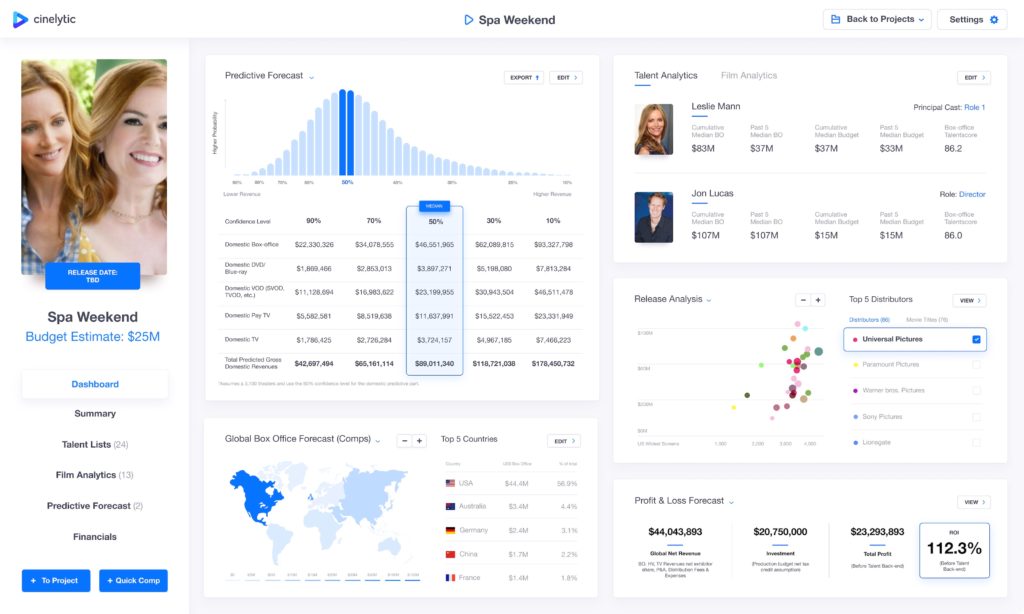

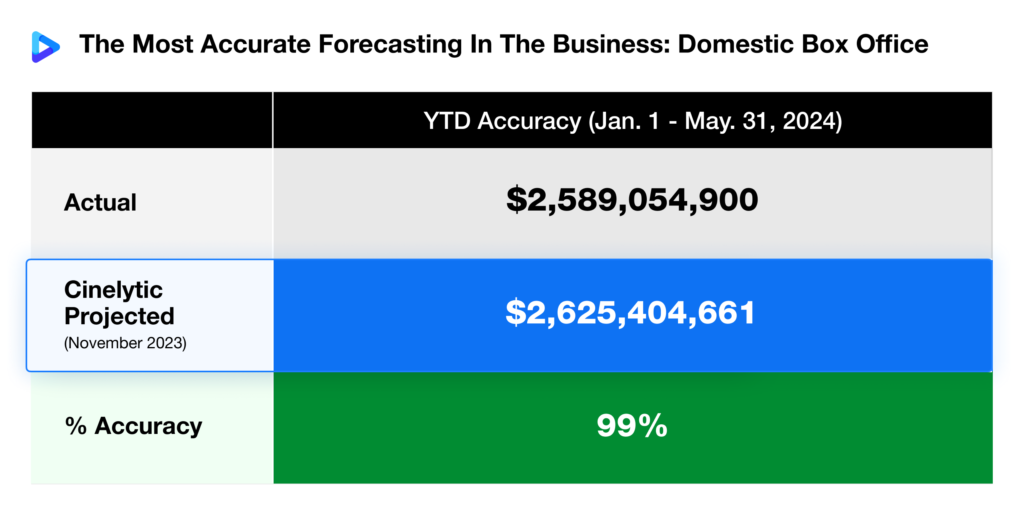

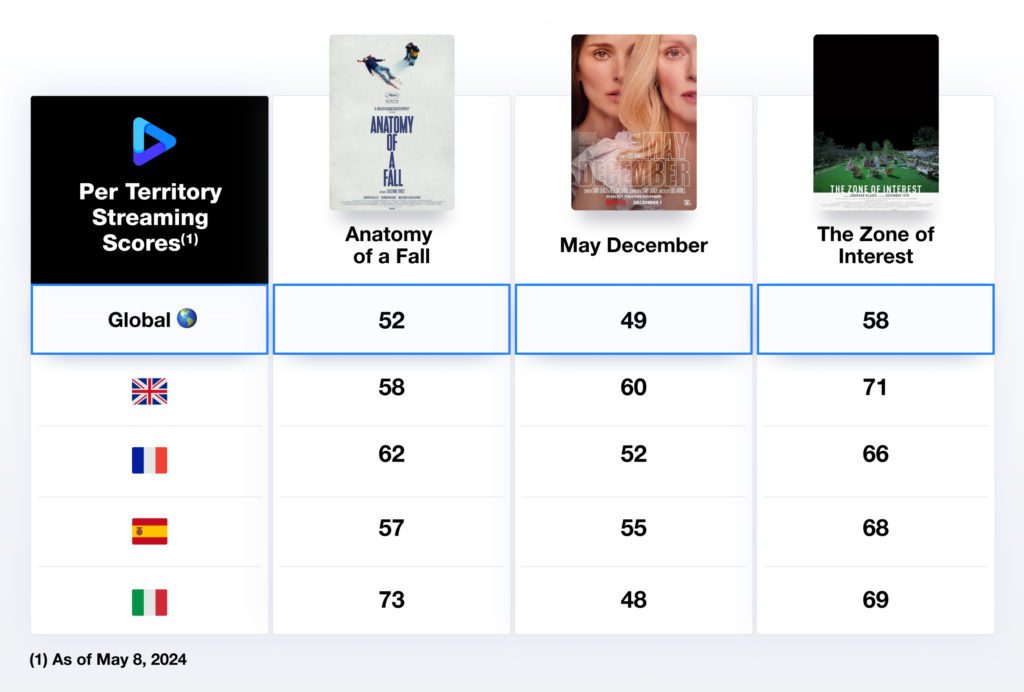

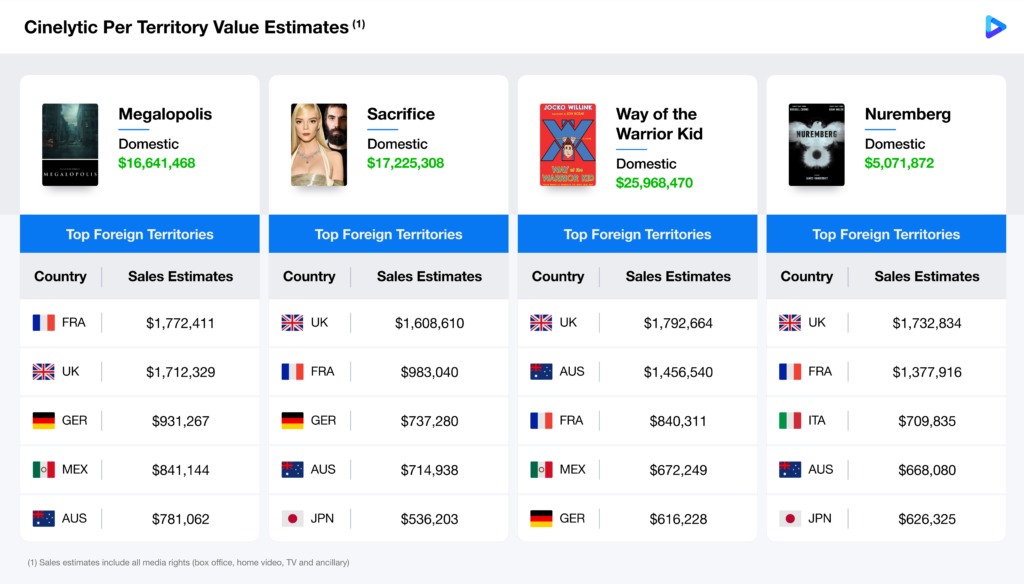

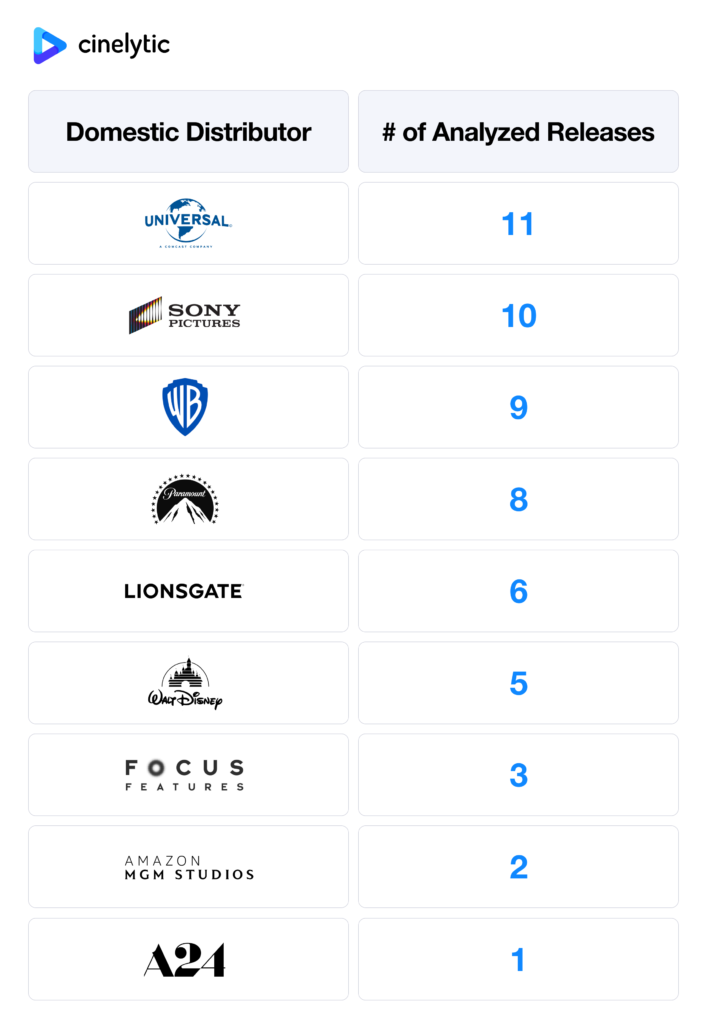

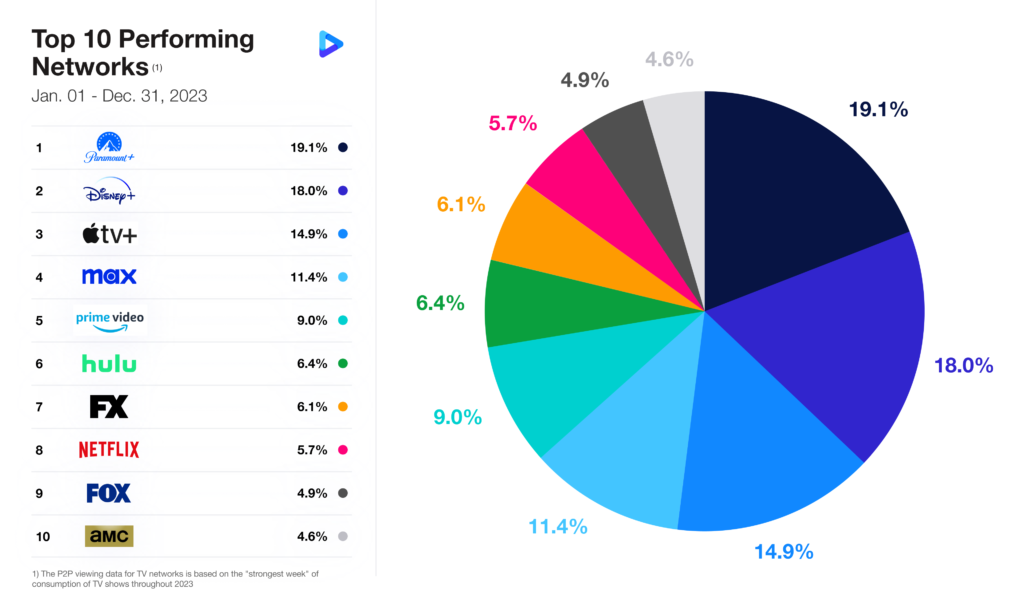

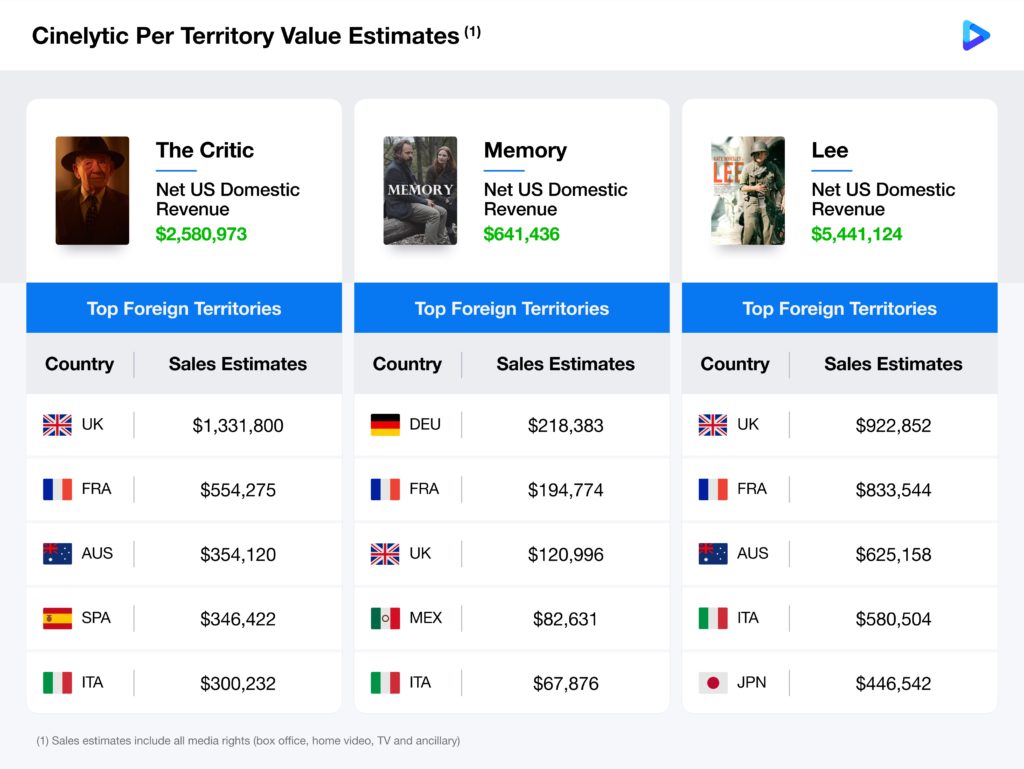

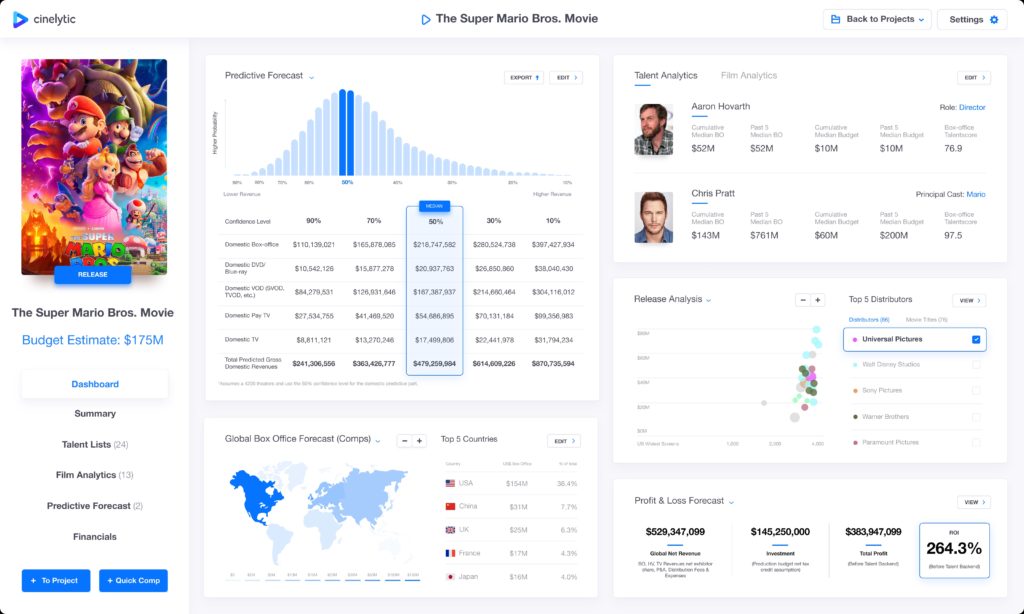

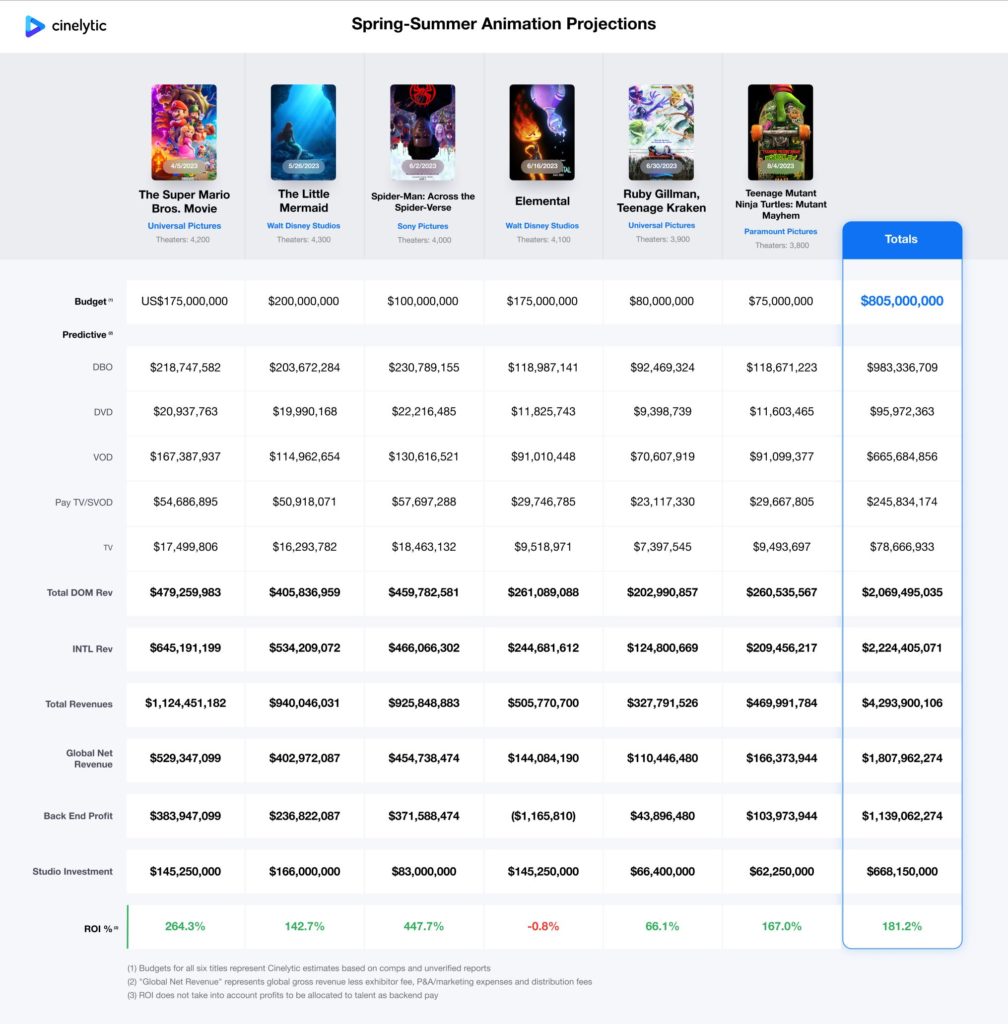

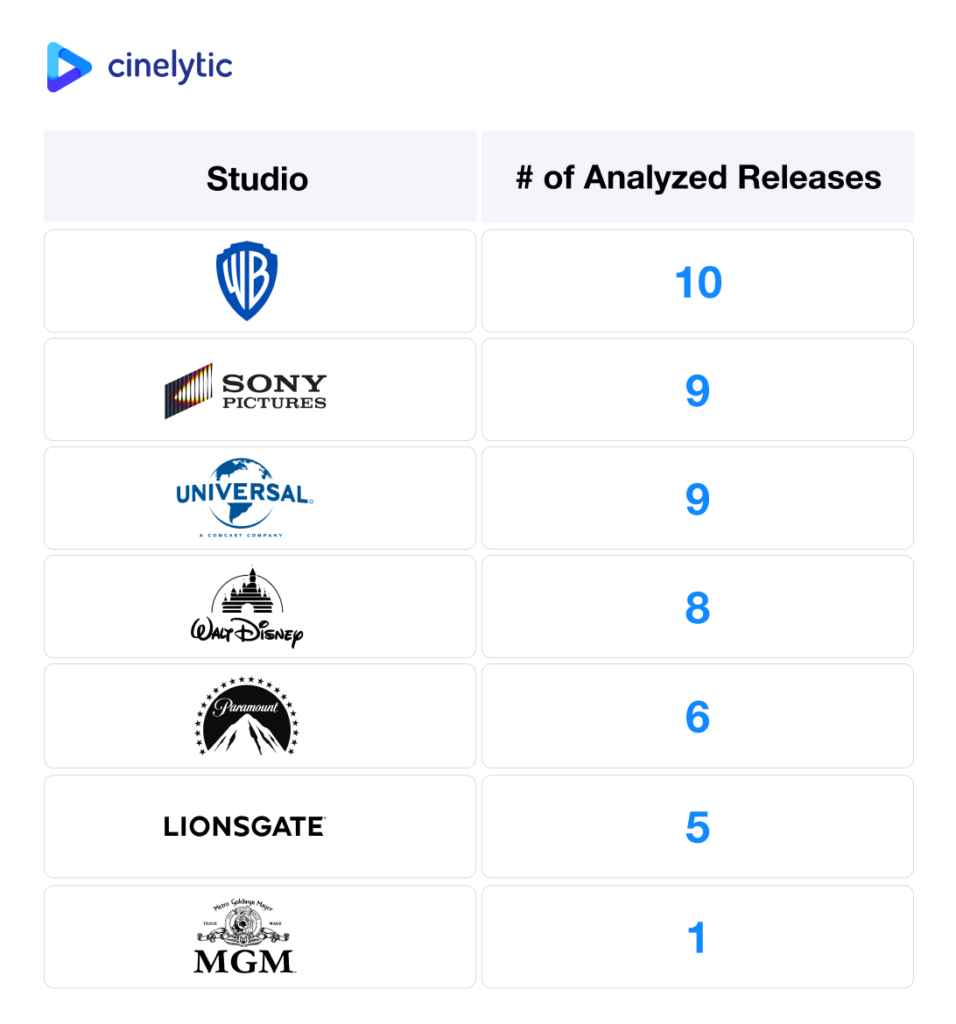

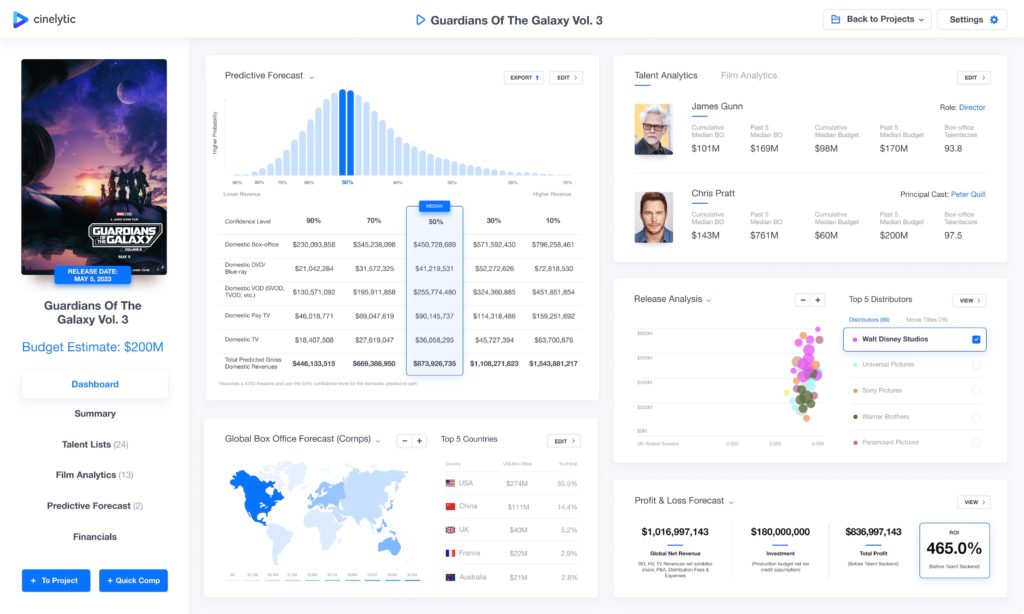

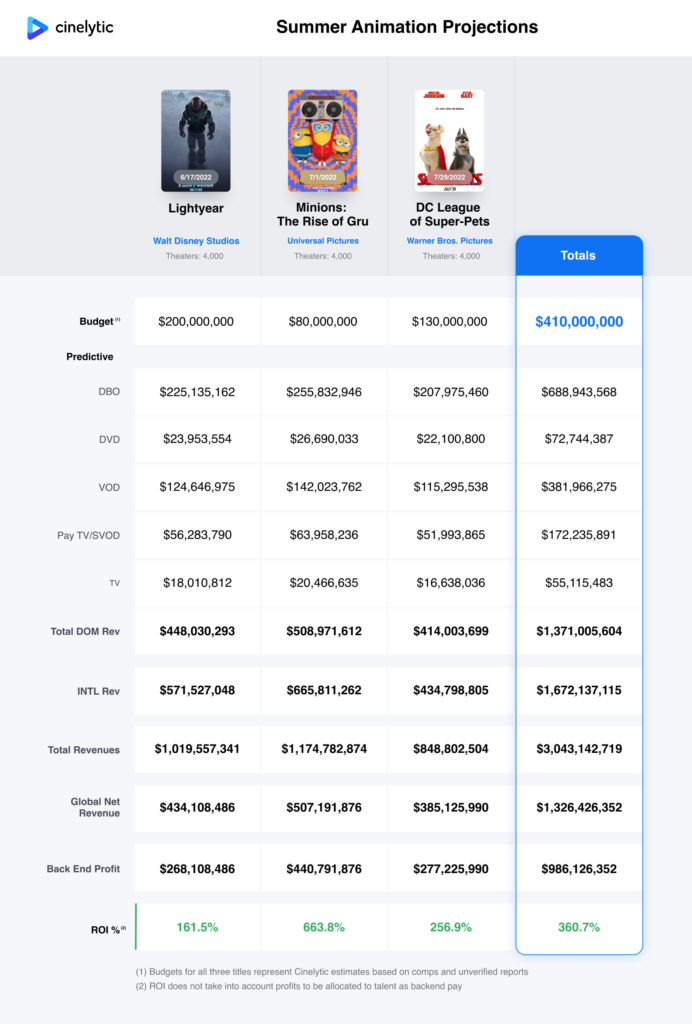

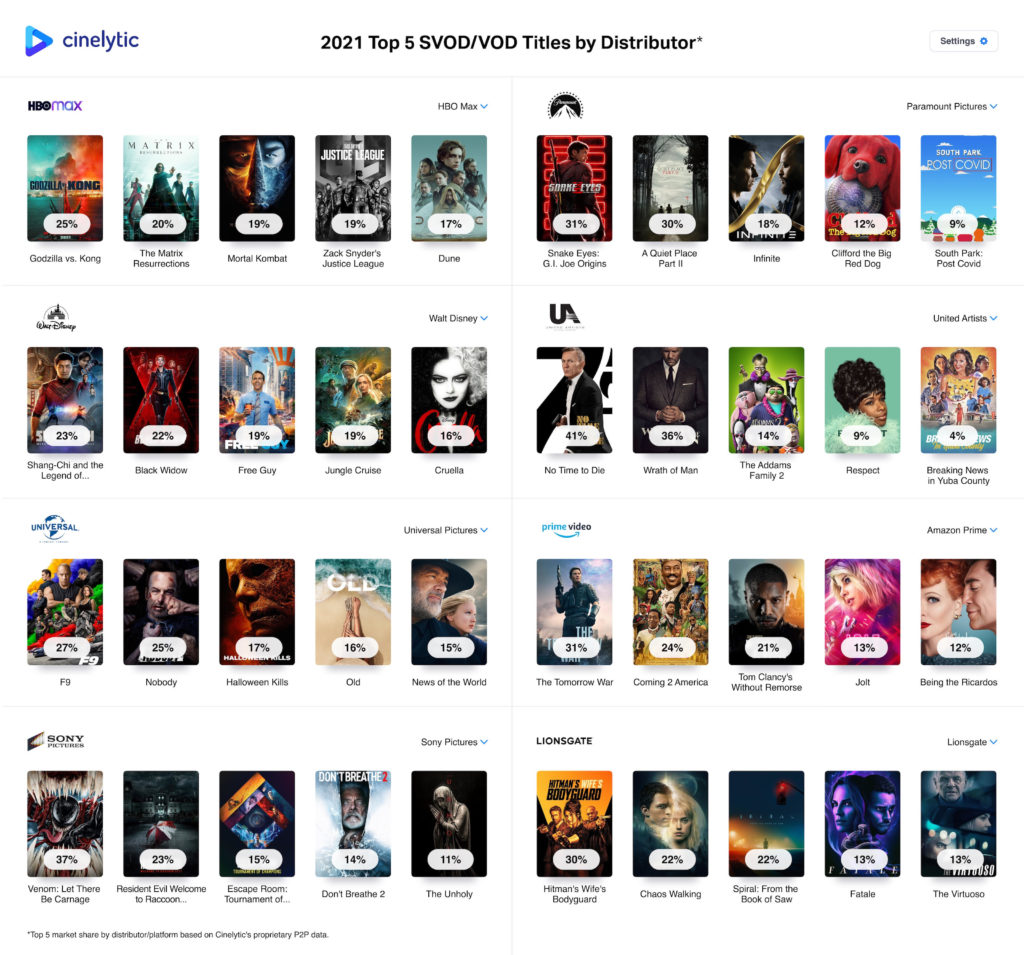

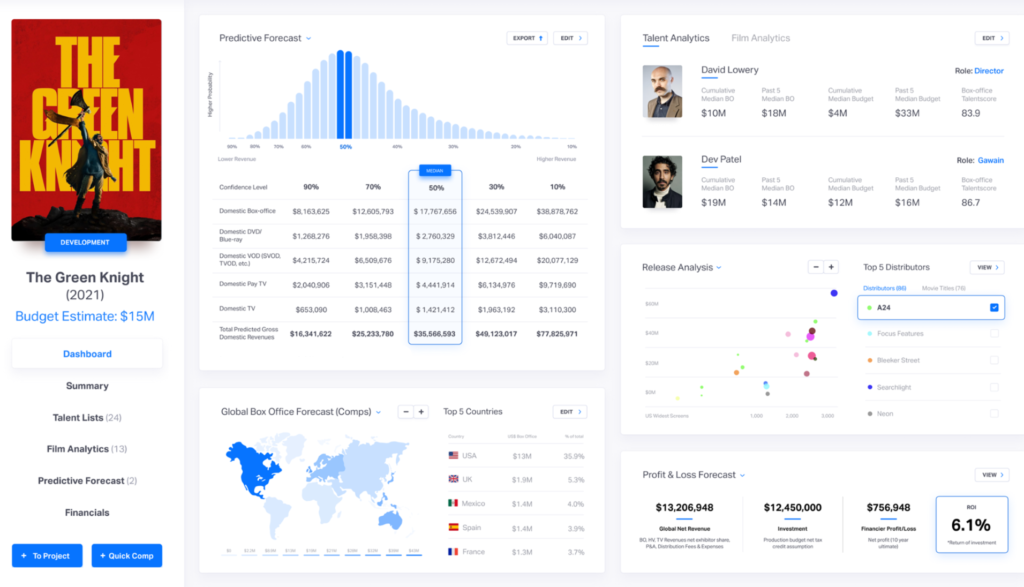

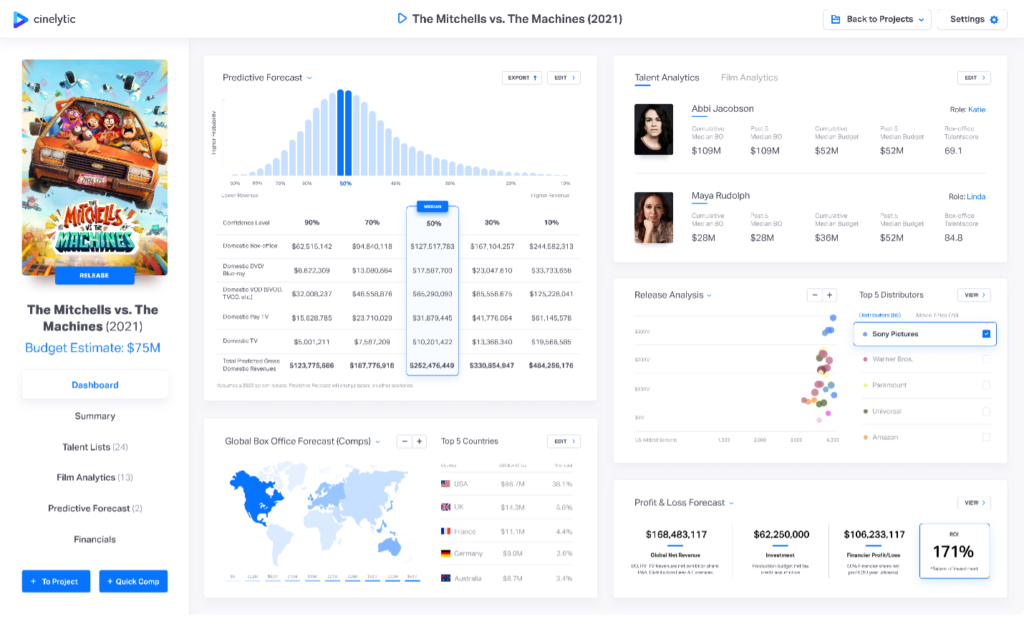

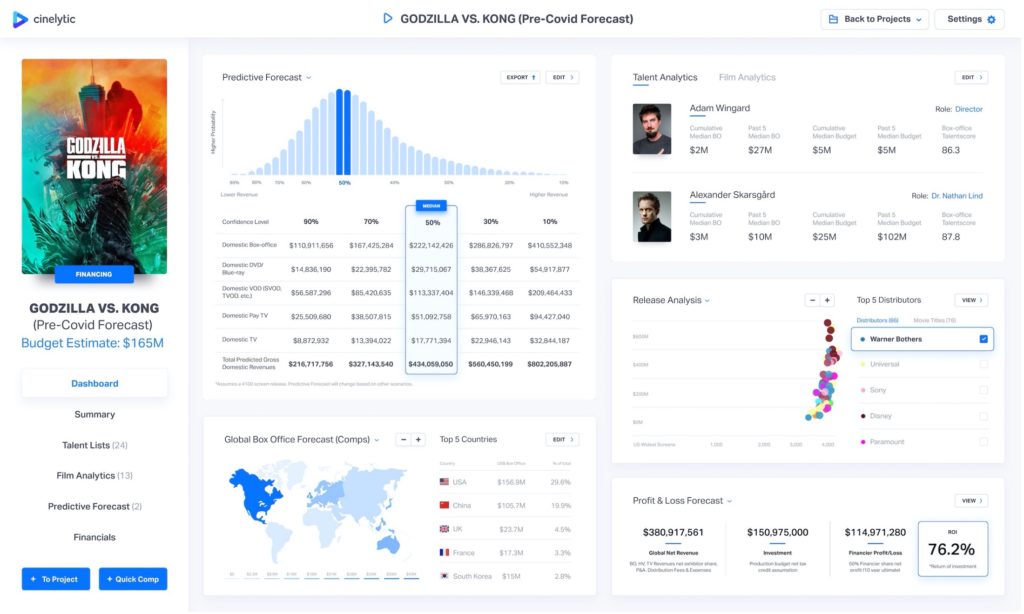

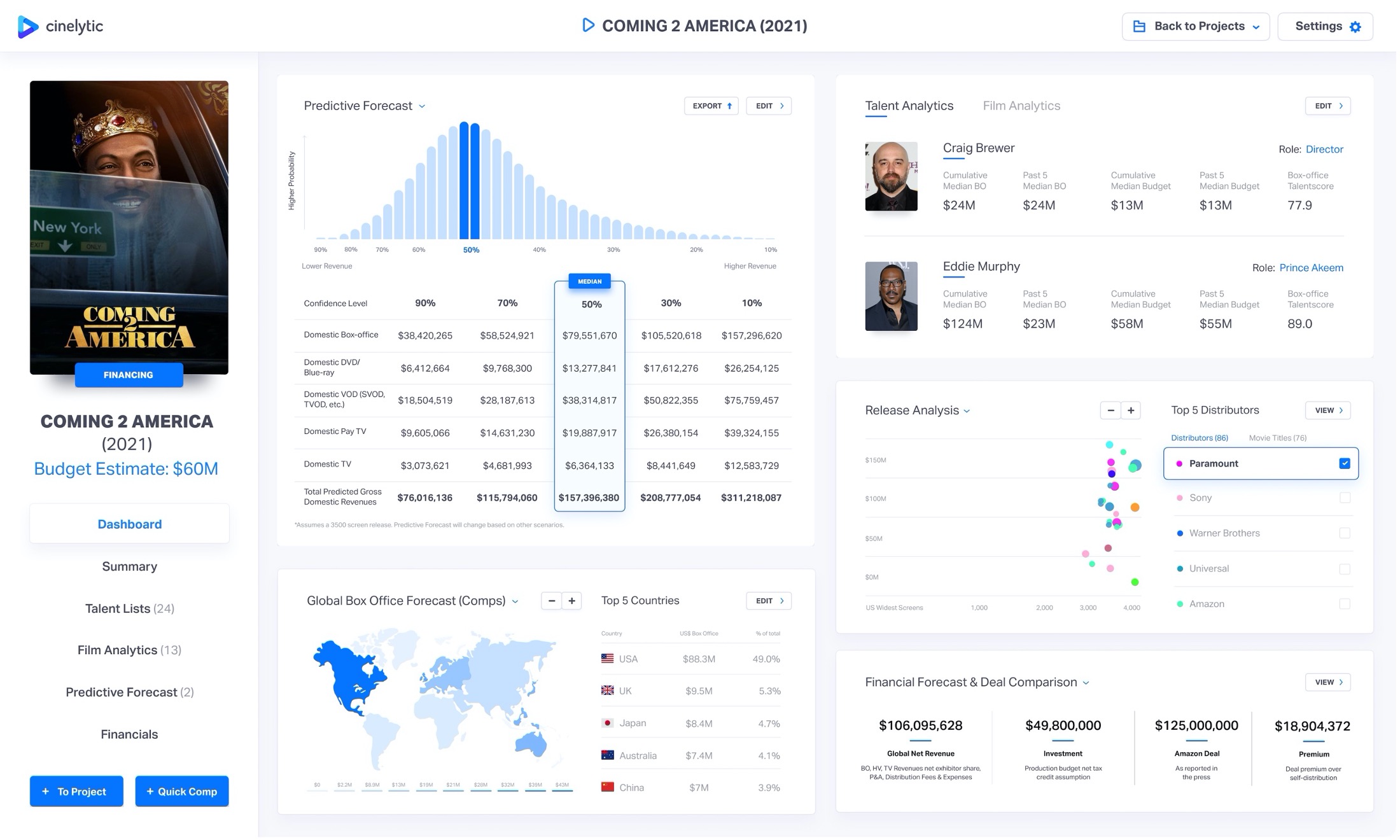

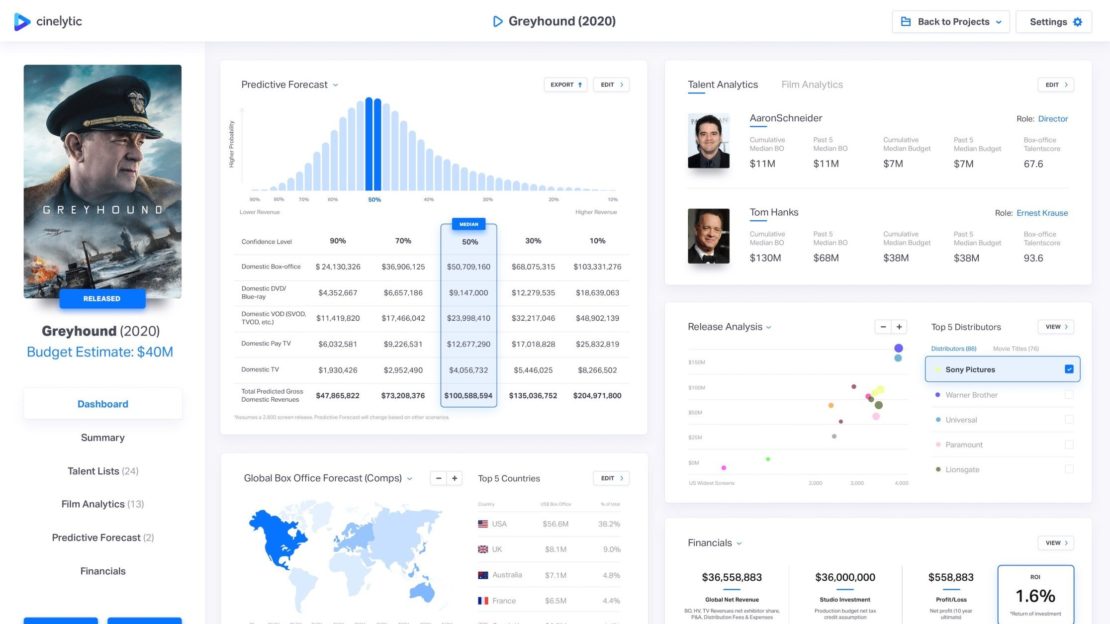

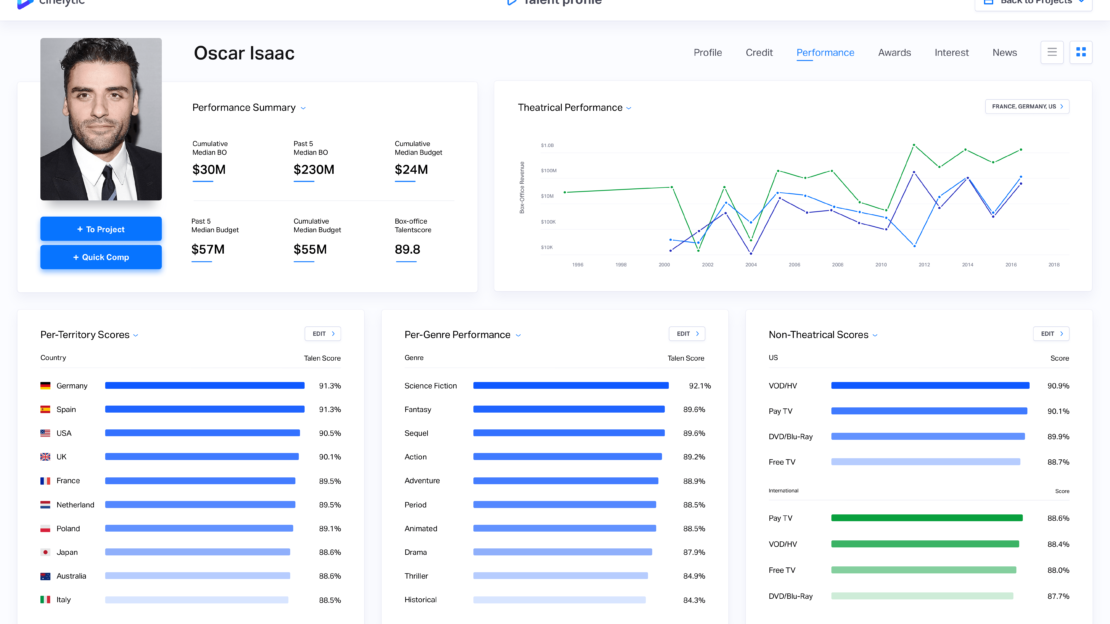

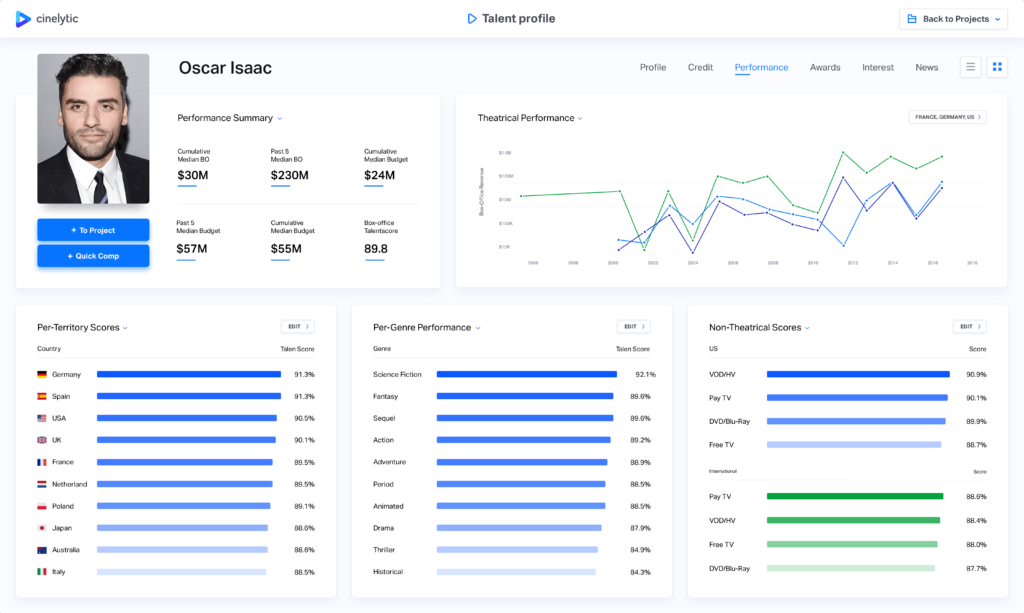

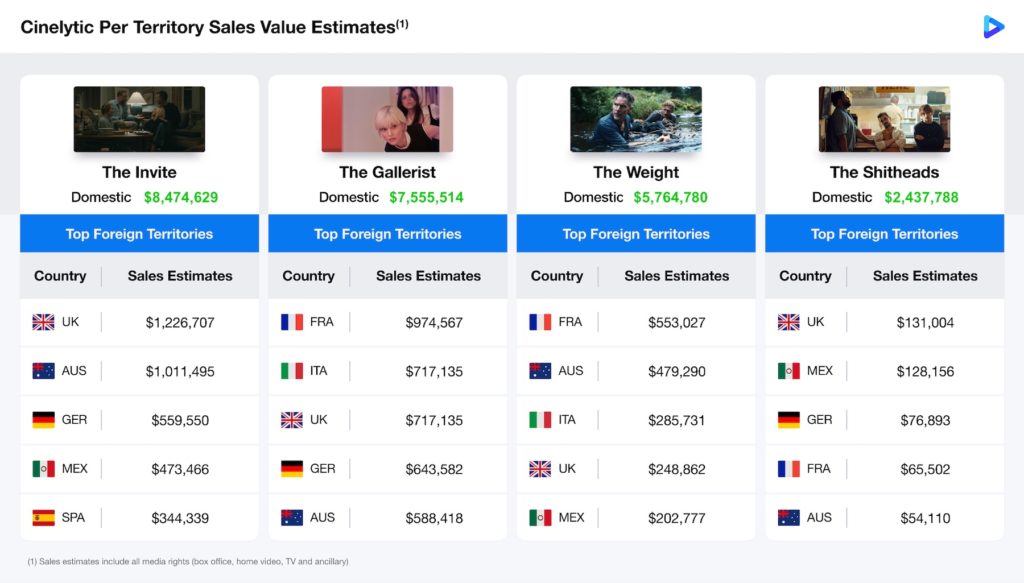

Our signature ROI forecasting, discussed later in these Insights, is particularly valuable for financiers, producers, and equity providers. However, our sales estimates tool offers a different advantage that enables both buyers and sellers at festivals like Sundance to assess the per-territory value of a title across all media rights (box office, home video, TV, and ancillary).

As shown in the graphic below, this tool is especially useful for those in a market setting who are working to determine the appropriate price for each territory’s rights:

From actress-director Olivia Wilde, THE INVITE is a sharp, sex-infused comedy of manners built around a dinner party gone hilariously wrong. Starring Wilde opposite Seth Rogen, Penélope Cruz, and Edward Norton, the film blends Wilde’s keen observational wit with ensemble chaos, positioning it as one of Sundance 2026’s most buzzed-about crowd-pleasers.

THE GALLERIST comes courtesy of BIRDS OF PREY writer/director Cathy Yan, presenting itself as a darkly funny thriller set against the manic spectacle of the Miami Art Basel art world. Anchored by Natalie Portman and Jenna Ortega with help from from Zach Galifianakis, Catherine Zeta-Jones, Sterling K. Brown, Da’Vine Joy Randolph, and Charli XCX, the film skewers market mania with sharp satire and high-wire ensemble energy.

A gritty period thriller from director Padraic McKinley, THE WEIGHT stars Ethan Hawke and Russell Crowe in a Depression-era tale of survival and redemption. Set in 1930s Oregon, the film follows a widowed laborer entangled with gold smugglers and moral peril as he fights to reunite with his daughter.

Rounding out the group is THE SHITHEADS from acclaimed indie filmmaker Macon Blair, a raucous buddy comedy that turns a simple job into mayhem and stars Dave Franco, O’Shea Jackson Jr., and Mason Thames.

Revenue Forecasting: Spotlight – THE INVITE

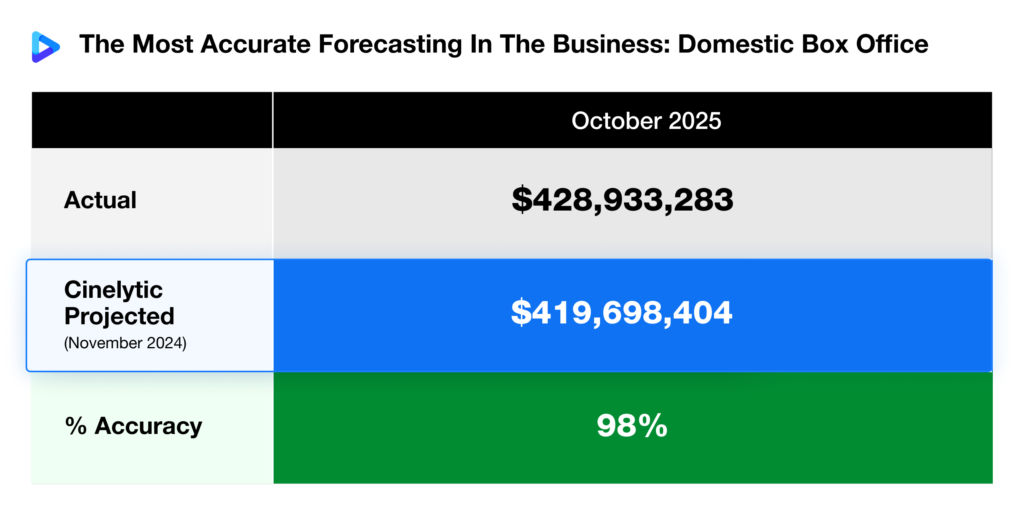

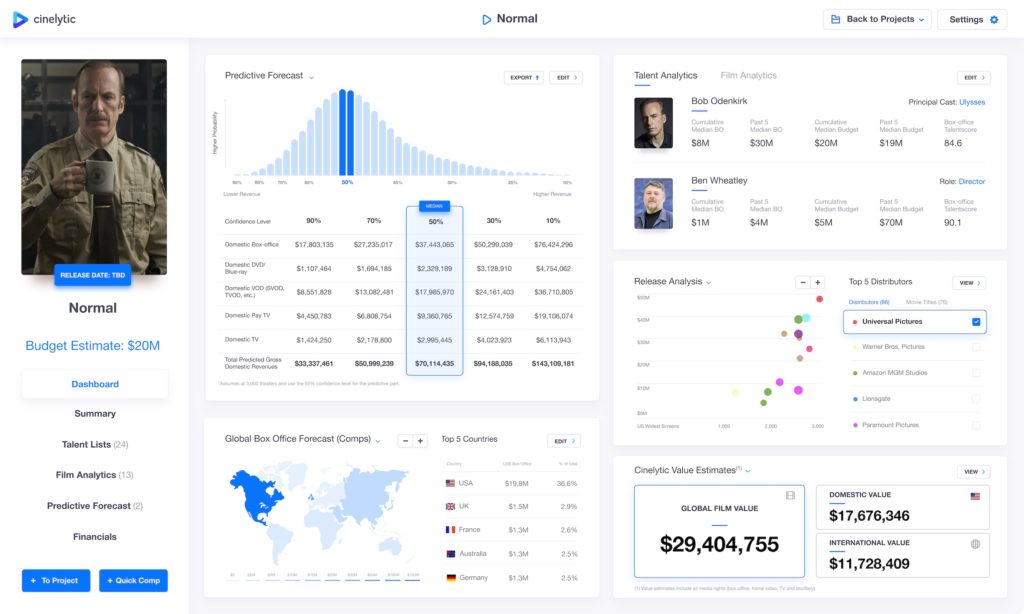

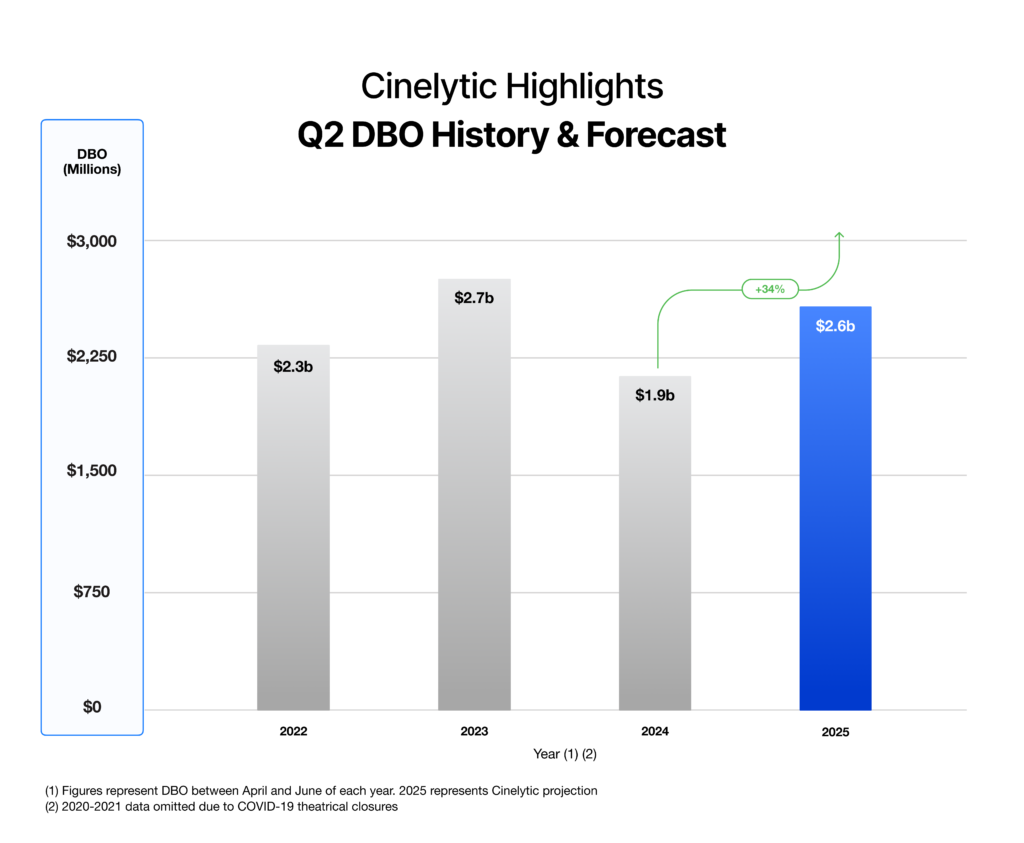

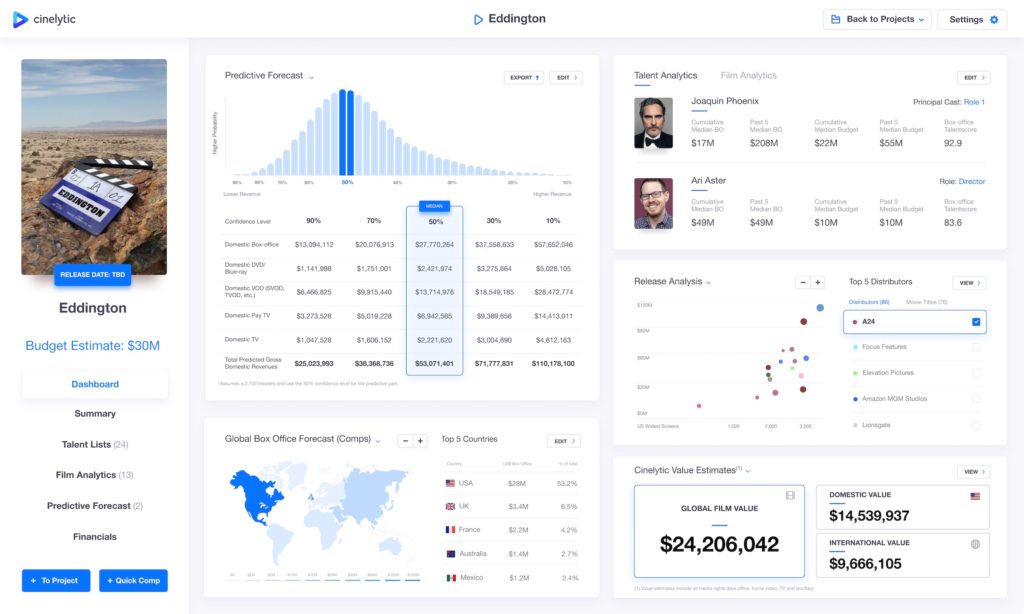

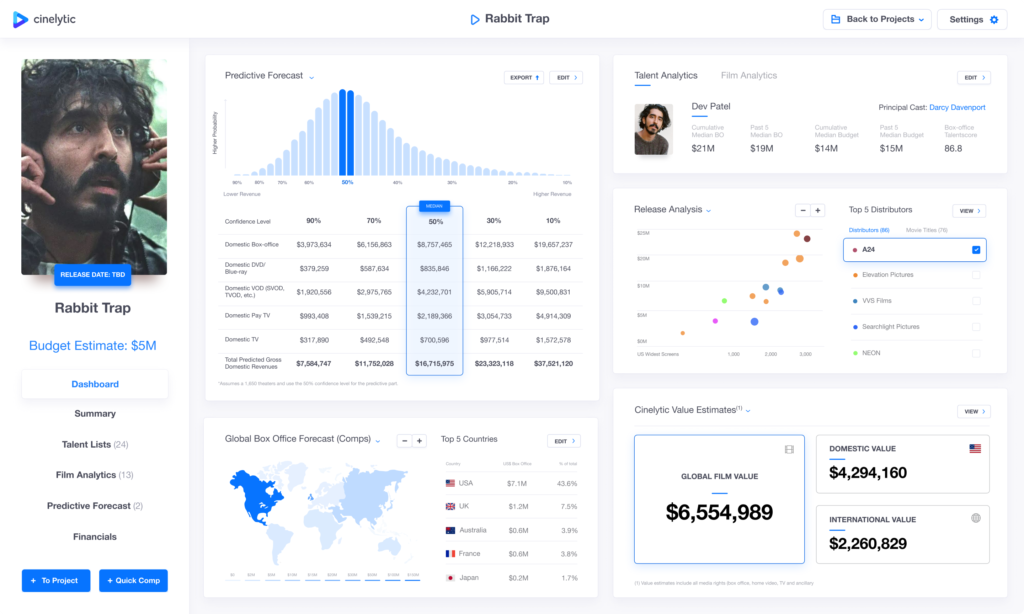

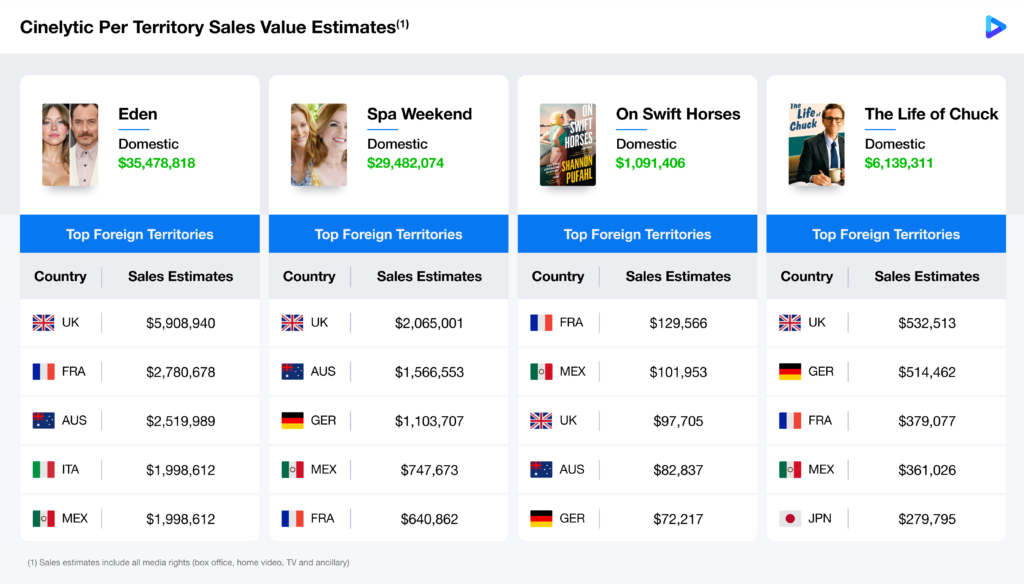

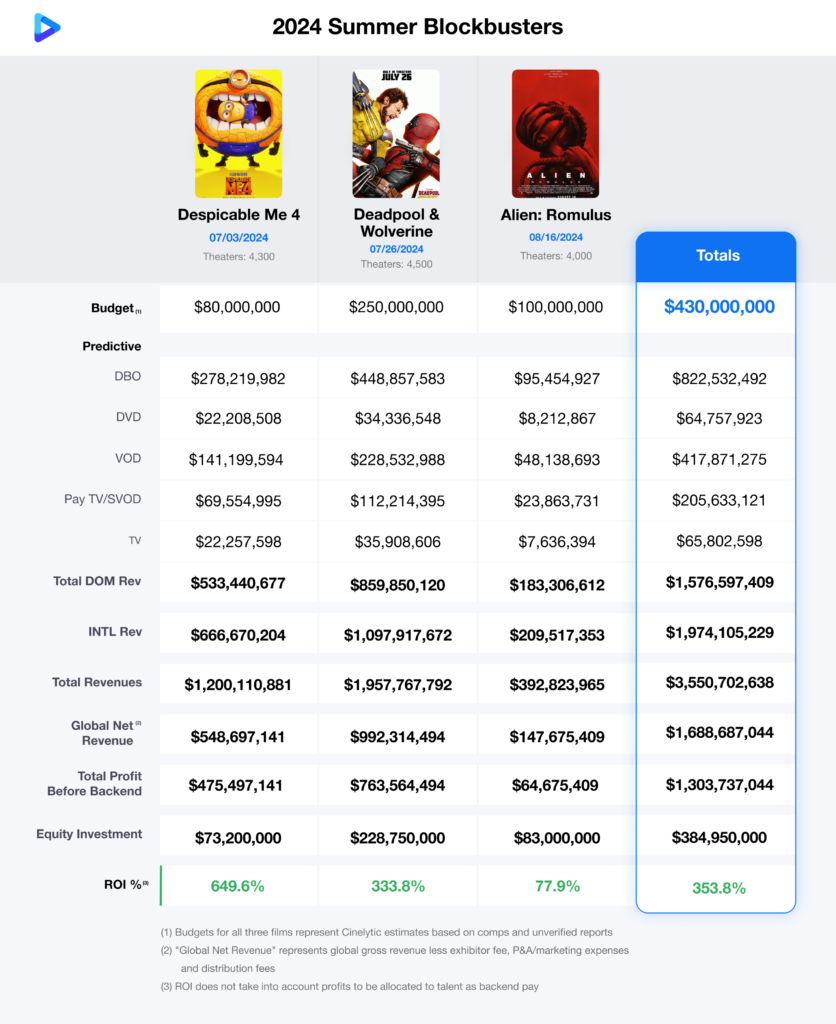

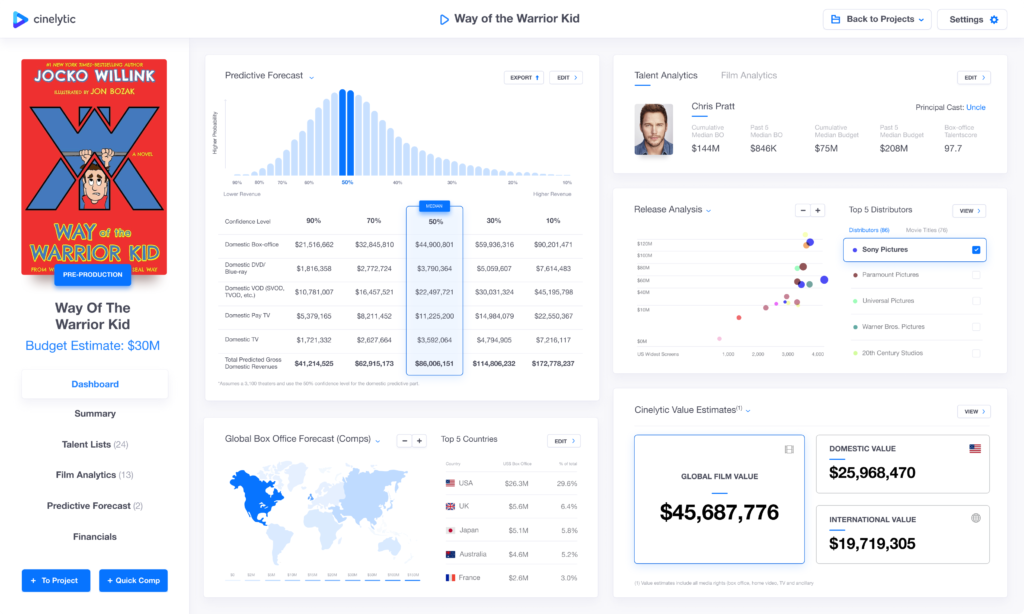

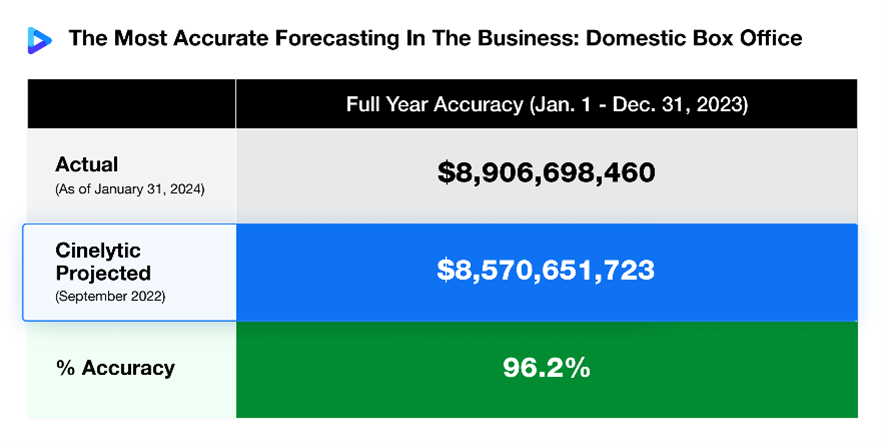

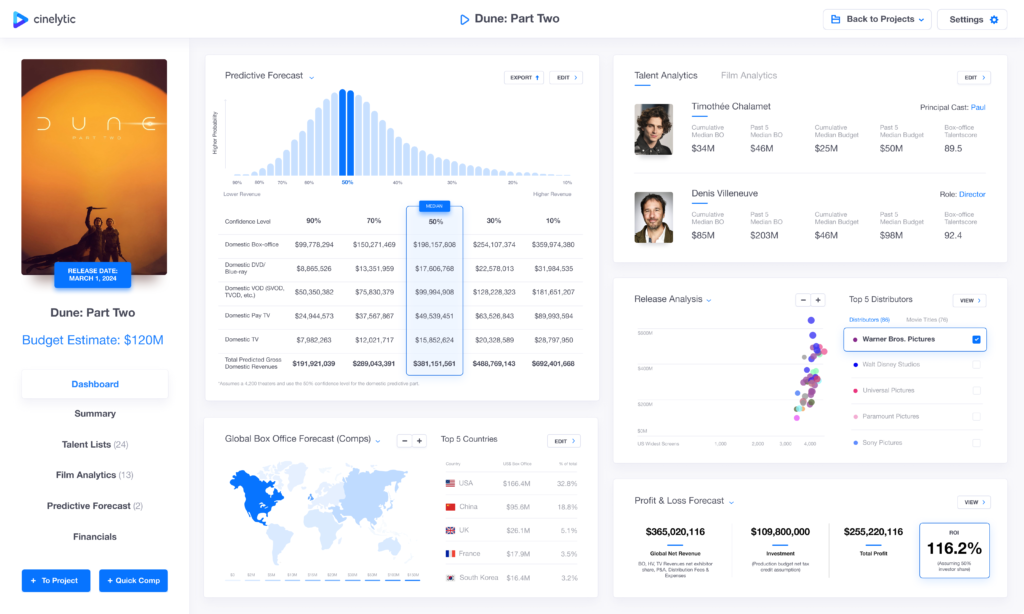

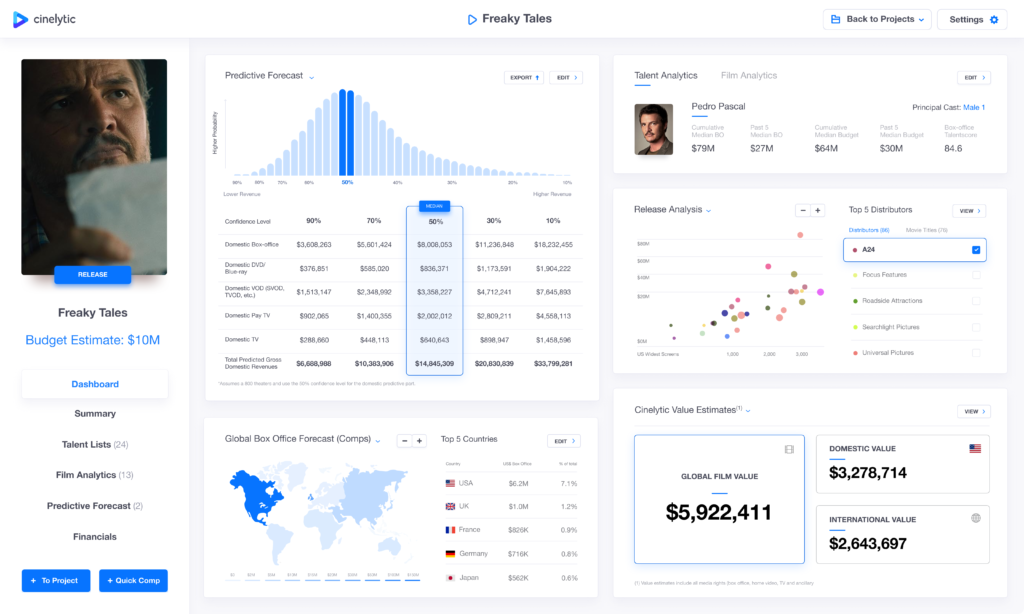

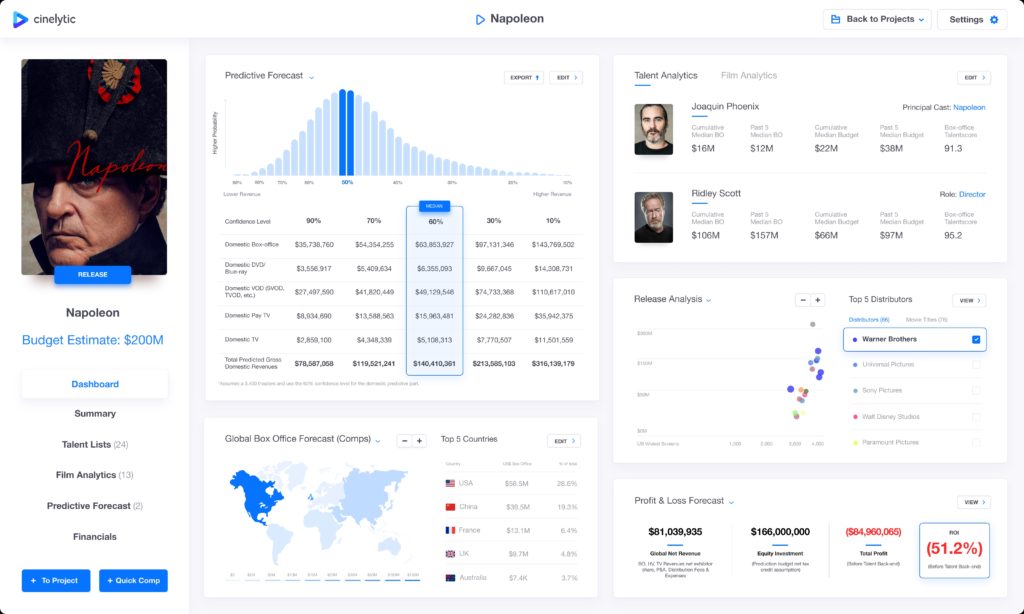

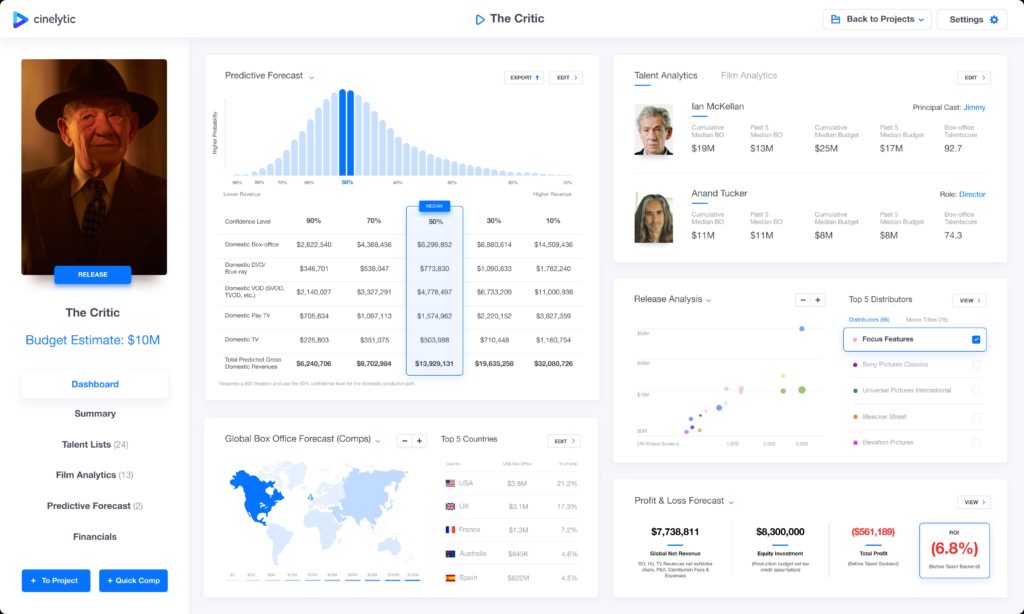

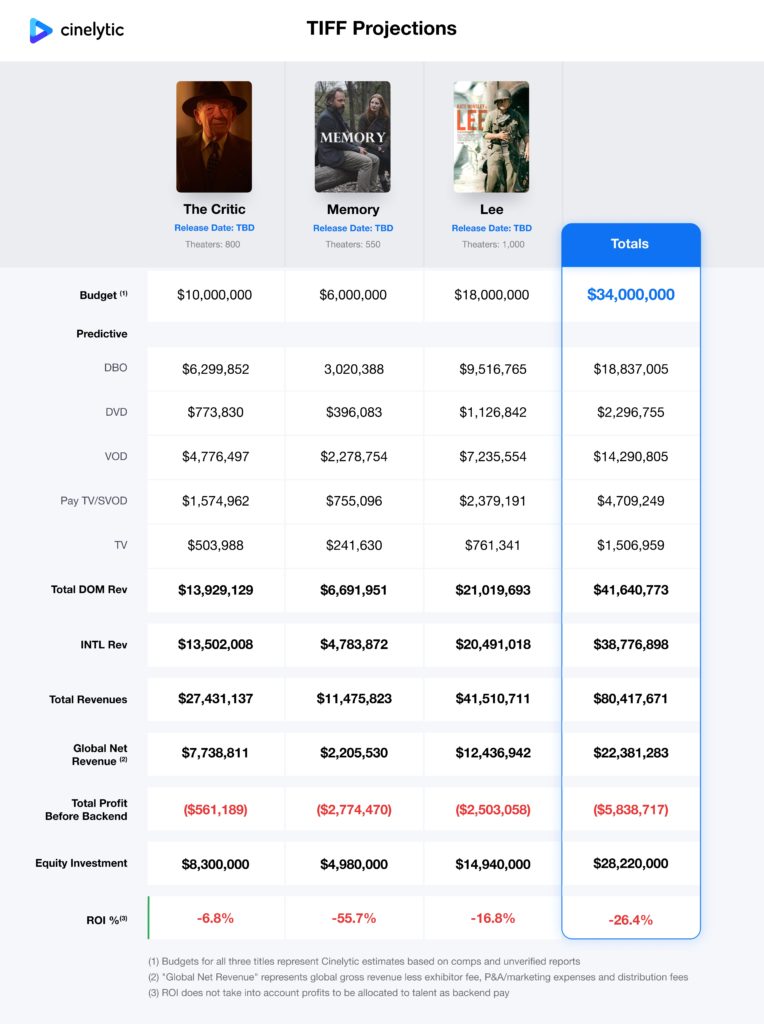

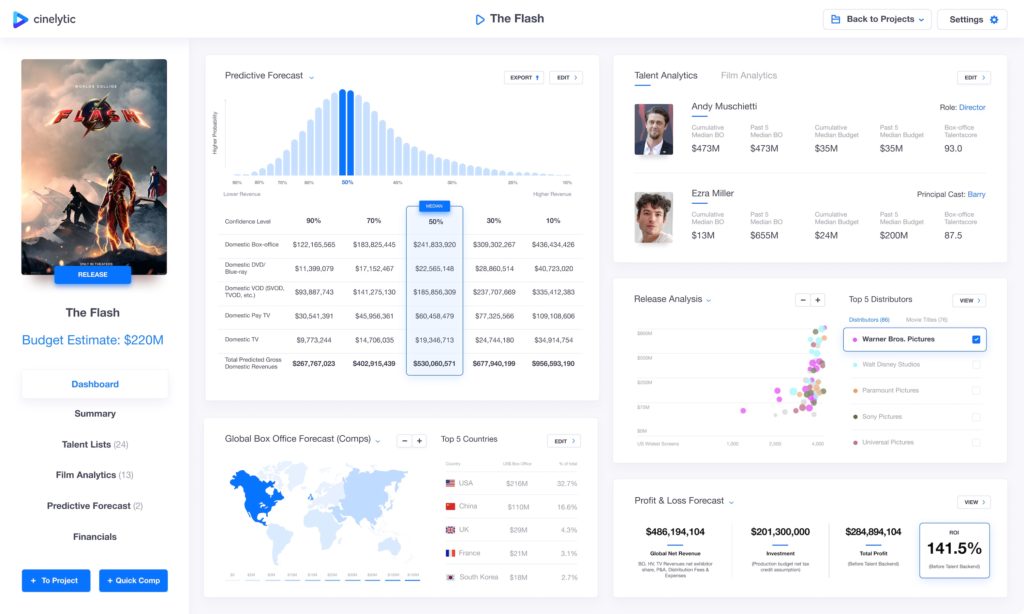

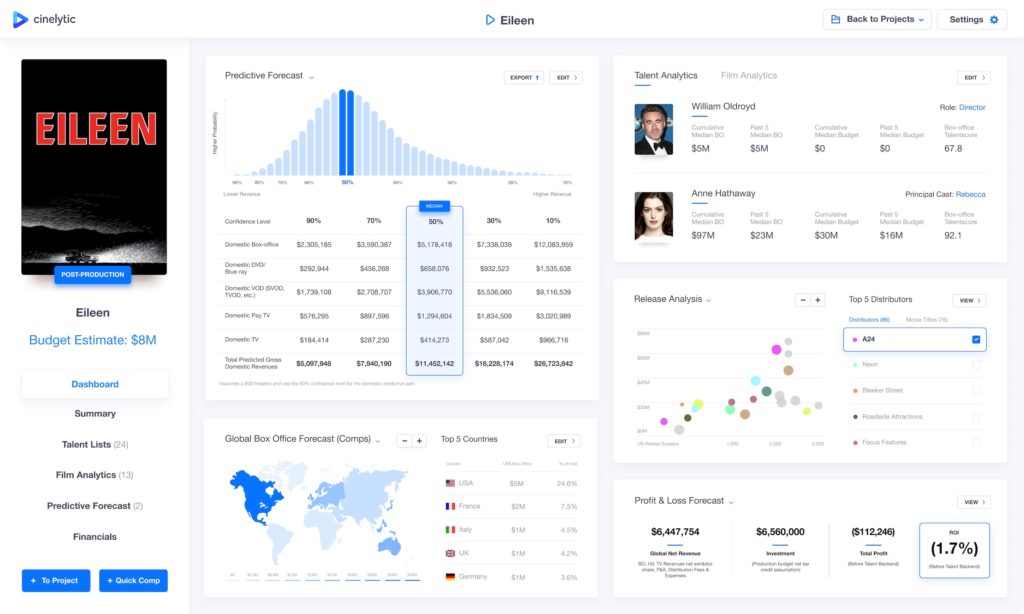

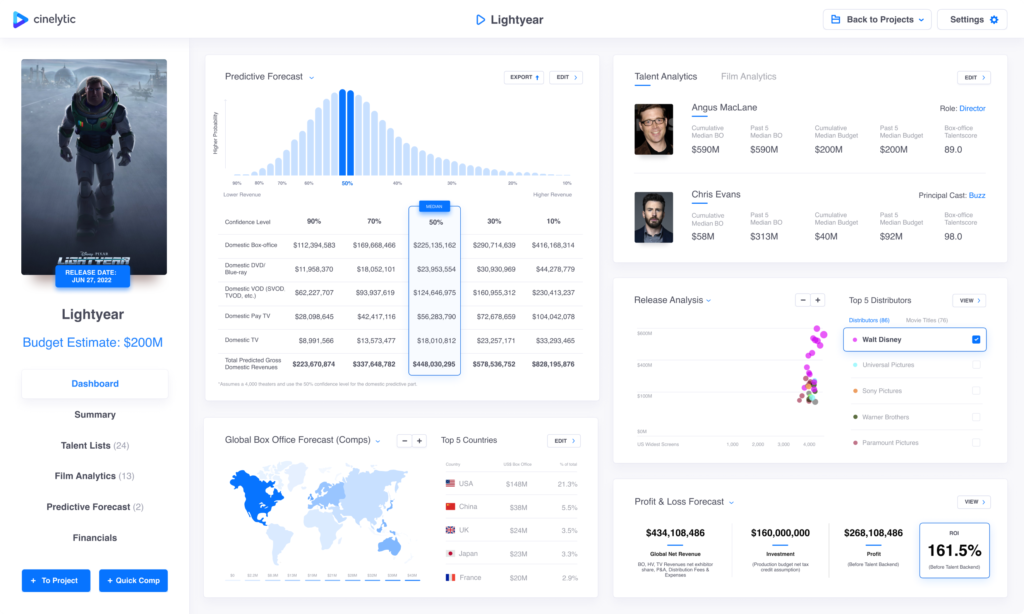

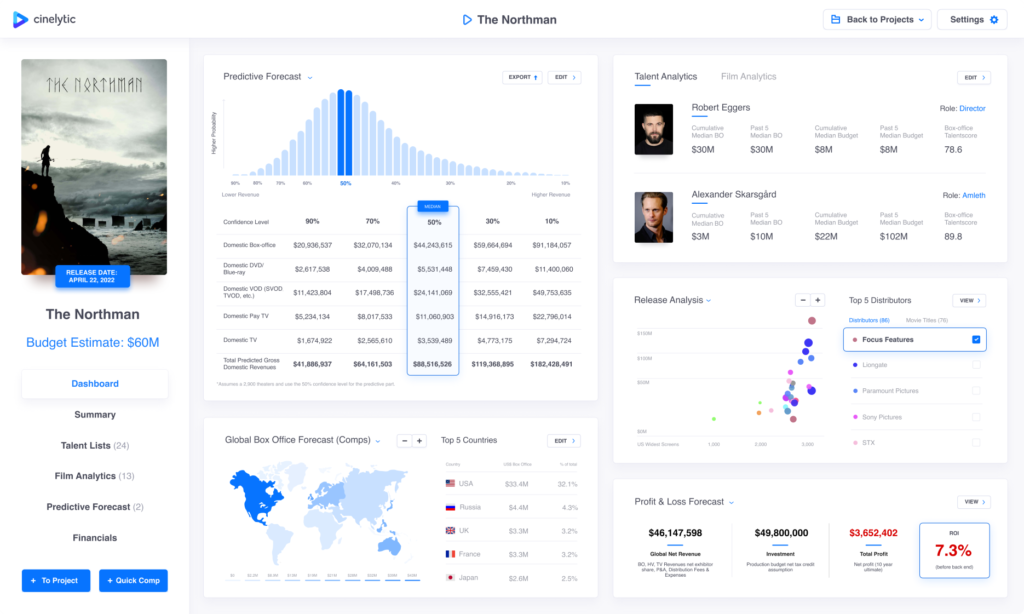

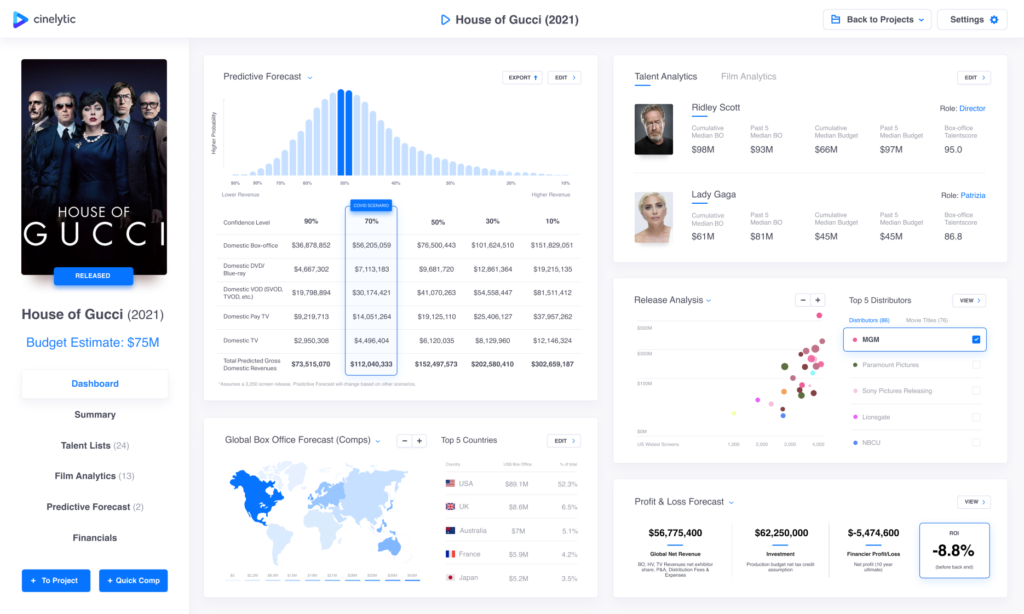

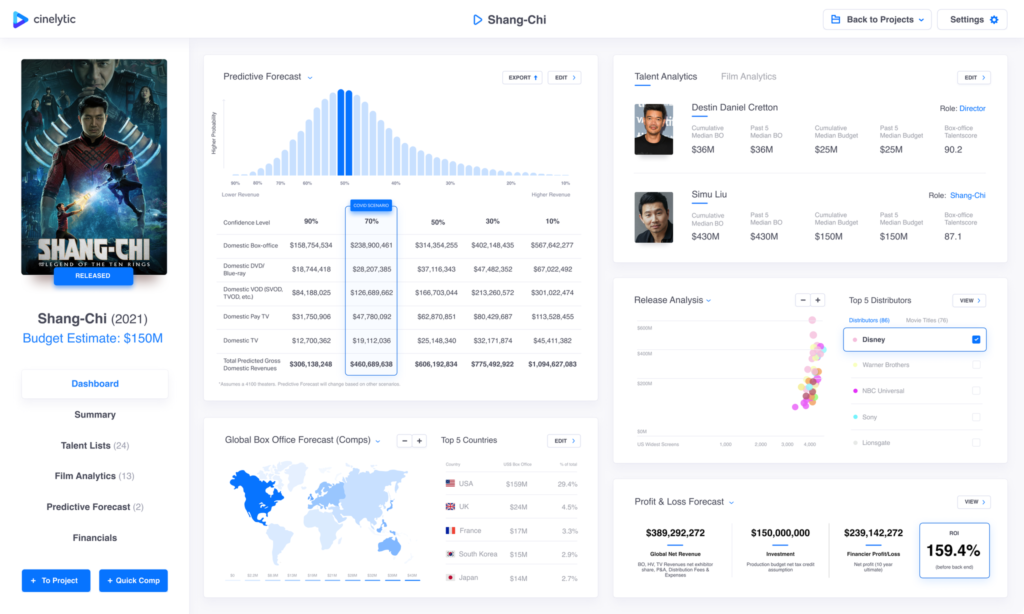

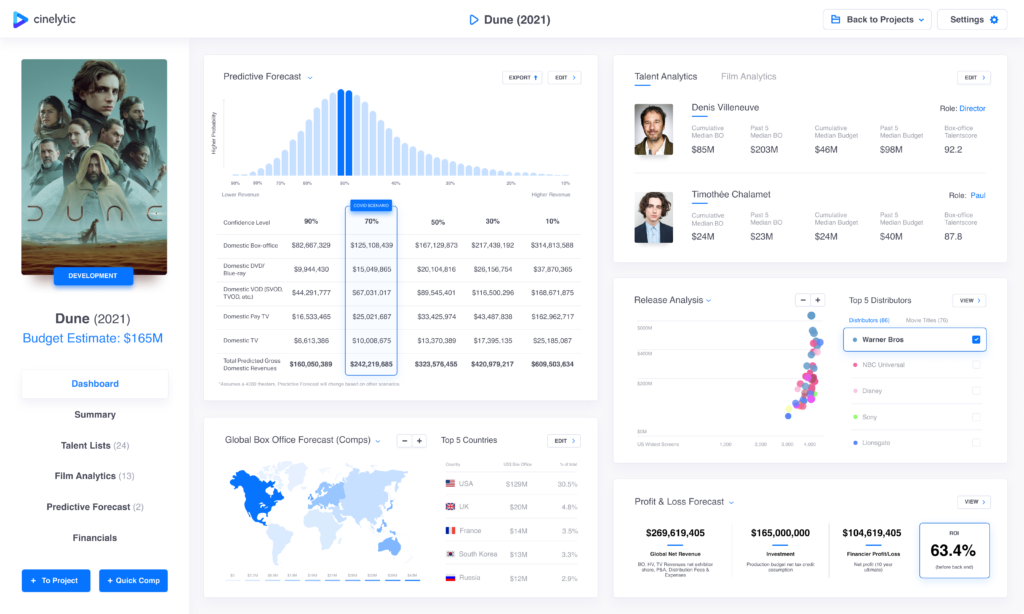

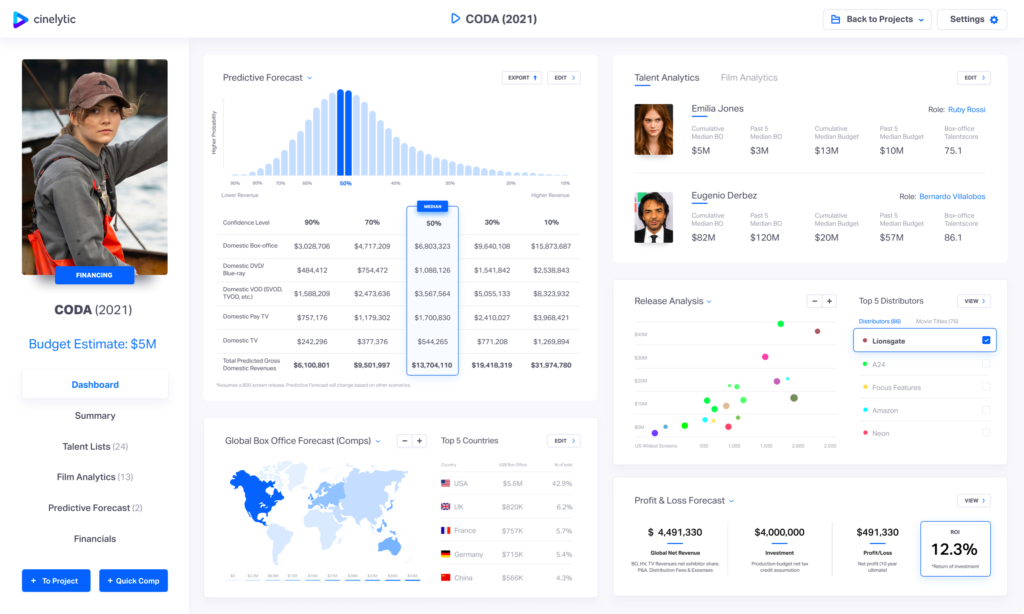

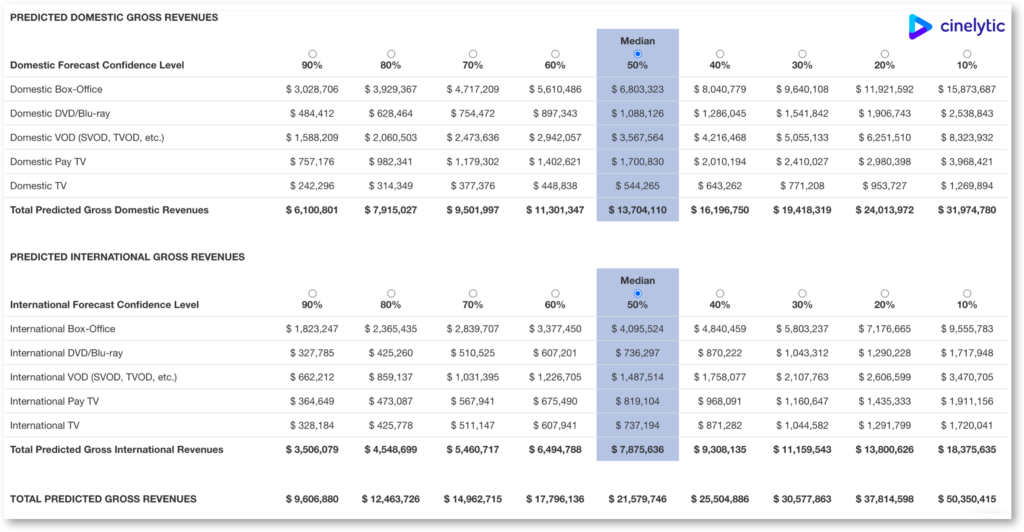

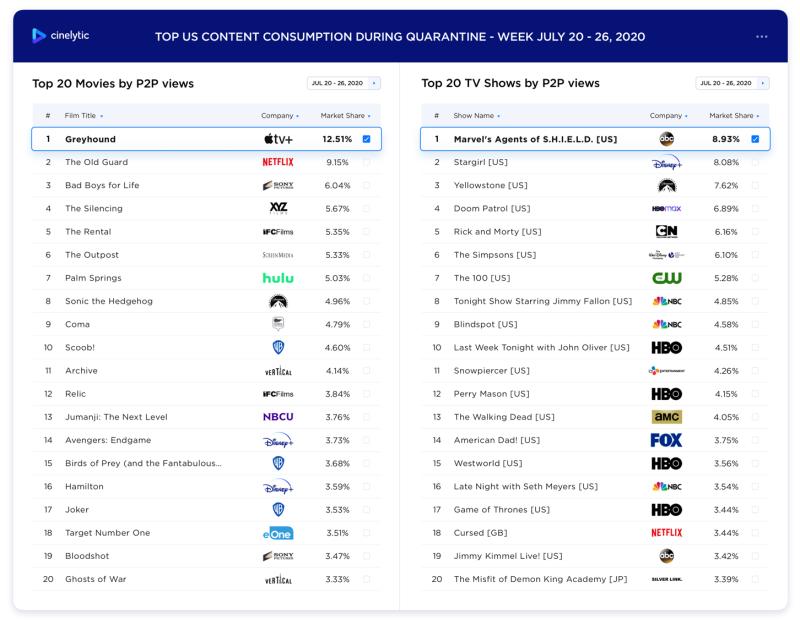

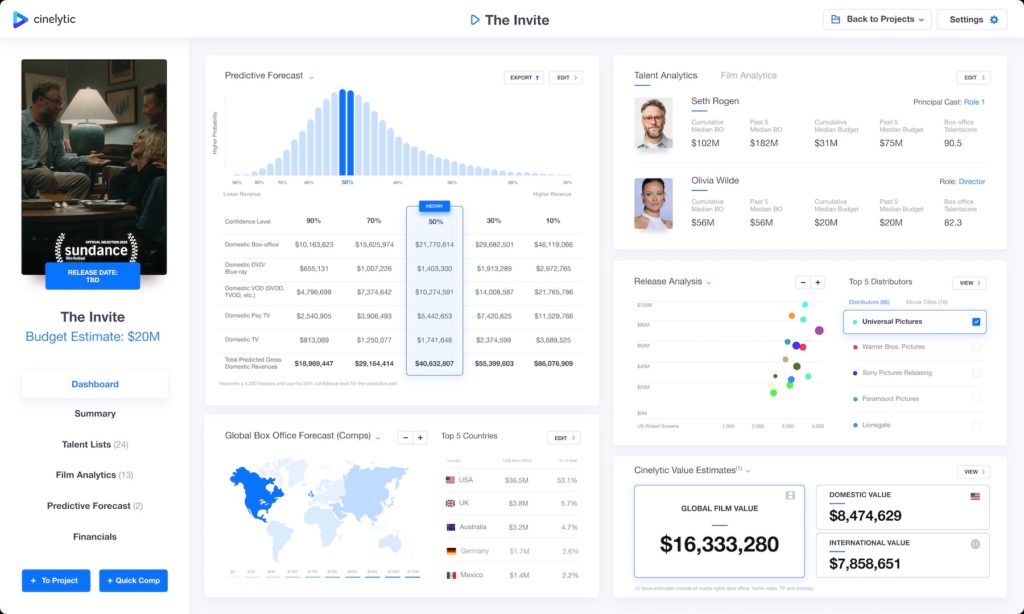

In order to provide a sample of our detailed projections, we chose to highlight THE INVITE and run it through our predictive tool to showcase what may lie ahead for these types of releases in terms of revenue.

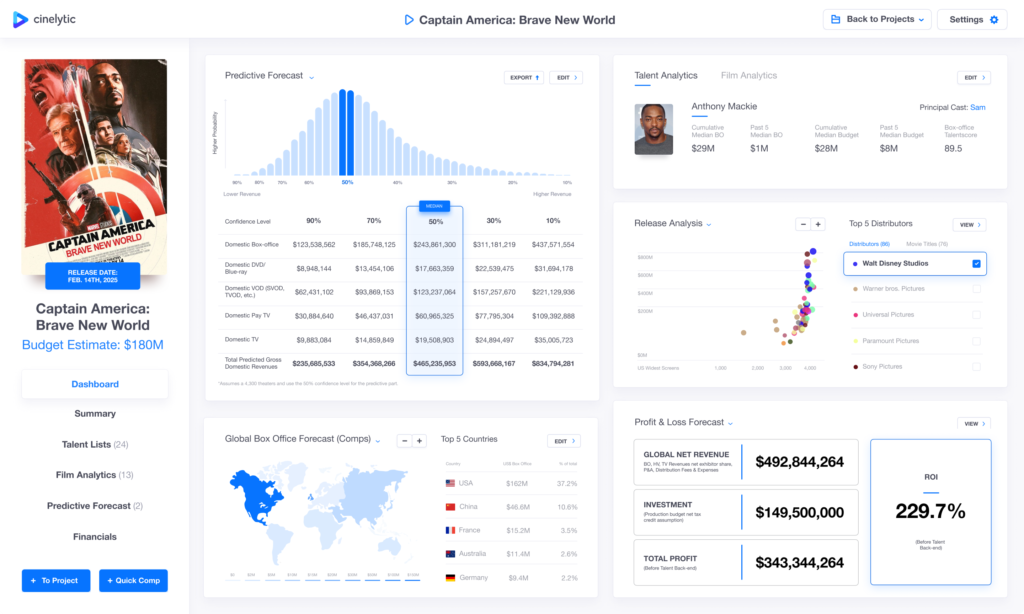

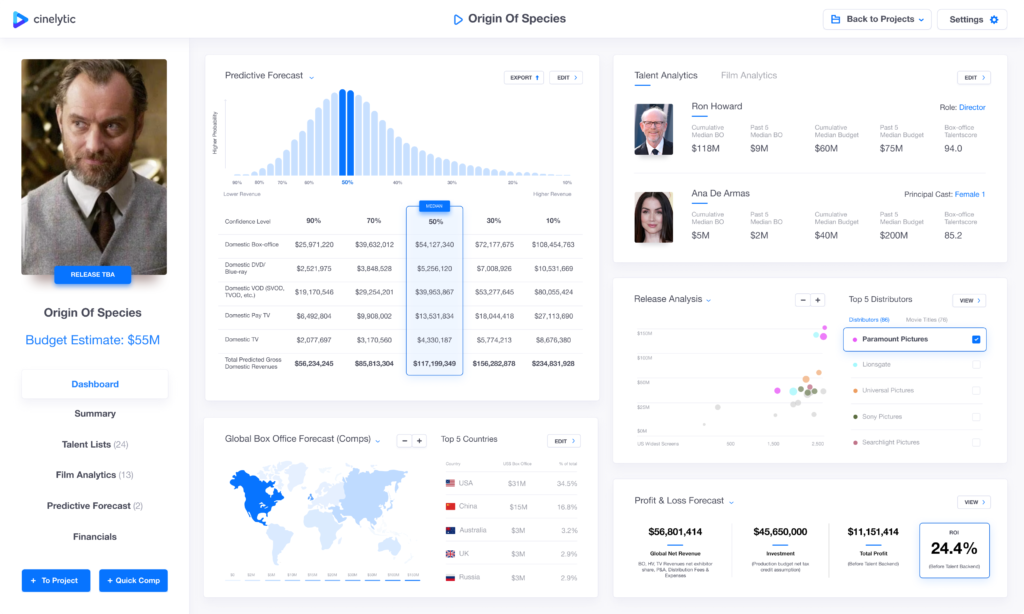

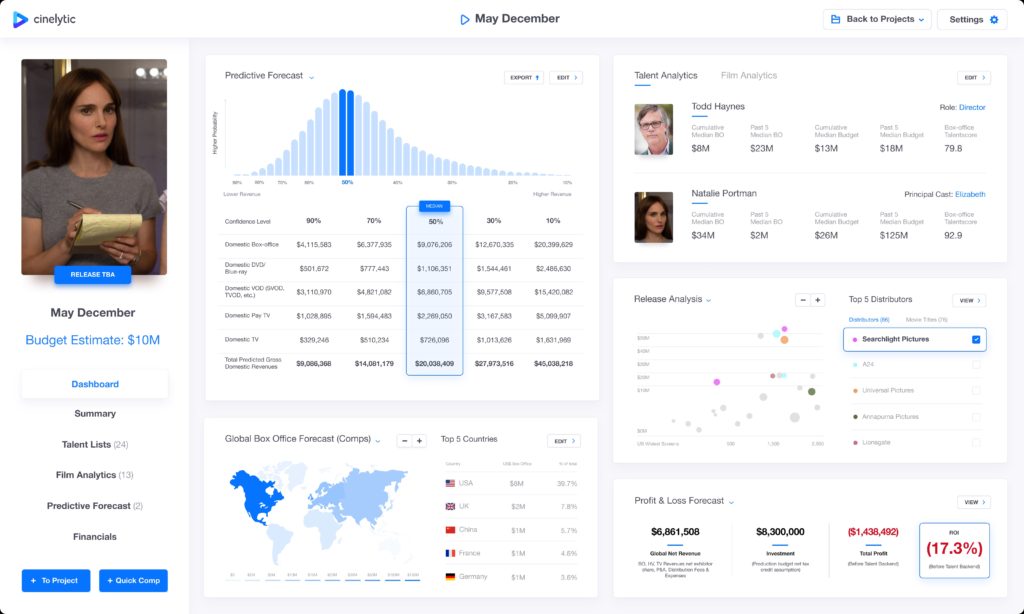

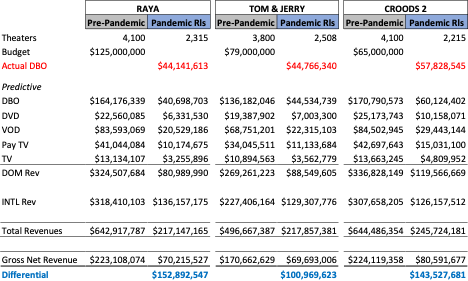

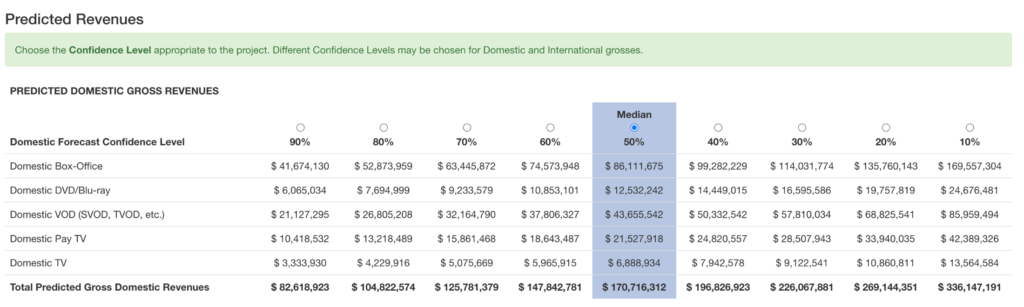

This tool takes into consideration 19 material input attributes to determine a full-performance waterfall, P&L and ROI. We estimated a budget of US$20m, an additional US$32m in global P&A costs and proposed a theatrical release strategy of 2,500 screens with Seth Rogen in the lead. The Cinelytic platform predicts a DBO of roughly US$21.8m, domestic gross revenues (BO, HV, TV) that total US$40.6m, and international gross revenues totaling US$35.7m:

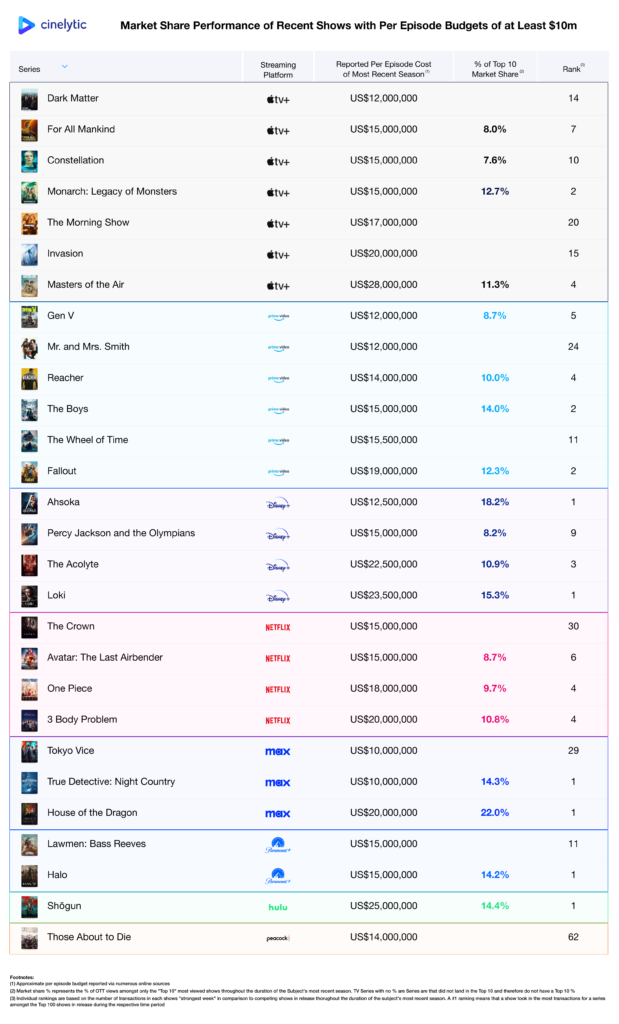

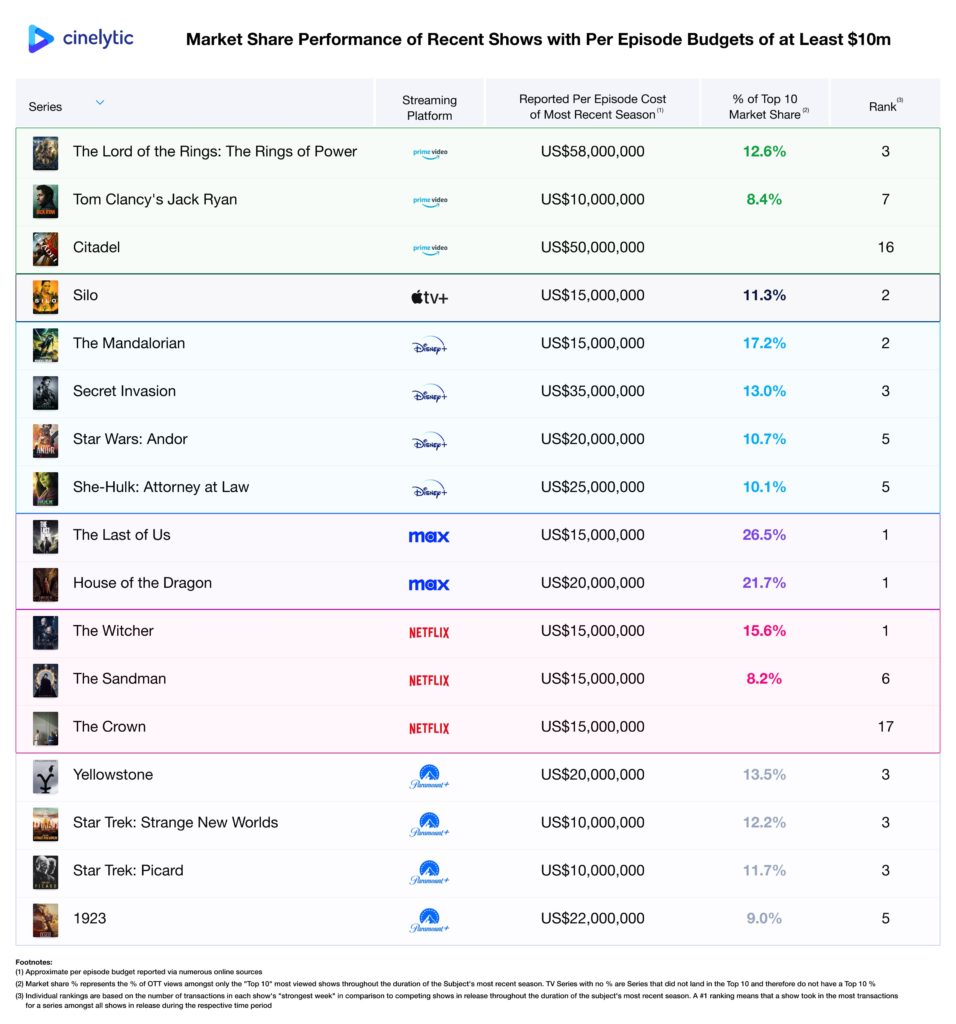

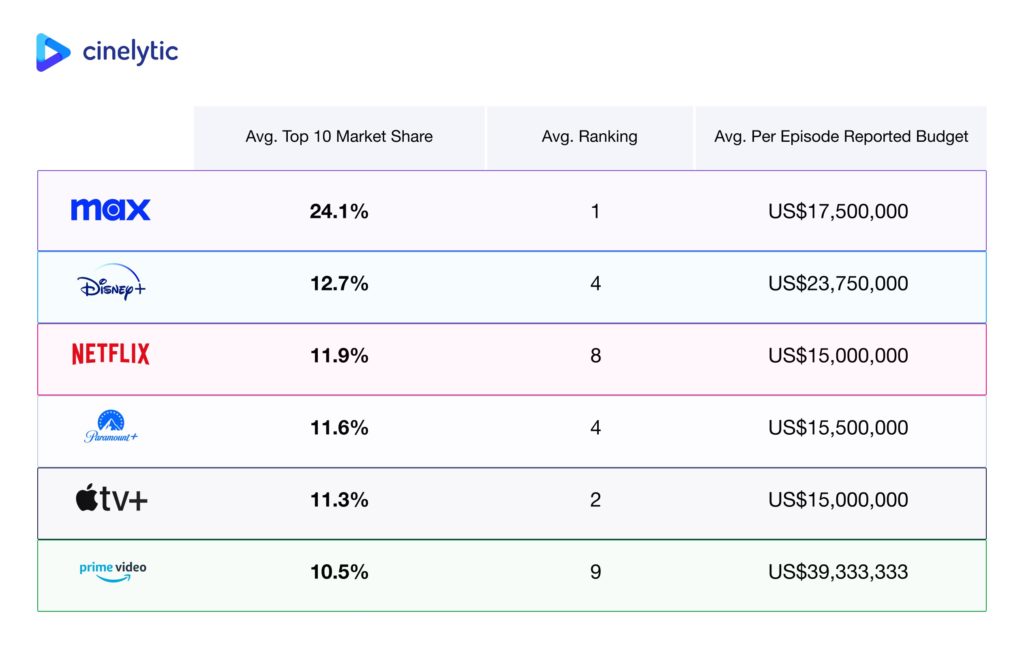

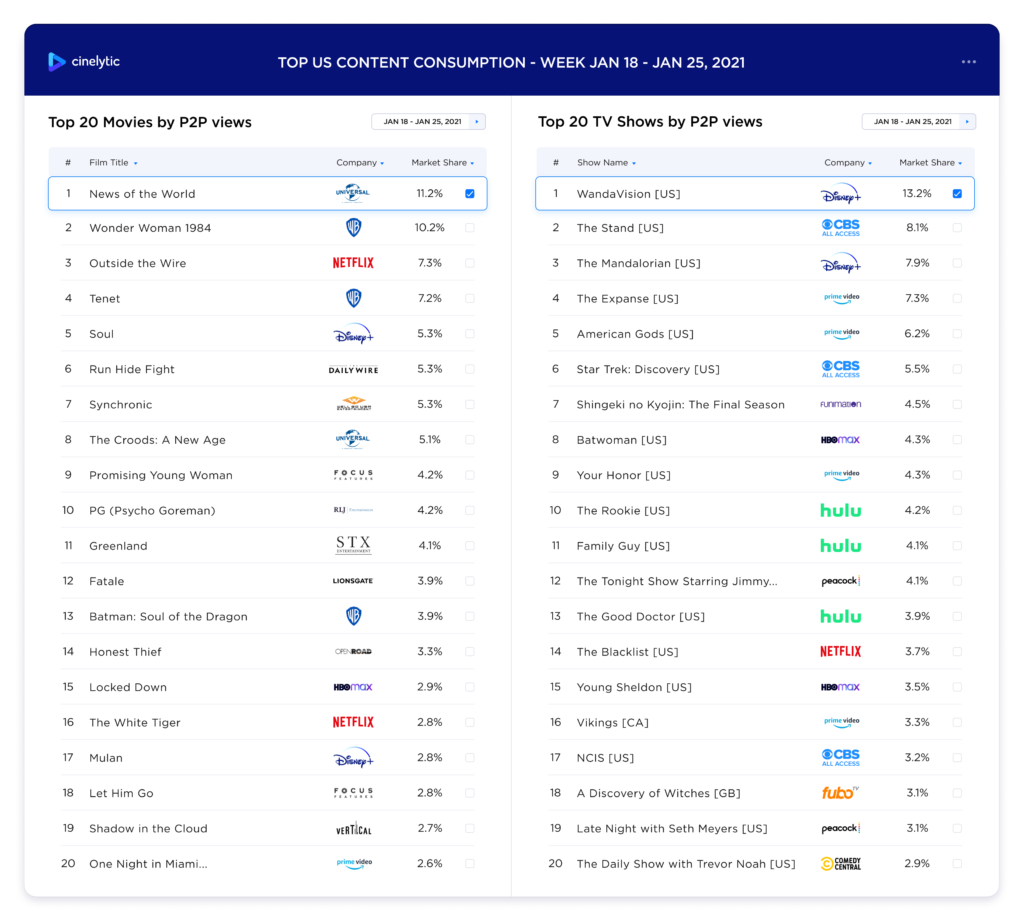

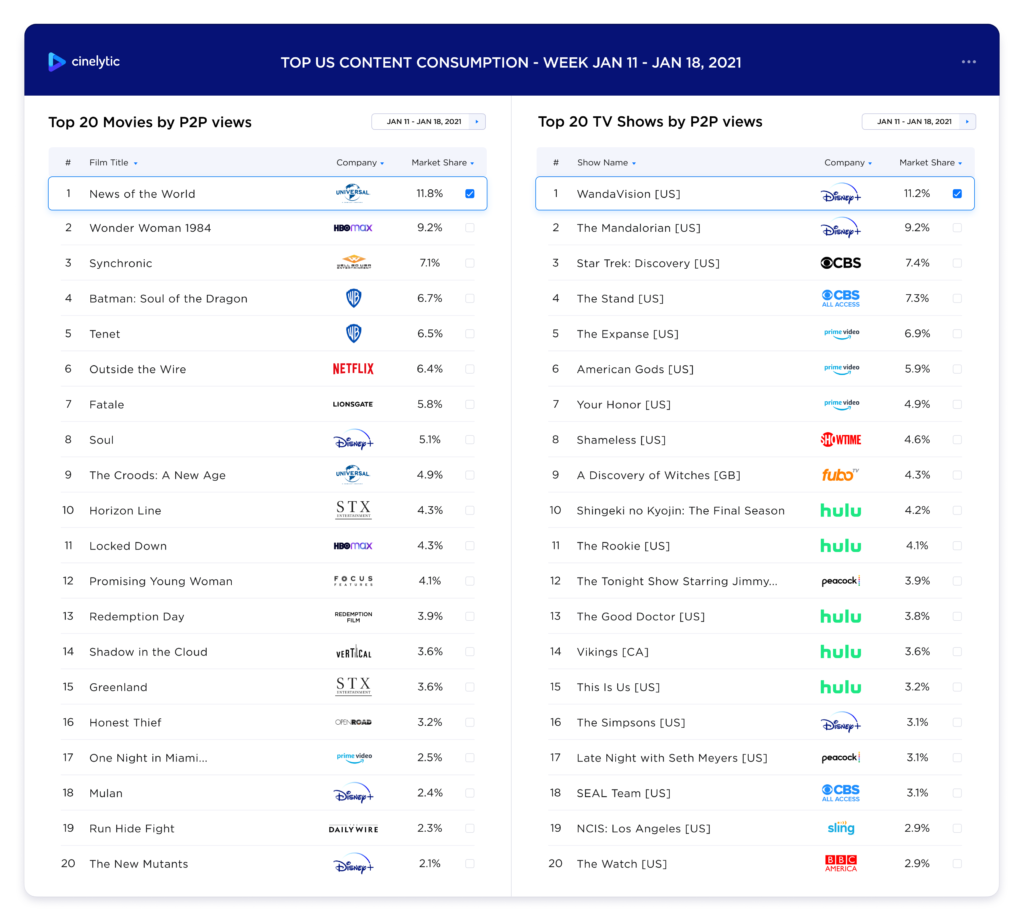

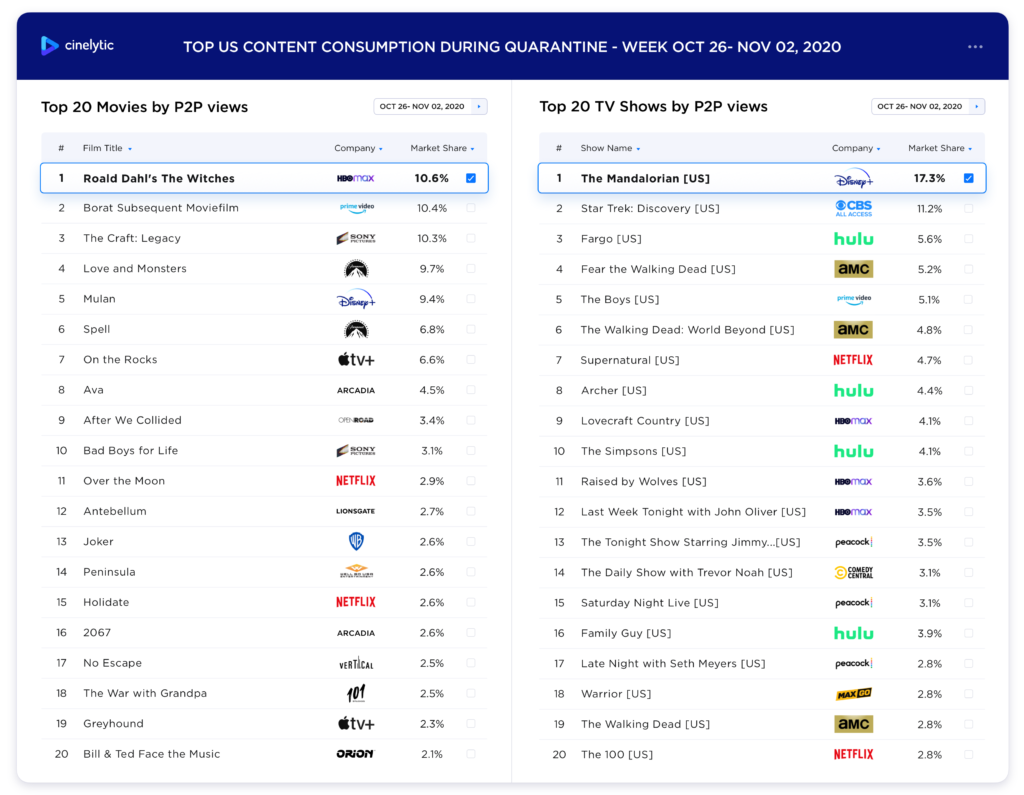

Streaming Success?

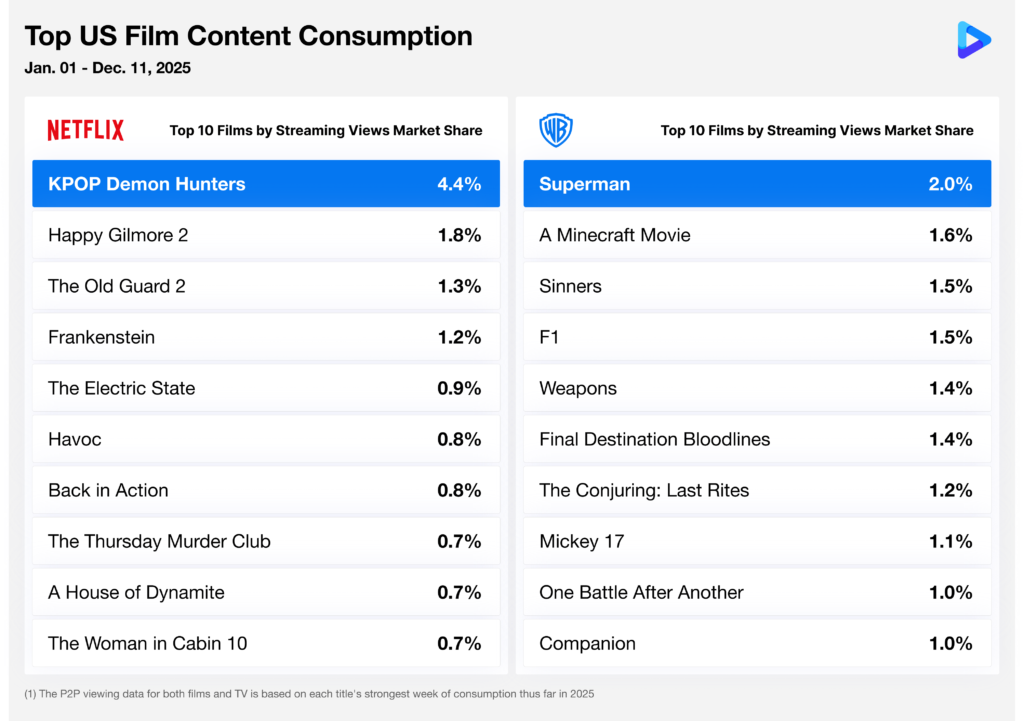

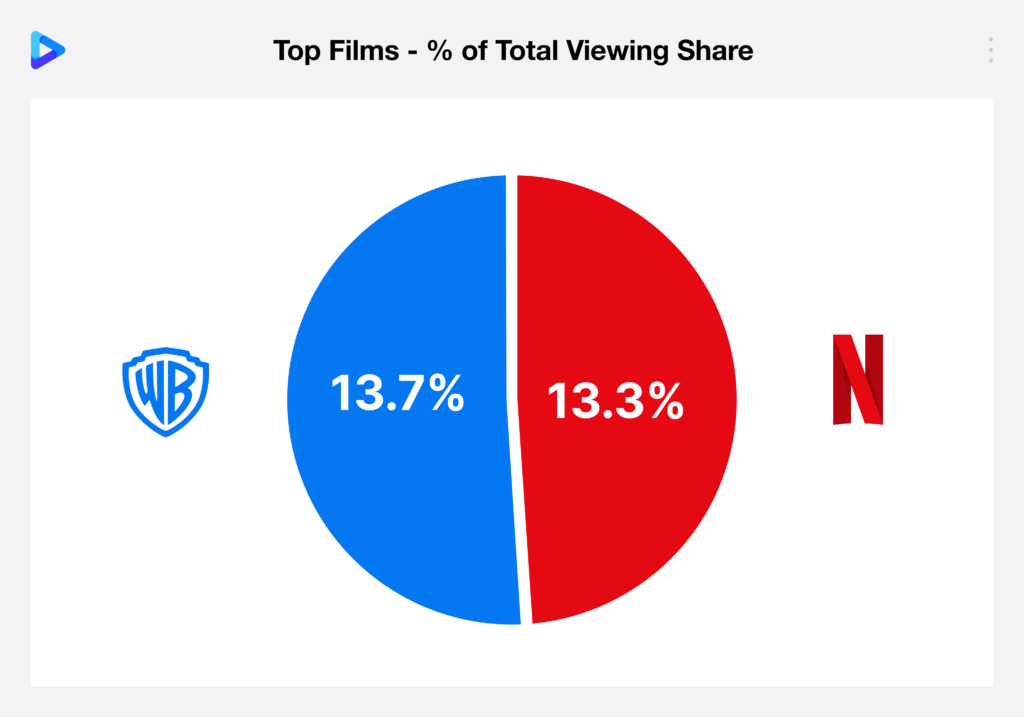

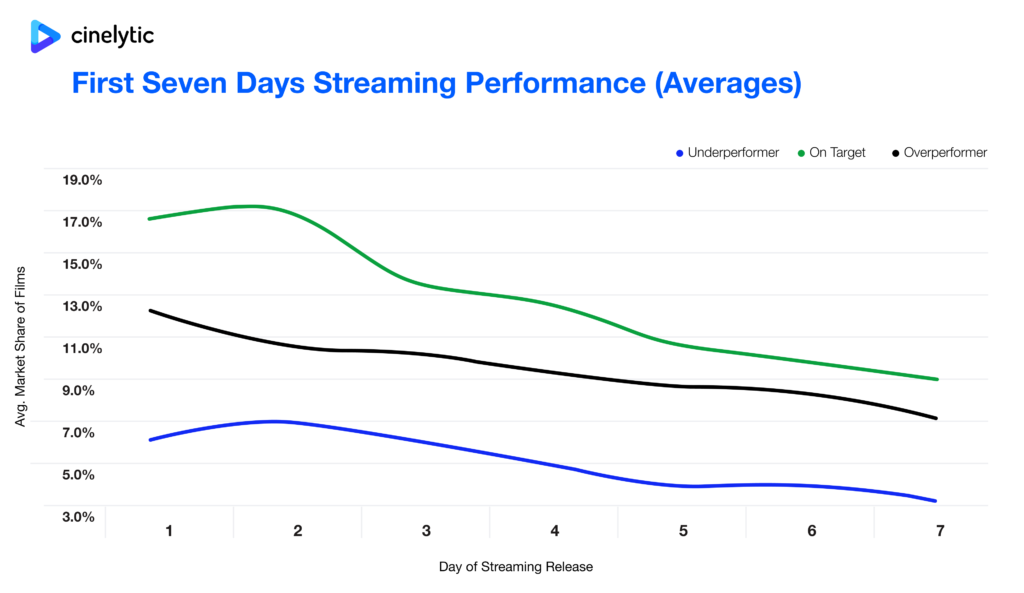

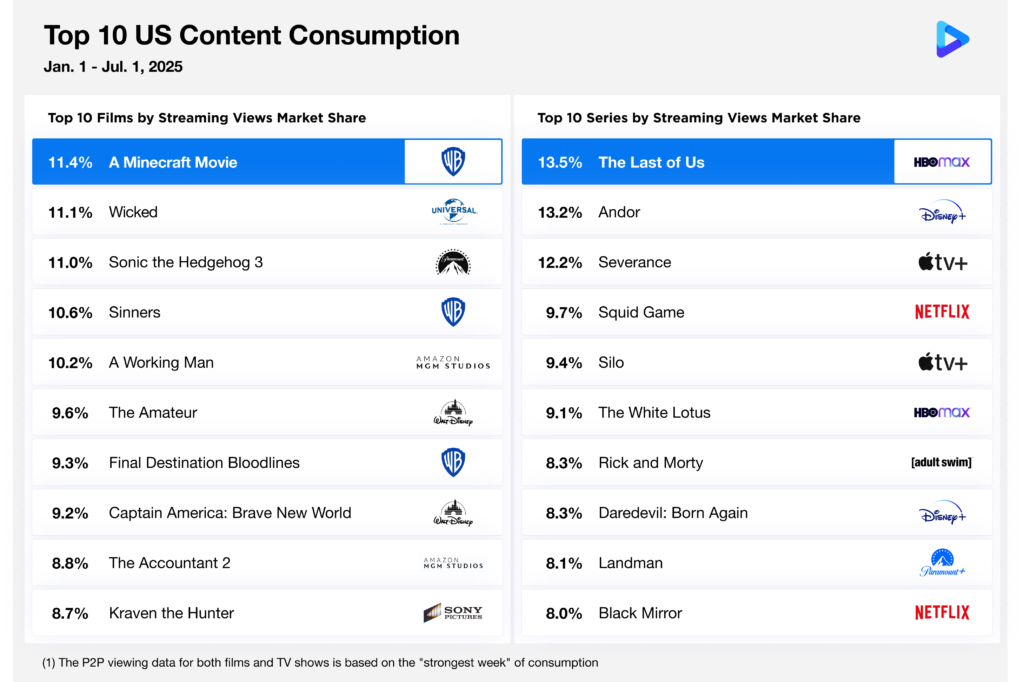

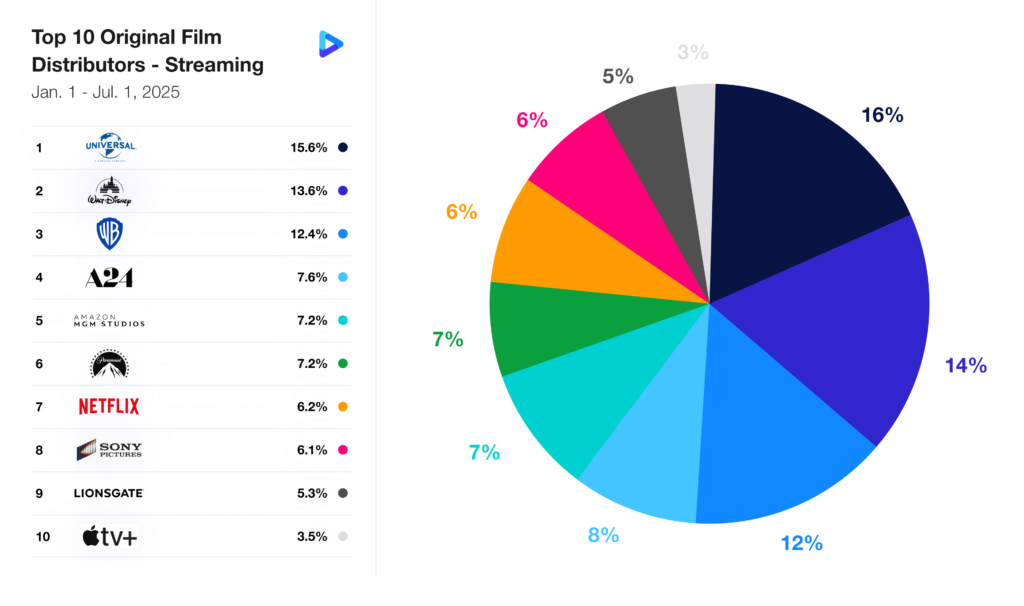

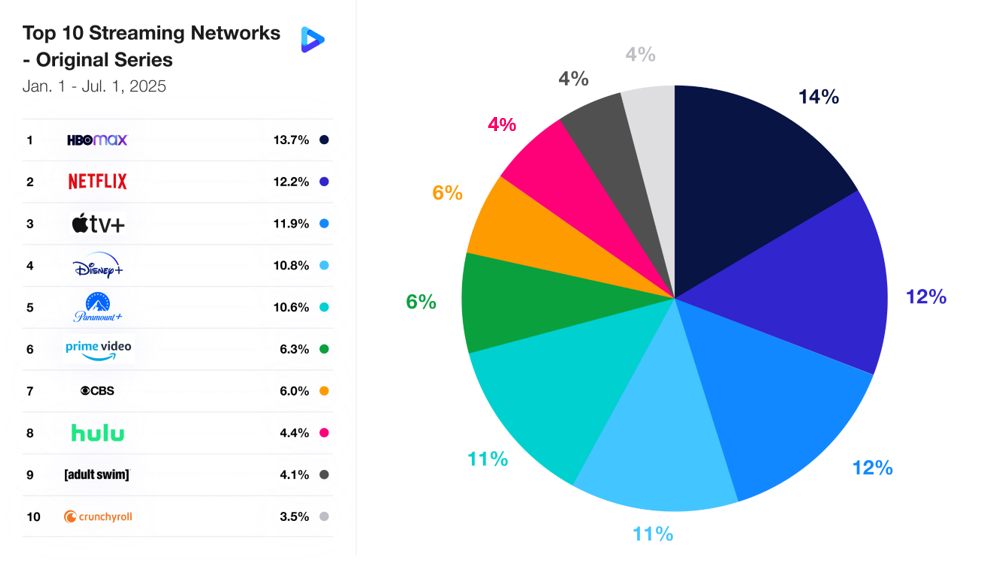

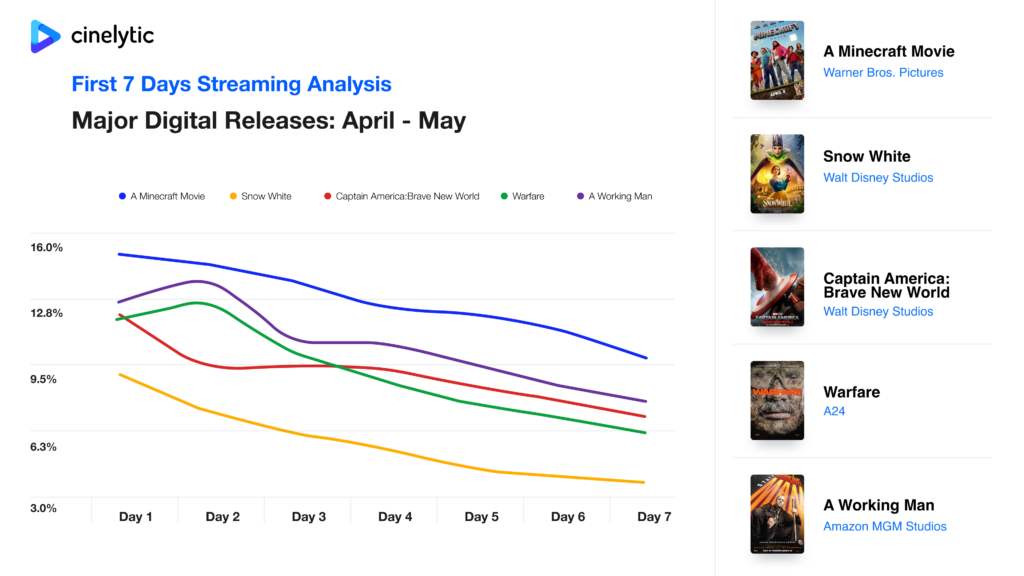

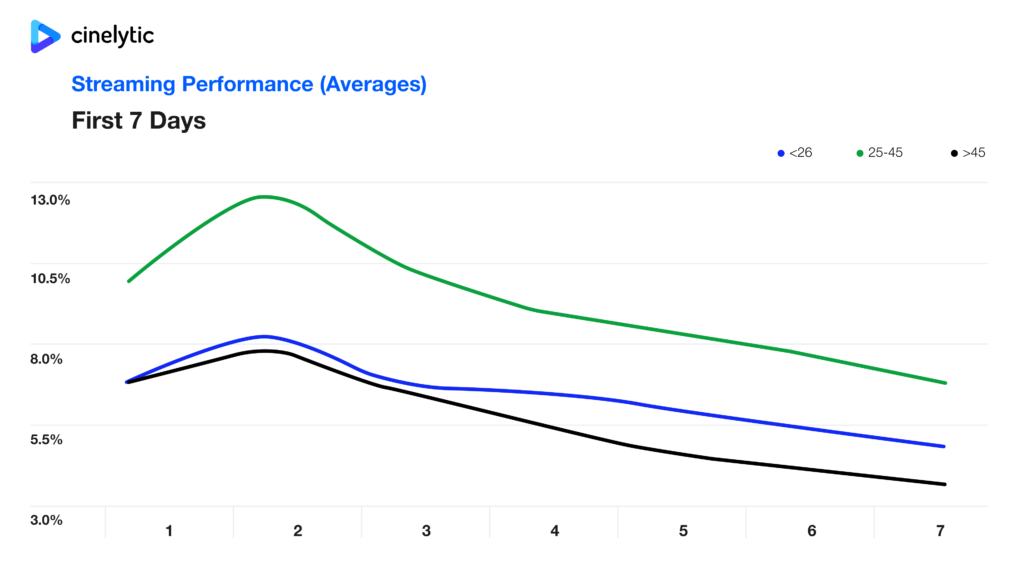

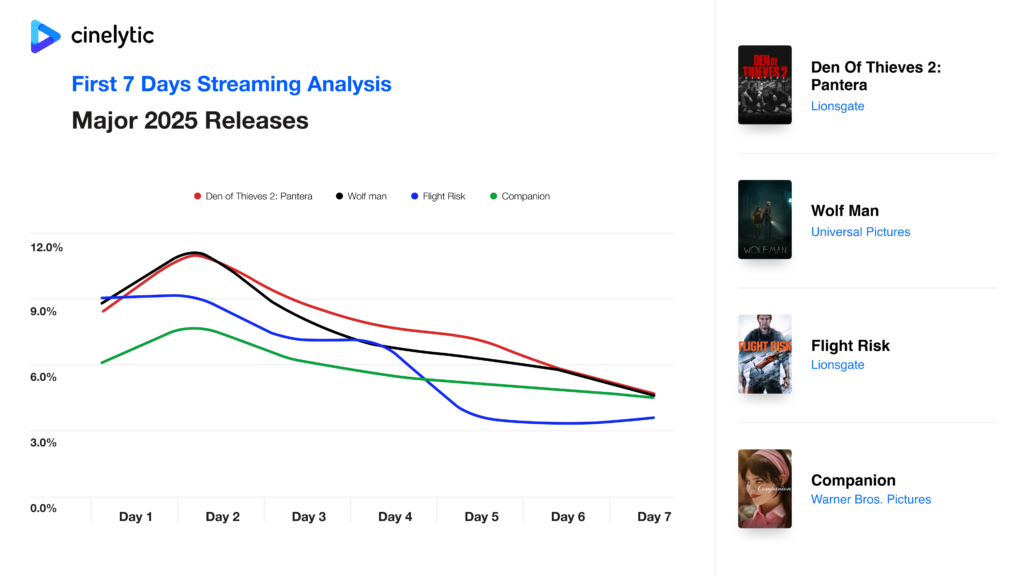

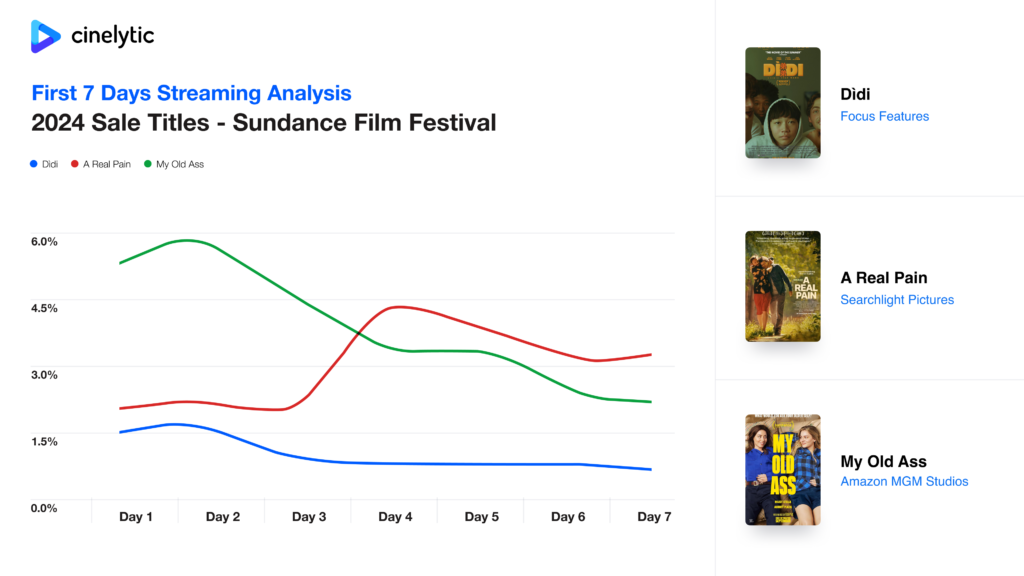

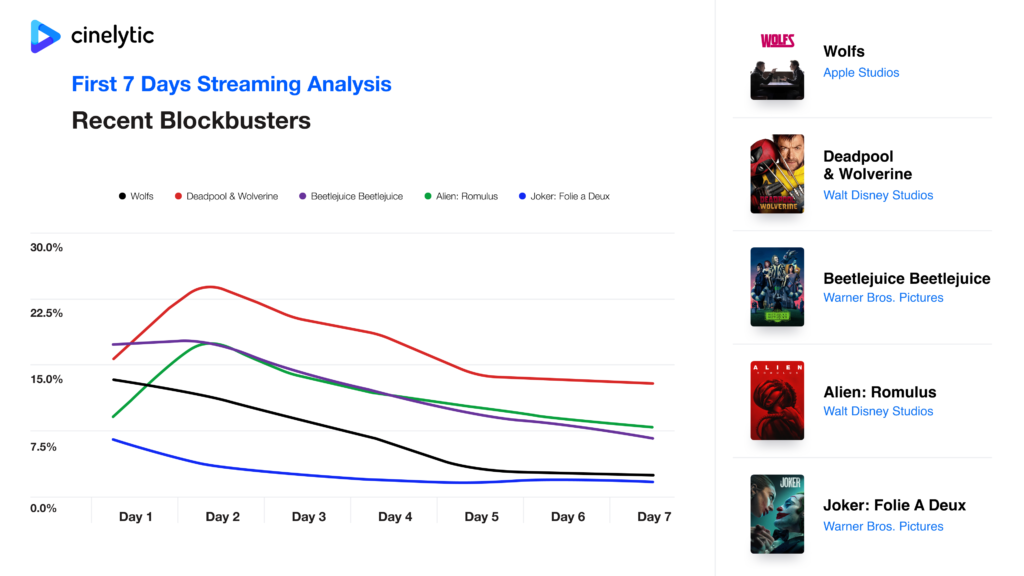

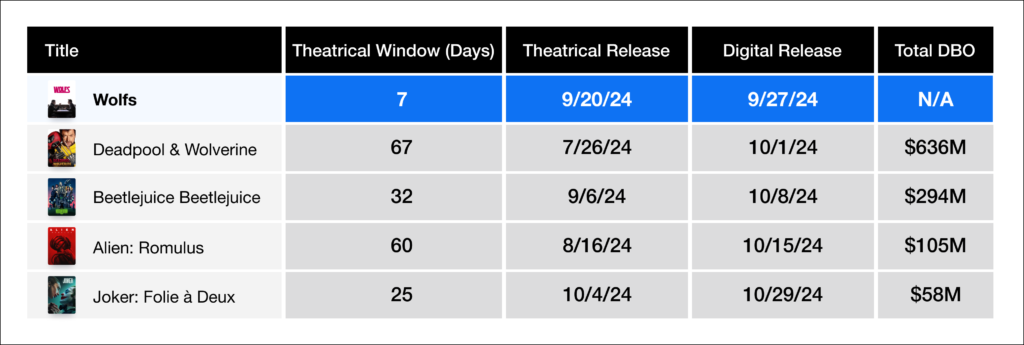

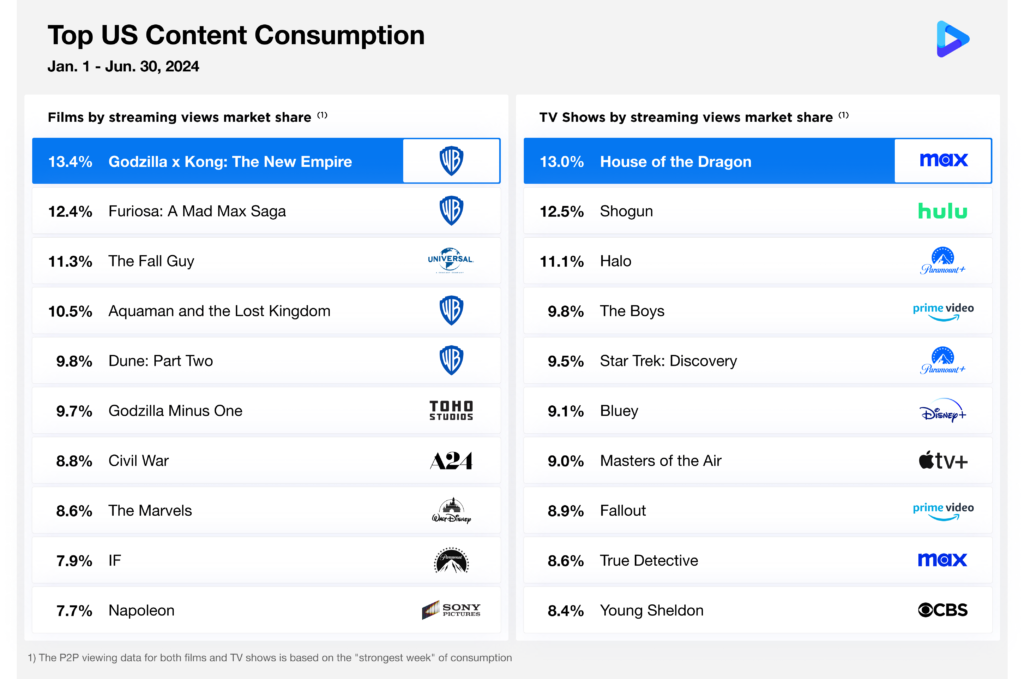

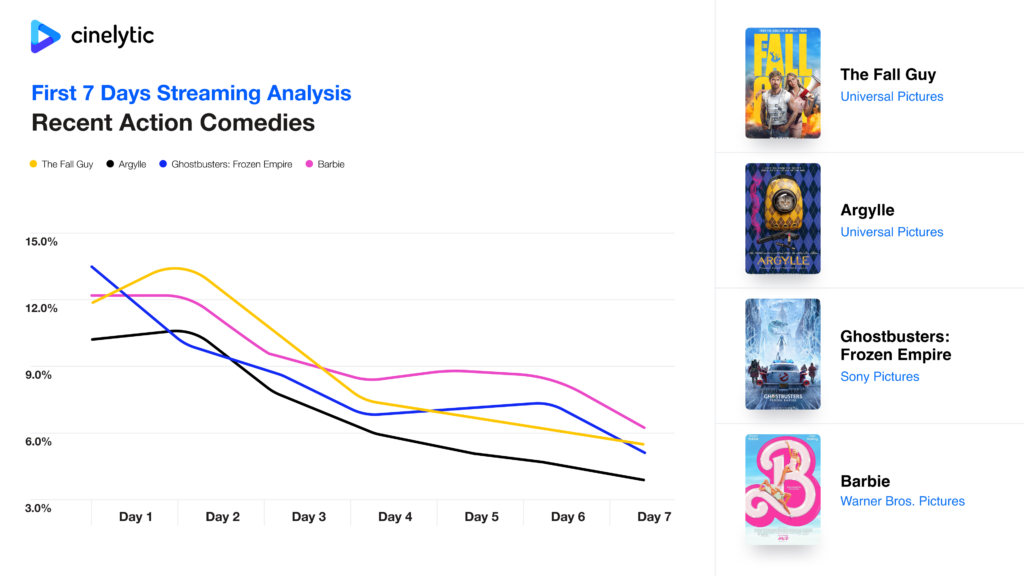

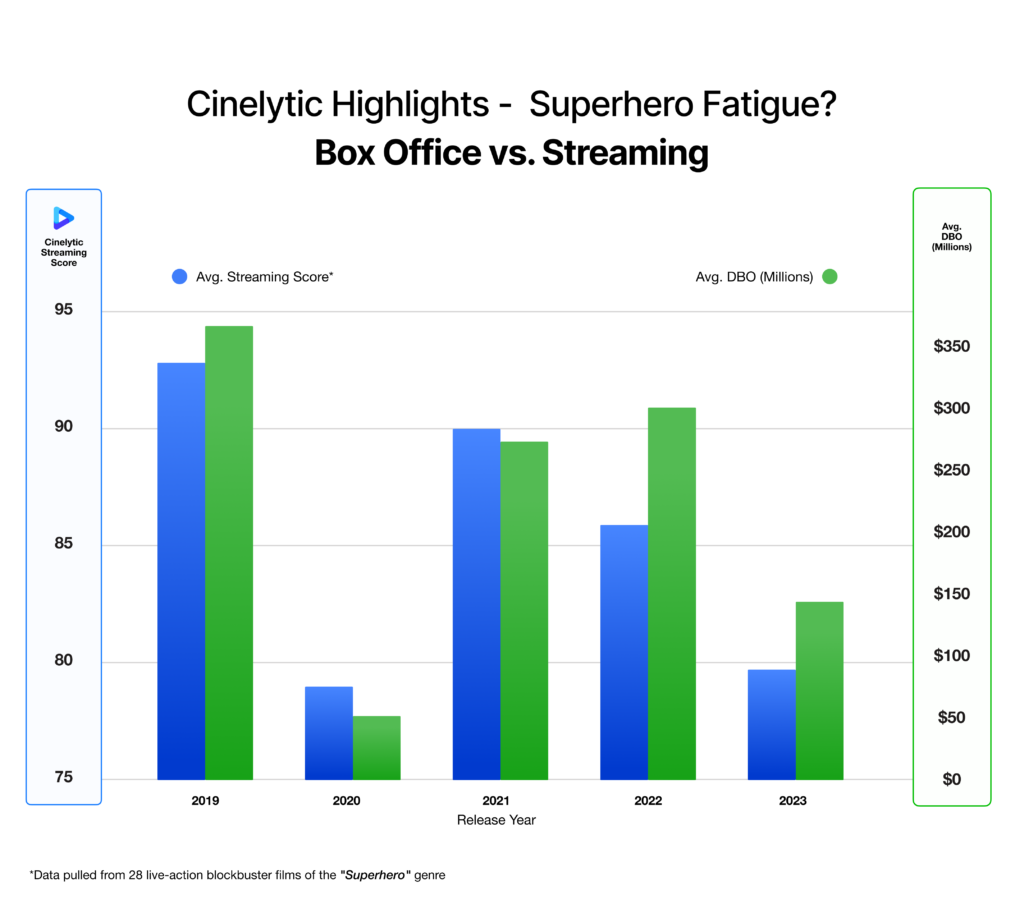

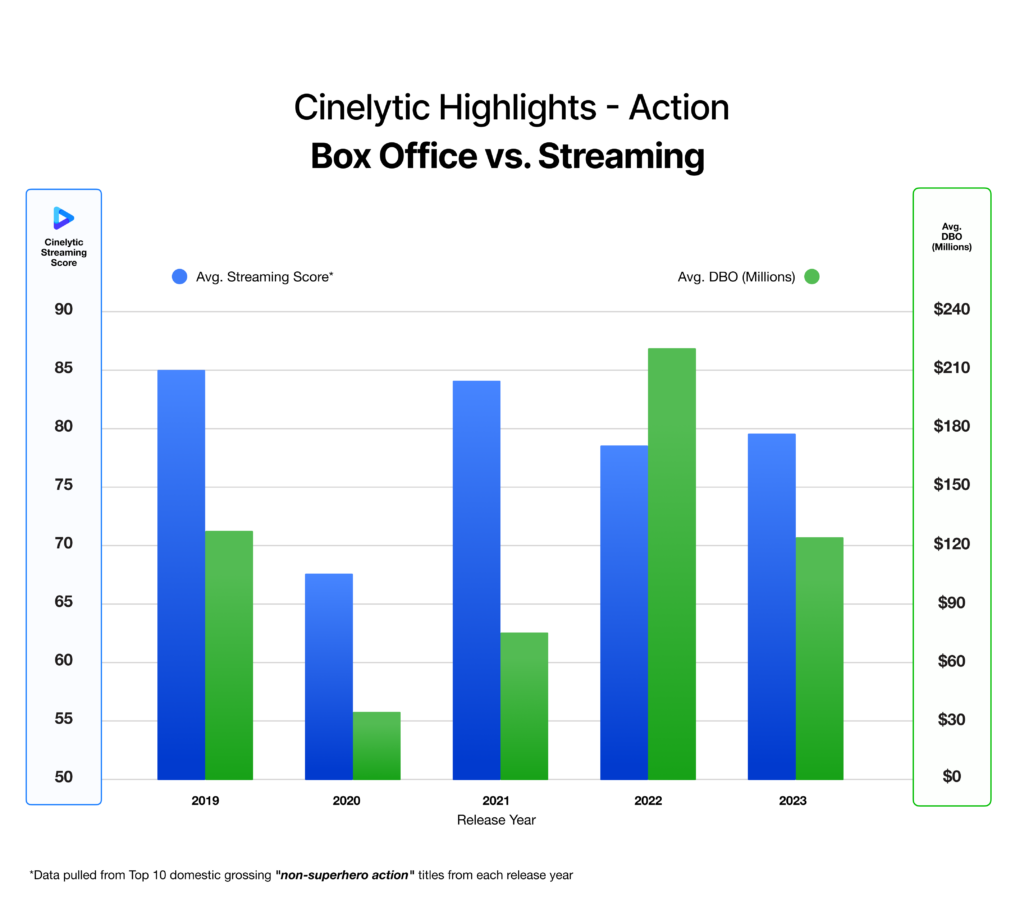

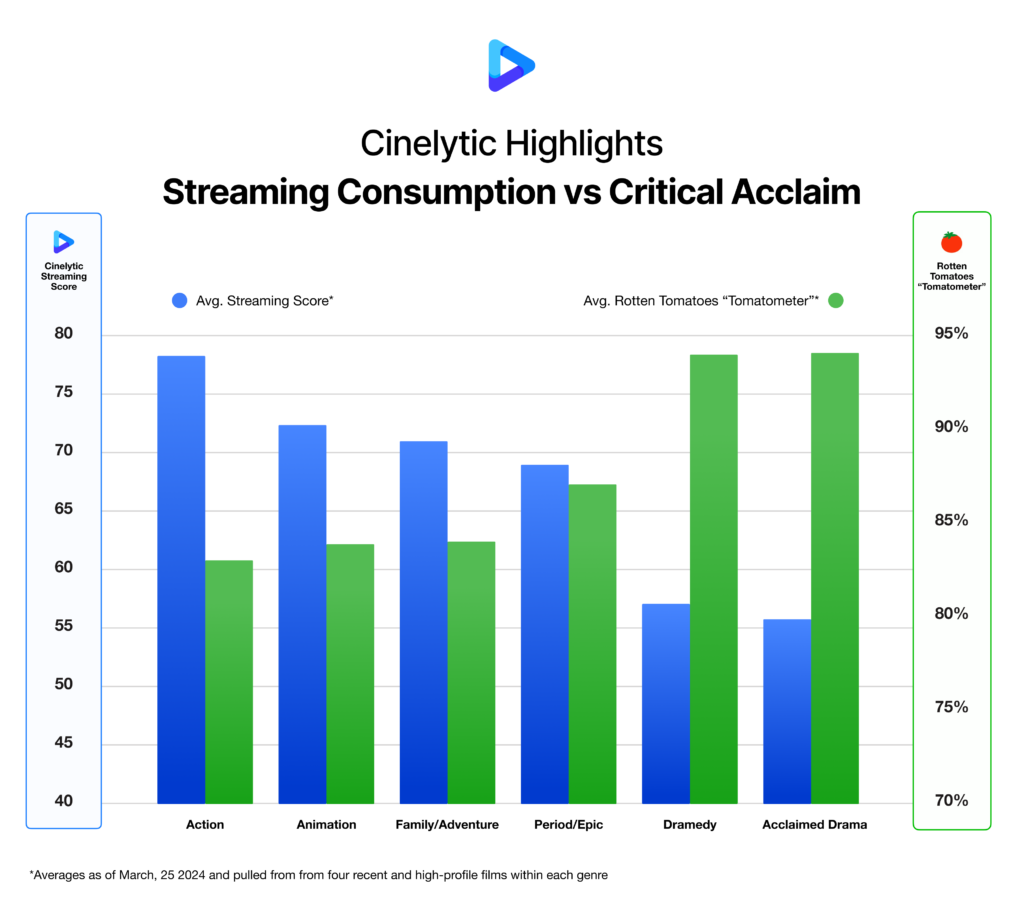

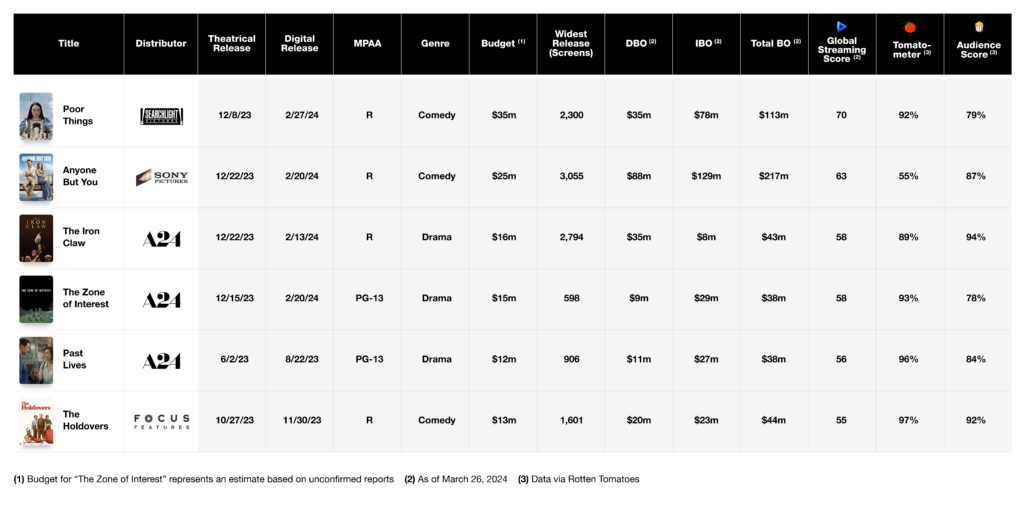

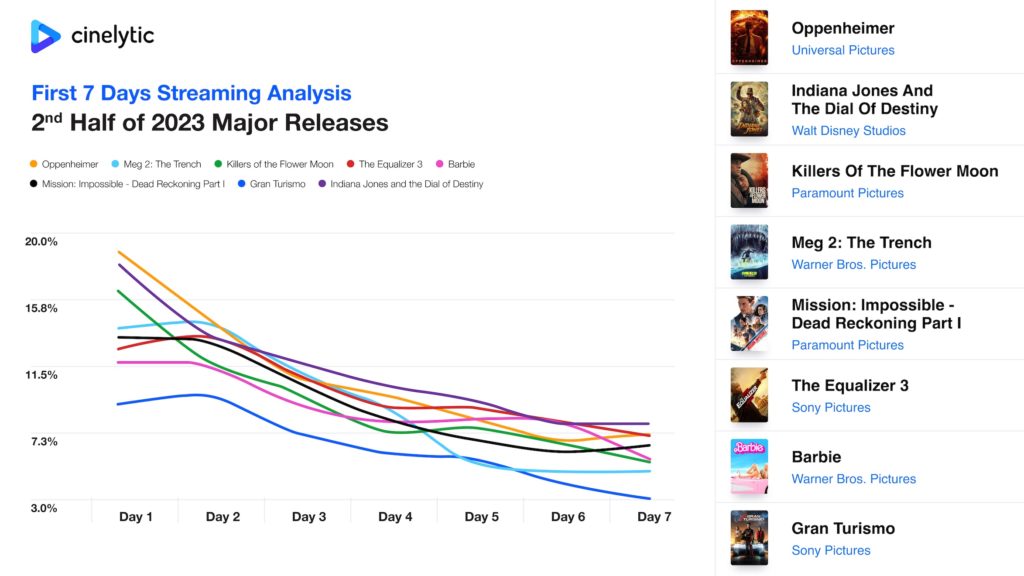

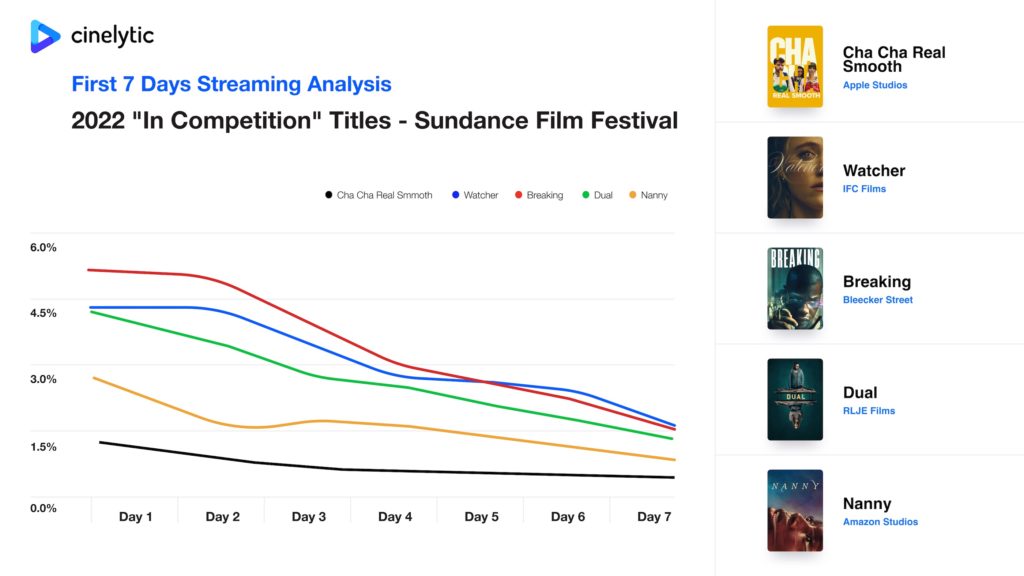

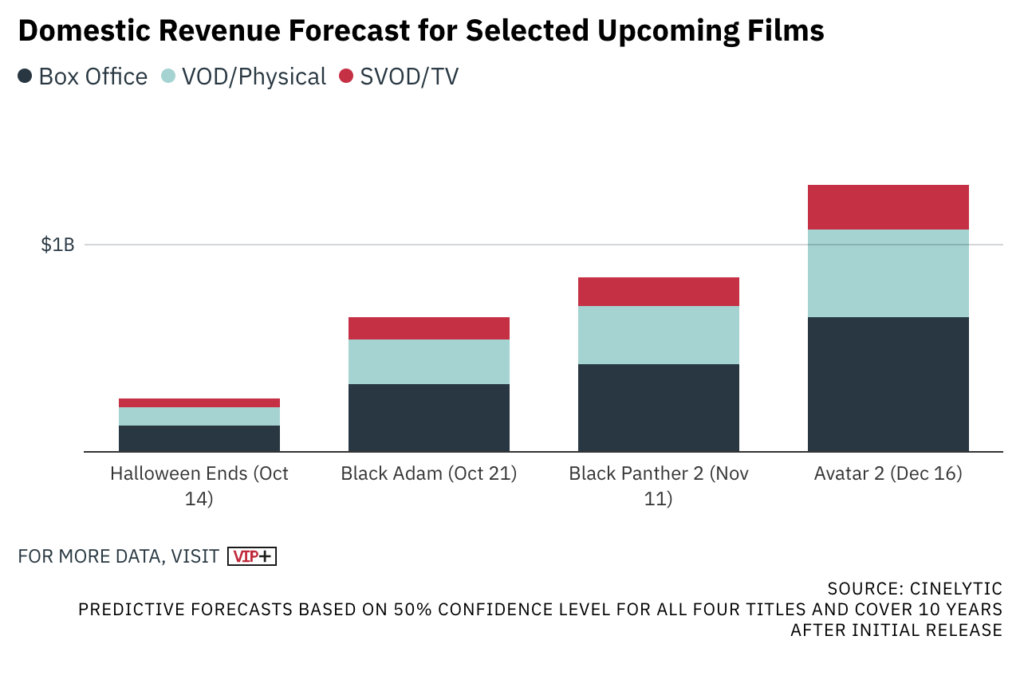

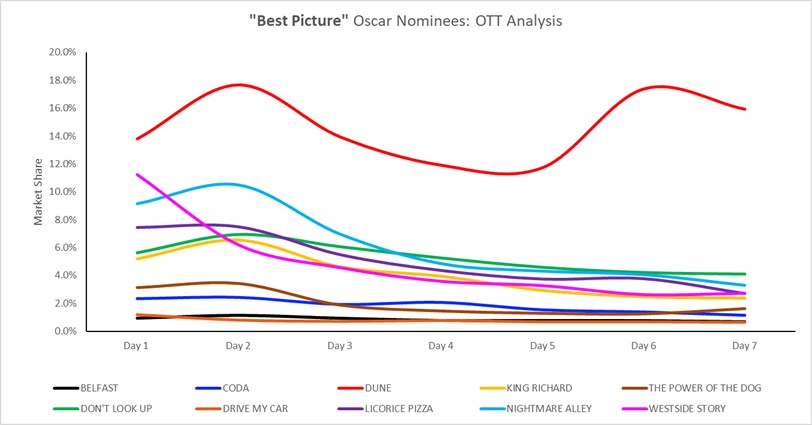

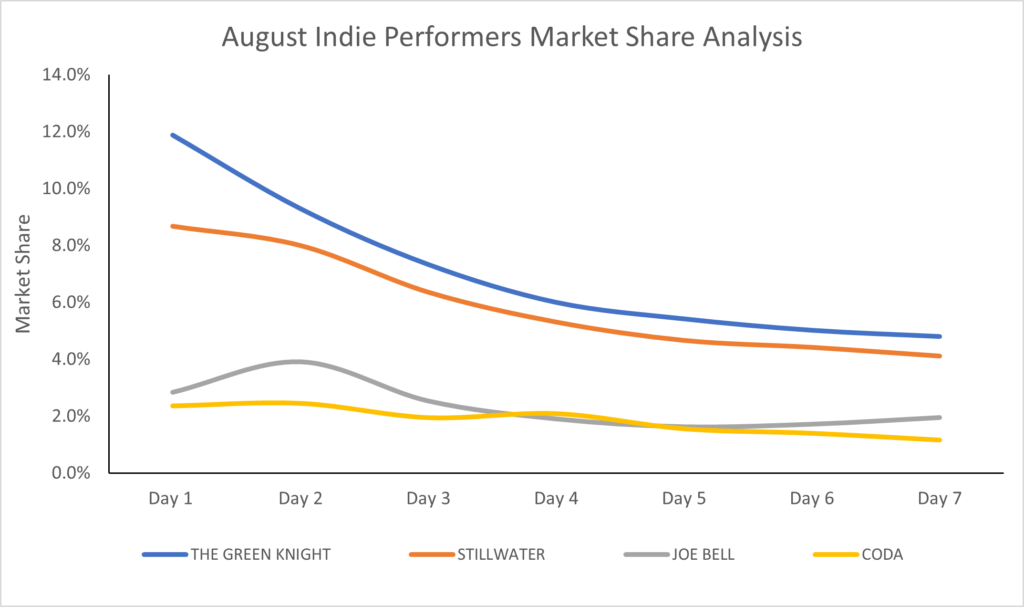

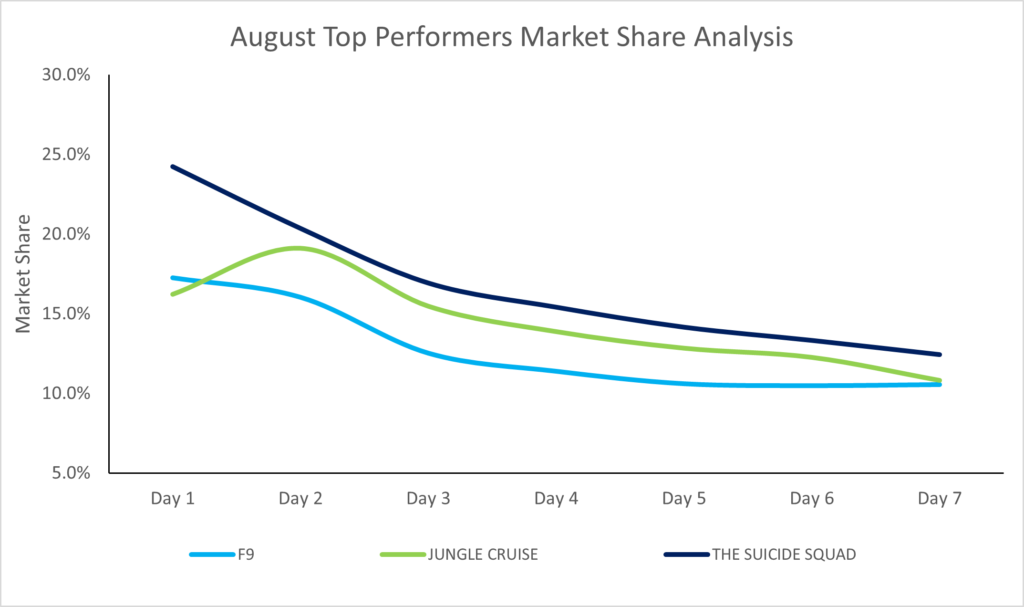

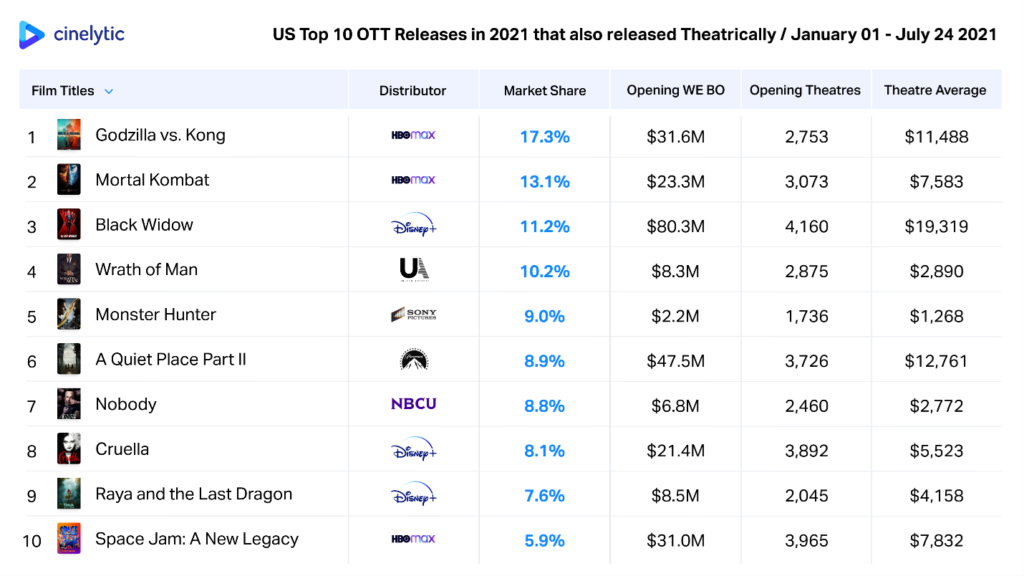

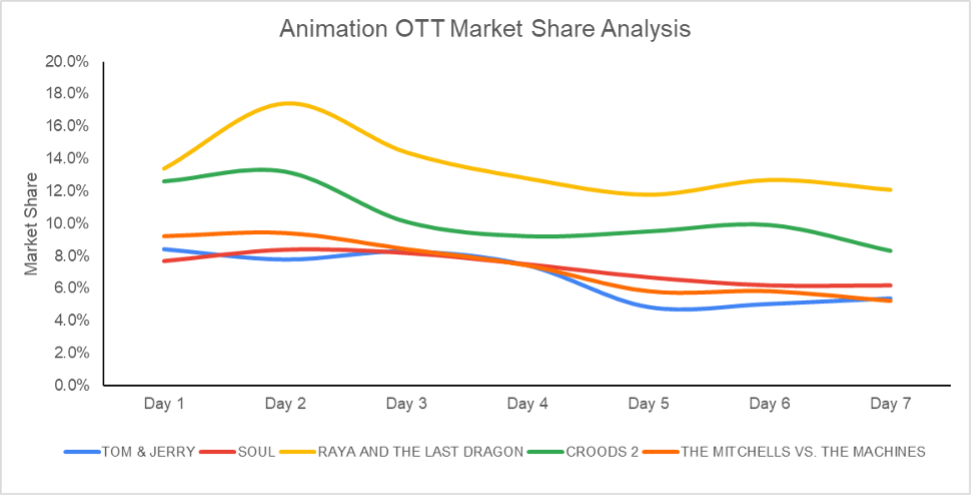

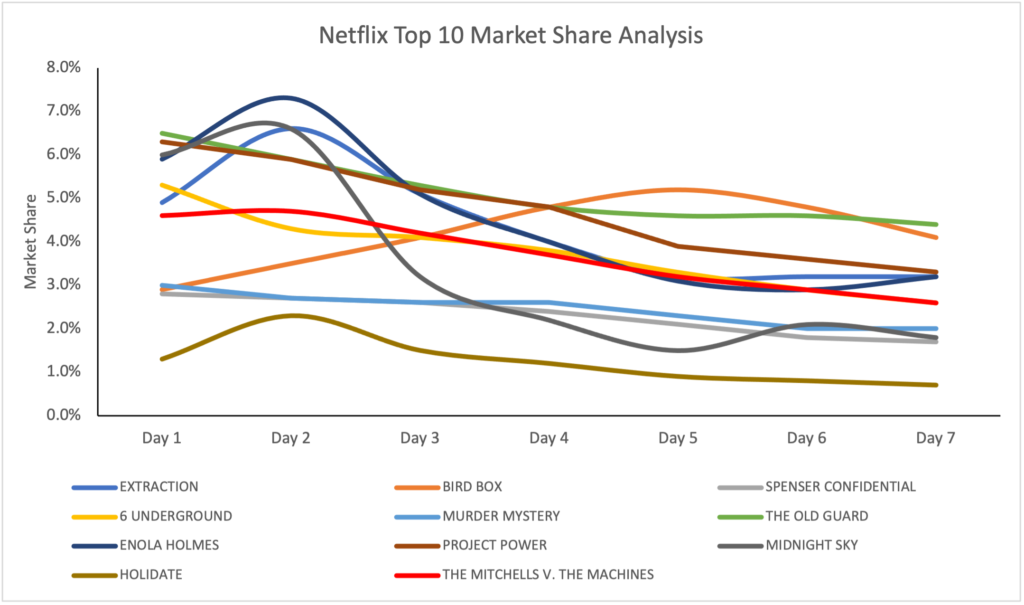

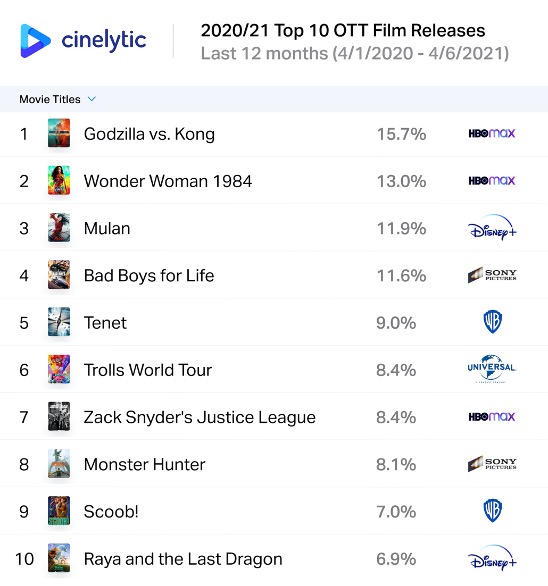

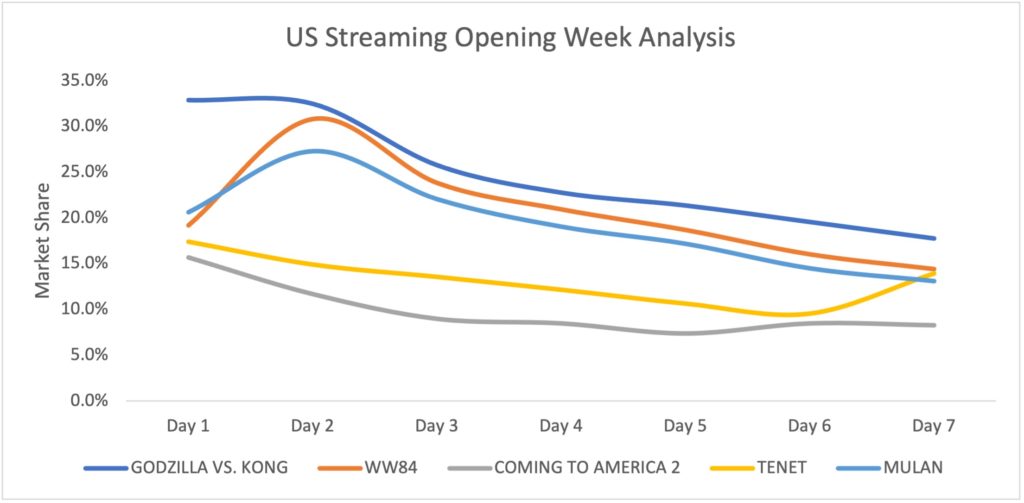

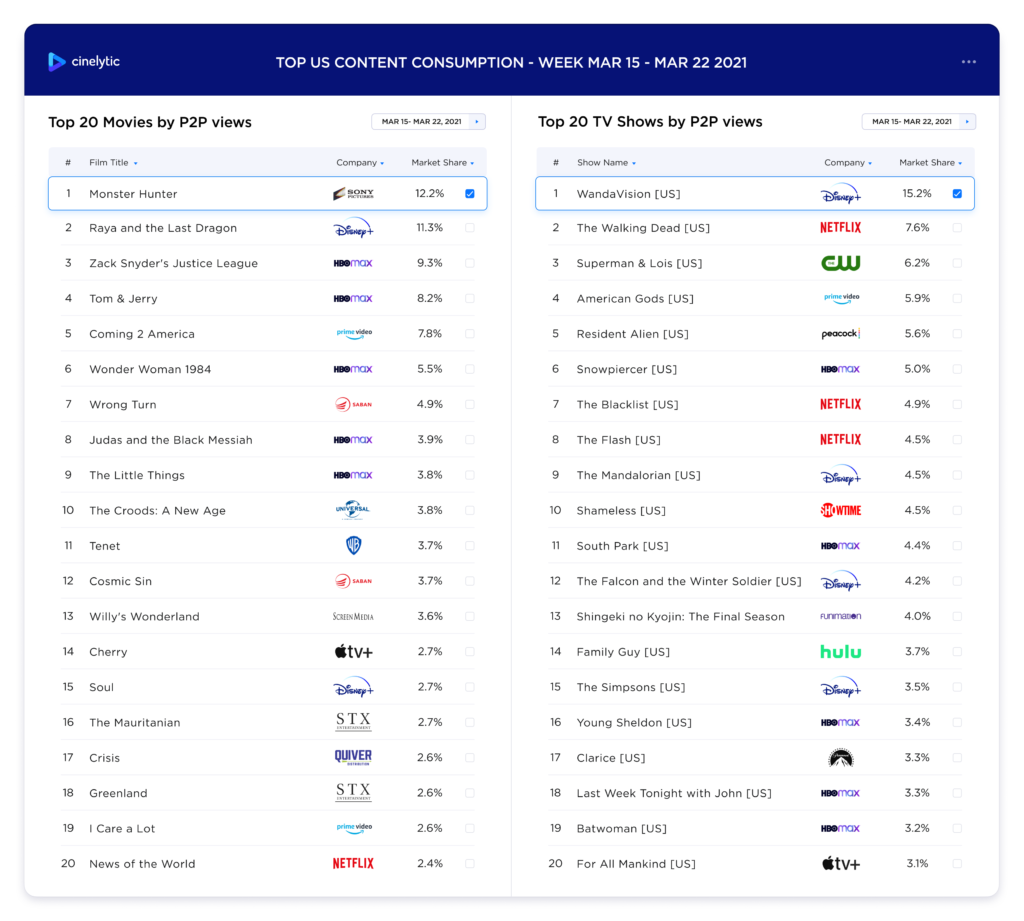

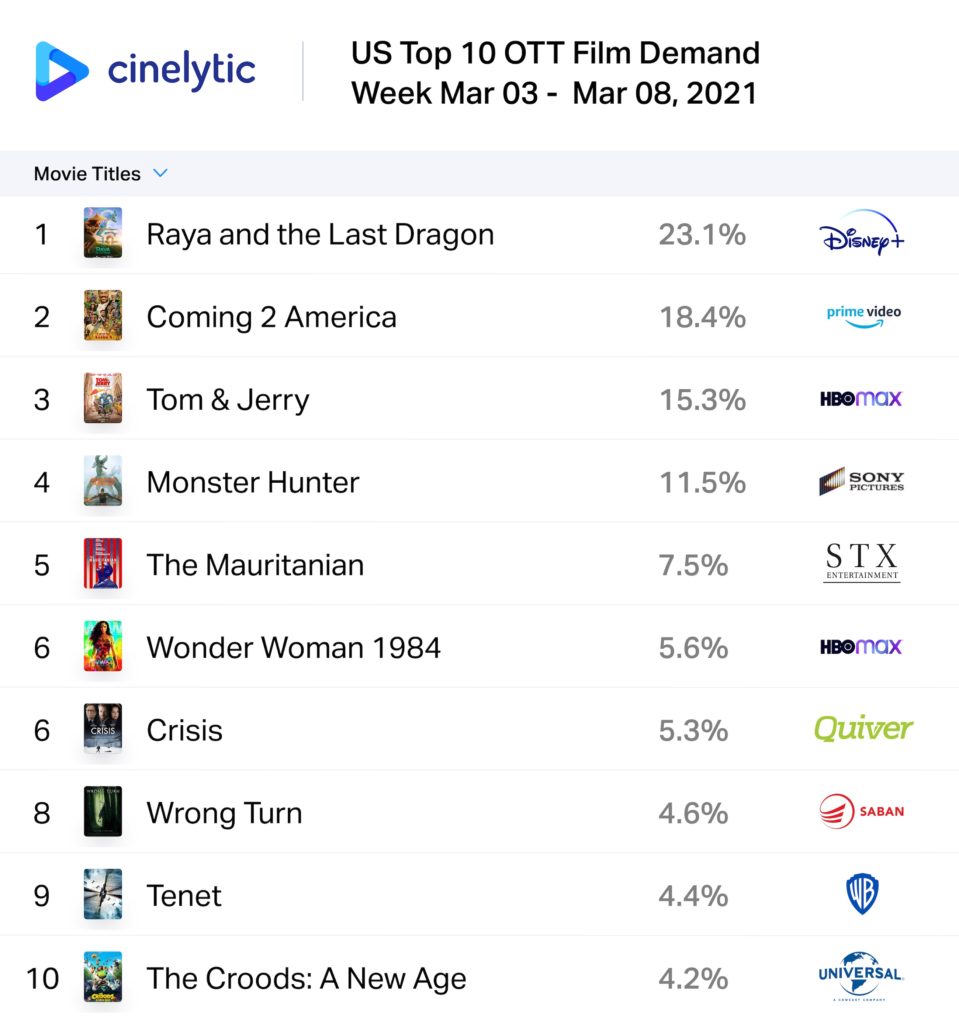

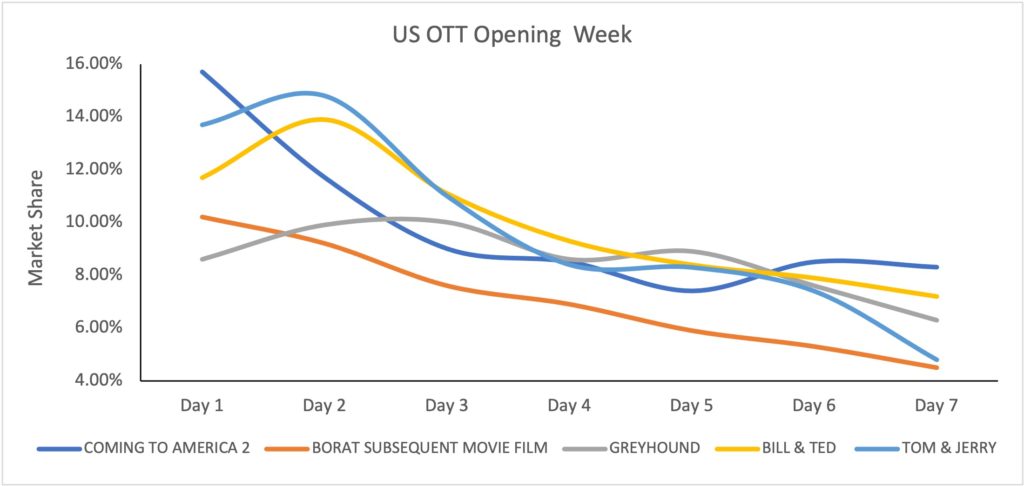

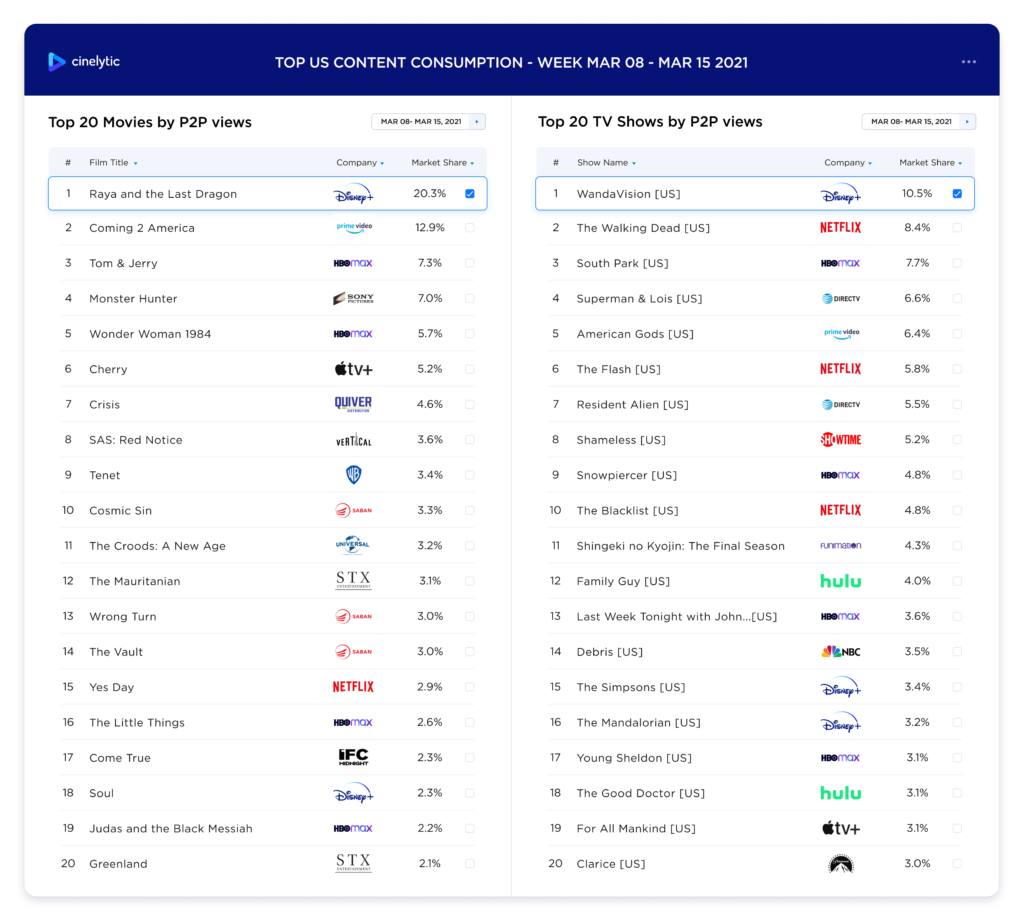

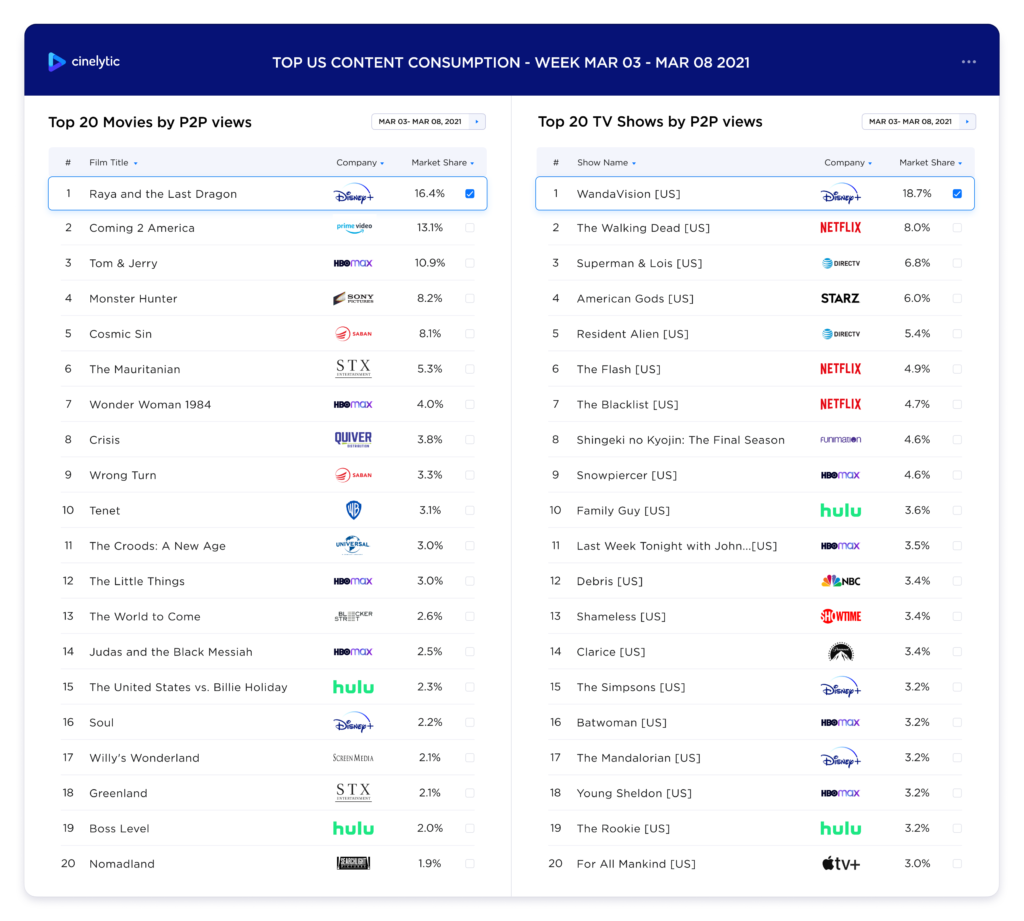

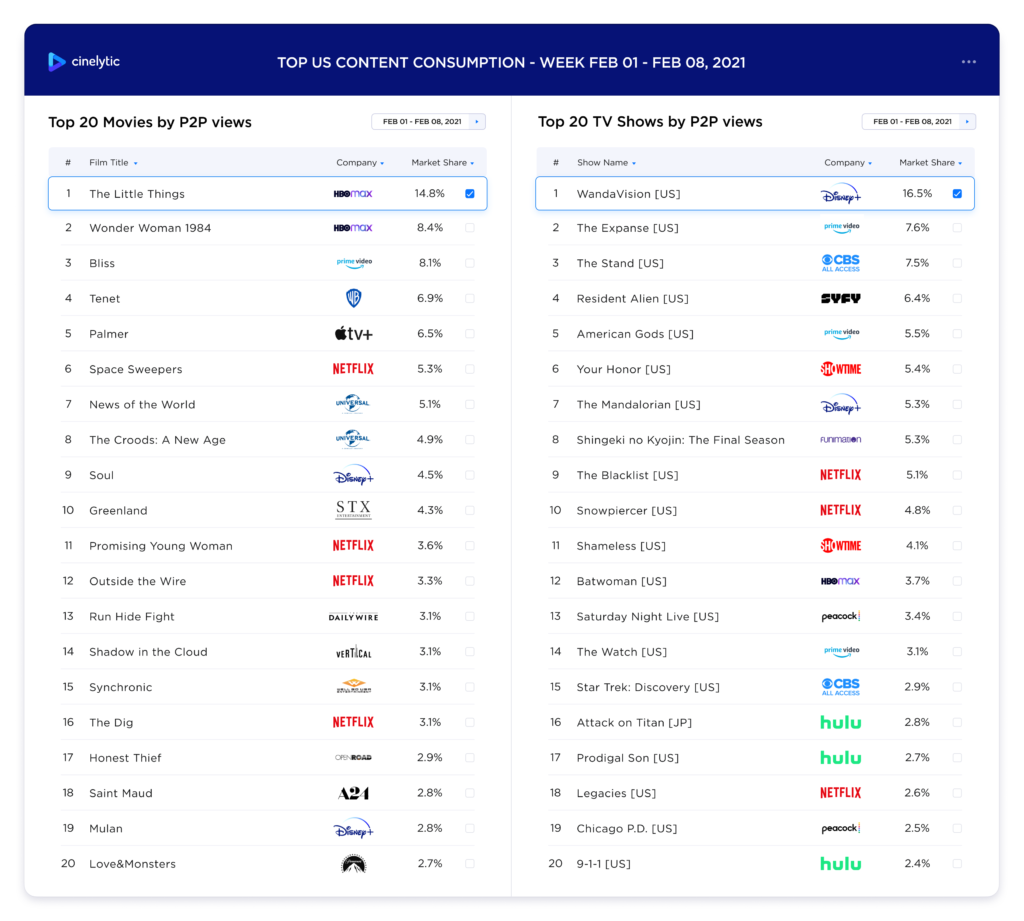

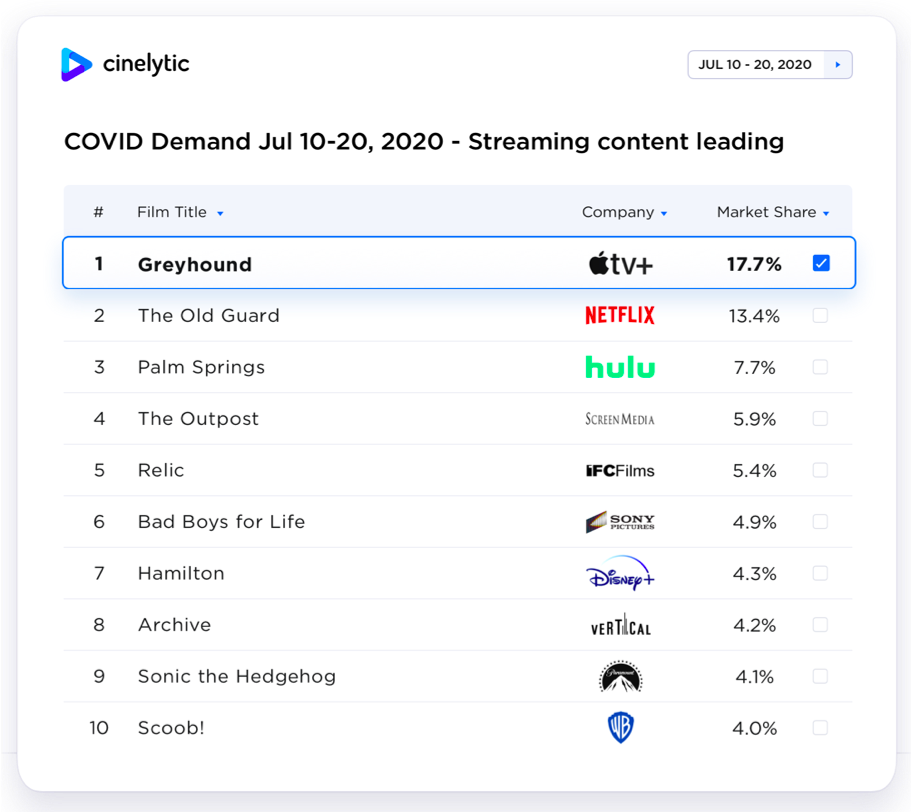

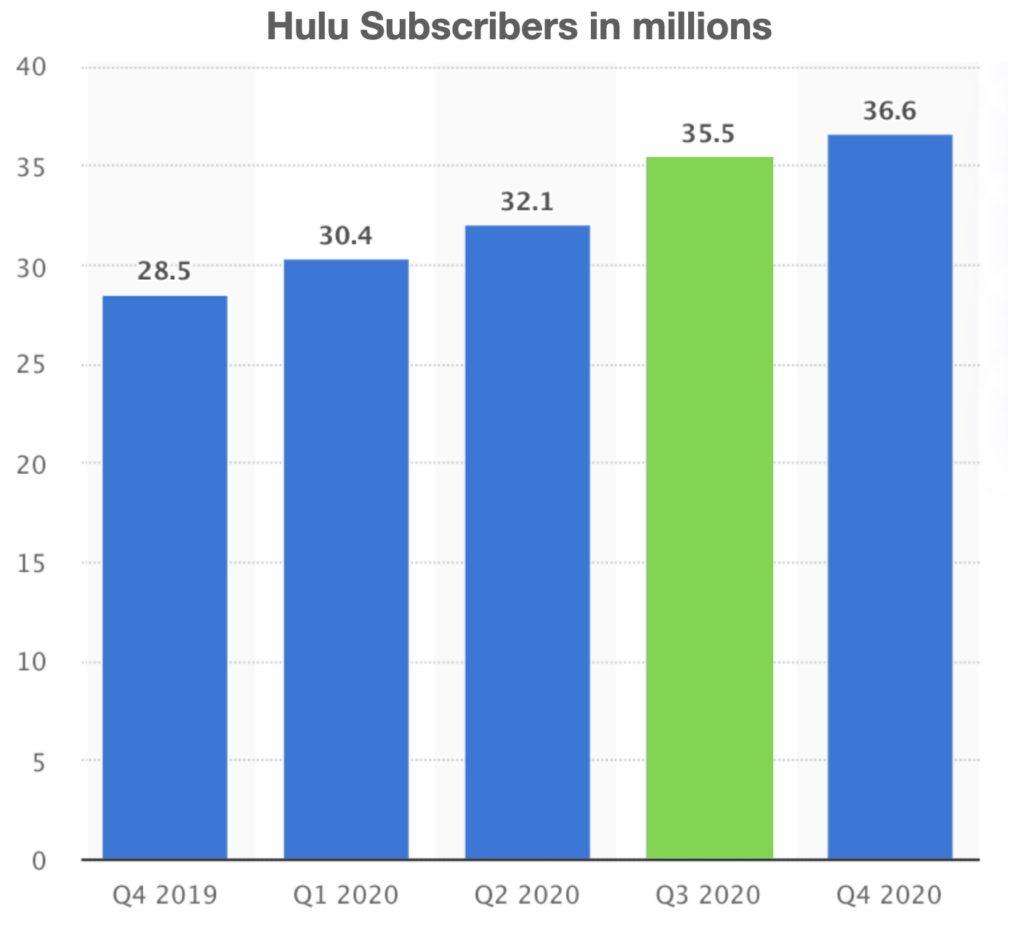

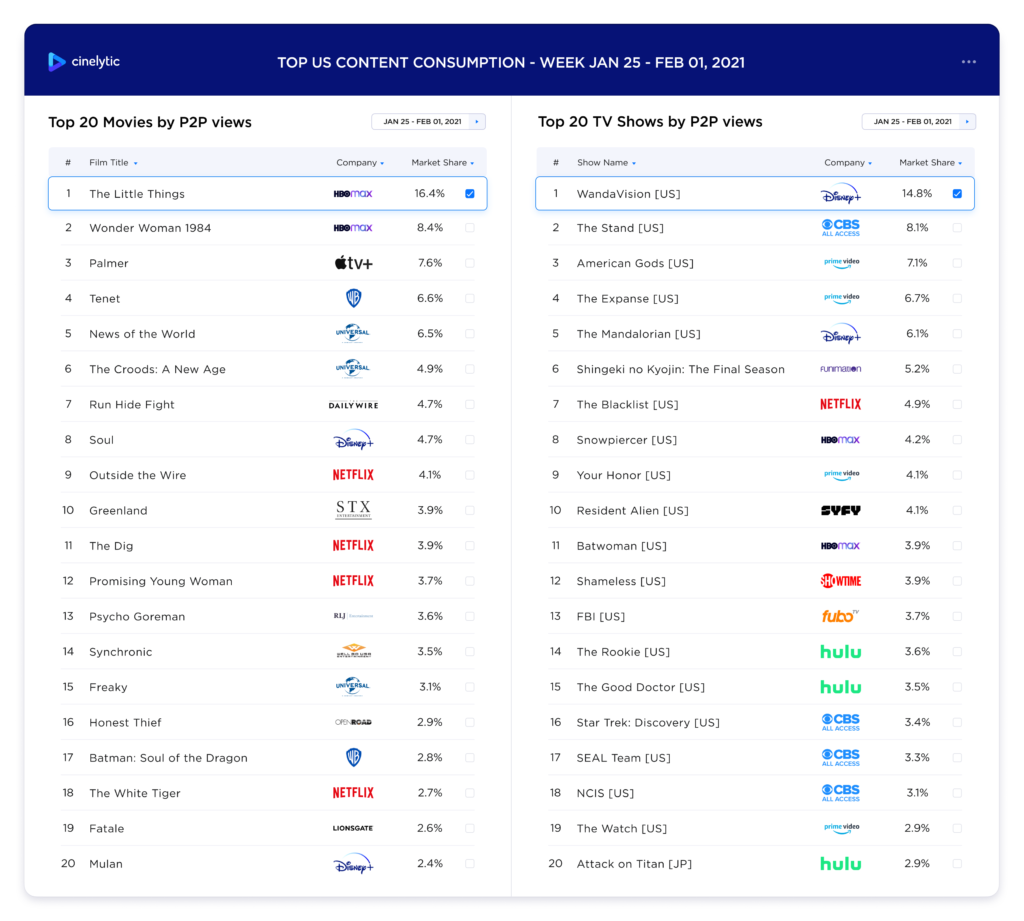

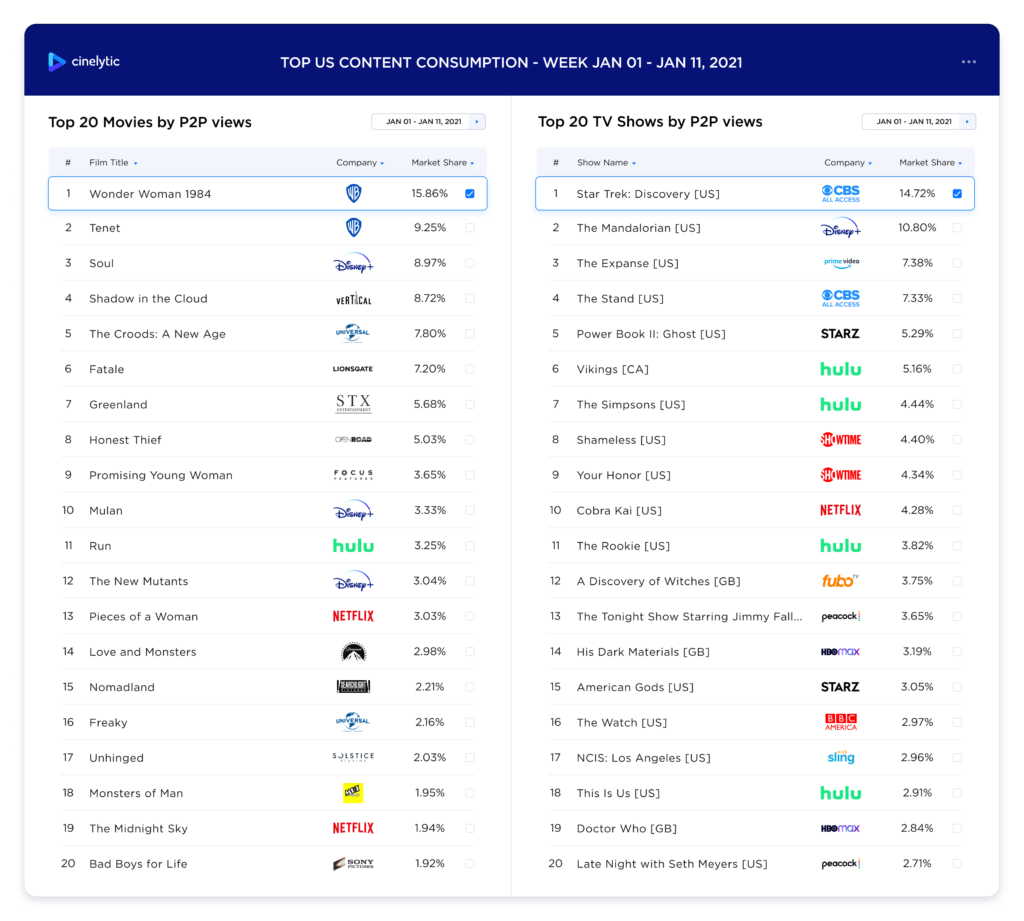

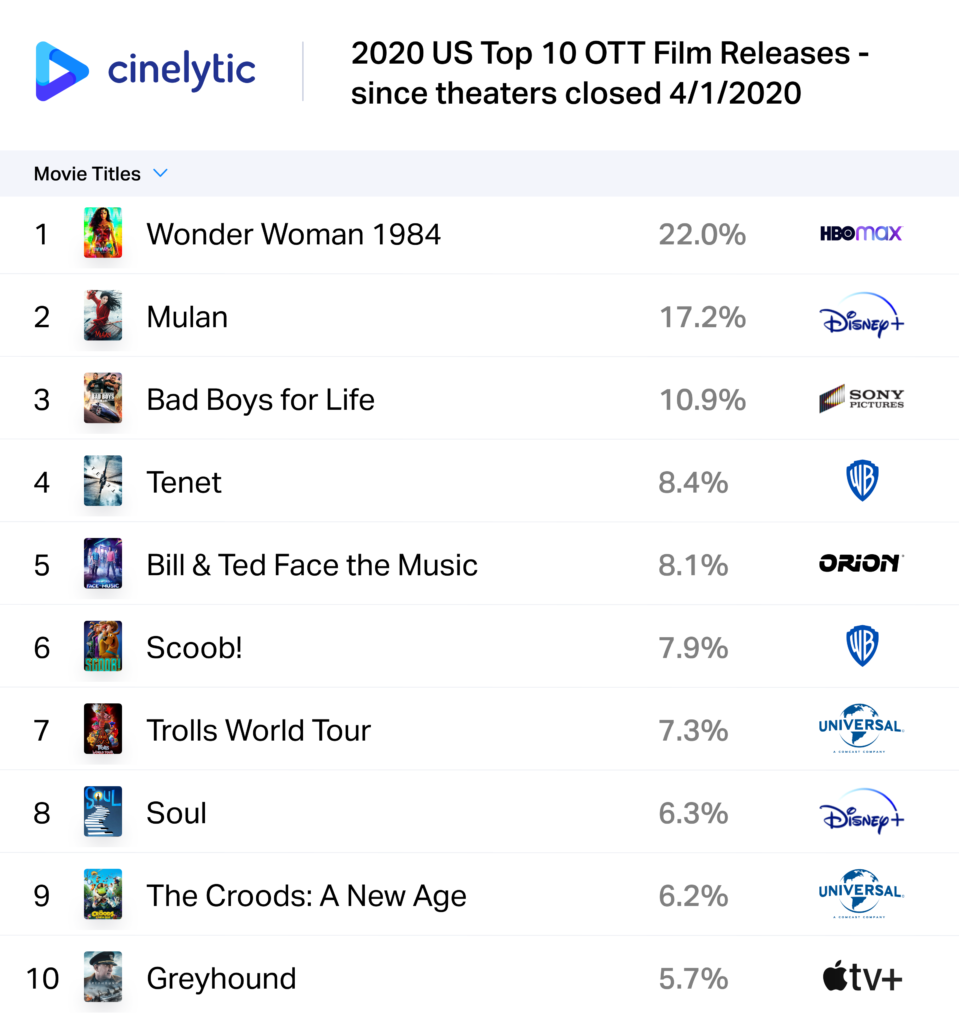

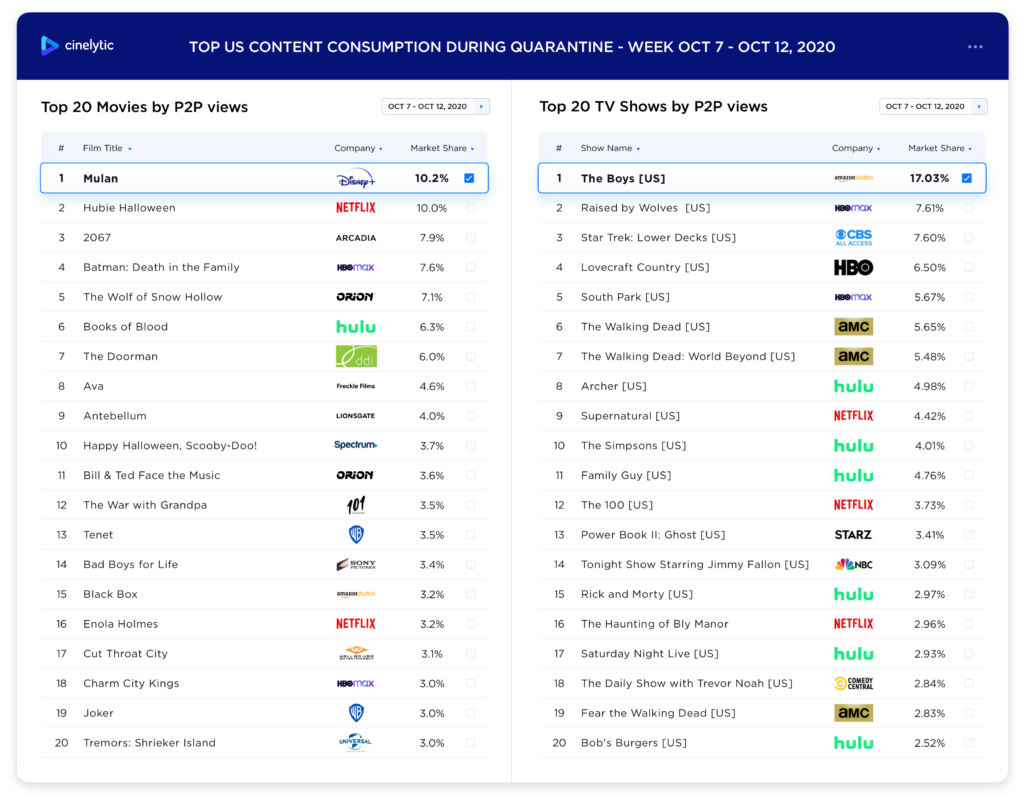

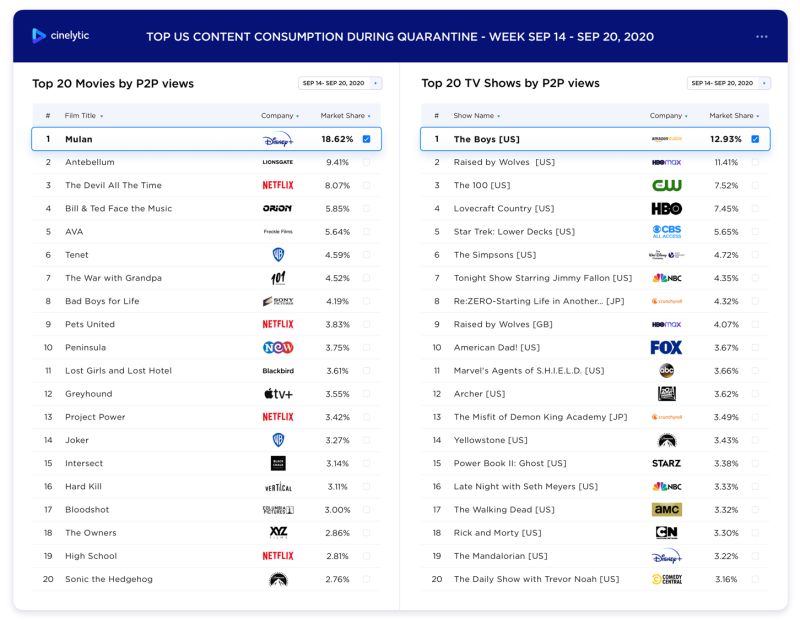

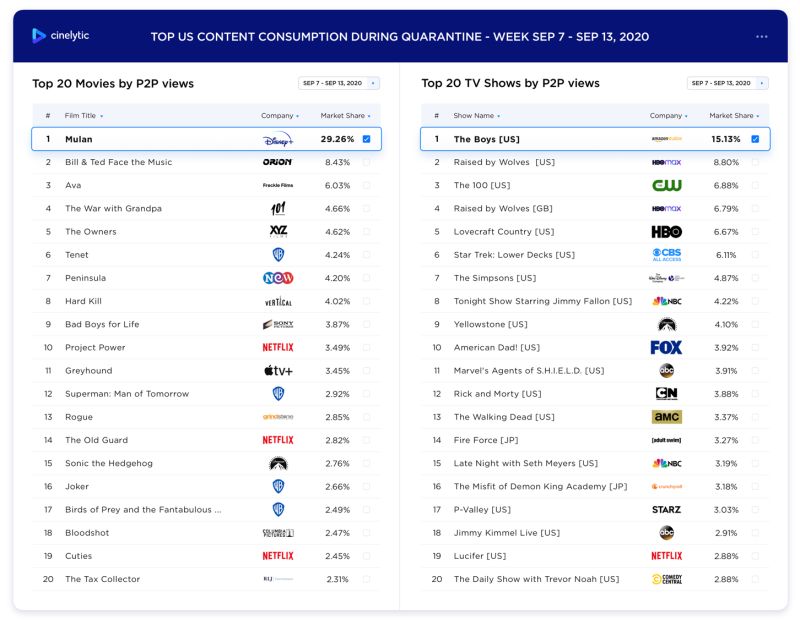

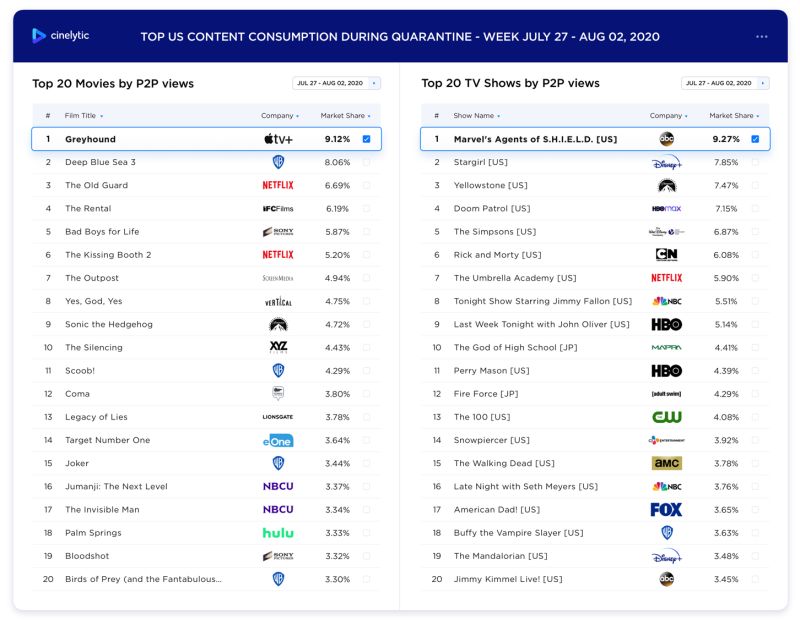

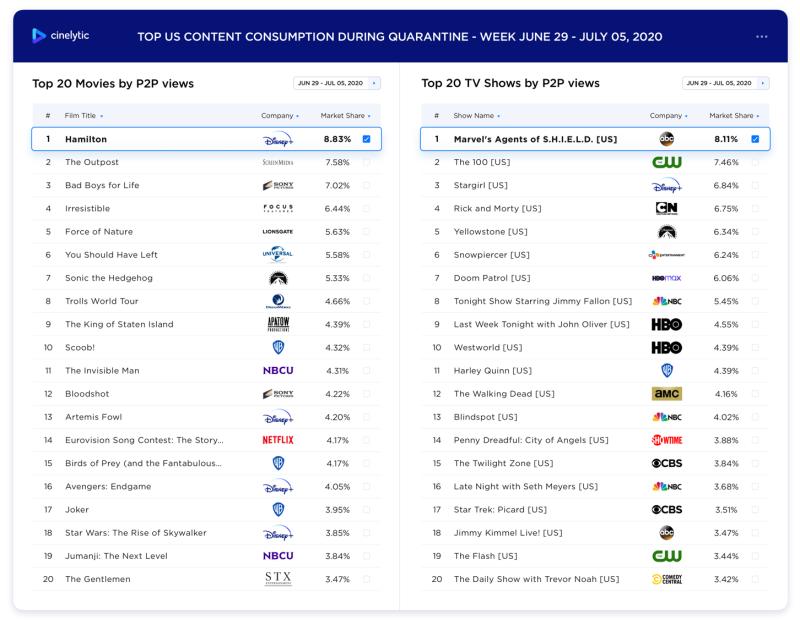

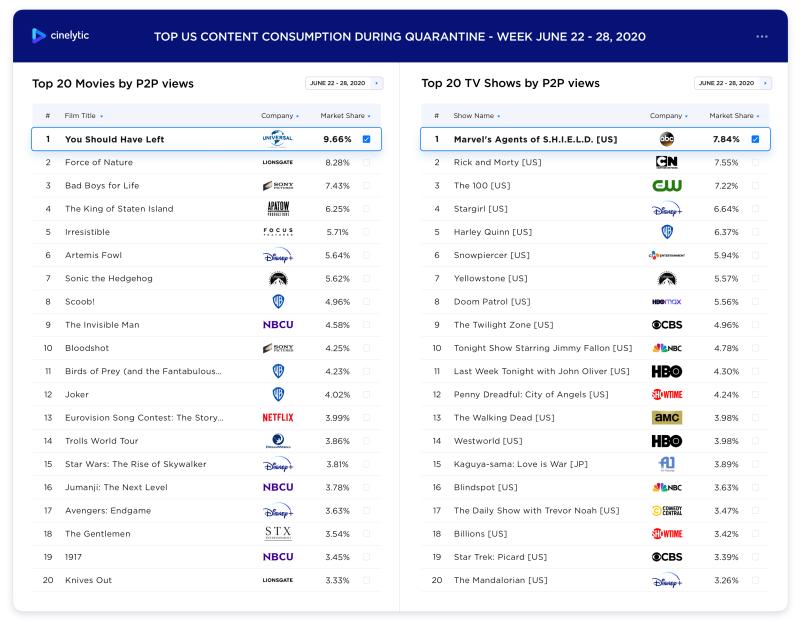

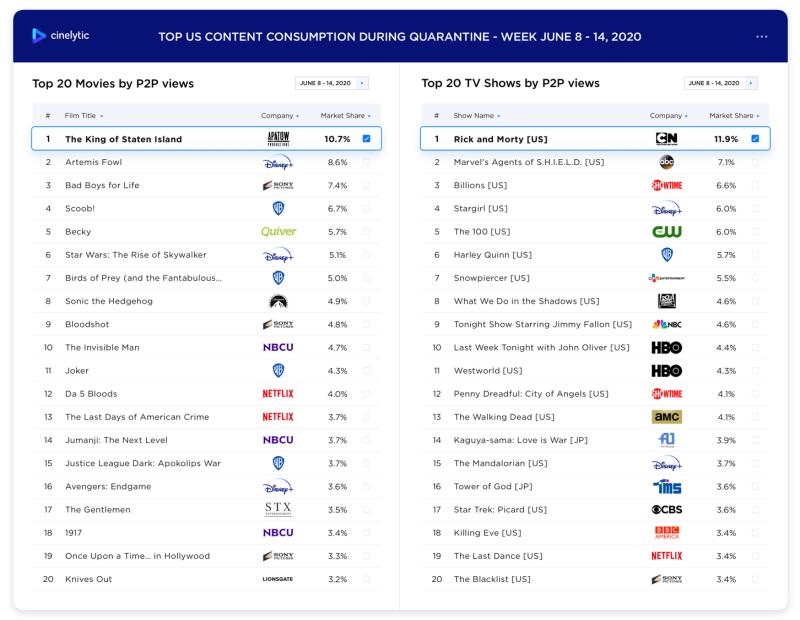

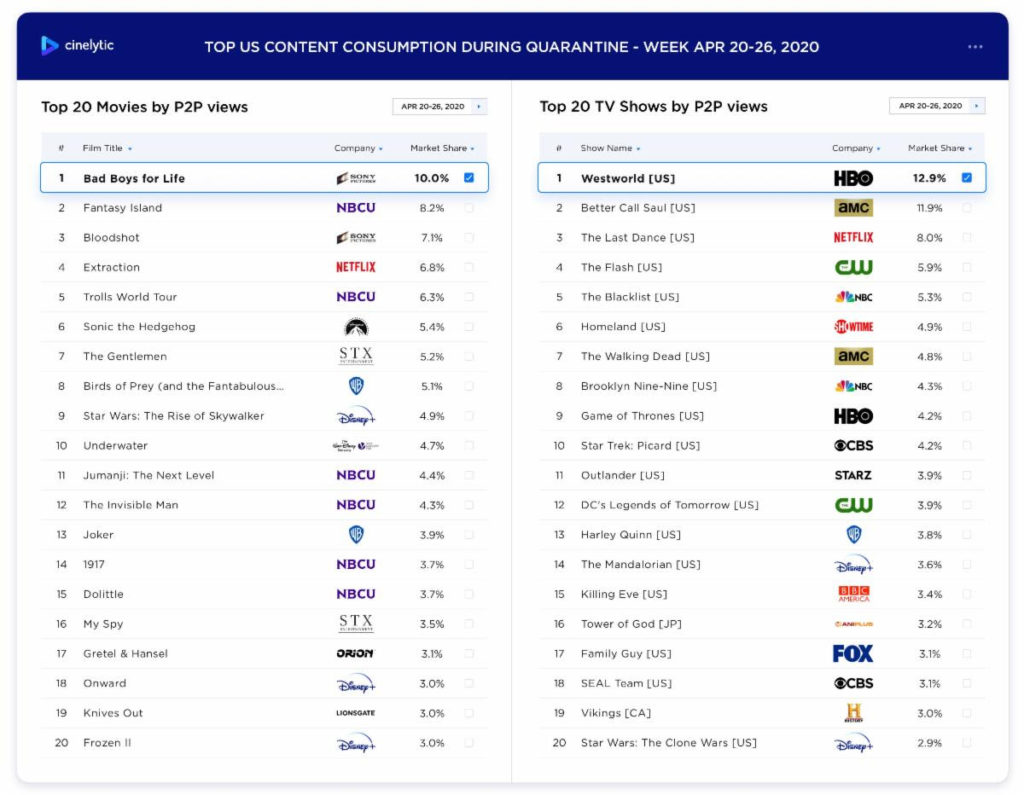

Box office potential is no longer the only driver of sales negotiations at festivals such as Sundance. With streaming platforms (VOD and SVOD) now serving as a major revenue source for festival titles, the focus has shifted toward understanding and analyzing audience consumption patterns.

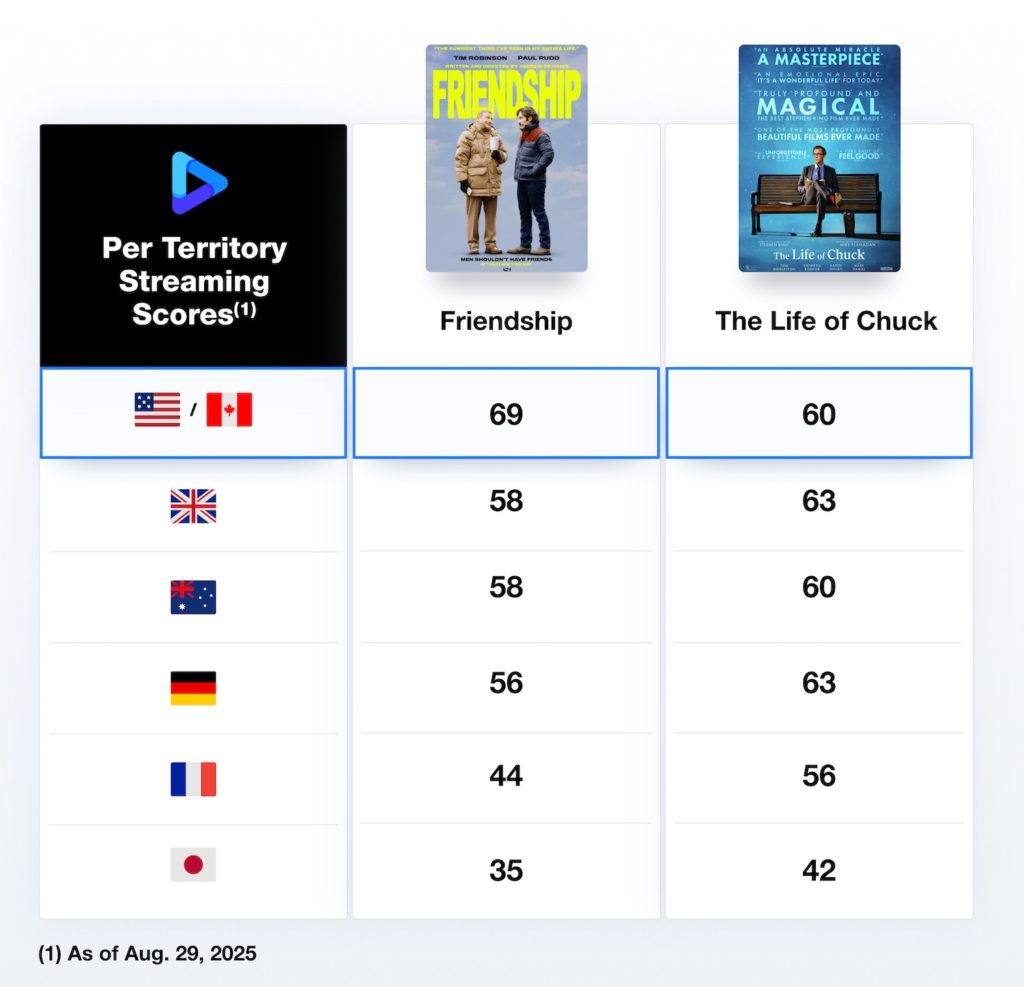

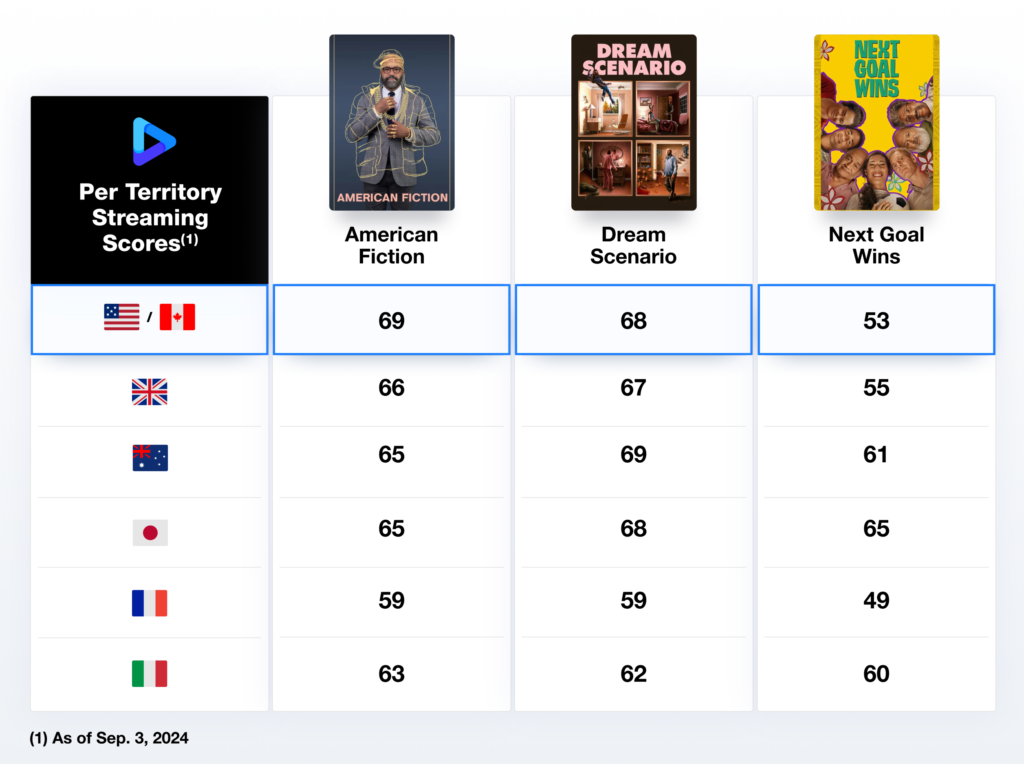

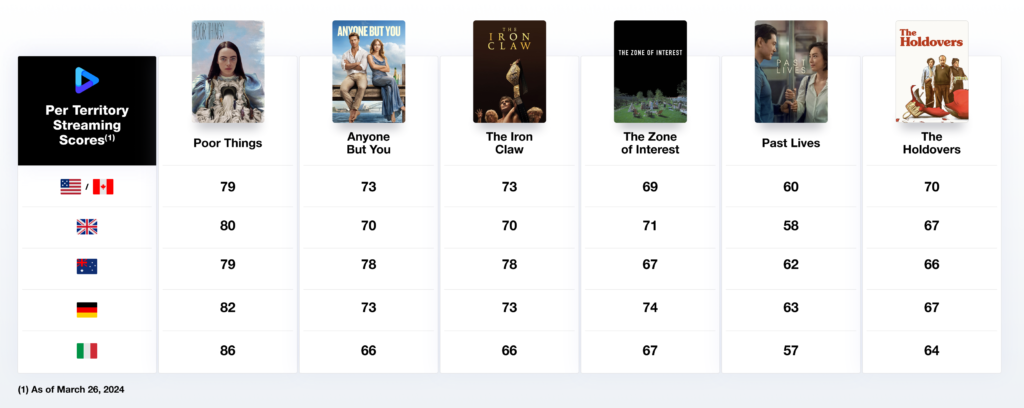

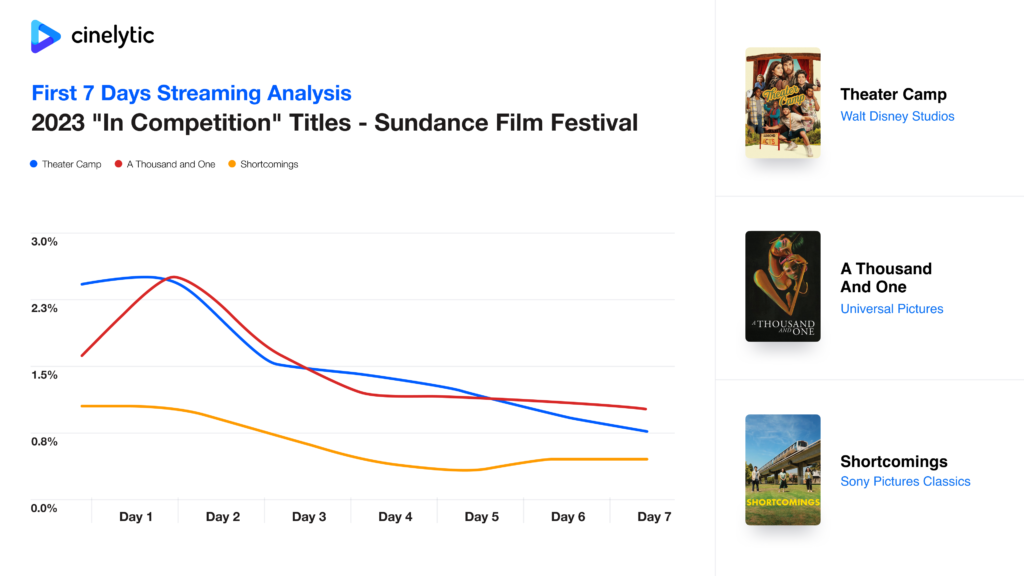

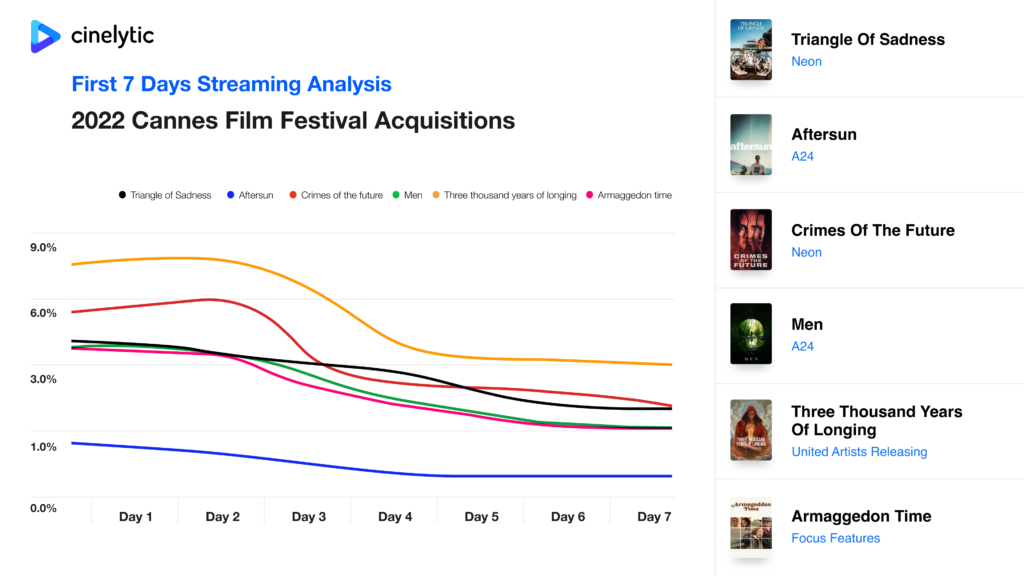

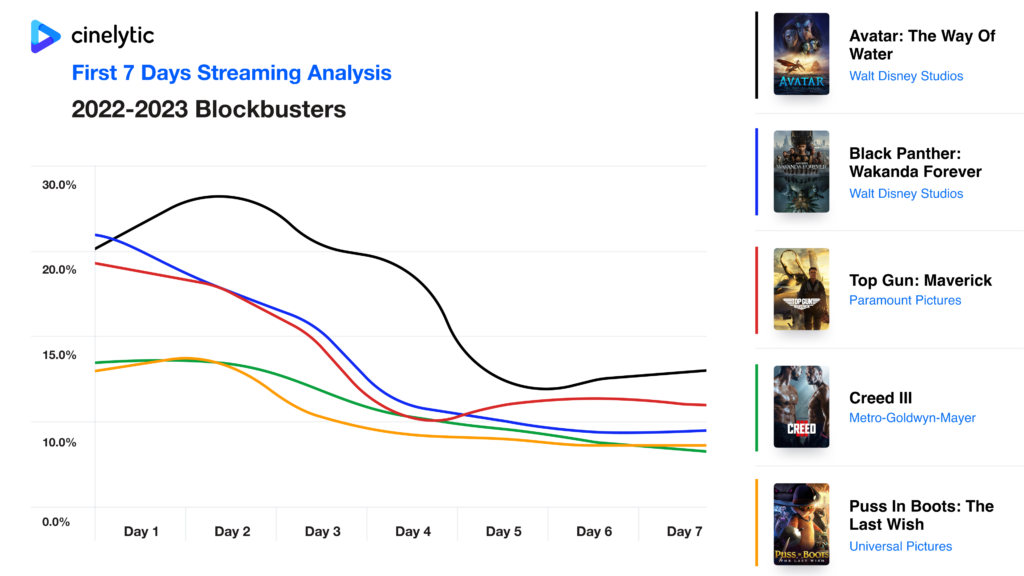

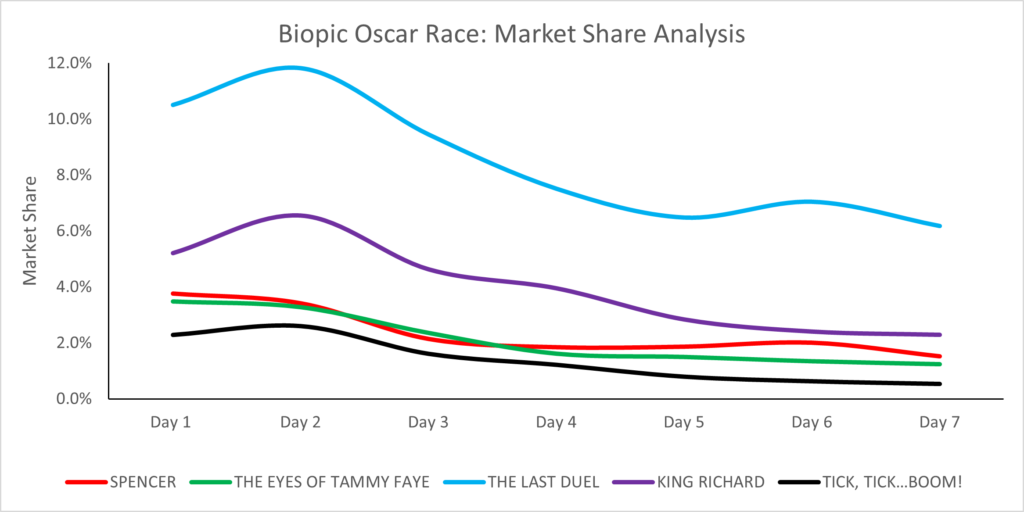

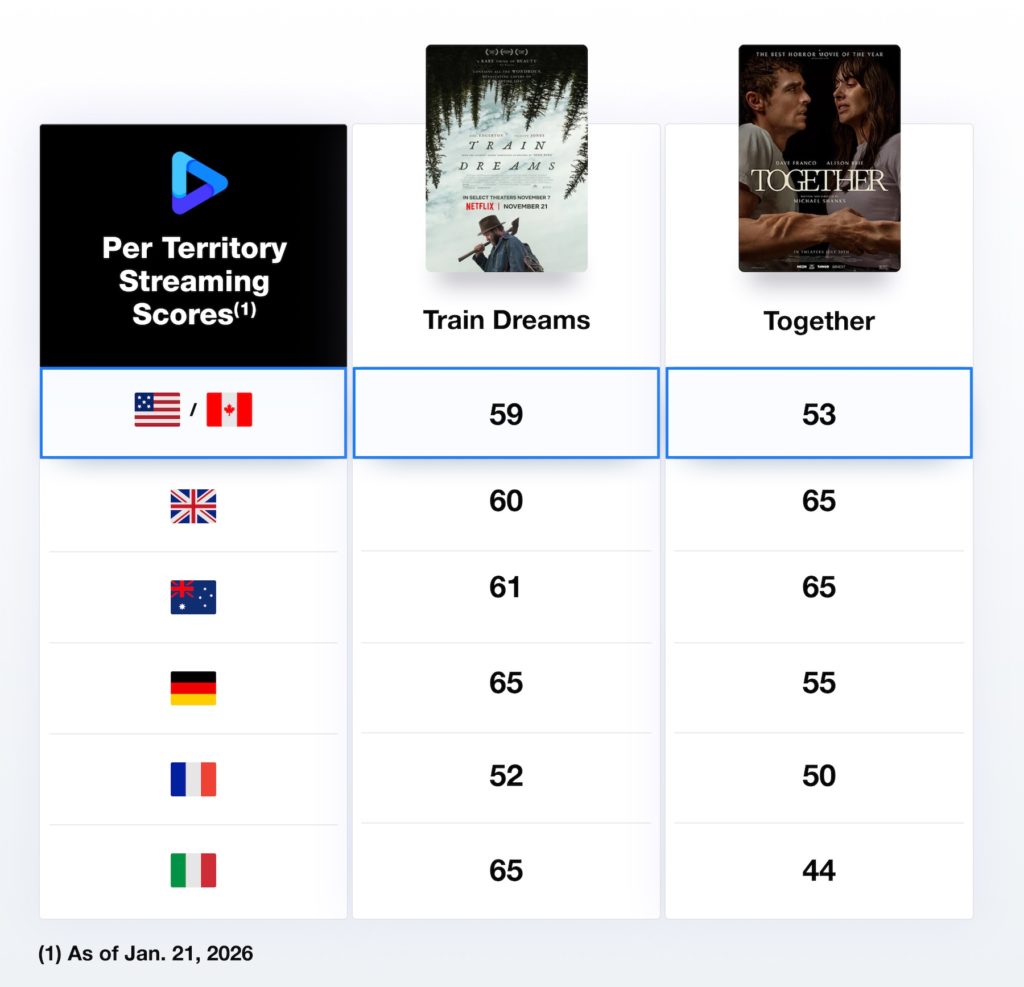

Specifically, we examined both the domestic and international streaming performance of two films that represented arguably the most high-profile sales at least year’s festival: TRAIN DREAMS and TOGETHER. To do this, we utilized our innovative tool, the “Cinelytic Streaming Store,” which predicts and tracks digital content consumption on a per-title basis across various platforms and countries, offering valuable insights through a proprietary viewing score.

This system also removes platform and subscription bias by normalizing performance and isolating true viewing demand rather than raw reach driven by subscriber scale, homepage placement, or algorithmic promotion.

Within that framework, TRAIN DREAMS, bought and released by Netflix, still outperformed Neon’s acquisition TOGETHER, particularly in the domestic market, indicating stronger intentional demand rather than passive consumption. Viewers were more likely to actively choose TRAIN DREAMS, engage more deeply, and follow through on completion, reflecting the impact of awards buzz, critical validation, and prestige positioning.

The softer demand for TOGETHER is consistent with its broader performance profile: despite a roughly US$17m budget and 2,300 screen domestic release, the film grossed only about US$32m worldwide, suggesting limited upside beyond initial curiosity. Taken together, the data reinforces that TRAIN DREAMS generated higher-quality, purpose-driven demand, even after removing platform-related advantages.

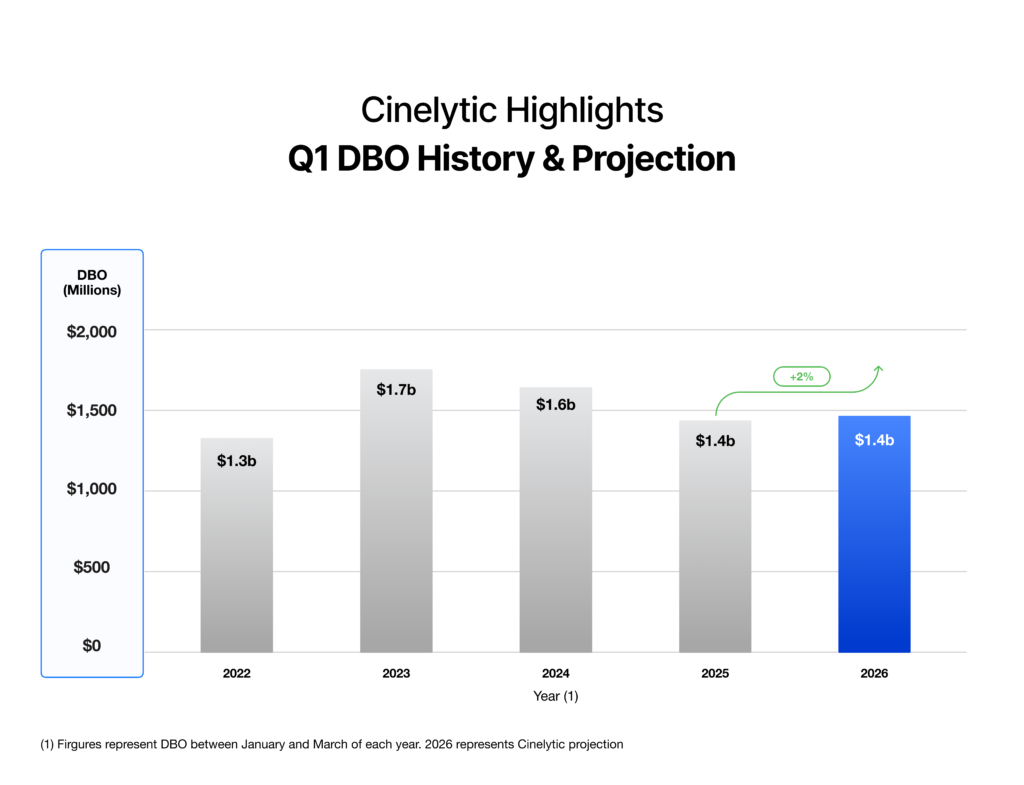

All to Say…

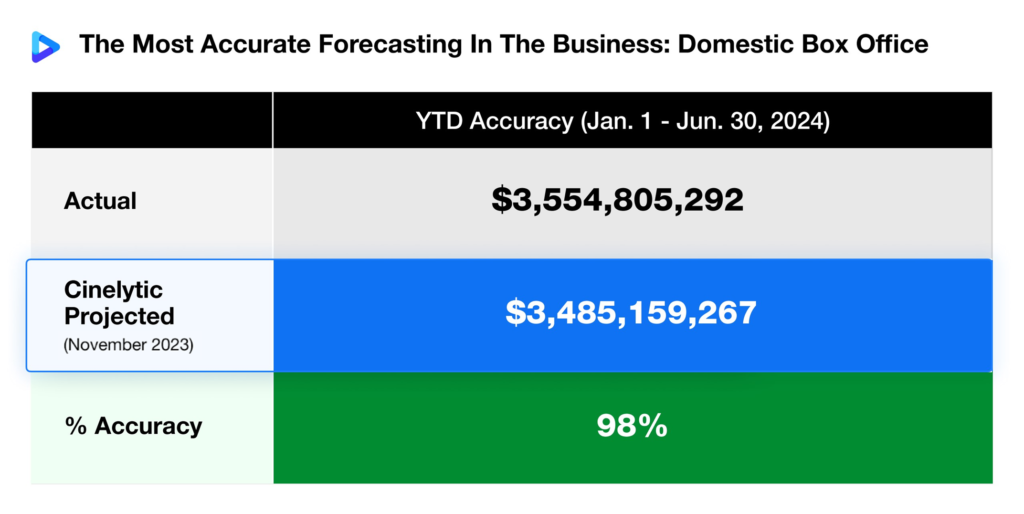

Forecasting film performance will never be an exact science, especially in a festival market like Sundance. However, the 2026 titles highlighted here show how data-driven analysis can meaningfully sharpen decision-making around valuation, sales strategy, and release planning. By assessing per-territory demand across all revenue streams, Cinelytic helps buyers, sellers, and financiers better understand where real audience interest exists and how it varies by market.